What is Digital Core Banking Software?

The definition of Digital Core Banking is that of a back-end system that’s able to process digital banking operations and transactions. Among its primary functionalities are customer management and onboarding, opening new accounts, managing existing customers, managing & issuing cards, processing payments, calculating tariffs & rates, accounting and creating a range of different reports.

Digital Core Banking can considerably reduce operating costs due to its automatic nature that minimises the manpower usually needed for execution. These systems offer a myriad of benefits that include simplification of banking processes, keeping pace with a rapidly-evolving market, customer convenience and an extended digital reach to remote locations.

Essentially, Digital Core Banking systems are designed to empower both existing and potential customers, providing them with increased account transaction freedom.

- What is Digital Core Banking Software?

- What are the main Digital Core Banking functions?

- What are Digital Core Banking features?

- What are the types of Digital Core Banking systems?

- Core Banking pricing

- What is the Core Banking example?

- What is Cloud-based Core Banking Software?

- Which is the best Core Banking system?

What are the main Digital Core Banking functions?

Core Banking offers functions such as current or payment accounts, payments, and cards. Additional functions provided by Digital Core Banking systems are depositing, money lending, loans and mortgages (which are not allowed for companies holding payment and e-money licenses).

What are Digital Core Banking features?

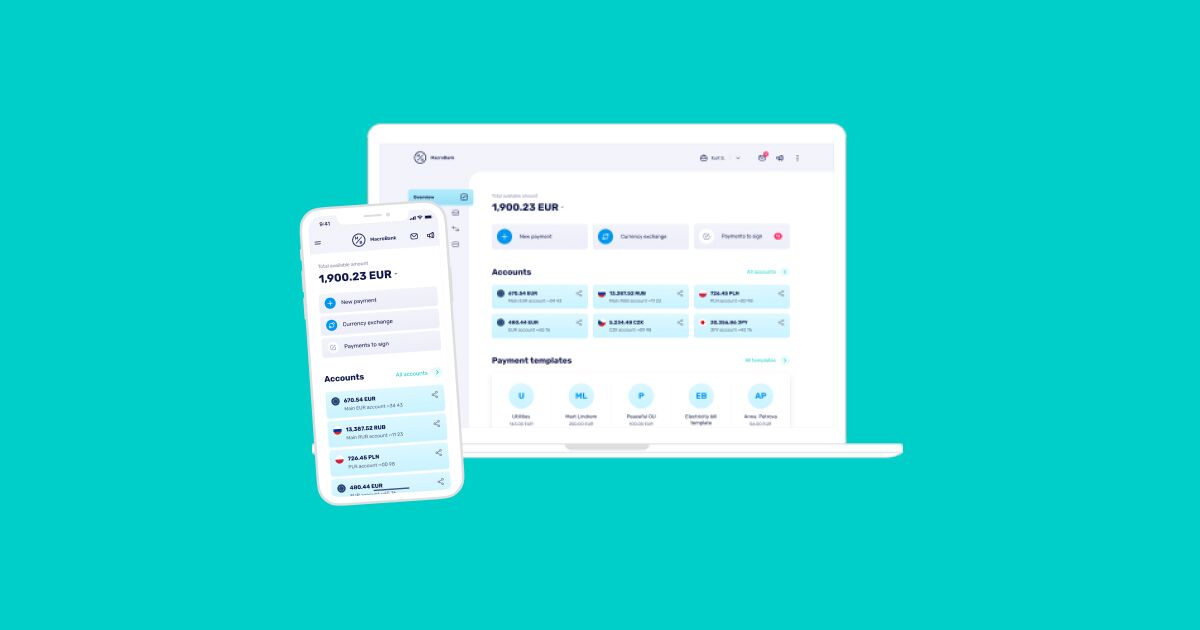

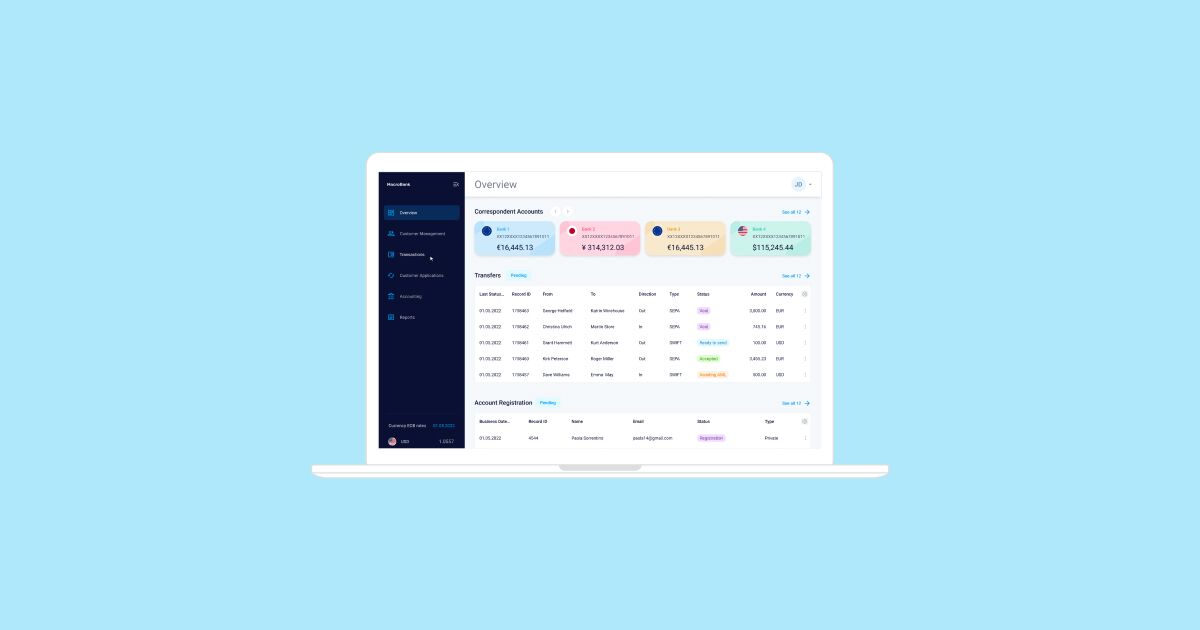

- Centralized dashboard for managing/administrating the system by bank/financial institution operators: onboarding and managing customers, opening new accounts & managing existing, processing payments, currency exchange, managing cards, creating different reports, establishing & calculating rates and tariffs, and chatting with clients.

