The financial services industry has undergone significant transformation in recent years, driven by the rise of digital technology, regulatory changes, and evolving consumer expectations. With the introduction of the PSD2 and upcoming PSD3 directive, new terms have emerged in the financial world, such as Banking-as-a-Service (BaaS), Embedded Payments, and Embedded Finance. While these terms are sometimes used interchangeably, they represent distinct concepts with unique applications, players, and benefits. In this article, we’ll delve into these three pillars of modern fintech, define each one, compare their differences, and examine their respective players, users, and benefits.

1. Definitions of BaaS, Embedded Payments and Embedded Finance

Banking-as-a-Service (BaaS)

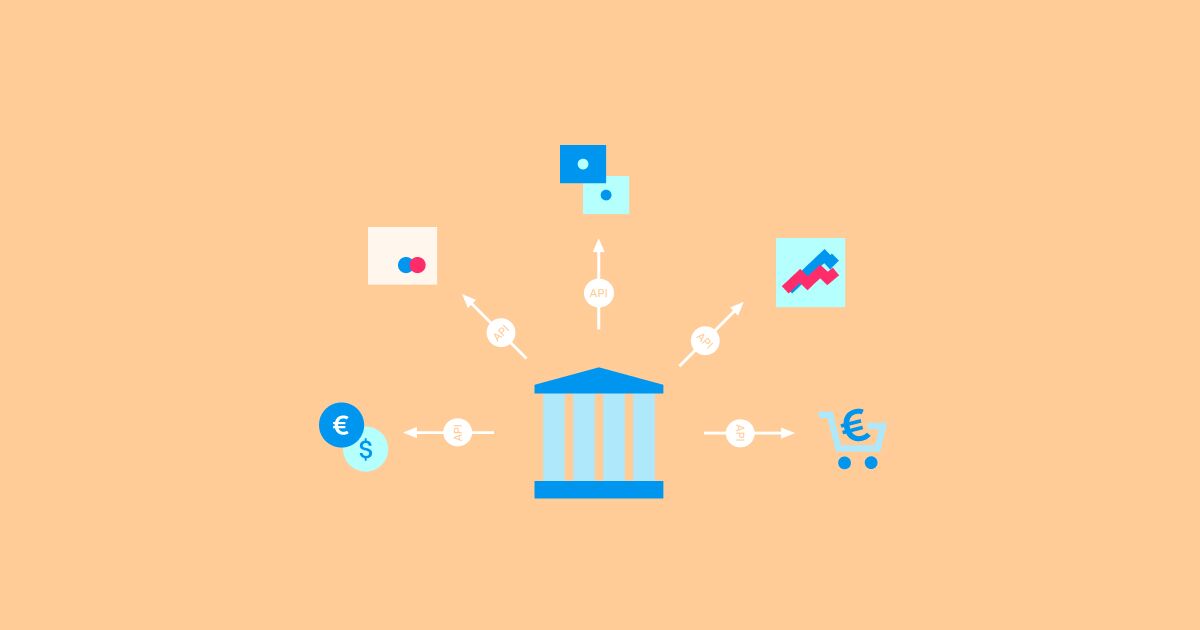

Banking-as-a-Service (BaaS) is a model that enables non-banking and financial services companies to offer banking services by leveraging the infrastructure of traditional banks. In a BaaS arrangement, a licensed bank opens its APIs (Application Programming Interfaces) to third-party licensed fintech companies, allowing them to build banking products and services on top of the bank’s regulated infrastructure.

BaaS providers offer various services, including physical and virtual IBANs, various payment types, currency exchange, and payment cards. By utilising these services, companies without a banking license or payment infrastructure can offer their customers bank-like services, such as issuing debit cards, opening accounts, or facilitating payments, all while remaining compliant with regulations.

Embedded Payments

Embedded Payments refer to the seamless integration of payments, cards and currency exchange capabilities within a financial or non-financial company’s platform, facilitated by a licensed financial services provider (e.g., an e-money or payment institution). This integration allows a company, whether licensed or not, to offer various payment methods or currency exchange services on an agent basis by leveraging the infrastructure of the licensed provider.

For example, a company that wants to offer SEPA payments without obtaining the necessary licenses or building its own infrastructure can connect to a licensed provider with an established infrastructure via API, enabling SEPA payments for their end-users.

Additionally, embedded payment functionality allows users to make payments directly within a non-financial services app without being redirected to a third-party payment processor.

Embedded Finance

Embedded Finance is a broader concept that involves integrating financial services directly into non-financial platforms, including payments, lending, insurance, and investment products. This integration allows companies to offer financial services as part of their core product or service, often without the customer realising they are interacting with a financial service provider.

For example, a retailer might offer buy-now-pay-later (BNPL) options at checkout, or an e-commerce platform might provide insurance for purchased products. In both cases, the financial service is seamlessly embedded within the primary customer experience, making it more accessible and convenient.

2. What is the Difference?

While BaaS, Embedded Payments, and Embedded Finance are interconnected, they serve different purposes and operate in distinct ways:

Scope and Functionality of BaaS, Embedded Payments and Embedded Finance

- Banking-as-a-Service (BaaS) primarily enables non-banks or financial service companies to offer banking services by leveraging the infrastructure of licensed banks. It provides the backend capabilities required to build banking products and services.

- Embedded Payments focuses specifically on integrating payment capabilities into financial or non-financial platforms, allowing users to make payments seamlessly within an app or service.

- Embedded Finance is a broader concept encompassing not just payments but a wide range of financial services integrated into non-financial platforms, making these services a natural part of the user experience.

