FinTech companies use white-label banking solutions to build their digital banks – they utilise ready core banking software and integrations with Baas service providers. With the aim of delegating software creation from scratch, fintech operators can opt for 3rd-party banking software and connected services that satisfy all their requirements and expectations.

Here we look into what white-label banking software is and the advantages it offers. We’ll also provide some advice on choosing the most suitable product.

According to the Fintech State of the Nation report, the number of UK fintechs is expected to double by the year 2030, and since the majority of these companies already use white-label platforms, it stands to reason that the number of white-label banking partnerships will also significantly increase.

White Label Banking as the sharing economy in banking and fintech

In general, a sharing economy is a socio-economic system built around the sharing of resources, however, this definition may not be best suited for fintech and banking (as usually, it is about p2p services). What we can say with certainty is the sharing economy concept has come into banking and fintech. When evaluating their resources and capabilities, new fintech startups are more likely to use ready third-party products and services instead of building their own.

Attempting to create digital banking solutions from the ground up can be truly overwhelming and a lot of time, money and manpower is required to develop a comprehensive payment infrastructure and core banking system. Moreover, there’s no need to waste time procuring special payment institution or E-money licences as some BaaS providers permit you to operate under their licence.

It’s now easier for fintech companies to create fintech products since the advent of white-label banking and business leveraging its benefits are able to develop products more rapidly and obtain infrastructure for ready payment from other financial institutions.

Three elements of White-label banking

It’s very important to note that it’s not mandatory to obtain all of these elements from a single provider. You can use software from one vendor and access financial services from another financial institution.

There are three core elements of White Label banking:

Most systems available on the market have been tried and tested. To save yourself energy, you can build a solution atop the framework set in place.

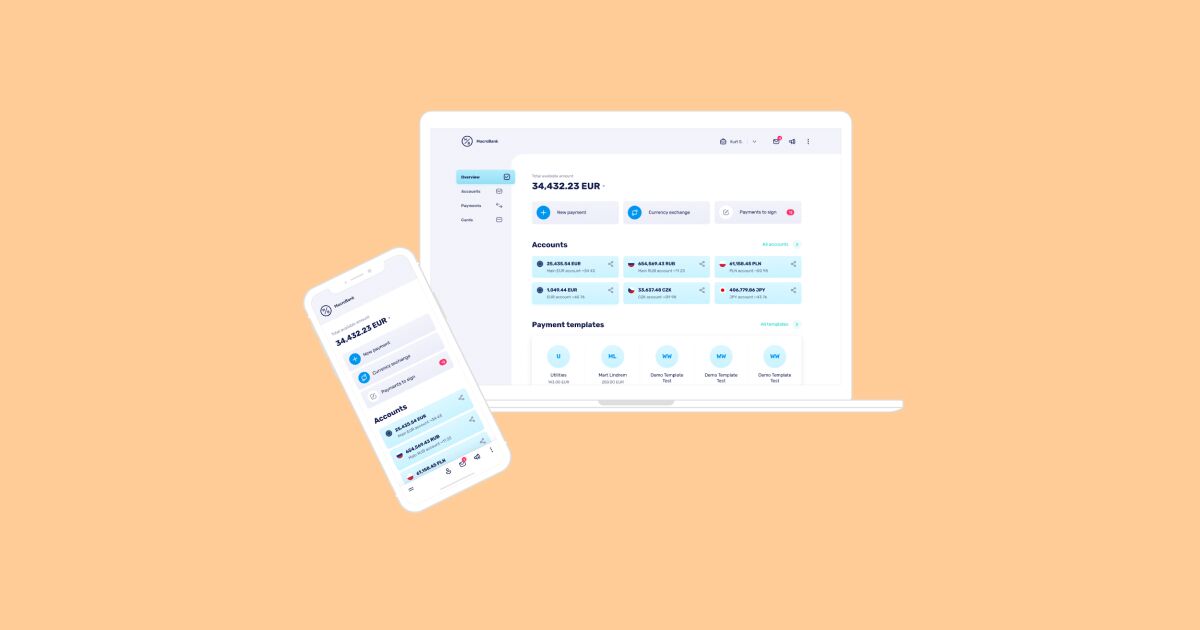

Core banking software (meaning back-office and administrator web interface) includes all the important elements for your business functionality (or modules), e.g. onboarding, current accounts, cards, currency exchange, payments and others.

Web banking and mobile banking applications for end-users. Of course, you can build them on your own and then connect them to a ready banking platform. However, you must take into account the fact that you can spend around €200k and a minimum of 6 months in development. Why not to focus on your business instead and use ready products?

API (APIs) of Banking services providers (Banking-as-a-Service) – once you’ve identified the software to build on, your next step will be to contact financial companies to discuss integrations.

If you want to make things easier and not build your payment infrastructure by yourself, Baas providers are the answer. They distribute their services through API – meaning you can plug into the APIs to create your products. Of course, you will need to sign an agreement and then make integrations (if the ready core banking software does not have your integration ready).

What are the Main Benefits of a White Label banking Platform?

White Label banking solutions confer many benefits. Below you can find some of them:

Lower project cost

To begin with when you buy a ready banking platform, a lot of money is saved on development. You’re spared from all the associated problems, as you can simply put the job in the hands of professionals. Also, you save money on a payment institution or e-money licence as you can obtain a licence-as-a-service from your BaaS provider.

