The year 2020 is closing, and we all witnessed how difficult this year was for new businesses, including Payment and Electronic Money companies. Covid-19 has had a huge impact on financial systems across the world, including the provision of digital financial services, the functioning of the FinTech market and the number of obtained e-money and payment licenses.

Fintech Investments and Market Performance

According to the Pulse of Fintech H1’20, a bi-annual report on global fintech investment trends from KPMG International, overall global Fintech funding dropped by 25.6 billion of investment globally across 1,221 deals during the first half of 2020. On the other hand, VC investment remains strong across the globe despite the global uncertainties resulting from the outbreak of Coronavirus. According to the report, the investment could surpass the annual record if the trend recorded in H1’20 continues.

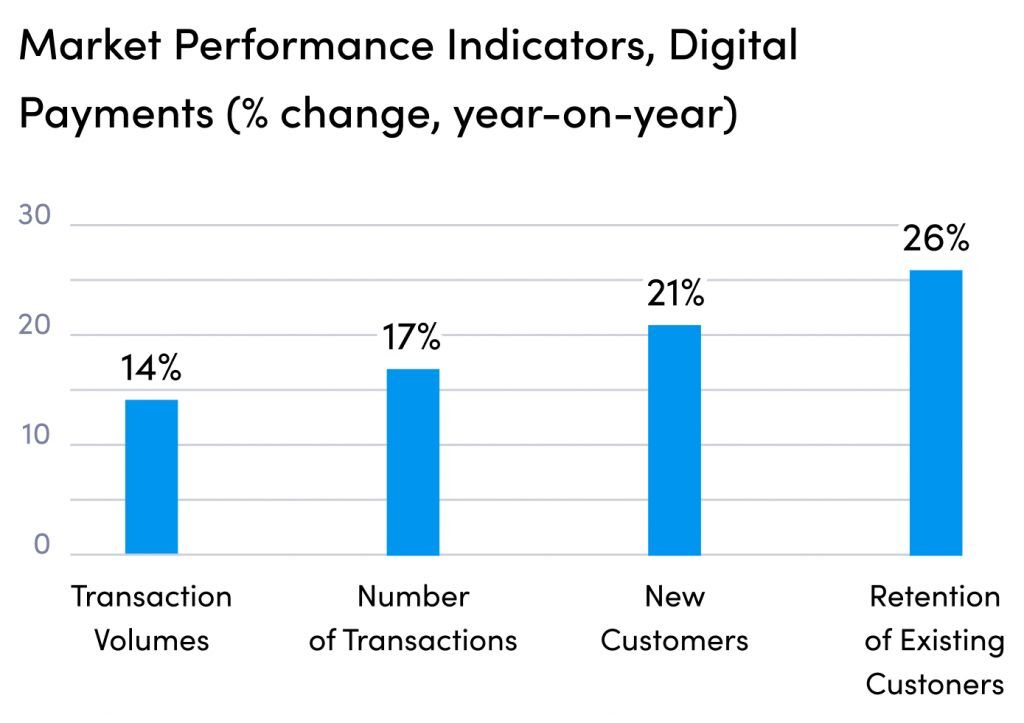

The findings of the Global COVID-19 FinTech Market Rapid Assessment Study suggest that FinTech firms’ operations have continued to grow despite the global situation. According to the survey, on average, Digital Payments respondents, the UK and European companies reported an increase in transaction volume, the total number of transactions and new customers by 14%, 17% and 21% year-on-year respectively. Digital Payments companies also indicated an increase of 26% on retention or renewal of existing customers and users.

