A Variety of eWallets Supported

01

Fintech & banking wallets

Offer your customers great convenience with a next-generation wallet solution that meets the payment and transfer needs of users on the go. Customer engagement is enhanced with new users being attracted by a top-level UX and supreme mobile services. Our white-label digital wallet lets customers create current accounts, order debit cards, convert currency, make transfers & more.

02

Retail wallets

Retail e-wallets represent a closed-loop platform that allows customers to make transactions and store assets within this financial ecosystem. It’s a facility that makes it easier for users to spend more money, resulting in growing revenues and levels of satisfaction.

03

Escrow & marketplace wallets

Allowing buyers and sellers to exchange assets, our escrow and marketplace e-wallets protect the funds of both parties when deals are struck. Funds are protected within the system until the point that the buyer accepts and confirms delivery of their merchandise.

Regulation and Business Compliant

Approved & compliant with EEA/UK regulations

Many different EEA/UK projects have involved the implementation of our white-label cloud ewallet software, receiving regulatory approval when companies obtain PI/EMI licences. Our solution also features KYC/AML tools & onboarding integrations that ensure security & regulatory compliance.

In the event of changes in regulations, our solution is easily adjusted to take account of the new requirements in place.

Meeting all of your business requirements

While the digital wallet solution we provide offers a range of different bank, payment service provider, card issuer, and KYC/AML provider integrations, it’s possible to add new providers as required. Your e-wallet can also be adapted to meet all of your business needs, such as changing workflows and customising existing processes.

White-label cloud digital wallet software that grows your business

The white-label cloud digital wallet software we offer is highly adaptable and able to support future changes you might face. Whether dealing with an increased influx of clients, amending your existing workflow, adding payment providers or new functions and modules, our software has you covered.

At the point you’re ready to make in-house developments or maintain your system internally, you can enjoy complete independence by purchasing the source codes or software licence.

Ideal for SMEs with restricted budgets

Our white-label cloud digital wallet software solution requires no initial investment! You just pay a small monthly fee, and you can get started! This SaaS ewallet is perfect for startups – begin with your MVP and a limited budget and scale your use in line with your business growth.

Primary Customer Payment & Banking functionalities

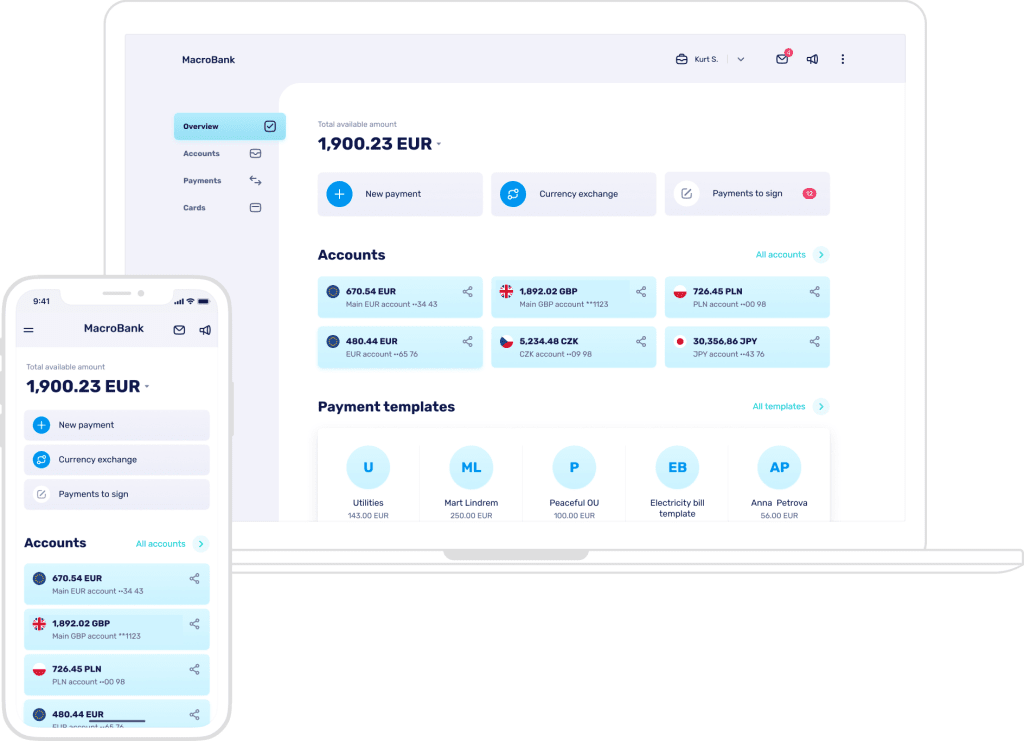

White-label web banking & mobile apps

The white-label web and mobile banking solutions we offer are ideal for financial organisations looking for banking apps that are easily customised and cost-effective. Catering to all customer needs, they allow for balance checking, statement viewing, payments, and more. Furthermore, our white-label applications can be customised and branded to meet all your business requirements.