- Web banking and mobile banking applications for end-users to perform different financial activities like viewing accounts, sending/receiving payments, signing payments, communicating with a bank and others.

- Two-factor authentication to sign payments or authenticate login into the system.

- Customer onboarding, AML and KYC processes to register new customers and perform their identity verification and required Due Diligence.

- Chat with customers to process requests and answer questions.

- Push notifications to deliver updates to customers.

- Financial accounting and general ledger.

What are the types of Digital Core Banking systems?

Depending on the hosting methods, Digital Core Banking systems can fall into the following categories:

Cloud-based Core Banking software. Hosted on the cloud, this option involves the delivery of all services, including networking, databases, servers, software, storage, flexible resources, economies of scale and internet analytics for more rapid innovation.

On-premise solution. This system works on a locally-hosted infrastructure such as hardware servers and databases.

Depending on the deployment method, Digital Core Banking systems can fall into the following categories:

Software-as-a-Service Core Banking solution. This is a cloud-based software model that is hosted on provider’s servers. The software provider makes this software available to users over the internet.

With the Software as a Service (Saas) option, you receive a ready-made solution and a list of ready integrations. Also referred to as a Pay As You Go, Software Rent or Plug & Play model, it’s accessible via a subscription, with support and periodic updates being included as part of the monthly cost.

Core Banking software license. This solution is deployed within your infrastructure and may be customized according to your specific operational and business needs. Updates and support from the vendor are only available when signing SLA. In case you have your own IT team, support can be provided internally.

Purchase of software source codes. Some vendors offer an opportunity to buy software source codes. In this case, you will be able to manage software and make any developments internally.

Core Banking pricing

The total pricing of software does not end with the software purchase price but also consists of other components. Below you can find all main categories of the Core Banking pricing:

- Software purchase, setup, monthly & maintenance fees

- Infrastructure costs – both for a cloud-based and a locally-hosted infrastructure

- Extra developments & customization costs

- External integrations cost

- Software updates & system hosting

- Future software developments

You can read about all costs involved in Digital Core Banking software in our article Final Core Banking Costs:

What is the Core Banking example?

Core Banking products are designed to process and manage different functions of different types of financial institutions. Examples of Core Banking products include Transact by Temenos, Mambu, Macrobank by Advapay.

Transact by Temenos is well known as software for licensed banks, and Mambu provides its software that is mostly focused on large-scale fintech projects, whereas Advapay serves small and medium-sized companies with limited budgets.

What is Cloud-based Core Banking Software?

Cloud-based Core Banking software, as the name suggests, is hosted on the cloud.

The biggest benefits of cloud-based banking software are:

Reduced Costs

When the switch is made to a cloud solution, it negates the need for expensive on-site development of infrastructure, as well as costly maintenance, storage and security updates.

Flexibility

Being supported by microservices architecture provides a significant advantage to those who use cloud solutions. That’s because it permits the load to be smoothly distributed on services, a geo-distributed architecture to be developed, and the distribution of service resources to be tightly controlled.

Improved Level of Disaster Recovery & Data Security

Providers of cloud services are continuously & thoroughly reviewing and analyzing their products to identify any indication of security vulnerability, with updates being delivered when required.

E.g. the Azure platform (the power behind our cloud banking services) has created a solid foundation that’s built on a global, world-class infrastructure. It’s also compliant with industry/regional/international standards, featuring numerous certifications like that of global fintech services.

Increased Speed of Operation

A number of elements, such as storage, data capture and interpretation processes, can be centralized using cloud technology. It’s also able to bring down the costs associated with these vital processes and result in much more precise, richer and more rapid data-led insights that can be used to boost performance by financial institutions.

Which is the best Core Banking system?

There are a variety of Core Banking software providers on the market. The best Core Banking system for your project is the one that meets your requirements for budget, functionality, and adaptability to your future needs/developments.

When comparing different Core Banking systems, take into account the following criteria:

Price. Core Banking software prices range from tens of thousands to several hundreds of thousands to millions. More information about the main components of Core Banking can be found in the article above.

Flexibility and scalability. Your ideal Digital Core Banking system should be flexible enough to adapt to the evolving needs of the company. More specifically, Core Banking should quickly connect new business operations and products or make other required changes. What`s more, a Core Banking system should be able to integrate with a wide variety of third-party digital solutions. Ask your provider how flexible the Core Banking system is.

Functionality. You should select a Core Banking system that comes with the functionality to meet your business needs, including end-user applications.

About Advapay

Advapay is a technology company providing the Digital Core Banking platform to empower fintech clients or digital banks to start their businesses and accelerate digital transformation. The platform delivers all essential functionalities, a front-to-back system and a set of tools to customise and bring new integrations. With Advapay, potential and existing customers can connect either to the cloud-based SaaS or on-premise software. Besides the technical infrastructure, the company provides business advisory and fintech licensing services. Interested to learn more, please drop us a message