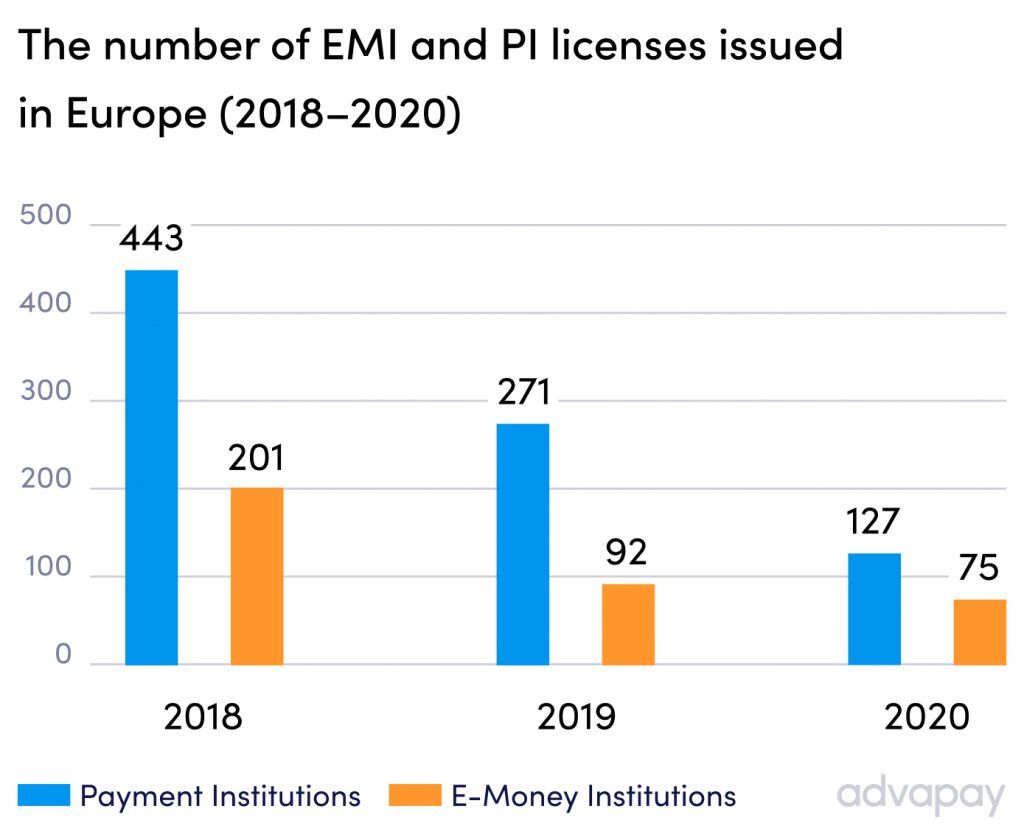

Total number of Payment Institution and E-money licenses issued in 2018-2020

When comparing the total number of licenses, we can see that the total number of Payment Institution (PI) licenses obtained in 2020 has decreased by 144 licenses or 53% compared to 2019, whereas the number of Electronic Money (EMI) licenses decreased by 17 licenses or 18%.

On the other hand, there also was a decrease in 2019 of issued payment licenses by 39% and 55% for e-money licenses compared to 2018.

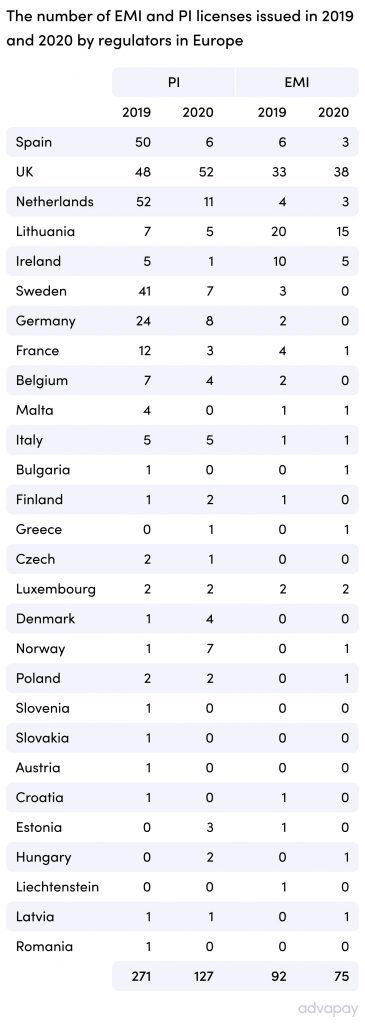

To have a big picture on licenses issued in the EU countries in 2019 and 2020, we have come up with a table shown below:

Most EU countries this year have issued a smaller number of licenses compared to 2019, however ten countries showed an increase of 1-6 licenses.

For EMI licenses, there are Greece, Hungary, Norway, Poland, Latvia and Bulgaria with the increase of 1 license (0-1) and the UK with the increase of 5 licenses (33-38).

For PI licenses the list looks as follows: Norway with increase of 6 licenses (1-7), the UK with increase of 4 licenses (48-52), Estonia (0-3) and Denmark (1-4) with increase of 3 licenses, Hungary (0-2), Finland (1-2), Greece (0-1).

