Payment or e-money companies establishing operations in the European Economic Area must ensure their customers can send and receive payments within the Single Euro Payments Area (SEPA). This challenge can be addressed by opening a correspondent account in a commercial bank, collaborating with a payment provider, or directly connecting to SEPA through systems like CENTROlink from the Bank of Lithuania.

In 2022, CENTROlink noted 148 active payment service providers, 19 from other European Economic Area (EEA) countries. It processed a substantial volume of transactions, with 276.3 million payments. Notably, 128.1 million were instant payments, showcasing the platform’s efficiency in handling real-time transactions. CENTROlink maintained a high availability rate of 99.6%, highlighting its reliability for diverse financial institutions.

Contents

- What is CENTROlink?

- Who is eligible, and how to connect to CENTROlink

- Core benefits of CENTROlink

- Equal Technological Ground

- Elimination of Credit Risk

- Streamlined Payment Chain

- IBAN and SWIFT BIC Codes

- Access to European Payment Systems

- Comprehensive SEPA Services

- Dual Infrastructure for Business Continuity

- Flexible and Secure Connectivity

- Speedy Connectivity

- Market Advantage through Faster Integration

- Independence from Commercial Banks

- Connection to CENTROlink – requirements for the participant

- CENTROlink setup steps

- Due Diligence:

- Non-Disclosure Agreement (NDA) and Technical Documentation Access:

- SWIFT BIC Code Application:

- CENTROlink Connection Application and IBAN Code Issuance:

- European Payment Council (EPC) Registration:

- Certification:

- Registration in Testing Environment of External Payment Systems:

- Testing in CENTROlink and External Payment Systems:

- Agreement with the Bank of Lithuania:

- Registration in External Payment Systems:

- Macrobank by Advapay: Core Banking software with built-in integration with CENTROlink

What is CENTROlink?

CENTROlink, managed by the Bank of Lithuania, is a payment system granting technical access to all licensed payment service providers within the European Economic Area (EEA). This access enables them to handle SEPA transactions, including SEPA credit payments (SCT), direct debit (SDD), and instant payments (SCT Inst). Launched on December 8, 2015, CENTROlink has experienced notable growth in Lithuania.

Following ISO 20022 standards and connected to the Eurosystem, CENTROlink has unique interpretations of transaction formats. Transactions first move to EBA Clearing before indirectly reaching TIPS.

Operating 24/7/365, CENTROlink follows SEPA instant payment processes, even for standard transfers (SEPA credit transfer) and direct debits (SEPA direct debit). However, it does not include B2B direct debit processing.

In contrast to the German Bundesbank’s system, which focuses on batch processing with limited operating hours, CENTROlink is a more advanced option. Furthermore, CENTROlink doesn’t require transaction confirmation, as potential errors are identified during transfer via EBICS or FileAct.

Unlike other European Central Bank payment systems that mainly serve connecting banks, CENTROlink from the Bank of Lithuania offers a unique European market solution for direct SEPA connection for fintechs.

Who is eligible, and how to connect to CENTROlink

Traditionally, SEPA access was confined to licensed credit institutions, causing challenges due to technical complexities in the documentation. To overcome this, institutions often used correspondent banks as intermediaries, resulting in extra fees and operational delays, especially in real-time payment scenarios.

For payment or e-money companies to provide SEPA payment services, the standard method involved making agreements with banks directly linked to SEPA or having correspondent connections with SEPA-affiliated banks. Until recently, there was no alternative to this business model.

CENTROlink emerged as a pioneering alternative, notably one of the earliest payment systems introduced by a central bank, extending direct SEPA connection services beyond banks to non-bank financial institutions.

According to CENTROlink rules, system participants can include licensed credit institutions by the Bank of Lithuania, central securities depositories, EEA-established credit institutions overseen by competent authorities, treasury departments of EU Member States, organizations providing clearing or settlement services within EEA oversight, and credit institutions or organizations offering clearing or settlement services established in countries with monetary agreements equivalent to EU legislation.

The system allows both direct and indirect participation. Indirect participants must engage in agreements with both direct participants and separately with the Bank of Lithuania for system participation.

