Embedded Finance (Embedded Payments) represents a financial technology that enables fintech and other businesses without their own payment infrastructure to access banking and payment capabilities offered by licensed banks or financial institutions. This convenient solution allows businesses to provide banking and payment services seamlessly within their platform, significantly reducing the time to market.

The Global Embedded Finance Market size is expected to reach $384.8 billion by 2029, rising at a market growth of 30.0% CAGR during the forecast period.

Content

- What is the difference between BaaS and Embedded Finance/Embedded Payments?

- What is the difference between Embedded Finance/Payments and Open Finance?

- A comparison table of the functionality of Embedded Finance, Banking as a Service, Open Finance and Open Banking

- What are some examples of embedded finance solutions?

- How to access BaaS or Embedded Finance and integrate banking/payment features into your products

- Who uses Embedded Finance?

- Key points about Embedded Finance

- Why is Embedded Finance the future growth of fintech?

What is the difference between BaaS and Embedded Finance/Embedded Payments?

BaaS and Embedded Finance have similar meanings but involve different types of service providers. BaaS, or Banking as a Service, is a service model where banks provide their banking infrastructure and services to licenced financial services companies. In contrast, Embedded Finance focuses on integrating financial services into other platforms, where licensed financial institutions like e-money companies and payment institutions share their infrastructure with other financial services companies or non-financial companies, including granting them the ability to operate under their licenses.

What is the difference between Embedded Finance/Payments and Open Finance?

Open Finance and Embedded Finance are two distinct concepts within financial technology (FinTech). They represent different approaches to delivering and integrating financial services into various platforms but have different focuses and implications.

Open Finance, transformed from Open Banking, refers to opening up traditional financial systems and services through open APIs and data sharing. It aims to create a more interconnected and collaborative financial ecosystem. In contrast, Embedded Finance integrates financial services directly into other financial or non-financial platforms or businesses, focusing on delivering a more comprehensive range of services within a digital ecosystem.

A comparison table of the functionality of Embedded Finance, Banking as a Service, Open Finance and Open Banking

| Embedded Finance | Banking as a Service | Open Finance | Open Banking | |

|---|---|---|---|---|

| Connect to external bank accounts | No | No | Yes | Yes |

| Transact without onboarding | No | No | Yes | Yes |

| Create new accounts | Yes | Yes | No | No |

| Issue cards | Yes | Yes | No | No |

| Provide payments | Yes | Yes | No | Yes |

| Access and share account / payment data | No | No | Yes | Yes |

| Coverage for banking/payment services only | No | Yes | No | Yes |

| Coverage for more types of services, like insurance, lending etc. | Yes | No | Yes | No |

What are some examples of embedded finance solutions?

Embedded Finance has ushered in a new era of seamless financial integration, enhancing user convenience and reshaping industries. From payments to investments and insurance, these examples underscore the profound impact of Embedded Finance on modern financial interactions.

