A Core Banking system for digital banks or a Digital Banking system is the software used to support the fintech business and its most common operations. Core Banking is a complex system to enable essential functionalities for digital banks: opening current accounts, transferring payments, currency exchange, issuing cards, and many more. This platform covers a wide span of services and is designed to assist financial institutions in tackling today’s biggest challenges – limited IT resources (both financially and human resource-wise), intense competition, continuous service developments, a new regulatory environment, and changing customer demands.

Therefore, Digital Core Banking must be built not only to support the current requirements of the business but also to be capable of growing together with the fintech company. From the development and functionality point of view, Core Banking is very complex. But there should be no complexity around usage point of view – it must be flexible, scalable, easy-to-use and easy-to-understand. Let’s run through the main points that you need to take into account when choosing Digital Banking system to ensure that the system quickly responds to the current and future fintech company`s needs, as well as able to deliver great user experience.

Microservices infrastructure – as simplicity to add additional functionality

New Core Banking systems are developed on a microservices infrastructure. This way, you can develop easy and flexible solutions – having in mind white-labelling, customisations, and adding new features. Unlike traditional monolithic core banking systems, new systems have independently deployable components to support continuous transformation and changes, thereby cutting down development efforts. Such systems enable digital banks to react swiftly to the latest market opportunities and decrease fintech business transformation costs. This microservices infrastructure is designed to fully support business growth – you can start as a small company with basic functionality and grow by adding necessary components or new providers step-by-step.

Business logic – a functionality to adapt business processes

The possibility to make additional integrations is only one part of the solution`s flexibility. Your system must be also flexible and future-proof for back-office operators as well. In many cases, for digital banks, the ability to adapt business processes is a must. Fintechs are changing fast – not only from the functionality side but from the business as well. Most business processes and workflows require constant updates as a result of new business requirements, regulatory, and market changes. And this is all about the flexibility and the business logic of Digital Core Banking – how easy and fast business processes or workflows can be changed.

One of good options is a visual editor of your business processes as Macrobank offers. It enables customisations and management of all business processes in back-office. Just click on the process, for example, onboarding, add a step or scenario then save everything. This is an excellent example of how business logic functionality works with minimal involvement of your IT specialists.

Another future-proof functionality is a customised reporting system. As accountancy rules and other legal aspects are changing continuously, the ability to adapt your reports according to these requirements is essential.

Possibility to connect your own front-office to a ready-made Core Banking to make your apps unique

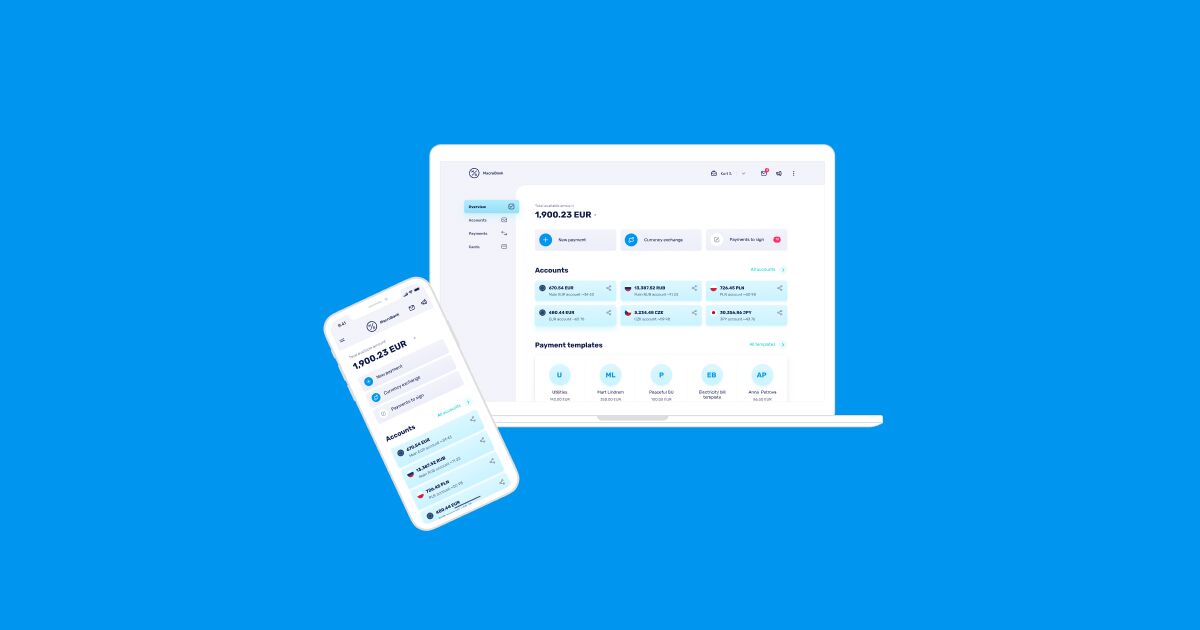

Usually, a ready-to-use Core Banking system includes such front-office interfaces like web banking and mobile applications. But what if you have a team of brilliant designers and you would like to develop your own design for the mobile application? Or, if you plan to introduce a mobile app with more advanced functionality and the standard mobile application does not suit your needs? In this case, the possibility to connect your front-office interfaces to a Core Banking engine will be the right fit.

Existing and future costs

Costs are probably the most ambiguous point of all. You need to consider the operational complexity in the future and your prospects because expenses proportionally depend on the size of the fintech business. It is crucial that you not only evaluate costs for your current operations or solutions but also have an insight into what the future may hold. How will a particular solution influence your needs and expenses in the future? And when the business grows, will this solution remain as cost-efficient as possible?

The SaaS solution is an excellent opportunity to start a fintech business. But sooner or later, when your business starts growing – the SaaS model will become too expensive. Usually, with the increase of transaction volumes, your monthly fee increases as well. For this reason, the right decision will be the transition to the Software license. For example, Advapay includes all the charges for SaaS setup into Software License costs, which means that you get a cost-effective solution without sacrificing the performance.

Additionally, think of the costs of your IT personnel. Which option is more lucrative for you – to have your team or to pay a monthly fee for support (Service Level Agreement, SLA)? Evaluate two options, because sometimes having internal resources can cost you more than paying monthly fees.

Plan your future when it comes to system functionality. Think of how to implement an efficient, customisable, and future-proof IT system from the start. This approach will ensure that the solution you implement today will support your business growth tomorrow.

Advapay is a technology company providing the Digital Core Banking platform to empower fintech clients or digital banks to start their businesses and accelerate digital transformation. The platform delivers all essential functionalities, a front-to-back system and a set of tools to customise and bring new integrations. With Advapay, potential and existing customers can connect either to the cloud-based SaaS or on-premise software. Besides the technical infrastructure, the company provides business advisory and fintech licensing services. Interested to learn more, please drop us a message.