When comparing different Digital Core Banking solutions – may seem that they are equal. But in fact – no. Some of them offer only a back-end system or just front-end, some of them are focused on providing solutions for companies with big budgets only, some of them provide limited functionality and some will limit you when it comes to customisation.

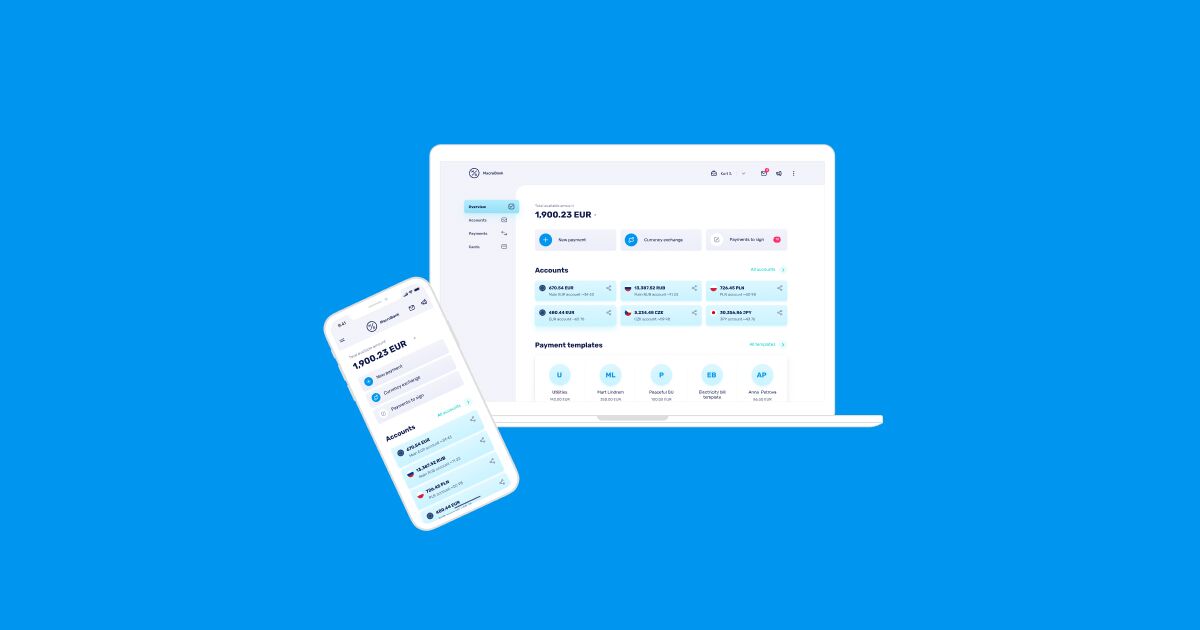

Today we introduce our Digital Core Banking solution Macrobank and its main advantages. We enable new banking providers to rapidly launch payment or digital banking projects through Macrobank`s robust, all-in-one and cost-efficient platform. Read our article to learn more why our solution makes sense for you!

Available to startups and small-to-medium fintechs with low and average budgets – special startup packages

We strive to democratise the banking industry and make the capabilities of Digital Core Banking available at affordable prices and offer special packages for fintech newcomers.

Up to now only multinational neo banks and challenger banks with millions of investments were able to afford these systems worth half a million USD. Meanwhile, small and medium-sized companies did not have big budgets at the start, and they were seeking cost-effective solutions that are capable of supporting their growth. Our Macrobank is designed to reach the potential of small and mid-sized companies and does not require big investments from the start.

Front-to-back Core Banking solution

Let’s start with technical details to grasp the architecture of a digital banking solution Macrobank that meets the main needs of digital banks. Any digital bank needs a technical system that consists of 4 main components to support all operations:

• An engine – a complete solution to enable all internal banking operations, e.g. payment account opening, accounting operations, currency exchange, payment processing, etc. The solution must be a modular, where each built-in module provides a specific function.

• Additional integrations and APIs to interconnect different payment systems and payment service providers. Each such API provides additional functionality. For example, the API to Western Union allows currency exchange, whereas the API to Decta – card issuing. These APIs are integrated into the system and their functions as an integral part of the Core Banking solution.

• A back-office is necessary to manage operations and customers. Employees of digitals banks, e.g., system operators directly work with a back-office.

• Front-office apps for end-users – web and mobile banking. Some core banking providers offer only one part of the full Core Banking solution – Core Banking engine with a back-office or just front-office apps. It means that several stand-alone systems handle back-office and front-office core banking functions. First, it limits customers, as they don’t have access to an end-to-end solution. As a result, they need to work with different providers, and all this may cause inconvenience, additional developments and actually – some severe problems. Our customers can benefit from Macrobank, which is a front-to-back Core Banking solution. They don’t need to partner with two different providers to integrate the Core Banking platform or develop web/mobile banking apps internally.

Full-service Core Banking solution – extended functionality

Our Core banking solution is a software stack that digital banks can implement to support the most common functions, including customer onboarding, opening accounts, debit card issuing, payments, currency exchange, general ledger, etc. It is a modular system that incorporates different modules and combines all the necessary functionalities.

Another important point to be mentioned is how the Core Banking system looks. When you think of a back-office, you might think that it must be as simple as learning how to deal with a mobile app. But this is not the case of the Core Banking platform. Back-office is necessary to set up tariffs, manage currency exchange, onboard customers, and change business processes. Therefore, the Core Banking solution will never be a two-click system and you do not need to expect the system that you can understand in seconds.

Configure and customise

Macrobank platform is highly modular and combines different stand-alone modules in one cluster, such as a core and codebase. Additional functionalities are available via APIs when they are plugged into one fully operational system. It is possible to configure and extend functionalities by adding new modules, e.g., card issuing, integrations with third-party providers – AML/KYC providers. You can pick any module from the existing offering or make new integrations.

Because the microservice architecture is the core of our system, we can configure existing modules and add new integrations hassle-free without any interruptions.

Advapay is a technology company providing the Digital Core Banking platform to empower fintech clients or digital banks to start their businesses and accelerate digital transformation. The platform delivers all essential functionalities, a front-to-back system and a set of tools to customise and bring new integrations. With Advapay, potential and existing customers can connect either to the cloud-based SaaS or on-premise software. Besides the technical infrastructure, the company provides business advisory and fintech licensing services. Interested to learn more, please drop us a message.