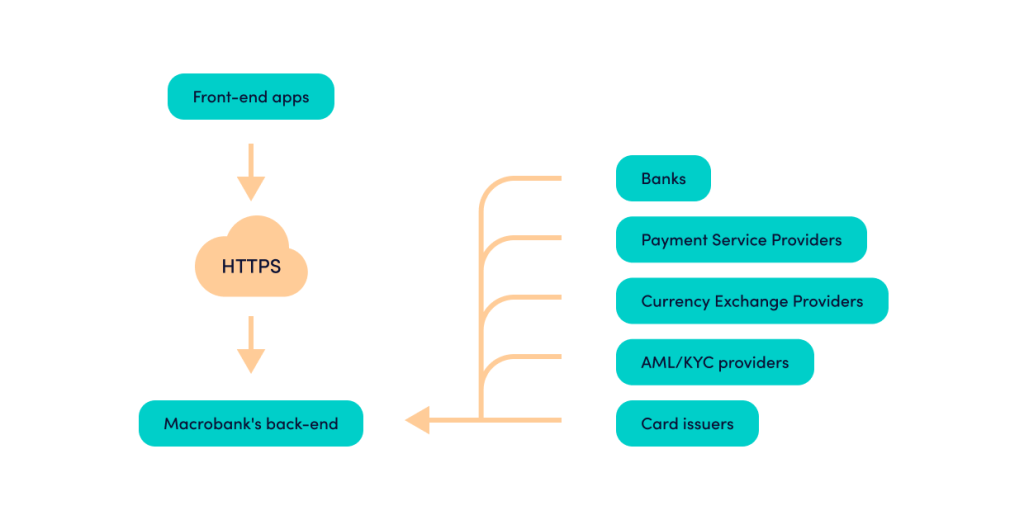

Embedded Payments, showcased by numerous licensed and non-licensed fintech companies, demonstrate the integration of current account features and payment services from licenced E-money or Payment Institutions such as Modulr directly into their platforms and applications. From a technical standpoint, the solution comprises a core banking platform, such as Macrobank, seamlessly integrated with a designated Embedded Payments Provider.

Embedded Lending and Embedded Buy Now, Pay Later Instalment Plans have revolutionised traditional layaway models, allowing consumers to acquire products instantly and pay for them over time. An illustrative case is BNPL providers Klarna or Afterpay, which present customers with interest-free instalment plans during e-commerce checkouts. This novel approach provides unparalleled convenience and flexibility for purchases when users opt for immediate ownership with subsequent monthly payments.

Embedded Investing has democratised stock market participation with applications like Revolut, which empowers users to engage in stock trading from their payment app.

Embedded Insurance has reshaped the insurance landscape, eliminating the need for in-person interactions with agents. Modern platforms integrate insurance application processes into existing checkout experiences. Travellers, for instance, can conveniently purchase insurance coverage during flight bookings, marking a significant departure from traditional insurance procurement methods. Or another example – Tesla vehicles are equipped with real-time sensors that offer usage-based insurance, allowing drivers to pay premiums based on actual behaviour.

How to access BaaS or Embedded Finance and integrate banking/payment features into your products

1 – Implement ready core banking platforms with ready integrations with Embedded Payments/Finance providers

For businesses aspiring to transform into digital banks, e-wallet platforms, or other comparable fintech ventures, accessing Embedded Finance products becomes streamlined by utilising a core banking platform equipped with seamless prebuilt integrations to connect with Embedded Finance providers.

If you intend to offer banking or payment services (such as e-wallets or digital banking), consider the advantages of prebuilt core banking platforms with readily available integrations. Instead of investing a year developing your own core banking software and connecting it with chosen BaaS providers, why not explore existing solutions already available in the market? Core banking platforms like Advapay’s Macrobank provide a comprehensive range of built-in integrations with various BaaS and other Embedded Finance service providers. Even if your preferred provider is not currently integrated, Advapay’s skilled team is fully equipped to manage all technical aspects. Connecting to platforms with prebuilt integrations saves precious time and ensures the highest level of security for your operations.

2- Access Embedded Finance products by connecting your application or platform with Embedded finance providers’ services through API

If you intend to incorporate financial products into your offerings – such as adding payment choices to your marketplace or any other non-financial venture – you must complete all necessary agreements, undergo onboarding with the service provider, and establish integration with the chosen embedded service provider.

Who uses Embedded Finance?

Through Embedded Finance solutions, fintech companies, e-commerce platforms, marketplaces, and other innovative entities have discovered new avenues for growth and improved customer experiences.

Non-licensed (fintech) companies and startups:

Companies in the financial services industry must obtain licenses and authorisation from competent regulatory authorities to operate legally. However, this process can be time-consuming and costly. To overcome this challenge and achieve a fast time-to-market, startups and non-licensed fintech companies can leverage Embedded Finance opportunities. By becoming agents of licensed financial institutions, they gain the right to distribute various financial services without the need to acquire their own licenses.

Licensed Fintech Companies:

Fintech companies, known for their disruptive nature, have been at the forefront of adopting BaaS and Embedded Finance capabilities. They utilise Embedded Finance or BaaS to challenge traditional banking models and deliver innovative financial services. By partnering with licensed banks or other licensed fintech companies, they can expand their product portfolio and offer their customers a broader range of financial services.

