Designed to Meet your Business Needs

Different deployment and payment options available

Whatever type of requirement exists, different deployment and payment options are available to meet your needs with SaaS, a Software Licence or source codes.

01

Software-as-a-Service (SaaS) model

Get to market faster with a digital core banking software solution that features in-built integrations with a low-cost subscription SaaS model.

02

Software licence

Purchase a software licence, allowing you to implement large-scale digital core banking developments.

03

Source codes

Get you complete independence from the vendor, letting you carry out developments and customisations in-house purchasing source codes

04

Transit from SaaS to software Licence or buy source codes

Begin using a SaaS solution and move to a software licence or purchase source codes for complete autonomy.

Providing your digital bank with the complete package

Our digital core banking software solution delivers the complete package with an array of winning features and functions for digital banking.

01

Ready integrations

A range of different integrations with currency exchange providers, card issuers, KYC/AML service providers, banks, payment service providers and more.

02

Back-office application

High-functioning back-office application for transactions and customer management.

03

End-user apps

White-label end-user web & mobile applications.

04

API and Open Banking

Connect to open banking features with cutting-edge APIs

Huge scope for customisation of digital core banking software solution

Rather than simply giving you the basic building blocks for your solution, we deliver a fully-customised digital core banking software solution tailored to your business.

01

Add new services, integrations & other large customisations

02

Customise modules & fields for all your digital bank requirements

03

Amend processes & workflows

04

Create custom-made white label banking and mobile app UI

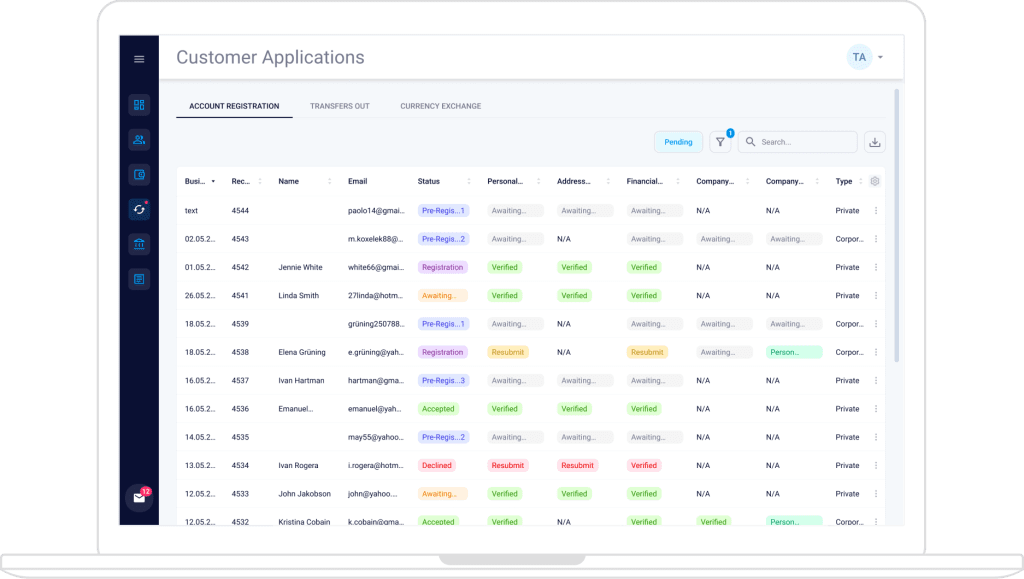

Clients, Transactions & Applications Managed With Ease

Customer applications & management tools

Our tool makes the tracking of client activities and data easy, allowing fintech companies to manage new customers and applications without missing a step.

01

View, approve or decline all customer applications

02

Open personal/business/multi-currency accounts & create dedicated current account IBANs

