Recently, MSBs have become very popular. Many new companies wonder what the difference is between an MSB company and an e-money or a payment company in the EEA or the UK and if MSB registration is the best-suited option for their business. This article discusses the main similarities and differences between these licences and the main benefits of an MSB licence.

We want to compare the process of registration, main requirements and development of payment infrastructure of an MSB company and an e-money or a payment company.

1. Serving clients in other regions

Let’s discuss the licence type that meets your client portfolio better.

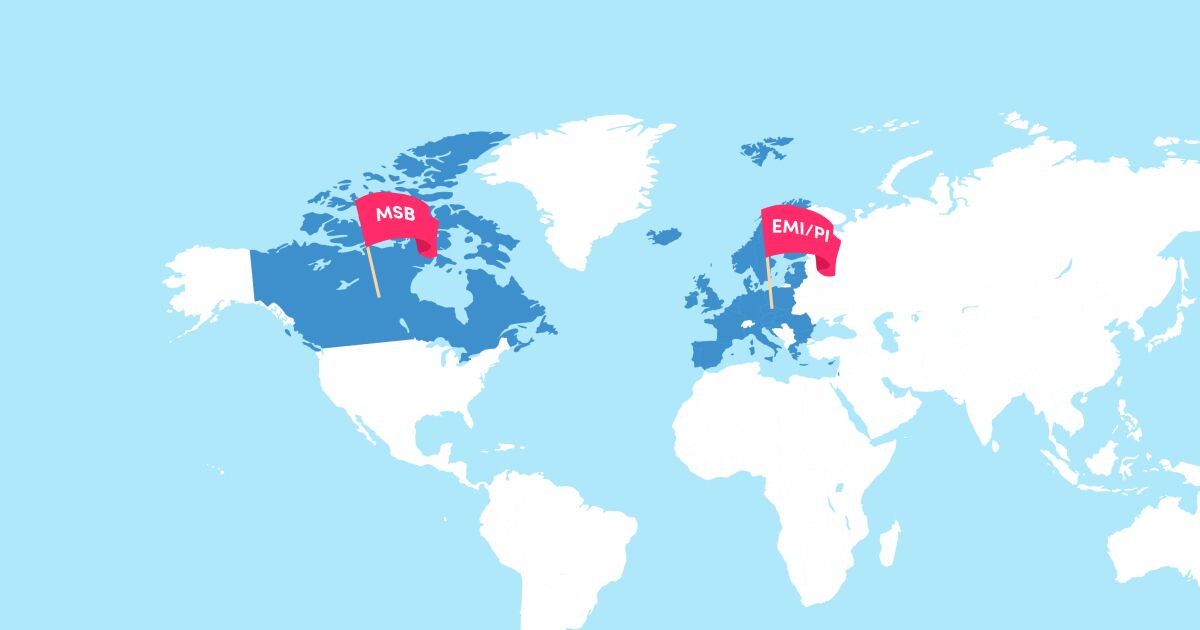

Electronic money institutions or payment institutions, licensed by any country of the EEA and taking advantage of passporting opportunities, may operate across the EEA. Additionally, electronic money institutions or payment institutions licensed in the UK have the right to operate in the UK. Likewise, Canadian MSBs are allowed to provide their services in Canada as a place of their registration.

But companies can also onboard clients from other jurisdictions if those customers find the company themselves, meeting a condition of the so-called reverse solicitation – when customers from other countries act on their exclusive initiative to seek financial services. This includes inside or outside their home state and finding a website or an app of a foreign financial institution without any specific effort to attract foreign customers from the institution’s side. MSBs, EMIs, and PIs cannot advertise services in other jurisdictions. Still, nobody restricts delivering services to customers if they naturally come to the website (or through the app).

Also, the Canadian regulator is more relaxed in working with clients outside of Canada. At the same time, most EEA regulators and also the UK regulator will not be satisfied if the number of customers outside their region exceeds 10-20 per cent. Consider your client portfolio and marketing strategy when evaluating which licence jurisdiction can better meet your business needs.

If you plan to operate in the EEA and advertise your services there, then Canada will not be a suitable option for you, and you should think about any of the EEA countries.

On the other hand, if you plan to work with clients that come through partners or acquaintances, Canada may suit you better.

2. Required documents

The next point is to discuss how big is the set of documents required by regulators. The more documents you need to prepare, the more expensive and longer your licencing process will be.

