This article presents a checklist guiding you through crucial aspects to consider when choosing BaaS providers.

The rise of banking-as-a-service (BaaS) and agent schemes is expected to persist due to continuous regulatory tightening on e-money and payment institution licenses. Acquiring one’s own e-money or payment institution license is extremely challenging without a sizable, experienced team, a large client base, and budgets of at least 1 million euros.

Conversely, the agent scheme and BaaS model offer significant opportunities for entities without licenses to provide payment services through BaaS providers. With growing regulatory scrutiny on licensed institutions, including BaaS providers, companies aiming to become agents must carefully evaluate their potential BaaS partners. A prime illustration highlighting the market’s instability among payment and e-money institutions is the case of Railsbank. Despite obtaining over $100 million from investors and an estimated valuation of nearly $1 billion in 2021, the company encountered regulatory and financial difficulties. As a result, all Railsbank agents were at risk.

However, BaaS providers are equally dedicated to identifying reliable agents for collaboration. They meticulously handle the onboarding process for new agents and scrutinise their potential agents’ business operations to mitigate the risks associated with their licenses.

Should you choose to become an agent of a licensed payment or e-money institution, it’s imperative to create a checklist of various BaaS providers in the market and select one that best aligns with your needs.

Below is a comprehensive checklist to aid your research on BaaS providers. This guide will walk you through the crucial aspects to consider when evaluating BaaS providers.

The full checklist to choose your BaaS provider

- BaaS Provider Infrastructure Assessment

- Alignment of your operations and client base with BaaS provider requirements

- Assessing Alignment between Your Customer Base and BaaS Provider’s Risk Matrix

- Negotiate Your Tariffs

- Thoroughly Address All Operational Procedures

- Formalise the Contract and Navigate Onboarding

- Selecting Your Core Banking Software Provider

BaaS Provider Infrastructure Assessment

First, we suggest starting with an analysis of the payment infrastructure provided by the BaaS provider, along with the range of services it offers. These typically include vital services like SEPA and SWIFT or other multi-currency payments, currency conversion, and payment cards.

SEPA Payments – Key Considerations

It’s crucial to confirm if your selected provider has direct access to SEPA (e.g., through CENTROLINK). The lack of such access can complicate your SEPA connectivity, increase SEPA payment costs for your clients, and raise associated risks.

Cross-border Payments – Key Considerations

If you intend to offer diverse currency payment options to your clients, it’s paramount to ask whether your potential providers have access to SWIFT or established agreements with Money Transfer Operators offering non-SWIFT payment rails. This consideration is essential to facilitate payments beyond the scope of SEPA.

Set of currencies

Furthermore, the BaaS provider should support various currencies, enabling agents to receive money in different currencies without needing immediate conversion. It’s recommended to thoroughly assess the array of currencies provided by your BaaS provider to ensure they match your specific needs and preferences.

Payment cards

Enabling convenient and widespread payment options and integrating payment card services is an important feature of the BaaS framework. A BaaS provider should present a white-label card product, giving the flexibility to brand the cards on individual preferences. These cards, available in physical and/or virtual formats depending on the provider, typically operate on a prepaid basis.

IBANs

Another noteworthy offering is the provision of separate IBANs (International Bank Account Numbers), which empowers users with distinct accounts for various financial purposes.

Alignment of your operations and client base with BaaS provider requirements

The fact that a specific BaaS provider offers essential services doesn’t guarantee they can provide those services to your company.

The next step in our checklist revolves around whether your chosen BaaS provider can effectively meet the requirements of your operations and clientele. This involves understanding the criteria established by BaaS providers – comprehending the types of companies they serve, their acceptable client risk profiles, and, conversely, the profiles that are considered unsuitable.

Operational Guidelines

Evaluate the scope of allowable agent operations and those that are restricted. For instance, it’s worth mentioning that many BaaS providers refrain from onboarding companies that offer cryptocurrency or gambling services, classifying these businesses as high-risk enterprises.

Client Geography

Thoroughly review the list of countries that the provider designates as restricted. This evaluation requires comparing it with the geographical distribution of your client base. Understanding the BaaS provider’s approach is crucial – determining whether they lean toward a lenient or strict position regarding services for non-EEA/UK clients.

Client Industries

Determine the industries within your client base that the BaaS provider categorises as high-risk. For example, some providers may not support industries such as affiliate marketing or other high-risk business domains.

Essentially, it’s wise to assess all the blacklists maintained by the BaaS provider thoroughly.

Assessing Alignment between Your Customer Base and BaaS Provider’s Risk Matrix

Another crucial step in our checklist is to evaluate the compatibility of your customer base with the risk matrix of your chosen BaaS provider. Each provider maintains a unique risk matrix that includes various parameters used to assess client risk. Client risk is determined based on these parameters, which can influence operational rules and service provisions. Understanding how well your customer base aligns with the risk matrix of the specific BaaS provider is essential.

