Are you seeking a comprehensive Core Banking software to expedite technological implementation and empower market entry? Want to consistently improve your core banking solution in alignment with technology, customer needs, or regulations? Co-construct your ideal solution with Advapay! Here are the benefits.

1 – A highly functional back office means greater opportunities for the future

A core banking solution must execute various operations and adapt to diverse business and regulatory requirements. It’s essential to dispel the notion that it should be a one-click solution. Besides standard banking and payment functions like automatic IBAN generation, account opening, payment processing, currency exchange, and card issuance, a core banking software must also offer flexibility to modify parameters, workflows, and other aspects swiftly upon request.

Operators of digital banks must handle routine alterations, such as creating client risk profiles, assigning risk statuses to customers, setting rules for each profile, adjusting commission fees (both percentages and fixed amounts), establishing new workflows or rules, assigning roles, and making other necessary modifications.

Choosing an overly simplistic core banking software may hinder future operations and create regulatory complexities due to its inability to meet requirements. Sooner or later, you’ll likely need to replace it with a more functional system due to its limitations.

With Advapay, you can enhance flexibility, leveraging the extensive capabilities offered by the virtually boundless functionality of our core banking system’s backend.

2 – Ready integrations or new integrations on request means a greater product portfolio

Core banking software should enhance the system with payment services, including AML/KYC verification, various payment options, card issuance, currency exchange, etc. This requires the capacity to integrate with service providers through APIs, which can save time and costs with pre-existing integrations.

Advapay empowers you to build your ideal product and enrich your Core Banking software per your specific requirements. All necessary services can seamlessly integrate into our core banking system, and you can easily utilise existing integrations with service providers for limitless innovation. Check out our technology partner marketplace, where we’ve listed some partners.

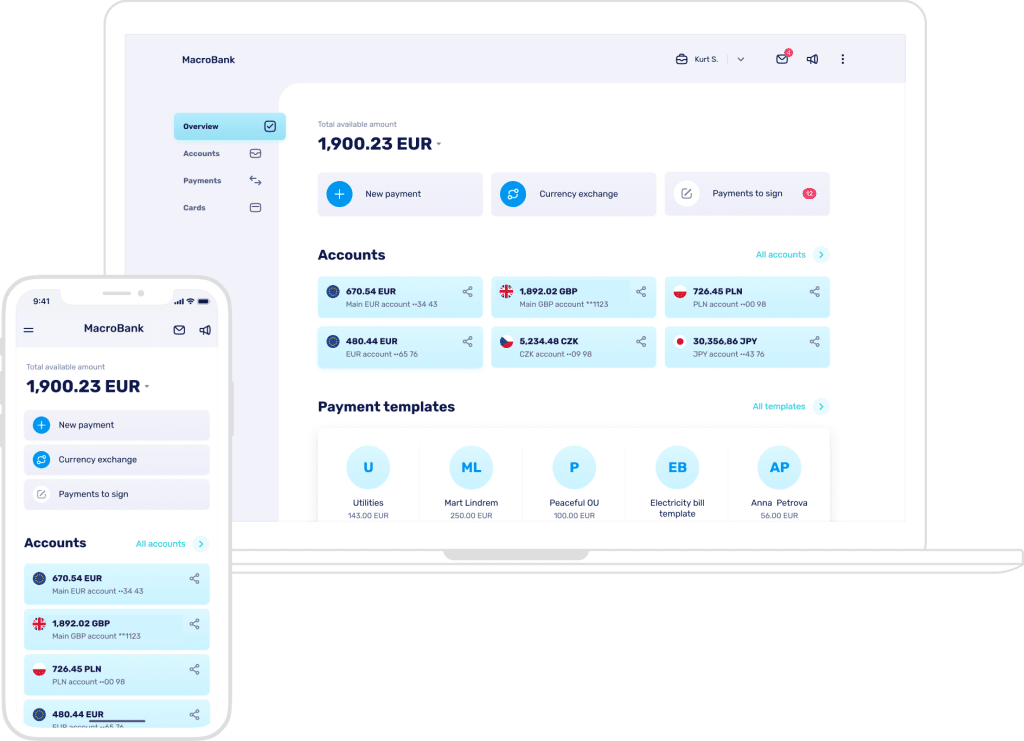

3 – White-label web banking and mobile banking apps to save your time and money

Customers require access to web and mobile banking applications to facilitate banking and payment transactions.

