In the dynamic landscape of modern banking technology, financial institutions must innovate to meet market demands, adhere to emerging regulations, and maintain security standards. Despite this, some companies still favour in-house platform development. The question arises: is developing an in-house solution more advantageous than opting for a ready Core Banking Platform? This article explores five compelling reasons highlighting why embracing a ready-made core banking solution is a strategic and efficient choice over the expensive and time-intensive path of proprietary development. From expedited time-to-market and cost reduction to regulatory compliance in the dynamic fintech industry, the benefits of ready-made solutions are poised to reshape how institutions approach technological advancements in core banking.

Much faster time-to-market

First, opting for a ready-made core banking solution rather than in-house development can accelerate your time-to-market.

Speed is crucial in the dynamic Fintech industry. Relying on ready-made solutions ensures your release remains relevant, avoiding obsolescence upon market entry. The industry’s continuous evolution demands agility, and embracing pre-built solutions is a strategic move for sustained competitiveness.

Launching a system within three months becomes a viable reality when opting for a ready core banking solution, especially with the ready integrations offered by the SaaS option. This swift deployment translates to quicker profitability, sparing you the need to invest years in meticulous development and search for an experienced IT team.

Developing core banking software from scratch is a challenging task. The intricate process involves identifying business needs, crafting technical tasks, coding, developing policies and documentation, integrating with business systems, and establishing gateways to external systems — just a part of the development process.

Securing a skilled IT team with expertise in this niche is exceedingly challenging. Furthermore, the challenge extends to retaining the team throughout the project’s duration, as the departure of even a single team member can adversely affect the timeline and successful execution of the project.

Save your money and know the price beforehand

The second factor revolves around overall expenses and the capacity to plan your budget effectively.

Choosing a ready-made core banking solution brings the advantage of knowing the price beforehand, enabling reliable budget forecasts that encompass both setup fees and monthly costs. This foresight lets you clearly understand the final expenses, eliminating the uncertainties associated with in-house development.

Institutions can avoid high implementation costs in proprietary development by bypassing the need for an expensive in-house IT team. Fluctuating schedules and deadlines in the latter scenario often lead to actual expenses exceeding the initial budget, creating unpredictability.

In contrast, ready-made solutions offer a stable financial outlook, sparing organizations from navigating unexpected and soaring costs. It’s a strategic move that ensures cost-effectiveness and frees up resources otherwise absorbed by the complexities of assembling and maintaining an in-house technical team.

Developing your own solution may incur costs ranging from 1 to 2 million, a significantly higher investment than opting for a ready-made core banking solution’s SaaS option or a software license.

Inclusive core functionalities and abundant customization options

Choosing ready-made core banking solutions allows swift access to essential functionalities without the prolonged wait of developing an in-house solution, which can take one to two years. Opting for a pre-built solution enables upfront scrutiny and testing, eliminating potential surprises. In contrast, with its extended timeframe, internal software development carries the risk of delivering a product that diverges from initial expectations.

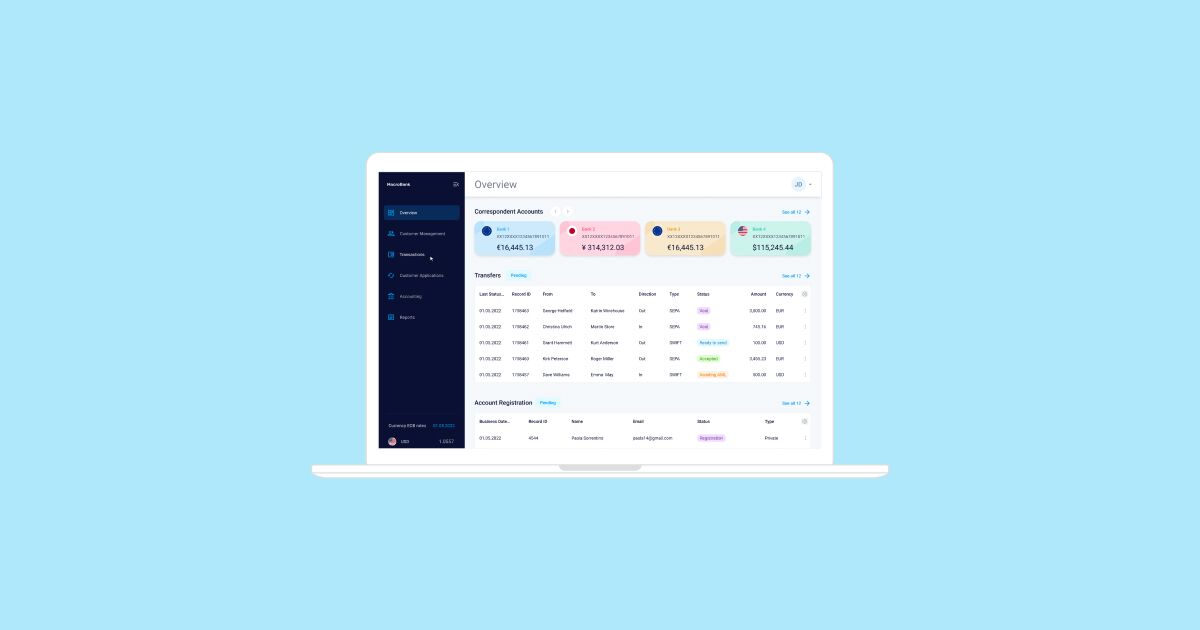

On the flip side, many ready-made core banking systems come equipped with all necessary functionalities, saving organizations from reinventing the wheel. This ready-to-use functionality not only saves time but also conserves resources. Furthermore, opting for a ready-made core banking solution doesn’t mean settling for a “use what you have” approach; instead, it offers a highly customizable solution. Systems like Macrobank exemplify this flexibility by providing access to various customizations, enabling tailored adjustments to meet specific business requirements or adhere to regulatory mandates.

No need for a vast internal IT team

Embracing ready-made core banking solutions eliminates the need for a large internal IT team during implementation and ongoing support. It simplifies the process since there is no need to find a large team of experienced industry experts well-versed in developing comparable solutions. Locating highly skilled professionals with experience in core banking or fintech software solutions is a formidable challenge.

Furthermore, avoiding reliance on an expensive in-house team mitigates the risks associated with potential skill and competency loss due to employee departures. Opting for ready-made solutions provides a pragmatic solution to the complexities and uncertainties of maintaining an extensive internal IT team.

Gain the expertise of a highly professional team and adopt a solution already trusted by other fintechs

Ensuring compliance with Fintech’s intricate regulatory software requirements is a complex task that demands seasoned professionals well-versed in core banking solutions.

Leveraging the technical proficiency of established professionals and a regulator-approved ready core banking solution ensures a smooth implementation process without unexpected hurdles.

Opting for an already operational solution in different financial institutions eliminates surprises, signifying a system endorsed and widely accepted by regulatory authorities. However, a solution aligned with regulatory requirements results from numerous industry IT professionals’ collective experience and efforts.

Acquiring a ready-core banking solution provides software and expertise accumulated over many years by highly qualified specialists.

Contact our consultants and register for a live demonstration for those uncertain about purchasing a ready-made solution or pursuing in-house development. This interactive session allows us to pose diverse questions to our specialists, enabling you to evaluate comprehensively how our solution aligns with your specific needs.