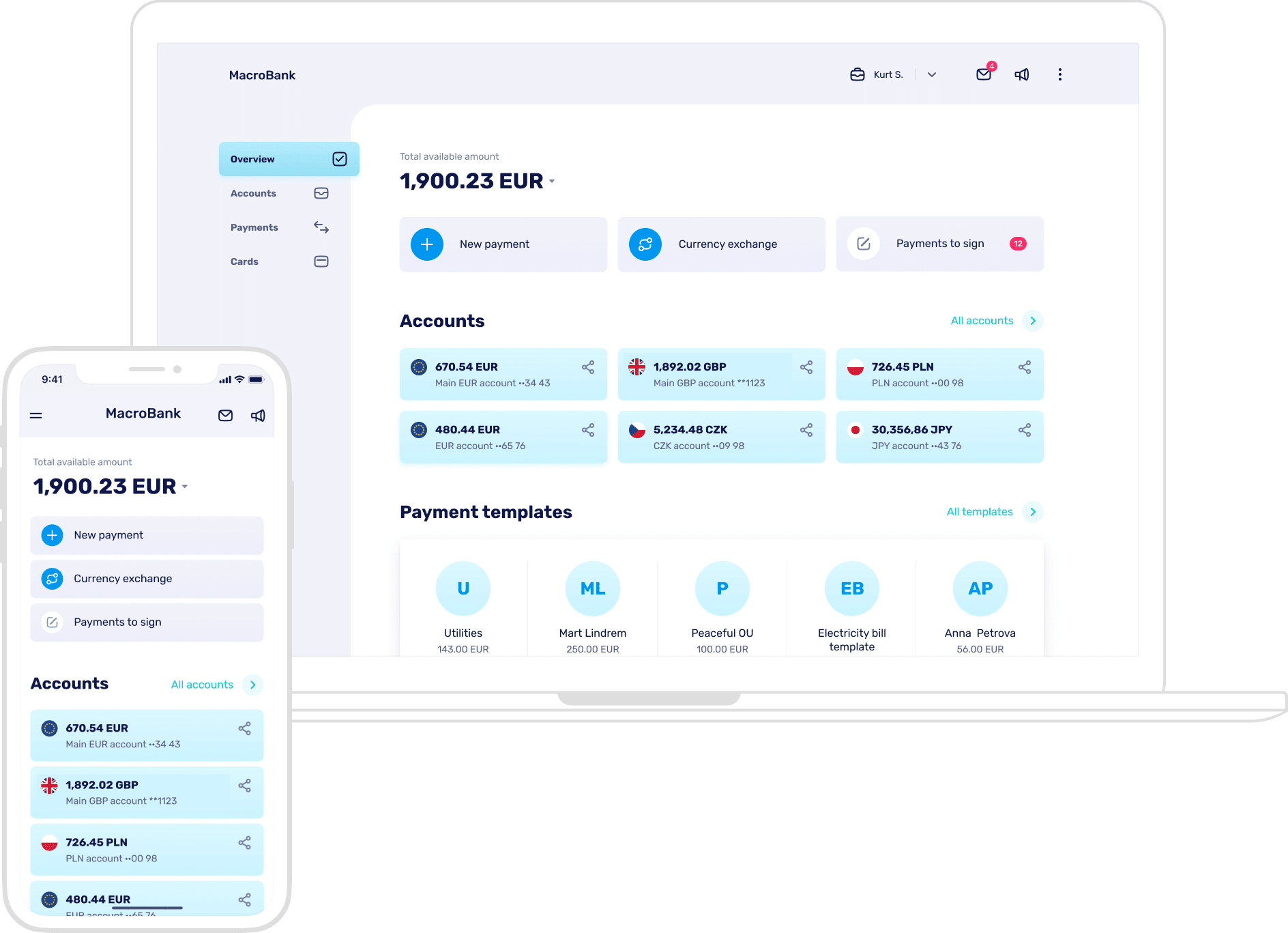

Branded apps with modern design and amazing user experience

What your customers get

01

Accounts and balance

List of accounts and the associated balance

History of operations

Account statements – fully branded in PDF, CSV formats.

02

Payments

Templates for SEPA, SWIFT and internal payments.

Payment orders for SEPA, SWIFT and internal payments.

Operation history and statements

Currency exchange orders

Security

Enhanced security for your customers

Security measures encompassing current account access, payments and role assignments to make web banking and mobile apps safer.

01

Secure access to the account

Automatic log out when the session is expired

Blocking the client to enter the web-bank after several unsuccessful login attempts

02

Multi-user account management

Multi-login system (single user login enables to access a web-bank of several customers accounts)

Multi-signature system (several signatories can be set up for operations)

03

Two-factor strong authentication for login and payment transactions

One-time password using different types of authentication, e.g., SMS, e-mail, hardware token (digipass), Mobile OTP/MAC generator (mobile token).

Static password for payments.