For digital banks and fintech companies, ensuring an exceptional end-user experience should be the top priority. This involves offering users excellent visibility, an intuitive and user-friendly interface, and an aesthetically pleasing design for an exceptional customer journey.

Developing new applications from scratch may take up to a year and cost hundreds of thousands of euros. Choosing pre-existing applications integrated with a core banking backend can save time and significantly reduce expenses.

Discover Advapay’s offerings! Our white-label web and mobile banking applications, built on cutting-edge architecture, prioritise customer satisfaction. These applications include all essential customer features, like checking balances, reviewing statements, making payments, and more.

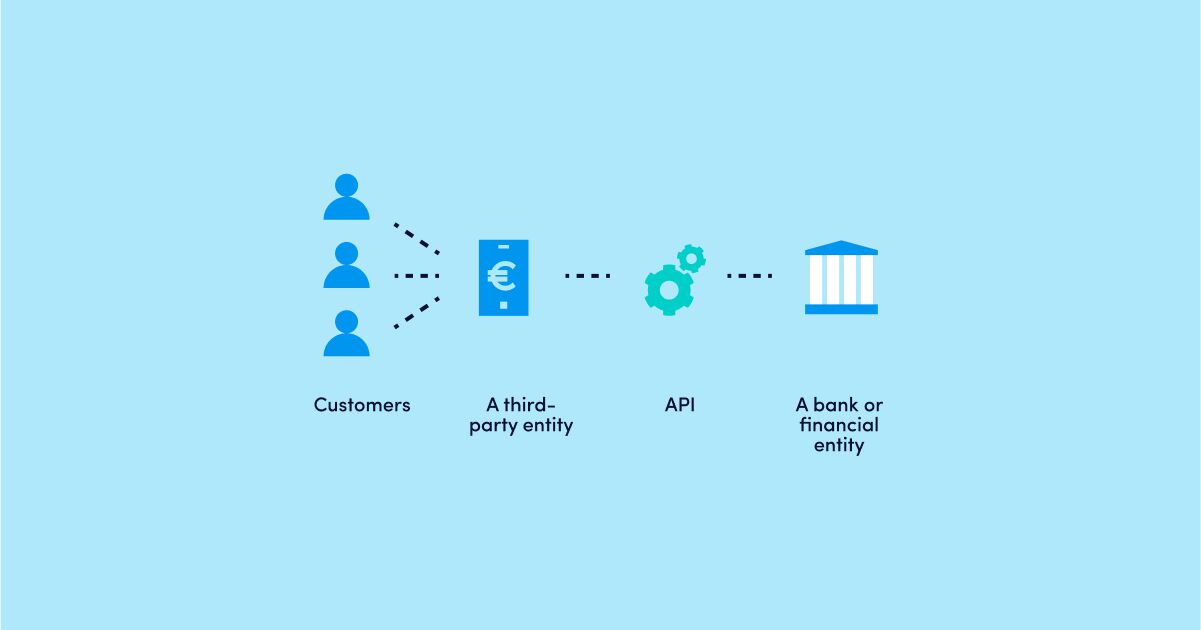

4 – BaaS and Embedded finance – readily available integrations to start your fintech business fast

BaaS and Embedded Finance, specifically Embedded Payments, are emerging trends in the industry. These concepts enable companies without developed payment infrastructure or financial services licenses to access payment and banking services seamlessly through APIs.

The availability of various BaaS partners provides our clients with two key benefits. Firstly, it saves them time by simplifying the process of selecting a preferred BaaS provider, as Advapay has curated a selection of reputable providers. Secondly, ready-made integrations further save our clients valuable time. Depending on the configuration, certain projects can be executed within weeks from a technological perspective.