How to connect to CENTROlink: Direct Connection

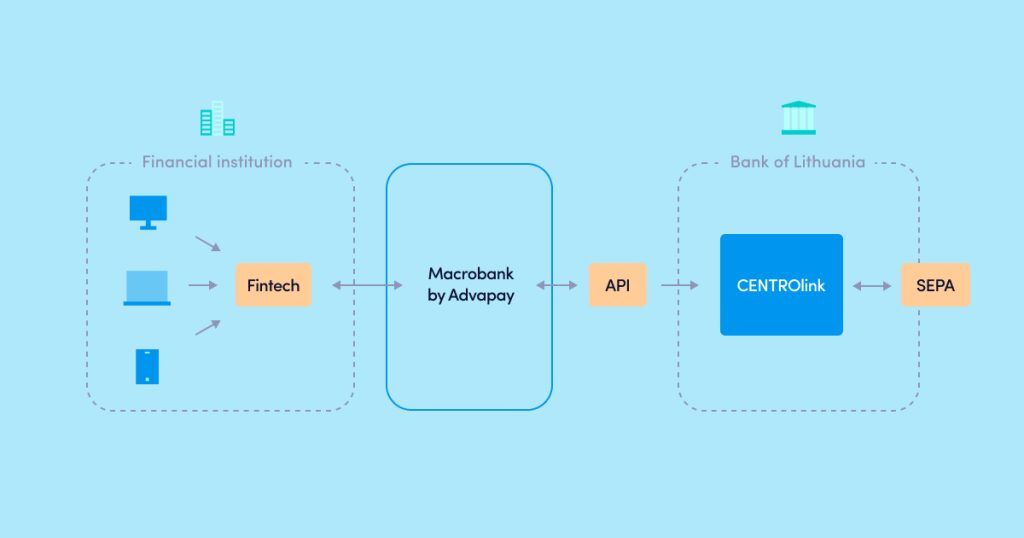

A financial institution, for a direct connection, can use its own IT system or choose a preconfigured core banking solution with integrated access to CENTROlink via its API (e.g., Macrobank by Advapay). While the financial institution starts the steps to join CENTROlink and completes an agreement with the Bank of Lithuania, the technical service provider (TSP) handles the gateway.

An illustrative example involves connecting to the Macrobank platform, which incorporates a gateway to CENTROlink in its comprehensive solution.

How to connect to CENTROlink: Indirect Connection

This option caters to both EU and non-EU financial institutions seeking SEPA access. The financial institution establishes a settlement account with a bank or EMI equipped with CENTROlink access. Once onboarded as a business client, they receive a set of virtual IBANs (sub-accounts) for their end customers. This empowers the company to set pricing and transaction fees while maintaining client relationships under its institutional name.

Technically, the financial institution must provide a client dashboard displaying their IBANs and transaction details, typically seamlessly integrated into the web/mobile banking platform.

Now, let’s explore the advantages of CENTROlink for Fintech companies.

Core benefits of CENTROlink

Equal Technological Ground

Non-bank institutions can pay under equivalent terms to traditional banks or credit unions.

Elimination of Credit Risk

Payments are processed through an account held at the central bank. This is a crucial advantage, as direct settlements via a central bank account streamline the payment chain by removing the need for a commercial bank. Non-banking financial institutions acquire the ability to inject payments into the system directly, leading to reduced processing time and operational cost optimization by bypassing bank commissions.

Streamlined Payment Chain

Direct settlements through a central bank account reduce payment processing time and optimize operating costs by excluding commercial banks.

IBAN and SWIFT BIC Codes

The Bank of Lithuania assigns a unique 5-digit financial institution code to the payment service provider. This code is used to create distinct IBAN account numbers for both the payment service provider and its clients. A payment service provider licensed in Lithuania receives a SWIFT BIC code with a Lithuanian country code, allowing global financial institution identification. In the system, payment service providers licensed in other countries can use SWIFT BIC and IBAN codes issued in their home countries. The Bank of Lithuania prioritizes Lithuanian financial institutions due to the high volume of connection applications to CENTROlink.

Access to European Payment Systems

CENTROlink connects the European payment systems STEP2, RT1 and TIPS, thus a payment service provider participating in CENTROlink gains access to the European payment systems without any additional expenses.

Comprehensive SEPA Services

CENTROlink offers a complete suite of SEPA services, including credit transfers (SCT), direct debit (SDD), and instant payments (SCT Inst).

Dual Infrastructure for Business Continuity

CENTROlink features a dual infrastructure, guaranteeing the business continuity of the system. This signifies that CENTROlink incorporates a fully redundant main backup system that seamlessly takes over transaction flows during technological failures or emergencies.

Flexible and Secure Connectivity

CENTROlink provides flexible and secure internet access to payment service providers, aligning with industry-specific requirements for payment security.

Speedy Connectivity

On average, the estimated duration to connect a financial institution to CENTROlink is three months, allowing for faster solution deployment.

Market Advantage through Faster Integration

Streamlining the integration process with payment networks accelerates solution launch, providing a competitive edge.

Independence from Commercial Banks

Direct connection to CENTROlink frees financial institutions from relying on commercial banks for limits or AML checks. CENTROlink solely provides technical support for payments, allowing the financial institution to manage AML checks and limit control.

Connection to CENTROlink – requirements for the participant

Financial institutions must meet particular technical and legal criteria outlined in CENTROlink’s rules to qualify as direct members. To become a licensed CENTROlink member approved by the Bank of Lithuania, they must fulfil the following criteria:

- Possess an identification code (BIC) in accordance with the ISO 9362:2014 standard for Banking telecommunication messages and Business identifier code (BIC).