For MSB Application, you need to submit a small set of documents that includes the Business Model Description and legal documents for the company applying for the registration. The compliance policy suite is not being submitted with the MSB application but is required when the company becomes operational.

In the case of an authorised e-money or a payment institution, be ready to submit around 20 documents on around 200-400 pages, covering such areas including business plans, financials, a programme of activities, outsourcing arrangements, structural organisation, suitability forms for managers and shareholders, risk management policy, AML-related documents, IT-related documents, covering security, data flows, IT compliance, and business continuity. EEA and UK regulators expect to receive meticulously prepared documents and come with different questions and requests for clarifications, resulting in an extension of the period for obtaining a license.

3. Time of obtaining an MSB registration and an EMI/PI licence

In the case of MSB, the preparation of documents usually takes up to one month; applications are typically reviewed within one or two months.

In the case of an e-money or a payment institution, the preparation of documents takes much longer. Usually, the process is at least 3 months long. Additionally, applications are reviewed for 9-15 months, depending on the jurisdiction. For example, obtaining a licence in the Netherlands can take around 9 months. In contrast, the process of licencing in Poland may take 15-18 months.

Such long periods in the EEA and the UK are due to the fundamentally different nature of the application review process, and the number of documents regulators evaluate.

In Canada, registration looks more like a notification procedure, where the regulator evaluates whether all documents meet the formal requirements.

In the EEA and the UK, regulators carefully evaluate teams to ensure they are ready to do business; they analyse all 200-400 pages of documentation, returning 2-5 times with 50-150 questions on all aspects of the business.

4. Permitted services for MSB and EMI/PI

Generally, the list of permitted services of EMIs/PIs and MSBs are very similar. However, they have some differences. Let’s compare.

Service provisions for EEA/UK PIs and EMIs are defined by PSD and EMD directives. PDS2 (Payment Services Directive 2) defines eight payment services allowed for payment institutions:

- Services enabling cash to be placed on a payment account and all the operations required for operating a payment account

- Services enabling cash withdrawals from a payment account and all the operations required for operating a payment account

- Execution of payment transactions, including transfers of funds on a payment account with the user’s payment service provider or with another payment service provider

- Execution of payment transactions where a credit line covers the funds for a payment service user

- Issuing of payment instruments and acquiring of payment transactions

- Money remittance

- Payment initiation services

- Account information services

According to EMD2 (Electronic Money Services Directive 2), e-money institutions can also issue electronic money in addition to the list of payment institutions’ services. But do not confuse the definition “electronic money” with “virtual currency” (including cryptocurrency)! Dealing with cryptocurrencies requires a separate license.

Canadian money services businesses (MSBs) must fulfil specific obligations as required by the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) and can offer one or more of the following services to the public:

- Foreign exchange dealing

- Remitting or transmitting funds

- Issuing or redeeming money orders or similar negotiable instruments

- Dealing with virtual currency (custody of crypto funds requires separate permission from the Securities Commission)

- Crowdfunding platform services

One of the most apparent differences between EMI/PI and MSB licences is that MSB companies can provide crypto and crowdfunding services. In contrast, if you want to provide these services in the EEA and the UK, you must have a separate licence.

5. Requirements for directors and management

The next point is to discuss the requirements for the management. These requirements also influence the final costs of the licencing process and raise a lot of difficulties in finding the appropriate personnel.

For an MSB licence, you must have at least one director and a compliance officer at the registration stage. Even though there are no residency requirements for both roles, it is recommended that the compliance officer has experience in the Canadian MSB industry or relevant education.

For European or UK e-money or payment institutions, the number of required personnel depends on the jurisdiction. For example, when submitting documents in Spain, the company needs to hire 2-3 local employees. In contrast, Ireland’s regulator has introduced new staff requirements, where the company must hire at least nine local employees.

Regardless of the country, before starting your operations in the EEA, you should have a team that covers general management, operations, compliance, AML, risk management, finance, IT, and internal audit. The differences between countries are only in the number of people you need to hire before document submission and how many must be residents of the licensing country.

6. Initial capital requirements

Initial capital requirements influence the project’s overall costs and can set barriers for companies without required investments. Let’s compare EMIs/PIs and MSB requirements.