E-commerce Platforms:

E-commerce platforms recognise the value of integrating financial services into their offerings to enhance customer experience. BaaS or Embedded Finance empowers these platforms to provide payment processing, digital wallets, and other financial services directly within their ecosystem. Collaborating with BaaS and Embedded Finance providers enables e-commerce platforms to offer secure and convenient payment options, allowing customers to complete transactions seamlessly and boosting conversion rates.

By integrating financial services into their platforms, e-commerce businesses become comprehensive business enablers, providing a marketplace for goods and financial tools to support the growth of their sellers.

Marketplaces:

Marketplace platforms have also embraced BaaS or Embedded Finance to augment their value proposition and gain a competitive edge. By integrating financial services, marketplaces streamline transactions, enhance trust and security, and foster a vibrant ecosystem of buyers and sellers.

Cross-Border Commerce:

BaaS and Embedded Finance have significantly facilitated cross-border commerce by addressing the complexities of international payments and currency conversions. Organisations engaged in global trade can partner with BaaS providers to offer their customers transparent and cost-effective cross-border payment solutions. This facilitates seamless transactions in multiple currencies, eliminates currency conversion challenges, and provides competitive foreign exchange rates.

Other businesses

Embedded finance reshapes diverse industries by seamlessly intertwining financial services with everyday operations. In the automotive sector, vehicles have real-time sensors that offer usage-based insurance, allowing drivers to pay premiums based on actual behaviour. Similarly, the hospitality industry is leveraging Embedded Finance to provide guests with personalised payment options, enabling them to split bills, access micro-loans for premium services, and manage expenses effortlessly through hotel and travel apps.

Key points about Embedded Finance

Seamless Integration: Embedded Finance integrates financial services through APIs directly into financial and non-financial platforms or applications, creating a unified user experience and offering a wide range of services through one platform or application.

Customer Convenience: Users can access various financial services, such as current accounts, payments, cards, lending, insurance, and investing, without leaving the platform they already use.

Wider Access: Embedded Finance can extend financial services to a broader audience by reaching users who might not typically engage with standalone financial institutions.

Partnerships: Non-financial companies or other financial institutions collaborate with licenced financial institutions (Embedded Finance providers) to deliver financial services under Embedded Finance providers’ licences and/or provide a wider range of financial services.

Innovation: Integrating financial services into diverse platforms encourages innovation and the development of new financial products.

Monetisation Opportunities: Financial service companies offering Embedded Financial services can generate additional revenue streams through fees, revenue sharing, or other financial arrangements.

Regulatory Considerations: Embedded Finance providers navigate regulatory frameworks when integrating financial services, ensuring financial regulatory compliance for companies using Embedded Finance services. Also, non-financial companies can enter the financial services market without becoming full-fledged financial institutions.

Ecosystem Growth: Embedded Finance can contribute to the growth of digital ecosystems, keeping users engaged and potentially attracting new users.

Financial Inclusion: Embedded Finance has the potential to bring financial services to underserved or unbanked populations through accessible digital platforms.

Why is Embedded Finance the future growth of fintech?

Embedded Finance and BaaS stand as the most rapidly growing trends within fintech. Its potential lies in revolutionising conventional banking and simplifying access to financial services for consumers and businesses.

By seamlessly incorporating financial services into various platforms and applications, Embedded Finance enables the expansion of product portfolios and enhances customer satisfaction. Furthermore, it promises cost reduction, accelerated time-to-market, and heightened business efficiency.

The potential of Embedded Finance to reshape our perception and utilisation of financial services is the primary reason it holds such promise for the future of fintech. Embracing this transformation is a shared aspiration that can drive innovation and progress in the financial world.

Advapay, a versatile core banking platform provider, presents an enticing opportunity to select an Embedded Finance Payments partner from a diverse range of readily integrated options for your business. Explore the compelling Embedded Finance propositions offered by Advapay and discover the extensive list of available BaaS providers on our Marketplace page. Book a call with our team!