With a White Label solution, you avoid a lot of these costs, as both software vendors and BaaS providers do most of the work for you. Choosing a white-label banking product means you get a platform with ready integrations with banking services providers, including licence-as-a-service. All you need is to make agreements with these service providers.

Solution reliability

Choosing a tried and tested core banking solution and then ordering your desired integrations from a software vendor is a far more rational path, particularly as the technical aspects call for a large amount of testing.

This path allows you to forget about a product’s technical aspects, mitigate risk and benefit from a high level of expertise. You also get to concentrate on the work you do best, allowing you to spend time developing and marketing your brand, improving your products and nurturing your client base.

Time-efficiency

The lower the number of stages you must pass through, the faster your products can be launched. A ready-made white-label banking platform only needs to be customised and adjusted rather than having to be created from scratch.

In addition, you do not need to spend years obtaining your own licence and building your own payment infrastructure – as you can get all main banking services and licence-as-a-service from one provider – for example, our BaaS partner.

White-label solution costs

When considering the budget you will spend on your white-label banking solution, the total costs can typically be divided into 4 parts.

Core banking software

Core banking backend is what powers everything.

Costs for core banking software include: purchase fees, setup costs, customisation fees, and monthly maintenance fees.

In the event that you choose a SaaS solution, you should budget for monthly fees over a certain period, e.g. one year. It’s important to know that a monthly fee for a SaaS solution may vary depending on the number of transactions, meaning you need to include your business growth into the calculation.

If you opt for a software licence, then budget for the software license including a setup fee and maintenance fees according to the Service Level Agreement (SLA).

Make sure that your core banking software offer includes white-label mobile and web banking apps – so you do not have the headache of development.

Customisation/Personalization in digital banking is crucial in gaining user trust and meeting their needs. So, you are likely to need additional customisation for software and extra development. That’s why you need to have a precise product development plan which will help core banking software providers calculate pricing for additional development as accurately as possible.

Your solution’s customisation and development takes a significant proportion of your total costs . Sometimes, vendors offer between 200-400 hours for customisation free of charge, however, once they’re depleted, you’ll need to start paying at their set hourly rate.

As such, you should make sure that your software provider offers a product that can be easily modified to suit your brand and business needs.

Integrations with BaaS providers and other service providers

If you choose a white-label banking solution, then your software provider handles integrations with BaaS providers and other service providers. Baas providers open up their framework using application program interfaces (APIs), with third parties (officially called BaaS agents) connecting to those APIs to build their products.

For this, you need to request a proposal from your white-label core banking solution vendor for developing all integrations for your project.

Support and Maintenance

The process does not simply stop once your white label provider has built the product, as you may run into issues that require assistance. That’s why you should opt for a provider that offers ongoing maintenance and support. It’s probably that you’ll be charged more for the privilege, but it’s more than worth the extra money in the long term.

Setup and monthly fee of connection to BaaS-provider

BaaS-providers charge a setup fee and a monthly fee for services. Setup fees vary depending on the provider and can be in the range of €15k-€75k, whereas monthly fees start from €3k depending on the services you plan to use.

Businesses That Can Benefit from White Label Banking

The types of businesses that benefit most from White Label Banking include:

E-Commerce or other areas

Banking services allow online retailers to boost their business, particularly as online shoppers overwhelmingly favour digital banking. As such, it’s simpler to convert this type of customer to online banking solutions. Online retailers can also entice customers using benefits associated with their banking services. For example, financing, cashback and virtual cards can be offered.

Also, other companies that want to acquire a new revenue stream can decide to enter the FinTech market.

Neo Banks or e-wallets

Functioning without what you would call physical branches, Neo banks operate exclusively over the internet. Should you be launching a neo bank that offers mobile banking, it’s far harder to build a new platform than to rebrand an existing one. Taking this route means you focus much less on obtaining licences and product development and more on growing your business.

Other companies operating in the fintech sector

Established fintech businesses like crypto-wallets, microcredits and other companies may decide to open current accounts and provide banking services instead of using third-party providers.

Final Thoughts

A white-label bank is a financial service that’s created over the top of the APIs of a licensed bank – something that many fintech companies prefer over building their own products from the very beginning. With all the technical aspects handled, there’s much more free time available to work on gaining new customers.

It’s a time-saving format that also reduces the cost and work needed to develop a new technology stack, as it offers a system that’s ready to go and customised perfectly to meet your unique needs.

White-label fintech solutions represent an exceptional offer, but they do come with increased risk. While it’s a great way to develop new top-tier solutions and enhance existing ones, there’s also a chance you may choose an unsuitable software or Baas provider, leading to catastrophic issues for your project.

If you’re looking to create the optimal financial management platform, it’s necessary to find a suitably qualified and experienced company to form a longstanding partnership.

Consider Advapay’s Core banking software and its BaaS providers to create your white-label infrastructure. Our highly-skilled team of professionals are ready and waiting to start implementing your project, and growth is just the start.

White-label banking is set to become a cornerstone of our financial future, so why not get in touch with us and come aboard today?

About Advapay:

Advapay is a technology company providing the Digital Core Banking platform to empower fintech clients or digital banks to start their businesses and accelerate digital transformation. The platform delivers all essential functionalities, a front-to-back system and a set of tools to customise and bring new integrations. With Advapay, potential and existing customers can connect either to the cloud-based SaaS or on-premise software. Besides the technical infrastructure, the company provides business advisory and fintech licensing services. Interested to learn more, please drop us a message