Open finance and open banking

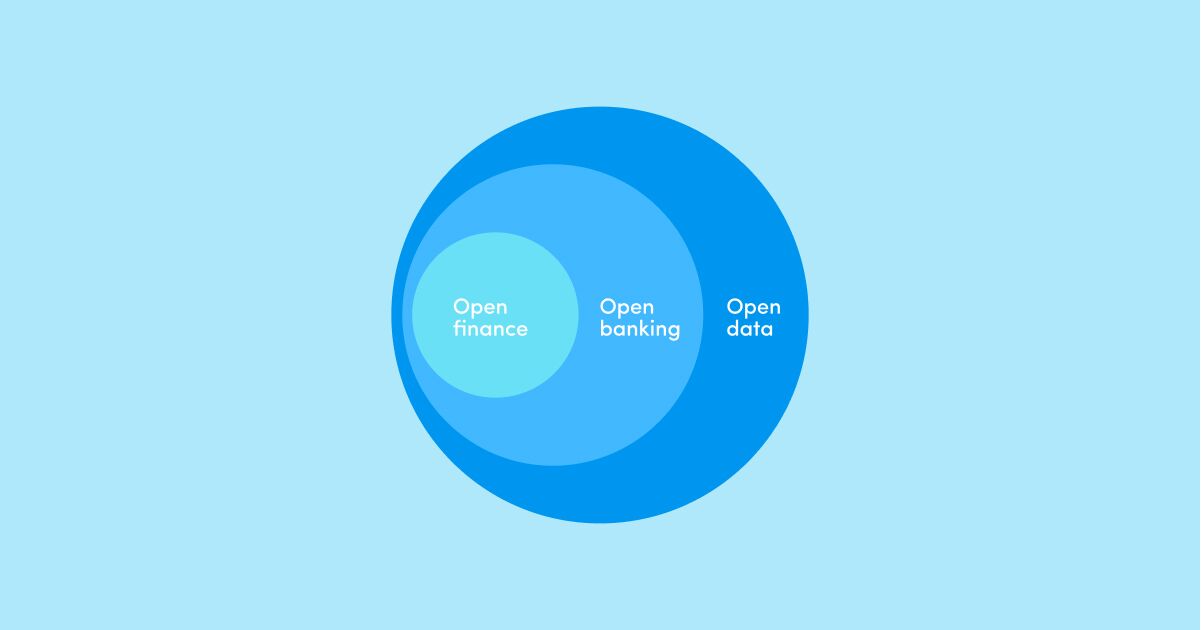

Open banking has been a transformative concept under PSD2 in the financial industry. Still, now there’s a new player in town: open finance. While open banking focuses on sharing payment account data, open finance takes it further by encompassing a broader range of financial products and services with the customer’s consent and understanding. By expanding the scope of data sharing, open finance creates more opportunities and value for businesses and consumers.

Unlike open banking, which primarily deals with account information and payment initiation services, open finance allows authorised third-party service providers to access a wider range of customer data from various accounts. This includes savings, pensions, investments, insurance, mortgages, etc. This abundance of data can be utilised to develop and offer personalised financial products and services that better meet customers’ needs.

The benefits of open finance

The benefits of open finance are numerous.

- Personalised offerings and tailored products: customers can enjoy more personalised offerings that cater to their specific requirements, enabling the financial sector to serve their needs better.

- Better financial management: customers gain a better overview of their finances, empowering them to make more informed decisions.

- Quicker and easier suitability assessments: open finance streamlines the process of suitability assessments, making it quicker and easier for financial institutions to evaluate the appropriateness of their offerings.

- Enhanced technical infrastructure: switching providers becomes seamless and eliminates the tedious paperwork and form-filling traditionally associated with such transitions.

- Better accessing risks: financial institutions benefit from open finance, as they can assess risks more accurately based on a better understanding of their customers.

- Enhanced data governance: at the heart of open finance lies the principle of empowering customers to exercise control over their data and choose the companies they wish to share it with.

Open finance examples

Open finance has the potential to revolutionise various sectors, including banks, lenders, electronic money and payment institutions, insurance companies, mortgage providers, and more. Its application extends beyond these sectors, presenting numerous opportunities.

- Lending – small and medium-sized enterprises (SMEs) can share a wider range of financial data with banks when applying for loans, leading to quicker and more tailored responses.

- Insurance – customers can share a broader data set with their insurance company to obtain bespoke insurance products.

- Investments – retail investors can grant their financial advisors easy access to their financial data, enabling better assessments of suitable products and services.

- Personal finances – open finance facilitates personal financial management, giving consumers a comprehensive overview of their finances without needing constant consultation with financial advisors or accountants.

Data under Open finance

What data is shared?

When it comes to data, open banking is limited to payment accounts. In contrast, open finance encompasses various data types most relevant and valuable to customers, including banking, investment, insurance, and pension services.

However, it is crucial to exclude data that could lead to risks of financial exclusion. Customers will have control over their data in open finance, and permission dashboards can be implemented to provide a simple overview of data that customers are willing to share. These dashboards simplify the granting and revocation of permissions for data sharing.

Who is eligible to access the data?

Companies accessing customer data should be regulated and supervised like those holding the data. Banks with customer payment data must provide access to other providers under specific conditions.

The technical side of data sharing

On the technical front, there is a need to establish common standards for customer data and interfaces (APIs). Developing these standards requires collaboration among companies and involvement from regulatory bodies. Industry cooperation can be crucial in standardising data formats and technical interfaces through contractual schemes.

Legislation of Open finance

Open finance is gaining importance within the European Union’s regulatory framework for payment services, particularly with the forthcoming Third Payment Services Directive (PSD3).

It also aligns with other initiatives related to finance and data within the EU, such as the Retail Investment Strategy and the broader Data Strategy.

Open finance supports creating a level playing field across sectors. It complements the Digital Markets Act, which addresses imbalances caused by dominant market players, making it easier for financial companies to access data from these platforms.

Sources: Payment services: revised rules to improve consumer protection and competition in electronic payments; Keynote speech by Commissioner McGuinness at event in European Parliament “From Open Banking to Open Finance: what does the future hold?”.

About Advapay

Advapay is a technology company providing the Digital Core Banking platform to empower fintech clients or digital banks to start their businesses and accelerate digital transformation. The platform delivers all essential functionalities, a front-to-back system and a set of tools to customise and bring new integrations. With Advapay, potential and existing customers can connect either to the cloud-based SaaS or on-premise software. Besides the technical infrastructure, the company provides business advisory and fintech licensing services. Interested to learn more, please drop us a message