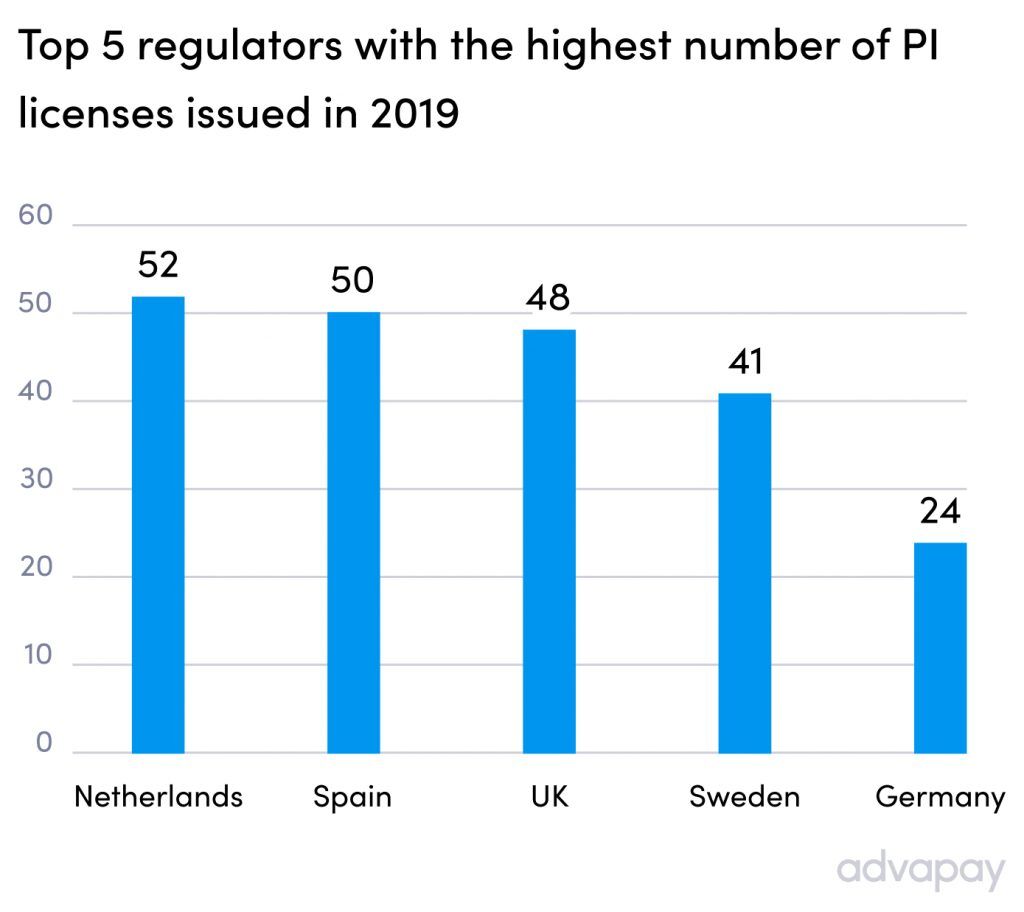

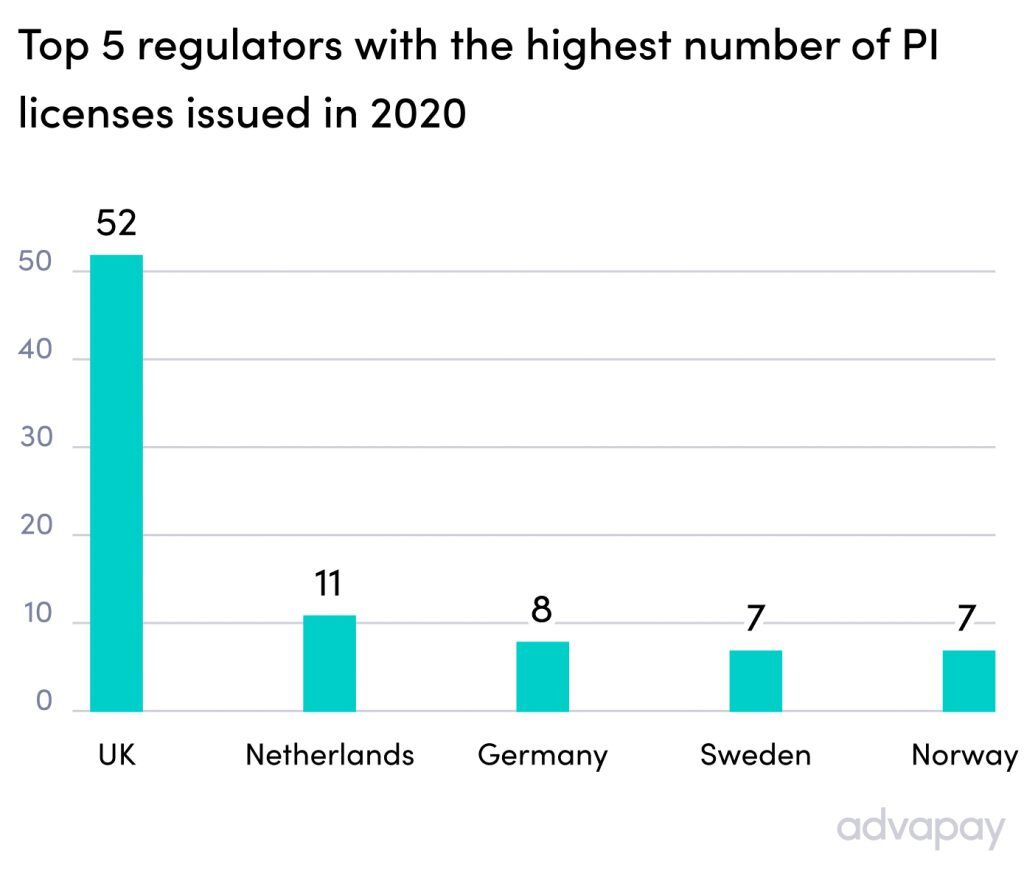

Payment Institution licenses

It is essential to analyse leaders in licenses issuing between 2019 and 2020. In 2019 the first place took the Netherlands, then Spain, the UK, Sweden and Germany. The Big 5 in issuing Payment Institution licenses in 2020 aren’t quite surprising – four companies, excepting Spain, have retained their place in the Top 5 ranking, but changed their positions in terms of numbers of licenses issued.

After having the 3rd position in 2019, the UK with an increase of 4 licenses holds the top place in 2020. The leader of 2019, the Netherlands, had a decrease of 41 licenses or 78% and holds second place in 2020. Spain, taking the second place and 50 licenses issued in 2019, has left the Top 5 chart with only 6 licenses issued in 2020. Sweden, with 41 licenses in 2019, had a decrease of 34 licenses or 82%. Germany has moved from the 5th to the 3rd position in 2020 and reported a decline of 67% in licenses issued. Norway has held the fifth position in 2020 with 7 licenses issued and showed a 600% increase comparing with 2019.

