13/10/20 – LONDON, UK – Advapay, a digital core banking platform for fintechs, and Sumsub, an identity verification platform that covers KYC/KYB/AML needs, have partnered to deliver a smart KYC and AML solution to digital banks and fintechs.

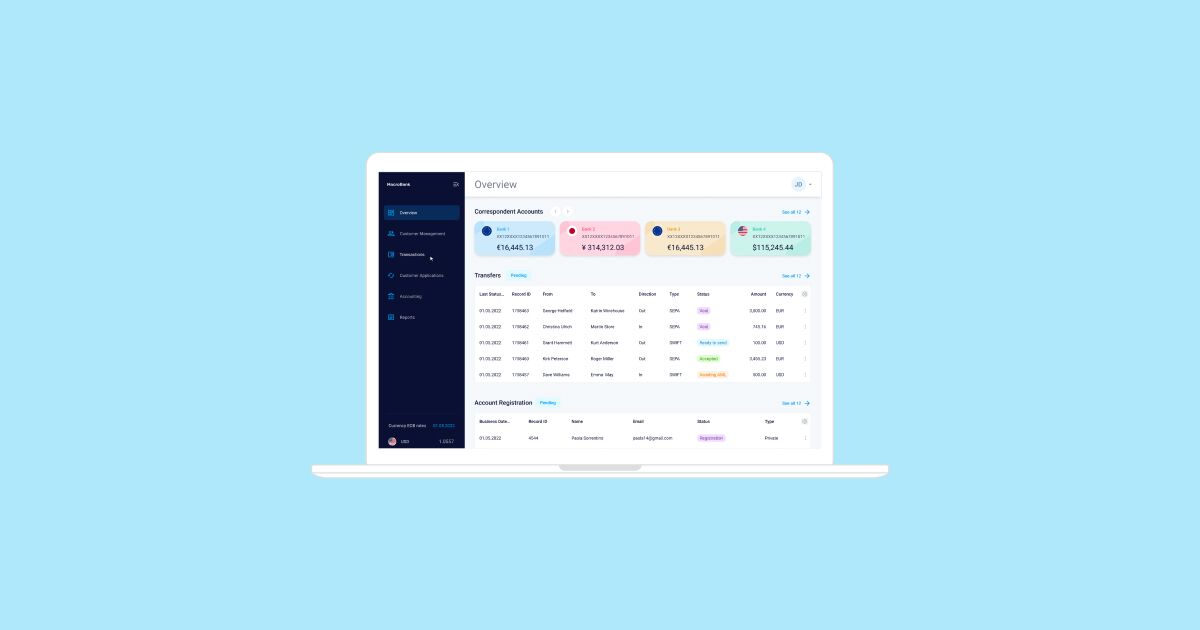

Advapay is an Estonian technology and fintech advisory company that facilitates regulated payment service providers with all the necessary fintech solutions. Advapay’s services cover everything from the professional fintech advisory and licensing services to the provision and implementation of the necessary customised IT infrastructure — a front-to-back digital core banking platform. The integration with Sumsub will broaden the scope of Advapay’s core banking platform and provide automated onboarding and KYC/AML functionalities. From now on, this new integration will be available and accessible for all Advapay’s clients from the list of ready-to-use integrations.

Identity verification is a mandatory requirement for all fintech businesses and is still a point of confusion for many of them. Sumsub is going to benefit all the businesses that use Advapay with an effortless and people-friendly identity verification solution powered with face recognition and matching technology for biometric identity proofing and liveness check, document screening and background checks. The company will ensure the verification of 6500+ types of local documents from 220+ countries and territories. It will help Advapay’s fintech clients to comply with regulators and their requirements, provide a 100% digital experience for their end-users and cut the time spent on identity verification to just a couple of minutes.

“We are pleased to announce that we have formed a strategic partnership with Sumsub.”, says Gustav Korobov, Senior Sales Executive at Advapay. “Sumsub’s solution will enable us to fully automate AML/KYC processes for our clients, providing a superior level of security. This means that we will embrace an entirely new value proposition and recreate exceptional customer experience.”

“We are really excited to work with Advapay and by connecting our solution to their smart banking ecosystem to help their clients achieve effortless and secure identity verification.”, says Jacob Sever, Co-founder of Sumsub. “From our experience, we can say that Advapay is a committed and reliable partner in providing a highly configurable Core Banking platform. It is the partner of choice to deliver end-to-end and fast-to-market solutions.”

About Sumsub

Sumsub is an identity verification platform that provides an all-in-one technical and legal toolkit to cover KYC/KYB/AML needs. The company focuses on accelerated ID verification, digital fraud detection and compliance for over 200 markets. Sumsub employs top market technologies combined with legal expertise, and assistance with financial requirements (FCA, CySec, MAS, FINMA, BAFIN, etc). Clients include BlaBlaCar, Gett, ESL Gaming, JobToday, Wheely, Vk.com, Decta, Exness, Bank Dobrobyt, HRS Group. Awards: Benzinga Global Fintech Awards 2018, The UK Startups 100 2020, PwC nomination for ‘The best use of tech award’. More: www.sumsub.com

About Advapay

Advapay is a technology company providing the Digital Core Banking platform to empower fintech clients or digital banks to start their businesses and accelerate digital transformation. The platform delivers all essential functionalities, a front-to-back system and a set of tools to customise and bring new integrations. With Advapay, potential and existing customers can connect either to the cloud-based SaaS or on-premise software. Besides the technical infrastructure, the company provides business advisory and fintech licensing services. Interested to learn more, please drop us a message.