Single Euro Payments Area (SEPA) payments, also known as Europe payments, are transfers in Euro between bank accounts in Europe and the European Economic Zone. It is a way to make fast, reliable and affordable Euro transfers in the SEPA zone.

What is the SEPA zone?

The SEPA zone brings together 36 different countries, including 28 member states of the European Union (EU), to improve efficiency and the competitive edge of the European economy. People, businesses and institutions in Europe can easily make pan-European payments like their local payments by bank transfers, direct debit, and credit or debit cards. Having this in mind, Europe has created a single market for payments in Euro and improved the payment infrastructure and standards in the European Economic Area.

Why is SEPA important?

Single Euro Payments Area is a single system for domestic and European transfers that promotes the EU trade and cross-border payments between citizens and European companies. Without high transaction fees, it allows banks in one country within the Single Euro Payment Area to directly charge an account from another country in Europe. Usually, the time necessary to transfer money in the SEPA zone is one business day.

From a legal perspective, SEPA is a set of rules and standards adopted by the European Payment Council. For example, Payment Service Directive 2 (PSD2) outlines a legislative framework for a refund mechanism for SEPA payments. In other words, customers have unconditional refund rights on the no-questions-asked basis for eight weeks from the date, when the money is debited from the account.

How do SEPA payments work?

There are several conditions for SEPA payments. First, the transfer should be done in EUR, and the recipient’s bank should be part of the SEPA zone. Second, an IBAN for the recipient’s account is required to simplify cross-border transfers and increase the number of successful payments on a European level. When it comes to bank fees, SEPA payments are shared commission (SHA) payments, meaning that the commission fee is split between both a sender and beneficiary.

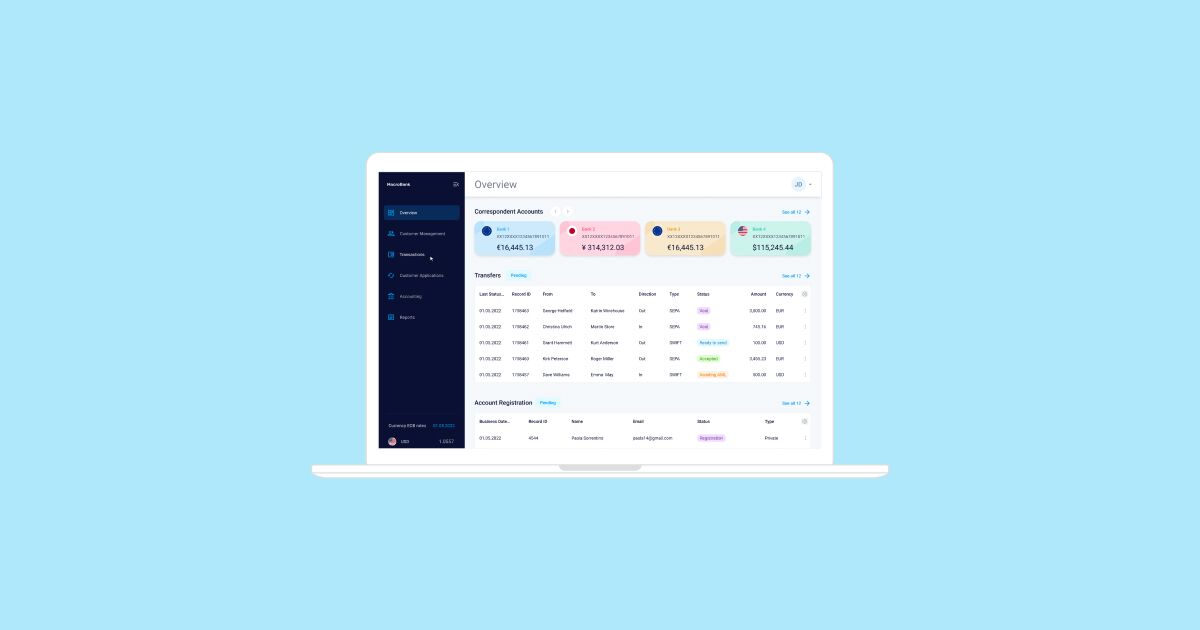

Advapay is a technology company providing the Digital Core Banking platform to empower fintech clients or digital banks to start their businesses and accelerate digital transformation. The platform delivers all essential functionalities, a front-to-back system and a set of tools to customise and bring new integrations. With Advapay, potential and existing customers can connect either to the cloud-based SaaS or on-premise software. Besides the technical infrastructure, the company provides business advisory and fintech licensing services. Interested to learn more, please drop us a message.