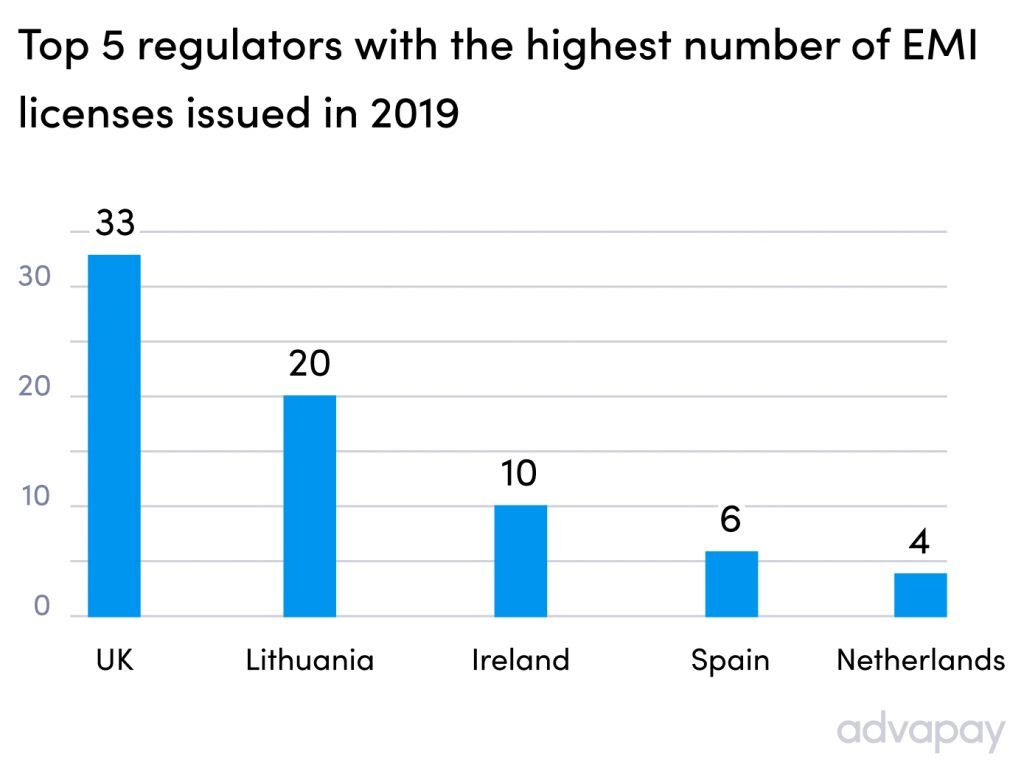

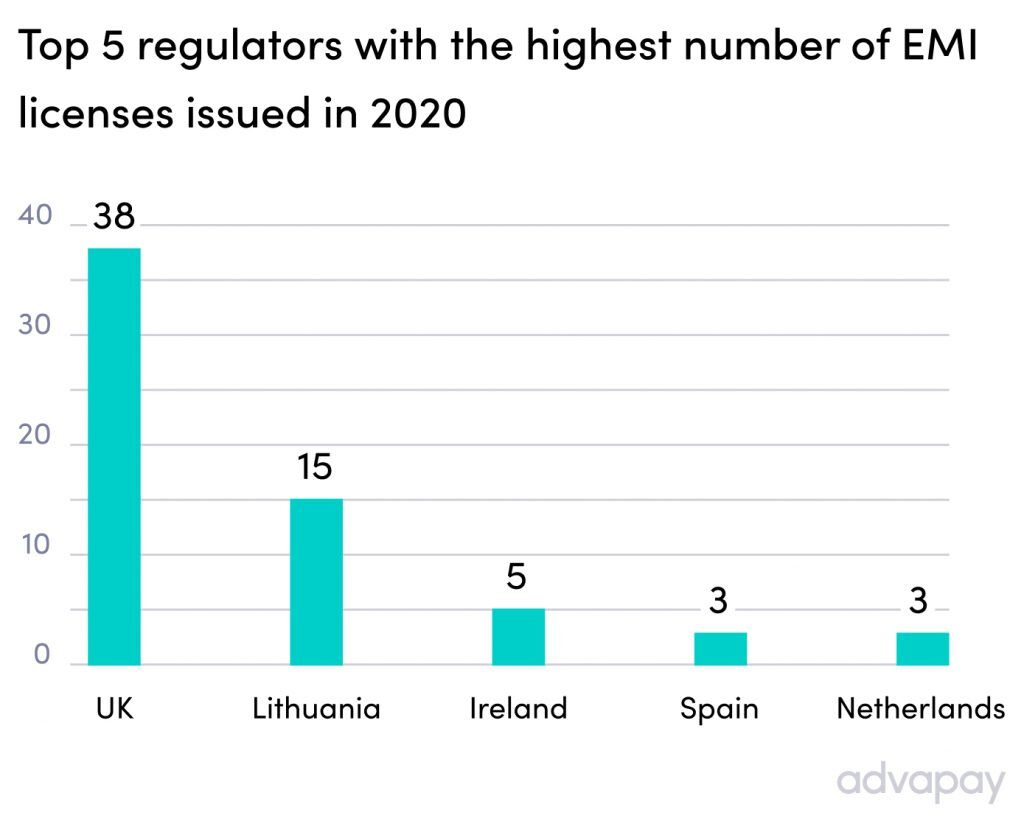

E-money institution licenses

A quick note on the statistic of e-money licenses – we can see that leaders of the year 2019 have retained their positions in the chart of 2020.

The UK, as a centre of FinTech business, showed an increase in licenses amounting of 5 licenses or 15% and has kept the first place. Lithuania, following the UK in the chart, showed a drop of 5 licenses or 25% decrease. Ireland showed a decrease of 50% and has issued 5 licenses less than in 2019. Spain and the Netherlands, which hold the 4th and 5th places, showed a 50% and 25 % decrease accordingly and have reported only three licenses issued in 2020.

Whether the pandemic has influenced the development of the fintech industry or not – there are quite a few opinions on this topic, but what is evident is that the Covid-19 pandemic has accelerated the use of FinTech or digital services compared to offline services thanks to the remote provision.

Statistics from: European Banking Authority`s Payment Institution Register. Updated: January 5th, 2021

Advapay is a technology company providing the Digital Core Banking platform to empower fintech clients or digital banks to start their businesses and accelerate digital transformation. The platform delivers all essential functionalities, a front-to-back system and a set of tools to customise and bring new integrations. With Advapay, potential and existing customers can connect either to the cloud-based SaaS or on-premise software. Besides the technical infrastructure, the company provides business advisory and fintech licensing services. Interested to learn more, please drop us a message.