To launch your fintech project and provide payment services you need permission or authorisation to perform these operations. Canadian Money Services Business (MSB) licence is one of the many options you can pick to register your payment business and start operating quickly.

Obtaining an EMI licence in any of the EU countries or in the UK is a very long and expensive process. From the very beginning to the actual launch, it can take more than a year and a half. You will need to allocate at least 3 – 4 months to prepare documents, 9 – 15 months to get authorisation from the regulator, 3 – 4 months to actually launch the basic payment infrastructure.

Therefore, new companies are usually forced to look for alternative options to start a fintech company – faster than obtaining an authorised PI or EMI licence. One of the strategies is to operate as an agent under the umbrella of a licenced BaaS provider, the other one is to register as a small payment institution. Today, we will investigate the third option – obtaining a Canadian Money Services Business (MSB) licence. Instead of becoming an agent of a BaaS-provider, obtaining a small PI/EMI licence, or becoming a fully authorised PI/EMI institution, you can get the Canadian MSB licence.

Read our latest article to learn more about Canadian MSB and EEA/UK-based E-money or Payment Institution main similarities and differences.

What is a Canadian MSB licence?

In the true sense, this is not a licence, but registration in a special register of businesses providing payment services, which is maintained by the Canadian regulator FINTRAC (Financial Transactions and Reports Analysis Centre of Canada). Money Services Business (MSBs) must fulfil specific obligations as required by the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) and associated Regulations, to help combat money laundering and terrorist activity financing in Canada.

There are two types of businesses that must fulfil obligations under the PCMLTFA in Canada: Money Services Business (MSB) and Foreign Money Services Business (FMSB).

What is a Money Services Business (MSB)?

The company is a Money Services Business (MSB) if all of the following criteria apply:

1-The company offers at least one Money Services Business (MSB) service to the public:

• Foreign exchange dealing;

• Remitting or transmitting funds;

• Issuing or redeeming money orders, traveller’s cheques, or anything similar;

• Dealing in virtual currency;

• Crowdfunding platform services.

2-The company has a place of business in Canada

What is a Foreign Money Services Business (FMSB)?

The company is a foreign Money Services Business (FMSB) if all of the following criteria apply:

1-The company is engaged in the business of providing at least one Money Services Business (MSB) service:

- Foreign exchange dealing;

- Remitting or transmitting funds;

- Issuing or redeeming money orders, traveller’s cheques, or anything similar;

- Dealing in virtual currency;

- Crowdfunding platform services.

2- The company does not have a place of business in Canada:

- The company is not incorporated in Canada;

- The company does not have a physical location in Canada; or

- The company does not have employees, agents, or branches in Canada.

3- The company directs its MSB services at persons or entities in Canada;

A business is directing services at persons or entities in Canada if at least one of the following applies:

- The business’s marketing or advertising is directed at persons or entities located in Canada;

- The business operates a “.ca” domain name; or

- The business is listed in a Canadian business directory.

4- The company provides these services to clients in Canada (that have a connection or residential ties with Canada).

What is the difference between the Money Services Business (MSB) and Foreign Money Services Business (FMSB)?

For the foreign Money Services Business (FMSB), there are more complex procedures to get registered, as well as there are several limitations on how the company can operate.

The main differences between the Money Services Business (MSB) and the foreign Money Services Business (FMSB) in the registration process:

- The company must be registered abroad.

- In addition to the documents required for the registration of the Money Services Business (MSB), the foreign Money Services Business (FMSB) must submit police record checks for the CEO, all directors, and beneficiaries. Police record checks are required from the country in which these employees are residents.

- The company must have an official representative of the company in Canada – a resident of Canada, who will communicate with the regulator (Fintrac) on behalf of the company.

- The registration process for the foreign Money Services Business (FMSB) usually takes longer than for the Money Services Business (MSB).

The main differences between the Money Services Business (MSB) and the foreign Money Services Business (FMSB) in operations:

For Canadian banks and credit unions, the foreign Money Services Business (FMSB) is a huge high risk. Roughly speaking, you will need to forget about opening correspondent accounts even in credit unions. The only option is third-party payment processing providers and remittance providers.

What are the advantages of the Money Services Business (MSB)?

- First, there is a short period of time necessary for the actual launch — a month for preparation, two months for consideration of an application, two months for launching an infrastructure. The Canadian Money Services Business is one of the rare options that allows you to start your operations in six months after the launch of the project.

- There are no requirements for the authorised capital, place of business and staff (only for a compliance officer).

- There is a possibility to provide services in both fiat and crypto. This sets Canada apart from Europe, where fiat and crypto transactions require different licences.

What are the disadvantages of the Money Services Business (MSB)?

- You will not be able to actively advertise your services in the countries of the European Economic Area and the UK. In fact, the only country where you have the right to advertise is Canada. However, the law does not prohibit onboarding clients from other countries.

- Secondly, it will be difficult for you to open correspondent accounts and develop an infrastructure outside of Canada. You need to consider that in Canada you will be able to open correspondent accounts only in local credit unions, not in traditional banks. Your capabilities to provide services will be defined by agreements with small partners limited in numbers.

How to register and run the Money Services Business (MSB)?

The registration and launch process comprises several stages.

STAGE 1. Document preparation

Duration: 1–2 months

To register the Money Services Business (MSB) in Canada, you need to prepare the following information:

- bank account information;

- information about your compliance officer;

- number of employees;

- incorporation information (if your business is a corporation);

- information about owners and senior management of the Money Services Business, such as their name and date of birth;

- estimate of the expected total dollar amount of transactions per year for each service of the Money Services Business (MSB) you provide;

- detailed information about every branch;

- detailed information about every MSB agent.