The initial capital of all EEA and UK-based Authorised Payment Institutions must at all times be at least EUR 125 000 where the payment institution intends to provide not only money transfer services or payment initiation services. Regarding EMIs, this minimum is EUR 350 000. Depending on the growth plan, sometimes a regulator can ask to increase the initial capital amount by 2-3 times. For example, a Lithuanian regulator has been known for its high evaluation standards for companies applying for licences. According to the company’s business plan, most cases require increasing the initial capital amount. These initial capital requirements put entry barriers for new companies, pushing companies with small budgets out of the race.

Compared with EMIs and PIs, the Canadian MSB does not have the minimum capital requirements, which gives companies without big budgets opportunities to start their payment business without high barriers.

7. Launch of the payment infrastructure and operations

Developing the payment infrastructure in Canada and Europe differs in nuances and the choice of specific partners to implement payment transactions.

The EEA and the UK provide a much more mature ecosystem with over 30 BaaS providers and dozens of fintech-friendly banks. Often these are mainstream banks or companies with large venture capital funding.

The Canadian ecosystem is different from the European one. The relatively small market (approx. 40 million people) and the reluctance of mainstream banks to work with MSBs (a direct consequence of the straightforward registration procedure and the passive position of the regulator!) leads to Canadian MSBs having to seek their fortune in small local banks and credit unions, which often are poorly automated and do not have a developed API, which is customary for European fintech companies.

Add to this the lack of direct access to SEPA and the minimal choice of providers ready to open current accounts in euros.

All this makes the process of infrastructure development for MSBs difficult, and the very type of an MSB business is quite complicated when it comes to creating a truly massive international payment service.

Conclusion

What conclusions can be drawn, and what company’s type best suits your business?

- Canadian registration is incomparably easier and cheaper to obtain and maintain.

- With Canadian MSBs, you can work with cryptocurrencies. At this time, the EEA/UK requires a separate crypto licence to provide cryptocurrency services.

- The EEA and UK licences are more prestigious. With an EMI/PI licence obtained in EEA, you can advertise your services in the EEA.

- Opportunities to create a diversified low-cost payment infrastructure with low transaction costs in the EEA are incomparably greater.

Comparison table

The table below compares the Canadian MSB and EMI/PI licenses in the EEA/UK.

| EMI/PI in the EEA/UK | MSB in Canada | |

|---|---|---|

| Permitted regions for serving customers | The EEA or the UK (depending on the licence), but the reverse solicitation is applied to customers from other regions. | Canada, but the reverse solicitation is applied to customers from other regions. |

| Time of obtaining | 9-15 months | 2 months |

| Permitted services | 1) Payments, currency exchange, cash withdrawals 2) Card issuing 3) Acquiring 4) Money remittance 5) Payment initiation services 6) Account information services 7) E-money issuing (for EMIs only) Please see the full list in the article above. | 1) Foreign exchange dealing 2) Remitting or transmitting funds 3) Issuing or redeeming money orders or similar negotiable instruments 4) Dealing with virtual currency 5) Crowdfunding platform services |

| Deals with cryptocurrencies | Dealing with crypto operations requires a separate registration. | Are allowed |

| Requirements for management | 4-5 local people, depending on the jurisdiction at the time of the document submission. | At least one director and a compliance officer. There are no residency requirements for the director role. |

| Initial capital requirements | At least 125 000 EUR for PIs and 350 000 EUR for EMIs. | No requirements. |

| Opening correspondent accounts | In commercial banks. | In credit unions or small local banks. |

| SEPA payments | Through CENTROLINK, a bank or a BaaS-provider. | Through third-party providers from the EEA region. |

| SWIFT and international payments | Through banks or BaaS-providers (SWIFT) or remittance providers. | Through a credit union, small bank (SWIFT) or remittance providers. |

| Card programmes | Through EEA/UK card issuers | Through local and international card issuers |

If you want to learn more about MSB registration, please read the article below and send us a message to book a call.

About Advapay:

Advapay is a technology company providing the Digital Core Banking platform to empower fintech clients or digital banks to start their businesses and accelerate digital transformation. The platform delivers all essential functionalities, a front-to-back system and a set of tools to customise and bring new integrations. With Advapay, potential and existing customers can connect either to the cloud-based SaaS or on-premise software. Besides the technical infrastructure, the company provides business advisory and fintech licensing services. Interested to learn more, please drop us a message