Neglecting this analysis before finalising agreements could result in potential issues in the future. Many of your customers might encounter onboarding difficulties, certain payment types could be restricted or even prohibited for these clients, elevated tariffs might be imposed, or you could incur charges for each client onboarding. To prevent such complications, it’s essential to ensure your customer base aligns with the risk-matrix parameters set by the BaaS provider.

Our recommendation involves approaching a BaaS provider with comprehensive information about your typical client profiles, customer base, or even examples of real clients. This information includes:

- Country of company incorporation

- Beneficiaries’ and management’s residence and nationality

- Physical company office location

- Company’s age (time since incorporation)

- Range of services provided by the company

- Payment transaction volume

- Industries of operation

- Company partners involved in monetary inflow and outflow

- Required payment service currencies

Once you share these details, the BaaS provider will subject a typical client from your client base to the risk matrix evaluation, illustrating the associated risk level. Subsequently, the BaaS provider will offer a proposal, including a financial arrangement.

Our suggestion emphasises transparent communication with the BaaS provider. It’s vital to depict your clients’ profiles and their associated risks accurately. Avoid the temptation to embellish information or underestimate client risk levels. Misrepresenting these aspects could result in the BaaS provider altering terms or closing your account. In the unfortunate event of account closure, any funds expended for company onboarding and integration will not be refundable.

Negotiate Your Tariffs

All tariffs are customised to fit your clients and business model, ensuring a personalised approach. If you have ambitious growth plans, there’s room for negotiation, especially for significant expansion. Discussing potential adjustments to tariffs based on increased transaction volumes is valuable. Showing a clear volume increase can help you secure reduced initial tariffs from the BaaS provider.

Thoroughly Address All Operational Procedures

Before finalising the agreement, it’s crucial to gain a comprehensive understanding of operational processes. This involves aspects like onboarding, customer support, and managing customer claims. For instance, when engaging with your BaaS provider, delve into onboarding-related inquiries such as:

- Outlining the onboarding procedure – Does it require a pre-approval step on your end, indicating the involvement of an AML (Anti-Money Laundering) department?

- Clarifying the client registration process, identifying responsible parties for application processing, and outlining subsequent steps. Typically, for low-risk B2C clients, the onboarding responsibility is shared with the Agent. However, for high-risk clients, most of the responsibility falls on the BaaS provider.

- Defining clear responsibilities is crucial for determining your hiring needs, and the BaaS provider may also ask about your team structure.

Formalise the Contract and Navigate Onboarding

BaaS providers often provide a standardised agreement with occasional modifications. After signing the agreement and processing the payment for onboarding, the subsequent phase involves document preparation. This includes various policies and a comprehensive overview of your business model. These documents are then submitted to regulators for approval. Typically, this entire process takes around 2 to 3 months to complete.

Selecting Your Core Banking Software Provider

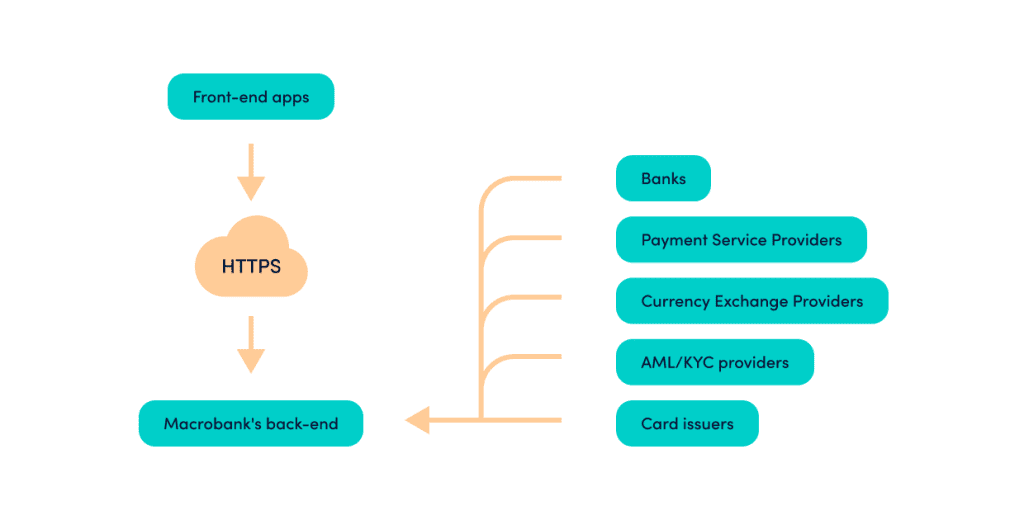

The final step in our checklist to choose your BaaS provider is selecting core banking software. In most cases, BaaS providers offer only their APIs to establish connections between their services and third-party core banking platforms, as they typically do not offer a comprehensive standalone solution.

