Designed

to manage

all your core

banking

operations

effectively

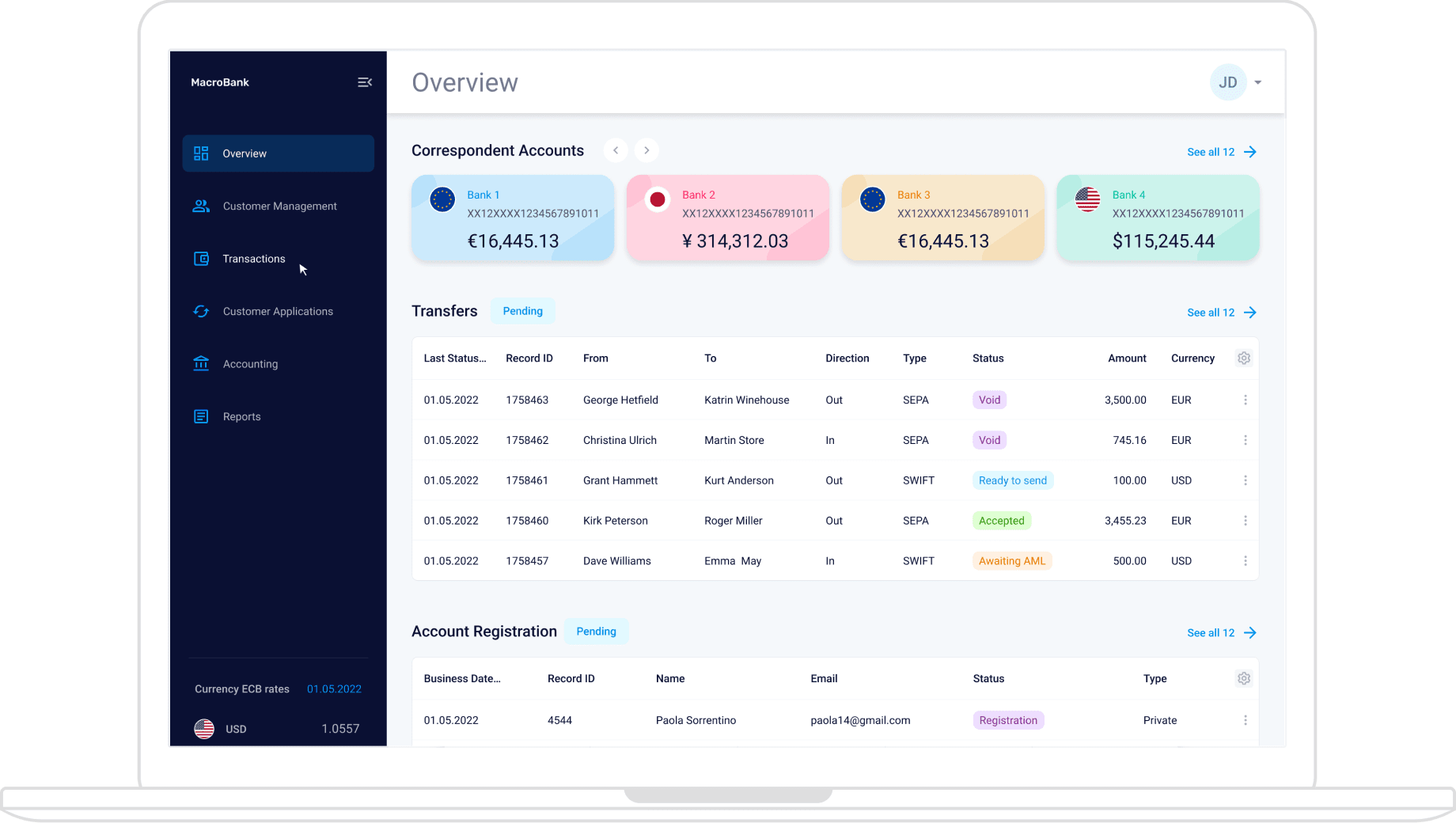

A full suite of inbuilt functionalities in Core Banking back-office

01

Manage customers and applications

Register and onboard customers

Process customer orders and applications

Use a general ledger to manage the client accounting system

02

Create customer groups, set tariffs and rules, give access and rights

Create own customer groups according to a variety of parameters

Set up individual tariffs, rates for each group or customer individually

Define transaction limits and adjust restrictions

Give access rights and restrict access

03

Give access rights and restrict access

Set up standard or unique user profiles, change payment forms or create new designs for tariff and currency rates tables. It is possible to create a customized design for tables and forms, e.g., add or delete form fields

Create your own Business Processes Management (BPM) workflow design and setting

04

Control processes and payments

Control incoming/outgoing/internal payments

KYC and AML triggers and notifications

Design and adjustment of KYC and AML rules, triggers and reports

05

Create technical, business and accounting reports and statements

Accounts chart and financial accounting reports in compliance IFRS or local requirements

Generation of statements and reports, including the save functionality