Full-fledged E-Money & Payment Institution Licensing services and MSB registration.

We do everything for you, so you can stay focused on your core business.

What You Need to Obtain a Licence

Local Presence & Team

Consisting of 2-10 identified local employees, depending on the jurisdiction.

Source of Capital

Transparent, clear and sufficient to cover first-year losses

Business Plan, Programme of Activities & Internal Policies

Several hundred pages of documentation

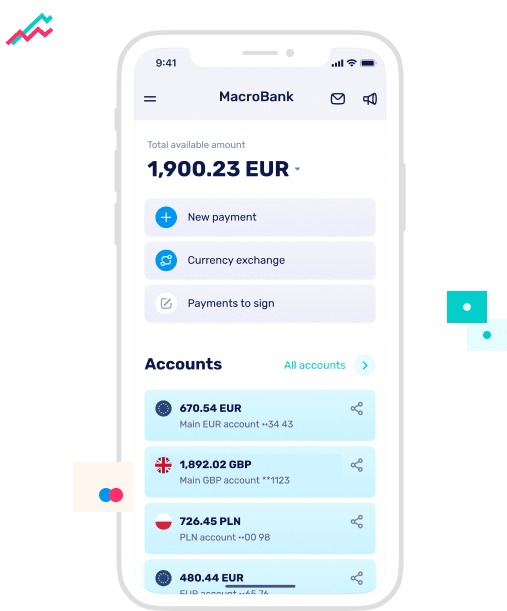

Core Banking Software

Secure, compliant & ready-to-deploy, with detailed documentation

Sufficient Budget in Place

To cover the costs of local personnel, consultants, lawyers, and the share capital amount for PI & EMI.

9-18 Months of Patience

Real terms to prepare documents and receive your license

What we do

01

Structuring advice & jurisdiction selection

02

Provide regulatory-compliant software with comprehensive descriptions

03

Business planning, forecasting & payment scheme design

04

Representation in regulatory communications.

05

Drafting of all policies, including AML compliance & risk management.

06

Project management, paperwork, incorporation & accounting

07

Local team recruitment

08

Establishment of necessary partnerships for outsourced activities

Jurisdictions

we cover

We have a strong focus on fintech businesses like digital banks, e-wallets, fiat-crypto wallets & e-commerce banking.

Advantages of Working With Us

Real experience

We have obtained more than 20 licences

All-in-one solution

We provide consulting services, assist in business development, communicate with regulators & deliver banking software

Fintech practitioners

We possess a deep understanding of business, IT & legal matters.

Blog

Looking for Core Banking software for your fintech project?

Learn more