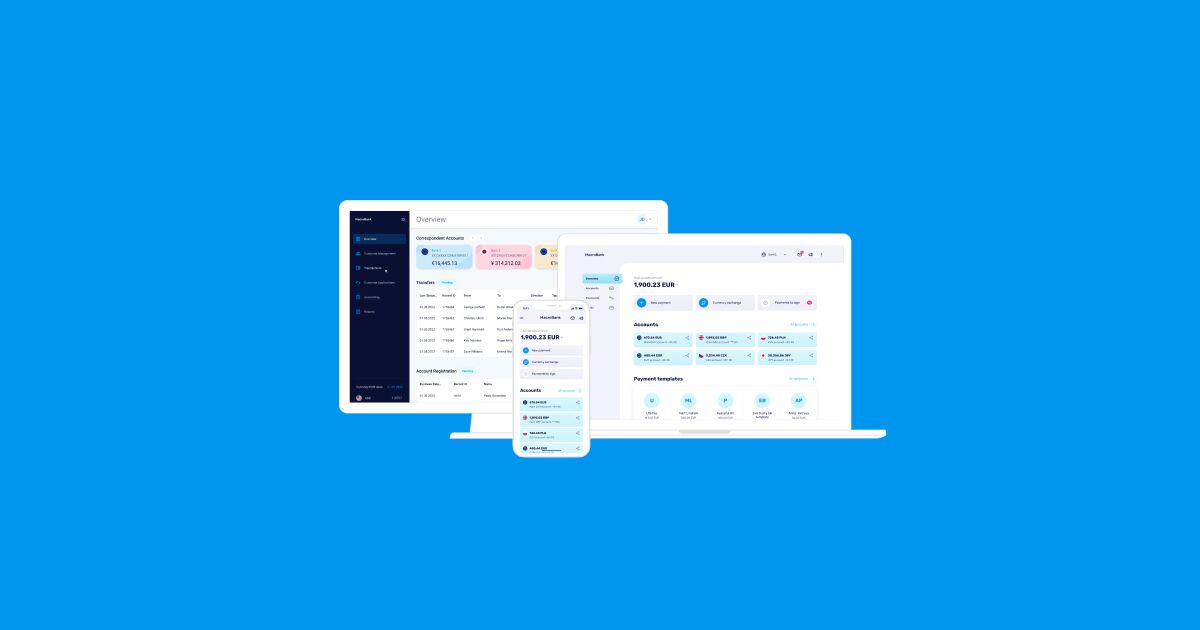

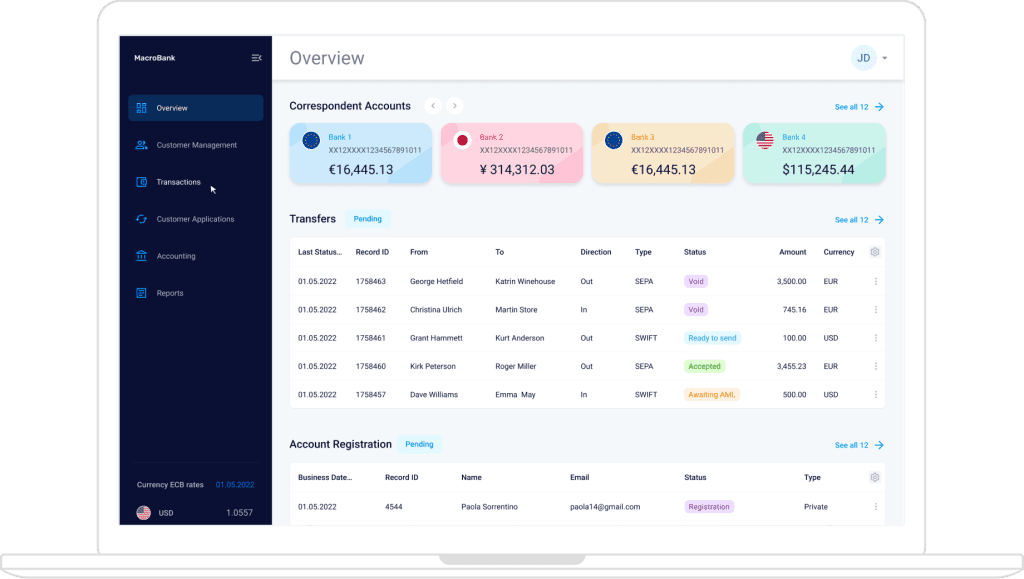

5 – New back-office application interface to manage operations easily

The new core banking software back-office application features an exceptional user interface for seamless operations management. The updated interface has a modern design and a wide range of functions, making it efficient for employees to handle tasks related to company applications, transactions, customers, financial operations, and more.

With this application, employees of digital banks and payment companies can easily view and accept registration, transfer, and currency exchange applications. They can also manage accounting, generate statements, apply filters, and perform various tasks to enhance operator effectiveness and comfort.

6 – Startups friendly core banking software to meet needs and budgets

You’re in the right place if you’re a small business or startup founder looking for cost-effective core banking software. Here’s why:

- First, we offer a SaaS package at a reasonable monthly fee, allowing you to enhance your solutions with additional functionalities using a pay-as-you-go model.

- Second, our pricing is transparent – no hidden fees. You won’t incur additional costs once we agree on specific functionality and sign the contract.