Consequently, before engaging with BaaS providers, it’s imperative to search for a suitable core banking software. While it’s possible to connect services to front-end applications directly, we strongly advise against pursuing this approach. Below, you’ll find the rationale behind this recommendation.

The Significance of Your Database

Your client database serves as the cornerstone of your operations. Integrating with a BaaS provider solely through your front office, without ownership of your database, may lead to a potential issue. If you decide to end your partnership with the BaaS provider, your entire client database remains within their domain. While contractual obligations may stipulate the return of your customer database, this process could take a considerable amount of time.

Customization of Software and Business Logic

If you wish to customise tariffs for different user groups or implement any other alterations, the responsibility for customisation falls on you. Your BaaS partner won’t undertake this customisation on your behalf. However, without a core banking system, it raises the question: How can you effectively execute such customisations?

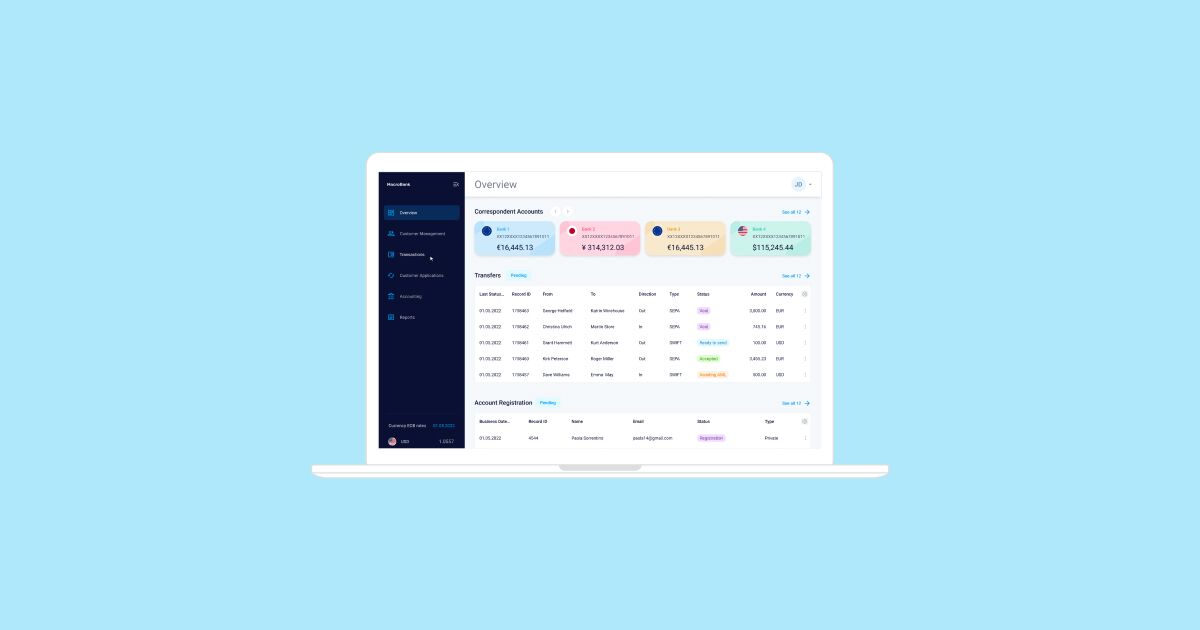

Smooth Migration to a New BaaS provider or own licence

Future decisions may prompt considerations about transitioning to another BaaS provider. Without a robust core banking system or reliance on a basic one, migrating to a new BaaS provider can be challenging. Choosing a pre-established, functional platform like Macrobank from the outset simplifies this process. Furthermore, such a choice enhances operational security, drawing lessons from incidents like the Railsbank situation.

Assessing Core Banking Software Platforms

First, create a list of core banking platforms. Then, identify if any pre-existing integrations with select BaaS providers are available. Such integrations markedly streamline the integration process and indicate that this specific software has undergone testing by the BaaS provider. In cases where ready integrations are absent, discuss with your shortlisted BaaS providers and software vendors regarding software requirements.

Get started with Advapay!

With the insightful checklist we’ve provided, you now have a solid foundation to navigate your journey to choose your BaaS provider and to become an agent of a BaaS provider. Advapay, as a core banking software provider with a network of over 10 BaaS partners, is prepared to assist you in this endeavour. Our collaborative approach and seamless integrations enable you to connect swiftly and efficiently. If you want to learn more about what we offer, reach out to our team at Advapay.