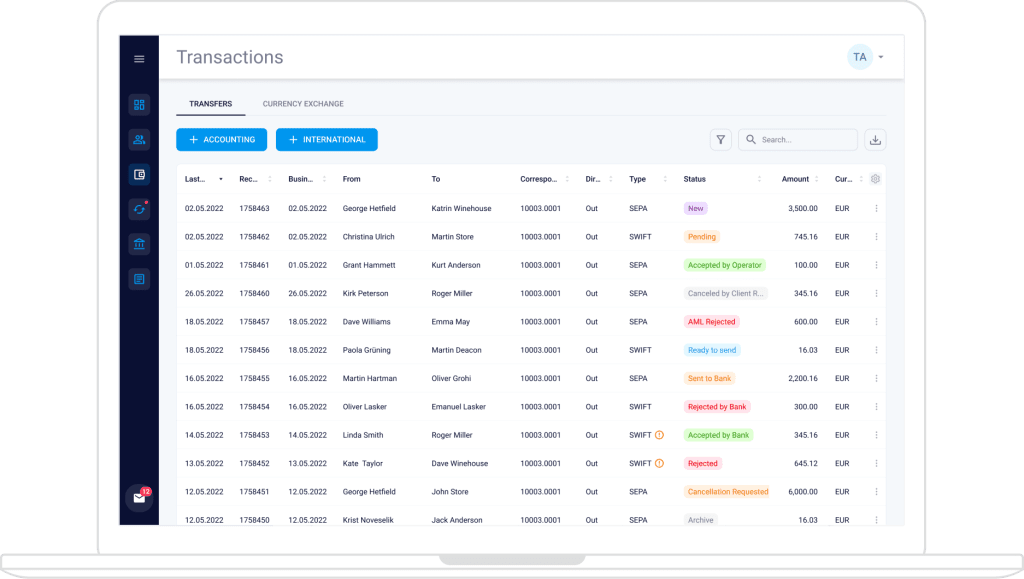

Control All Activity From a High-functioning Back-Office

Customer applications & management

Customers can be obtained and managed effectively, along with creating profiles, document flow management and granting access permissions thanks to our cloud-based digital wallet solution’s helpful advanced management and registration tools. Being able to track this important client data allows your organisation to seamlessly manage their customers and activities.

Chart of Accounts & General Ledger and Accounting

Our solution offers multi-currency & real-time accounting of financial transitions in adherence with IFRS (International Financial Reporting Standards). This involves many functions, such operations with financial instruments within your digital bank and management of your back-office operations` accounting.

AML & KYC

The solution we offer is created to prevent money laundering, manage risks and ensure compliance with legal & regulations rules – elements your business needs to be protected against. KYC/AML document checks, transaction monitoring & screening and remote identity verification are all facilitated.

Permissions, Rules & Roles

According to user-defined rules, as well as other parameters, administrators are able to manage your employee projects, providing access and conducting data analysis. Team members can be granted administrative access, allowing more than one person to manage your back-office operation and different rules to be set for different customers.

Supporting Customers

Via the tool, your customer support department is able to streamline the experience customers get during interactions. Thanks to top features like a list of requests and your message inbox, customer satisfaction levels are increased. The tool allows you to support customer service teams during their day-to-day duties using filters, status updates and other important features.

FAQs

Q: Which integration does your solution have built-in?

A: We offer a range of ready integrations for AML/KYC providers, payment service providers, banks and card issuers. See below for an extensive list.

Q: Can you add new integrations, not on the existing list?

A: Absolutely! If you opt for a provider that’s not featured on our integrations list, and you have a fully legal relationship set up, we can offer complete integration support. If you have an in-house IT team and you’d rather carry out integrations internally, it’s possible to switch to purchasing source codes or a software licence.

Q: Is it possible to see a product demonstration?

A: Yes! Just enter your details into the form below and we’ll get back to you ASAP.

Q: How much does your solution cost?

A: The amount you’ll pay will depend on which integrations you opt for. Once we’ve gained a full understanding of what your project entails, we’ll provide you with an accurate quote for the solution, including any extra developments required.

Q: How is your solution pricing set up?

A: We offer a SaaS solution with a monthly subscription that doesn’t involve you paying a setup fee. If you opt for a software licence, it’s possible to pay a setup fee and then provide support internally, meaning no more costs from us. It’s also possible to buy fixed-cost source codes and again support development internally.

Q: Are other deployment options on offer (such as on-premise)?

A: Absolutely. You can decide to go for a software licence model or buy source codes for deployment on your IT network.

Q: Is it easy to connect to BaaS providers?

A: Sure, and there are a couple of ways to do it. Either onboard with our BaaS-partners, and we will carry out the integration once you’re confirmed or locate a BaaS provider by yourself, and we’ll take care of all the technical aspects.