We understand that budgets are crucial for businesses, especially startups and SMEs. Our software is confidently budget-friendly for startups.

7 – Secure solution and adapted to conform with regulatory requirements

Our solution is secure and tailored to meet regulatory requirements effectively.

First, Advapay ensures regular system updates, incorporating the latest security features and protocols.

The system allows for setting groups, rules, and roles and creating custom processes. This empowers operators of digital banks and fintech companies to establish distinct customer risk groups with specific rules for each group. Operators can also define workflows for higher-risk customer categories. These capabilities enable efficient oversight of riskier customer groups, validation, approval of transactions, and management of compliance processes, eliminating regulatory compliance concerns.

Additionally, our solution offers pre-integrated compliance, fraud monitoring, prevention, KYC, and KYB services to safeguard customer data, prevent fraud, and ensure secure authentication for each transaction or Internet banking entry.

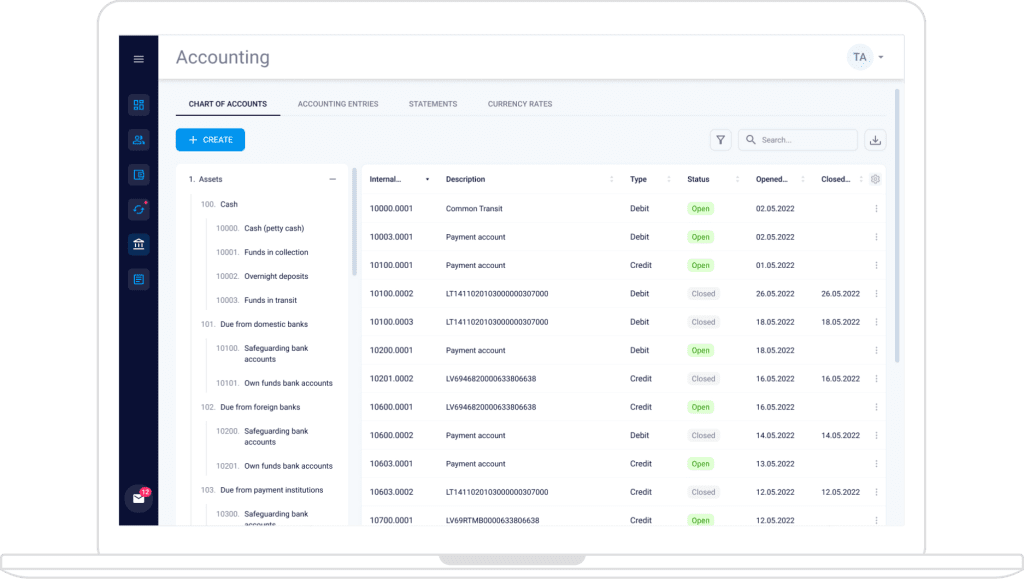

8 – Built-in accounting system to manage all financial operations

Our core banking software includes a built-in accounting system for managing financial operations. The general ledger and accounting system, a fundamental component, enable fintechs to accurately record, track, and manage financial transactions, offering a comprehensive view of the digital bank’s financial health. This integrated accounting system simplifies financial operations, ensuring compliance with regulatory requirements.

Through our built-in general ledger and accounting system, you can record all financial transactions of your digital bank or fintech company, including accounts, deposits, withdrawals, and transfers. As the central accounting record, it summarises financial activity over a specific period, providing a comprehensive overview. This module facilitates the generation of detailed reports customised to business and regulatory needs, aiding in cash flow forecasting. The recorded data can be used with your accountant to plan for long-term success accurately. Additionally, the module efficiently manages your fintech company’s nostro and vostro accounts, supporting reconciliation and accounting for funds in correspondent accounts. It also assists in consolidation and reporting related to account data, allowing seamless execution of multi-currency operations and effective management of the client accounting system.