Additionally, we recommend preparing at this stage:

- compliance program;

- simplified business plan – not necessary that it will be requested, but it can be very handy.

STAGE 2. Application consideration by the regulator

Duration: 1–2 months

Applications are usually reviewed within one or two months. The regulator may ask additional questions about AML or request a business plan. While the application review is underway, you can finalise the AML manuals and deploy the software.

STAGE 3. Launch of the payment infrastructure and operations

Duration: 2-3 months

After registering with Fintrac and submitting the compliance program, the company can launch the payment infrastructure.

First, you need to open correspondent accounts in credit unions. Correspondent accounts in Canada are available in major currencies, including Canadian dollars, US dollars, euros, and British pounds. The services credit unions provide may vary and depend primarily on the risk rating of the particular MSB. Simultaneously, the more competent is the work on the development and implementation of the compliance program, the lower the risk rating will be, and the more services available for your business.

For international transfers not available with credit unions, Money Services Business (MSB) can use the services of local and foreign remittance providers.

If you plan to launch a card program, there are both local and international card issuers who work with Money Services Businesses (MSB).

To provide SEPA payments, you must connect to third party providers. To provide SWIFT payments you can connect to any credit union or third-party providers.

To provide such operations as buy, sell, receive, and send cryptocurrencies, you will need to sign an agreement and integrate with a crypto exchange or liquidity provider. Keep in mind that you will be able to store client cryptocurrencies on your own wallets only after registering with the Securities Commission, which is a much more complicated process than launching a Money Services Business (MSB).

How can Money Services Business (MSB) add agents?

Agents are individuals or entities authorised to deliver services on behalf of the Money Services Business (MSB). They do not need to be authorised with Fintrac, and they are not the actual branch of the Money Services Business (MSB).

They are added through the business personal account in Fintrac (or when registering with Fintrac). To register, the Money Services Business (MSB) must enter the following information about its agents:

- name of the agent;

- address of the agent;

- telephone number;

- year in which the agent first became an agent of the Money Services Business (MSB);

- number of branches or subagents the agent has;

- type of service or services the agent provides;

- listing of the months in the 12 months immediately preceding the date of the most recent agent list in which the gross transaction amount of the agent with respect to financial products or services issued by the MSB exceeded $100,000;

- name and address of any depository institution at which the agent maintains a transaction account for all or part of the funds received in or for the financial products or services issued by the MSB.

To give you an idea, gas stations, merchants, and supermarket corporations can be considered as agents. Keep in mind that the agent of the Money Services Business (MSB) can also be another Money Services Business (MSB).

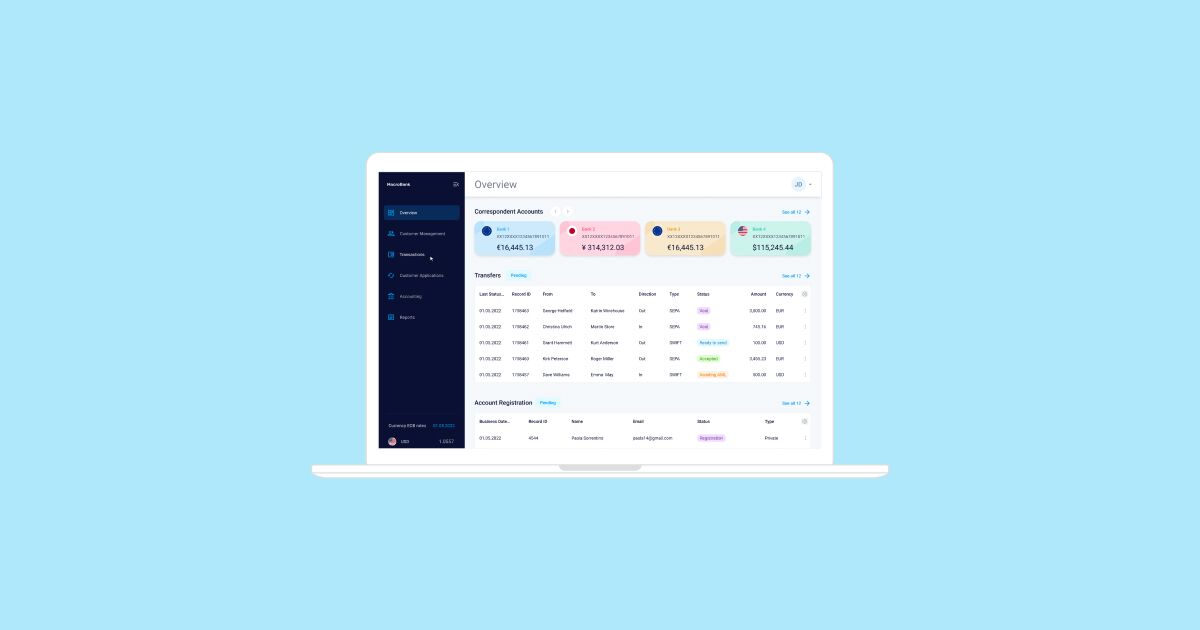

About Advapay:

Advapay is a technology company providing the Digital Core Banking platform to empower fintech clients or digital banks to start their businesses and accelerate digital transformation. The platform delivers all essential functionalities, a front-to-back system and a set of tools to customise and bring new integrations. With Advapay, potential and existing customers can connect either to the cloud-based SaaS or on-premise software. Besides the technical infrastructure, the company provides business advisory and fintech licensing services. Interested to learn more, please drop us a message