User Interaction

- Banking-as-a-service (BaaS) typically operates in the background, providing the necessary infrastructure for companies to offer banking services. The end-user may not even be aware that a BaaS provider is involved, as the service is branded by the company using it.

- Embedded Payments can function in two ways: in the background, connecting services to a core banking system’s back office, or through a front-end application for direct user interaction. In both cases, the payment experience seamlessly integrates into the user’s primary activity, such as shopping or booking a service.

- Embedded Finance involves direct user interaction across a broader range of financial activities. Users may engage with lending, insurance, or investment products within a platform, often without realising they are accessing financial services.

Regulatory and Compliance Requirements

- Banking-as-a-Service (BaaS) requires the involvement of a licensed bank to manage regulatory and compliance aspects, ensuring that all financial services offered by the third-party company comply with local and international regulations. BaaS services are enabled by the PSD2 directive, which governs the relationships between banks and their agents.

- Embedded Payments must also comply with local and international regulations (e.g. PCI-DSS, Payment Card Industry Data Security Standard). However, they do not necessarily require a full banking license; instead, they may operate under a financial services license (e.g., payment institution or e-money institution license). Similar to BaaS, Embedded Payments are enabled by the PSD2 directive, which regulates the relationships between licensed financial services entities and their agents, whether licensed or not.

- Embedded Finance requires compliance with various regulations depending on the specific financial service offered (e.g., lending regulations for BNPL services, insurance regulations for embedded insurance products).

3. Players and Users of BaaS, Embedded Payments and Embedded Finance

Banking-as-a-Service (BaaS)

- Players: The BaaS ecosystem includes traditional banks that provide the infrastructure, fintech companies (mostly licensed) that build and deliver financial products, and API platforms that facilitate the connection between the two.

- Users: BaaS is primarily used by fintech companies, neobanks, and non-financial companies looking to offer banking services without acquiring a banking license. Examples include fintech startups, e-commerce platforms, and large technology companies.

Embedded Payments

- Players: Embedded Payments are powered by licensed e-money or payment institutions that offer payment and currency exchange integration services.

- Users: Embedded Payments are utilised by a wide range of businesses, including e-commerce platforms, marketplaces, on-demand service providers, and retailers. End-users are consumers making purchases or payments within these platforms.

Embedded Finance

- Players: The Embedded Finance landscape includes fintech companies, financial institutions, and technology platforms that provide integrated financial services.

- Users: Embedded Finance is utilised by companies across various industries, including retail, e-commerce, transportation, and real estate. The end-users are typically consumers or businesses accessing financial services while interacting with a non-financial product or service.

4. Benefits of BaaS, Embedded Payments and Embedded Finance

Banking-as-a-Service (BaaS)

- Lower Barriers to Entry: BaaS enables companies to enter the financial services market without requiring a banking license, significantly lowering the barriers to entry.

- Scalability: Companies can quickly scale their financial services offerings by leveraging the infrastructure of established banks.

- Focus on Innovation: By outsourcing backend banking operations, companies can concentrate on innovation and user experience rather than managing infrastructure.

Embedded Payments

- Expanded Service Portfolio: Embedded payments enable companies to expand their service offerings without building proprietary infrastructure or acquiring additional licenses.

- Faster Time to Market: By connecting to existing infrastructure, companies can quickly leverage payment services, bypassing the lengthy process of developing their own infrastructure or obtaining licenses.

- Revenue Growth: Embedded payments can boost revenue for both agents and sponsors (licensed financial services companies). Sponsors can monetise their services by charging fees. At the same time, agents can create new revenue streams by offering these services to end-users through transaction fees or payment processing services.

Embedded Finance

- Enhanced Customer Engagement: Embedded Finance allows companies to engage customers more deeply by offering relevant financial services within their core product experience.

- New Revenue Streams: Companies can generate additional revenue by providing financial services such as lending, insurance, or investment products within their platforms.

- Personalised Offerings: By integrating financial services into their platforms, companies can offer more personalised and relevant products, enhancing customer satisfaction and retention.

- Market Differentiation: Companies that successfully implement Embedded Finance can differentiate themselves from competitors by delivering a more comprehensive and integrated customer experience.

5. Conclusion

BaaS, Embedded Payments, and Embedded Finance are interconnected yet distinct concepts that are reshaping the financial services industry. BaaS provides the foundational infrastructure that enables non-banking companies to offer banking services. Embedded Payments and Embedded Finance focus on integrating financial services directly into financial or non-financial platforms to create seamless user experiences.

Each model offers unique benefits: BaaS lowers barriers to entry and enhances scalability, while Embedded Payments and Embedded Finance streamline user experiences and create new revenue streams. As these models continue to evolve, they are likely to play an increasingly important role in the future of finance, enabling companies to deliver more innovative and integrated financial services that meet the needs of today’s digital-first consumers.

Understanding the distinctions and synergies between BaaS, Embedded Payments, and Embedded Finance is crucial for businesses leveraging these technologies to enhance their offerings, improve customer experiences, and drive growth in an increasingly competitive landscape. Whether you’re a fintech startup, an established financial institution, or a non-financial company entering the financial services market, these models provide powerful tools to help you succeed in the digital age.

Advapay at stake:

How can Advapay can assist you in launching your fintech business?

• Assistance in EMI/PI licencing in the EEA/UK

• Registration of MSB company in Canada

• Delivery of a comprehensive Core banking system encompassing back-office and white-label applications for end-users

• Assistance in payment infrastructure development

• BaaS-solutions in collaboration with our partners – EEA/UK licenced EMIs and PIs