Advapay by numbers

35

Clients

5

Offices

50

People

Launch your digital bank

with our

Core Banking software Become a payment, e-money or MSB company with

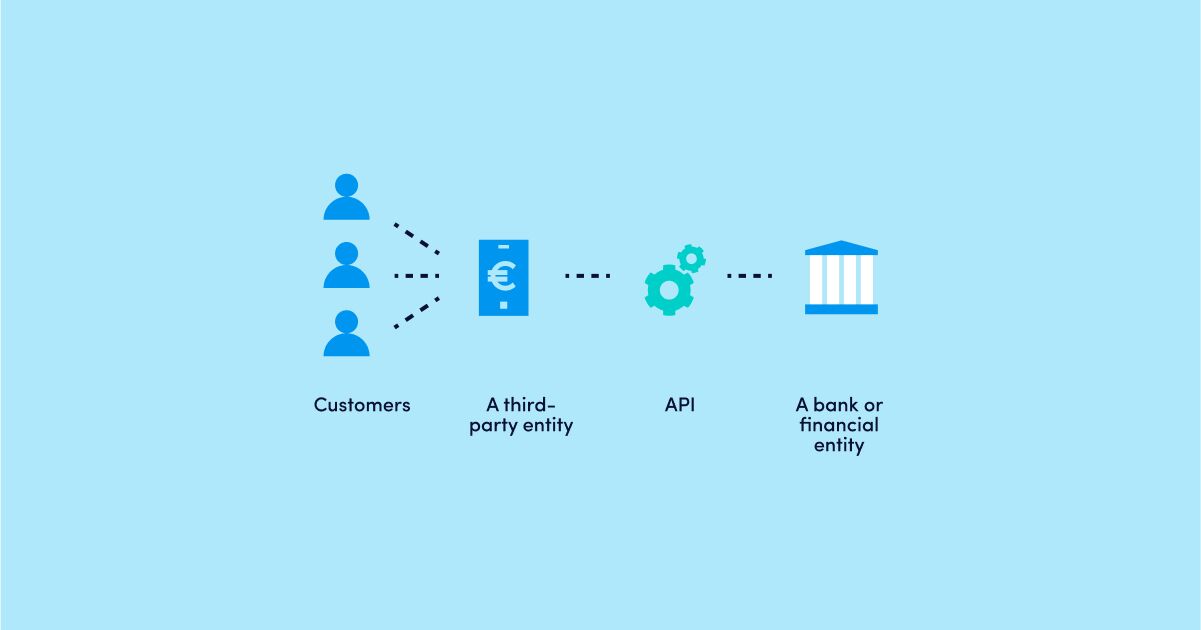

PI/EMI Licensing servicesDevelop your payment infrastructure with

BaaS solutionsAdvapay is a Core Banking software vendor and fintech consulting company. Founded by banking practitioners and fintech entrepreneurs, we are unique in the way we operate.

There is no other company in the fintech industry that helps fintechs on all three levels: sophisticated software, business and payment infrastructure development, and legislative consultancy.

Such a holistic approach brings an added value to businesses that seek to launch a fintech company and save time and money.

Our verticals

Digital banks for SMEs

E-wallets for individuals

Crypto-fiat wallets

E-commerce solutions

Crowdfunding platforms

Micro-finance institutions

We help fintech companies to launch and grow their businesses

Want to learn more how we can help you?

Talk to our expert

Rely on our expertise and

hassle-free solutions

We build fintech

companies from

the ground

We are fintech practitioners with

an extensive experience in developing and successfully managing fintech businesses from scratch.

We deliver truly

end-to-end

solutions

With our licensing services, Core Banking software, a network of BaaS providers and the end-to-end care we can support fintech companies throughout the lifecycle of their business.