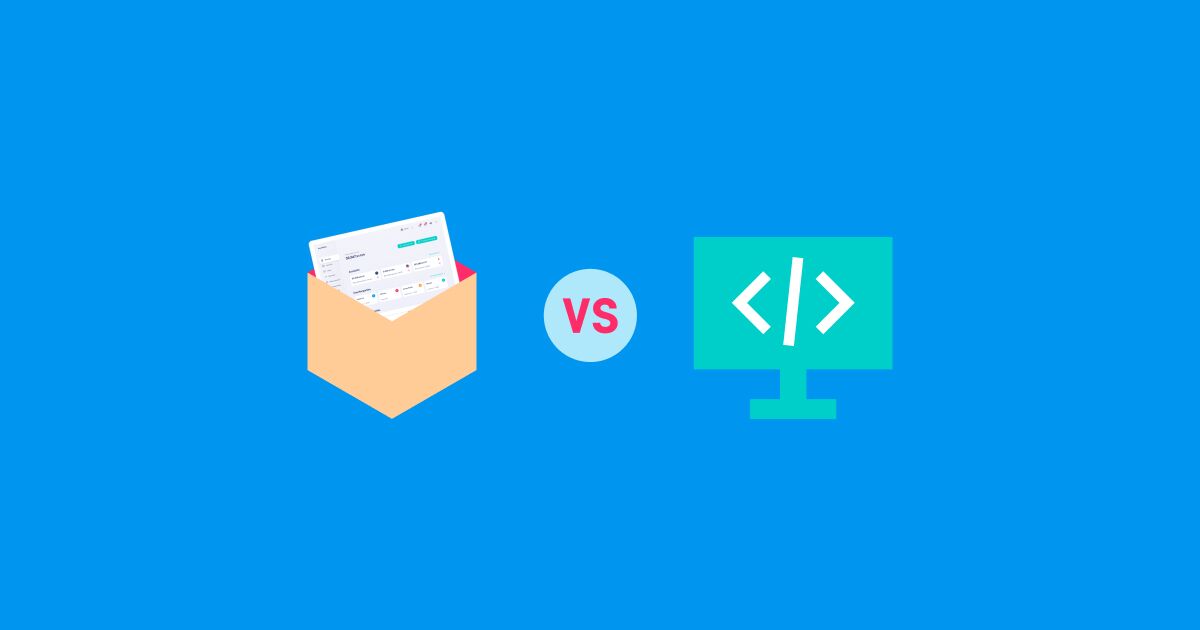

9 – Different deployment and purchase options are available – SaaS, software licence and source codes

Advapay offers a range of deployment and payment options tailored to the specific needs of different businesses.

SaaS (Software as a Service):

The SaaS option (cloud-based banking model) is ideal for fintech startups with limited budgets and provides basic functionality for a quick business launch. This package includes pre-made integrations with a convenient monthly fee. As the fintech startup grows and requires additional integrations or features, the solution can be easily upgraded to meet evolving business needs. Additionally, there’s an option to transition from the SaaS model to a Software License.

Software License:

Designed for established businesses, the software license solution is deployed within the company’s infrastructure and can be customised to meet specific operational and business requirements. It’s ideal for companies with distinct technical solution needs and allows for additional integrations as requested. This option is well-suited for large companies and those with long-term business plans. The model involves a one-time setup fee and a monthly maintenance fee based on the Service Level Agreement (SLA), making it suitable for companies lacking internal IT resources or preferring external support.

Furthermore, there is an opportunity to elevate the solution to the next level by purchasing the source codes. This enables handling all developments internally, offering limitless possibilities and unparalleled independence for enhancing the solution.

Source Codes:

Advapay offers the option to purchase software source codes for maximum flexibility and independence. This choice allows complete customisation to meet current and future business requirements. Companies selecting source codes can internally manage the software with their IT team, taking charge of storage, maintenance, and security-related activities. This option also permits the development of new modules, integrations, and back or front-end customisation. However, it’s important to note that the software cannot be copied or sold externally.

Typically, this option is favoured by large companies with well-defined business plans and substantial IT teams. Opting for this choice allows them to skip the time-consuming process of developing core banking software internally, providing a ready-to-use solution with a proven track record spanning many years.

Core Banking software Macrobank by Advapay: Empowering Continuous Evolution in Core Banking

Macrobank, an innovative Core Banking software, enhances efficiency across multiple areas. Tailored to address current and future challenges in financial institutions, it represents cutting-edge solutions.

At stake:

- Robust Back Office Functionality

- Ready Integrations for Seamless Implementation

- White-Label Web and Mobile Banking Apps

- BaaS and Embedded Finance Capabilities

- Modern Back-Office Application Interface

- Startup-Friendly Design

- Compliance with the Security and Regulatory Standards

- Built-In Accounting System

- Diverse Deployment and Purchase Options

Our solution offers access to various functionalities, technology, and partner ecosystems that prioritise security and compliance. Macrobank empowers you to design personalised offerings within your chosen ecosystems, facilitating efficient product launches. Contact us to explore your product possibilities and schedule a demo!