- Identify account numbers, both their own and clients, following the ISO 13616-1:2007 standard for international bank account numbers (IBAN).

- Directly or indirectly participate in TARGET2 or commit to becoming a participant, with an issued mandate to the Bank of Lithuania to debit its PM account, excluding credit unions not affiliated with the Lithuanian Central Credit Union.

- Authorize the Bank of Lithuania to represent them in the STEP2 and/or RT1 systems.

- Join the SEPA Credit Transfer Scheme Adherence Agreement and/or the SEPA Core Direct Debit Scheme Adherence Agreement, and/or the SEPA Instant Credit Transfer Scheme Adherence Agreement through registration with the European Payments Council.

- Issue digital signature certificates to authorized individuals from the Bank of Lithuania’s electronic certification system.

- Possess the required hardware and system software, undergoing testing procedures to demonstrate operational readiness per the technical documentation of the System operator.

- Maintain sufficient technological system resources and implement systems and procedures to manage operational risk effectively.

- Inform clients that personal data provided in payment orders and instructions will be processed in the system.

- Ensure that members of the management body have a good reputation and possess the necessary qualifications and experience required to fulfil their duties.

- Establish adequate legal and organizational measures to prevent money laundering terrorist financing and comply with international sanctions.

- For participants with appropriate licenses from the EEA or other jurisdictions, additional requirements include providing a Capacity Opinion (if not provided) and, if established outside the EEA, presenting a Country Opinion (unless the Bank of Lithuania has a valid legal opinion for that country).

CENTROlink setup steps

Due Diligence:

Conduct a thorough evaluation of the payment service provider, including risk assessment. Complete the provided Questionnaire and submit it with necessary documentation to the Bank of Lithuania. The bank decides on participation within 15 working days, notifying the institution of rejection. If applicable, the bank will explain the reason within 5 working days.

Non-Disclosure Agreement (NDA) and Technical Documentation Access:

Sign an NDA for access to CENTROlink’s technical documentation. The Bank of Lithuania reviews API documentation for compliance. Access to restricted information is provided only after signing the NDA, with the financial institution held accountable for any disclosure.

SWIFT BIC Code Application:

Apply for a SWIFT BIC code. Institutions licensed by the Bank of Lithuania follow this procedure. Those licensed in other European Economic Area countries or other relevant jurisdictions can use the BIC code obtained under their own license.

CENTROlink Connection Application and IBAN Code Issuance:

Apply to connect to CENTROlink and acquire a financial institution code for IBAN accounts. Institutions licensed in other European Economic Area countries or relevant jurisdictions can use the IBAN obtained under their existing license.

European Payment Council (EPC) Registration:

Register the CENTROlink participant with the European Payment Council (EPC) as per payment system rules.

Certification:

Sign a Certification Agreement and receive personal certificates for accessing CENTROlink. These certificates ensure the security of the financial services company’s connection to the payment system infrastructure.

Registration in Testing Environment of External Payment Systems:

Depending on the SEPA payment scheme chosen, the Bank of Lithuania registers the financial institution in test environments of external systems (STEP2, RT1, etc.) after obtaining the BIC code and IBAN.

Testing in CENTROlink and External Payment Systems:

Conduct required testing in CENTROlink and external payment systems within the agreed timeframe. Submit a test report to the Bank of Lithuania.

Agreement with the Bank of Lithuania:

Complete the registration form, provide a third-party-issued capacity opinion, and submit a country opinion for institutions outside the EEA if required. A country’s opinion is unnecessary if the Bank of Lithuania holds a valid legal opinion.

Registration in External Payment Systems:

The Bank of Lithuania registers the payment service company in external payment systems (STEP2, RT1, etc.) within the set timeframe by respective payment systems.

More information about CENTROlink can be found on the Bank of Lithuania website.

Macrobank by Advapay: Core Banking software with built-in integration with CENTROlink

We possess expertise in collaborating with CENTROlink, having worked with various clients linked to CENTROlink through Advapay. This platform facilitates a unified connection to CENTROlink, diverse payment schemes, multiple banks, card issuers, AML/KYC services, and other service providers. It is accessible through both Software as a Service (SaaS) and software license deployment options.

Macrobank, an innovative Core Banking Platform, enhances efficiency across multiple areas. Tailored to address current and future challenges in financial institutions, it represents cutting-edge functionality.

At stake:

- Robust Back Office Functionality

- Ready Integrations (including CENTROlink) for Seamless Implementation

- White-Label Web and Mobile Banking Apps

- BaaS and Embedded Finance Capabilities

- Modern Back-Office Application Interface

- Startup-Friendly Design

- Compliance with the Security and Regulatory Standards

- Built-In Accounting System

- Diverse Deployment and Purchase Options

Our solution offers access to various functionalities, technology, and partner ecosystems that prioritise security and compliance. Macrobank empowers you to design personalised offerings within your chosen ecosystems, facilitating efficient product launches. Contact us to explore your product possibilities and schedule a demo!