🚀 Exciting News: Introducing new Macrobank Core Banking Back-Office Application! 🎉

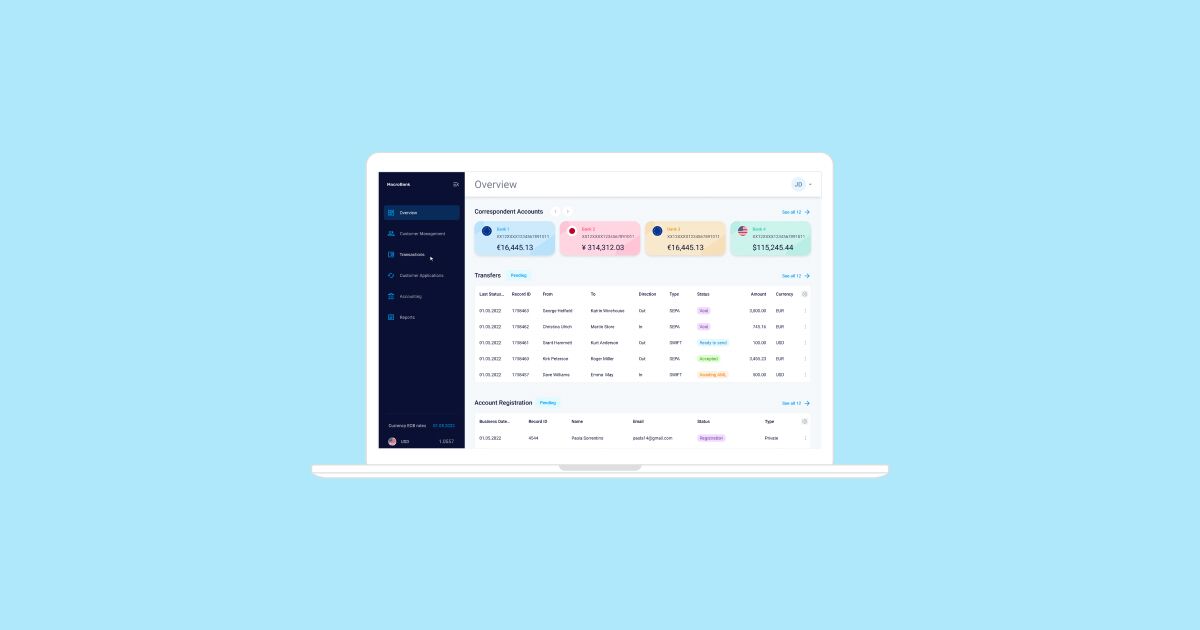

🌟 Designed to enhance the everyday work experience for digital banks and fintech companies, our new back-office application boasts a modern user interface and powerful management tools.

✨ Key Features of our new Macrobank Core Banking Back-Office Application

✅ Effortless Application, Customer and Transaction Management: Streamline your workflow by easily managing operations with just a few clicks.

✅ User-Centric Tools: Dive into an array of tools designed to enhance user interactions and satisfaction.

✅ Swift Customer Requests Handling: Respond to customer queries and requests with unprecedented speed and precision.

🌐 And finally, User-Friendly Interface

We understand the importance of a user-friendly interface, and our back-office application delivers just that — making everyday tasks enjoyable for your dedicated team.

💼 Let’s Connect!

Curious to explore how Macrobank’s back-office application can transform your operations? Reach out, watch the demo and let’s embark on this innovation journey together! Contact our team!

Visit Advapay Youtube channel to view more videos.

Macrobank by Advapay: core banking back-office application for operators

The core banking back-office application for operators by Macrobank boasts a comprehensive range of functionalities essential for efficient operations.

- Management of all processes. Operators can seamlessly manage customers and applications, facilitating the registration and onboarding processes, as well as the streamlined processing of customer orders and applications.

- Accounting. The application integrates a robust general ledger system to effectively manage client accounting systems.

- Different customisation tools. Additionally, operators have the flexibility to create customer groups based on various parameters, establish individualized tariffs, rates, and transaction limits for each group or customer, providing a tailored approach.

- Enhanced control. The system also offers extensive control over access rights, allowing the configuration of standard or unique user profiles.

- KYC/AML. Moreover, operators can exercise control over processes and payments, including the monitoring of incoming, outgoing, and internal transactions, as well as the implementation and adjustment of KYC and AML rules.

- Reports. The application further empowers operators with the capability to design and generate technical, business, and accounting reports and statements, ensuring compliance with IFRS or local requirements and offering a comprehensive overview of financial activities.

Discover all Macrobank Core Banking back-office application features:

1) Customer Management:

- Private and Corporate client profiles dashboard;

- Private client profile creating (General info, Business activity, AML compliance) and workflow;

- Private client profile – Documents;

- Private client profile – Related persons;

- Corporate client profile creating (General info, Business activity, AML compliance) and workflow;

- Corporate client profile – Documents;

- Corporate client profile – Company officials;

- Customer Statement;

- Session Log.

2) Customer Account Management:

- Adding new customer account;

- Customer account maintenance;

- Adding new IBAN to account (multiple IBANs);

- IBAN(s) maintenance;

- Account balances.

3) Remote Users Management:

- Remote User creating;

- Remote User maintenance;

- Signature Scheme;

- Authentication methods;

- Permissions.

4) Transactions:

- Payments dashboard;

- Internal Transfer;

- Customer Internal Transfer;

- International Outgoing Payment – SEPA;

- International Outgoing Payment – SWIFT;

- International Incoming Payment – SEPA;

- International Incoming Payment – SWIFT;

- Documents attachment;

- Currency Exchange dashboard;

- Currency Exchange.

5) Customer Applications:

- Private and Corporate Account Registration dashboard;

- Private Account Registration;

- Corporate Account Registration;

- Payment applications dashboard (International Outgoing Payments – SEPA, SWIFT);

- Application for SEPA payment;

- Application for SWIFT payment;

- Currency exchange dashboard;

- Client Currency Exchange Order.

6) Accounting:

- Accounts, Chart of Accounts;

- Gl Entries, dashboard;

- Gl Entries, transaction creating, actions (view, edit, delete);

- Statement of Accounts;

- Currency rates.

7) Overview:

- Widget ‘Correspondent accounts’;

- Widget ‘Transactions’;

- Widget ‘Customer applications’;

- Widget ‘Currency ECB rates’.

8) Reports:

- Extended Balance Sheet (Trial balance);

- Corresponding Account Balances with Grouping;

- Profit/Loss;

9) Customer Support:

- Client Mail;

- Signed message (Requests).

10) User Profile info.

11) 2FA Authentication.

12) Push-up notifications about new messages and requests.

Core banking Macrobank by Advapay: Empowering Continuous Evolution

Macrobank, an innovative Core Banking Platform, enhances efficiency across multiple areas. Tailored to address current and future challenges in financial institutions, it represents cutting-edge solutions.

At stake:

- Robust Back Office Functionality

- Ready Integrations for Seamless Implementation

- White-label core banking: BaaS and Embedded Finance Capabilities

- Modern Back-Office Application Interface

- White-Label Web and Mobile Banking Apps

- Startup-Friendly Designs

- Compliance with the Security and Regulatory Standards

- Built-In Accounting System

- Diverse Deployment and Purchase Options – Cloud-based banking SaaS, on-premise, software license, purchase of software source codes.

Our solution offers access to various functionalities, technology, and partner ecosystems that prioritise security and compliance. Macrobank empowers you to design personalised offerings within your chosen ecosystems, facilitating efficient product launches. Contact us to explore your product possibilities and schedule a demo!