03

View lists of customers and assign each their own specific status

04

Allow/block features and assign rights with ease

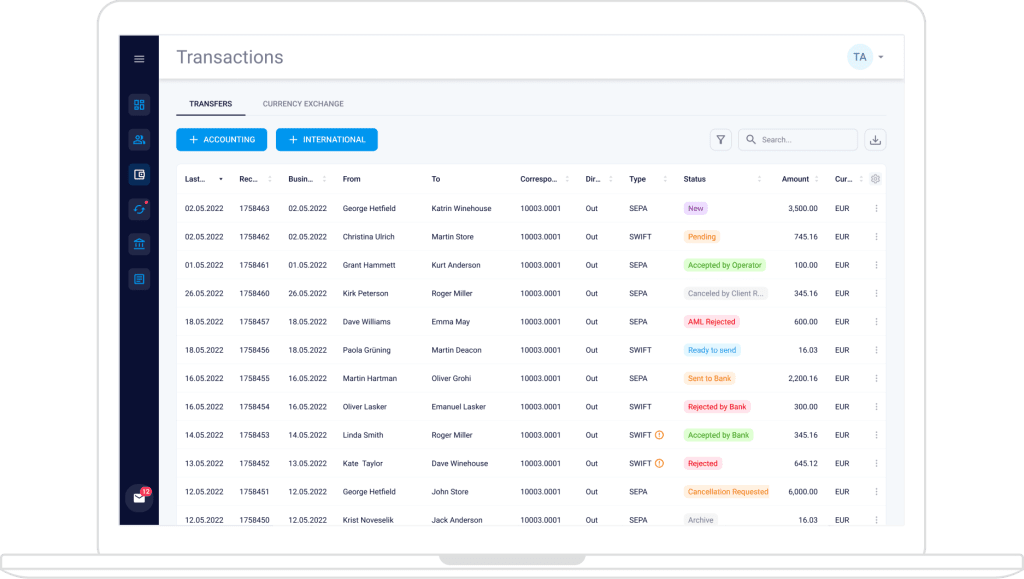

Payment processing & management

The processing and management of CHAPS, FPS, SEPA, SWIFT & internal payments is made simple, offering ready-to-use payment service provider/3rd party provider integrations.

When dealing with international payments, our software solution automatically converts the currency via API & employs ready-made integrations with currency exchange & liquidity providers.

01

Approve or deny incoming/outgoing payments

02

Determine payment rules e.g. create auto-payments & others that require mandatory verificationt

03

Set specific commission fees for each payment type

04

Manage mark-ups/rates & set base currency

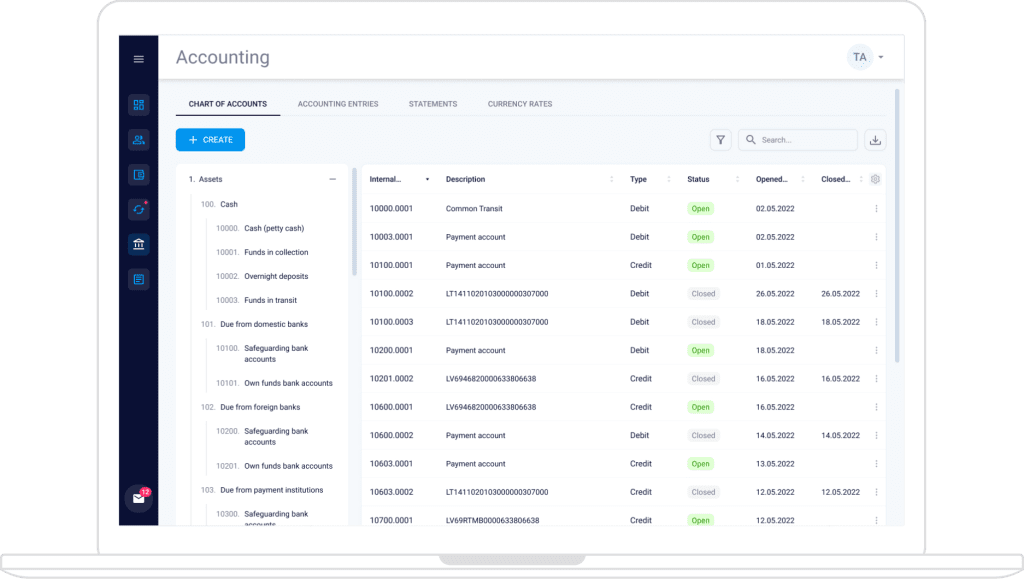

Enjoy the benefits of the complete accounting system

The comprehensive accounting system we offer, delivers multi-currency, real-time financial transaction accounting in adherence with International Financial Reporting Standards (IFRS).

A variety of functions are included, such as your digital bank’s financial operations and back-office accounting management.

01

Financial account management features for tax periods and everyday operations, such as setting up general ledger and chart of accounts and the management/reconciliation of your bank’s vostro/nostro accounts.

02

Enjoy precise reporting for your accounting department, with a complete overview of your operations & financials gained from a snapshot. These highly-detailed reports provide great insight with which to enhance your financial planning & forecasting.

03

Enhance your decision-making abilities through the provision of accurate real-time info and financial solutions that give you greater stability & improve performance.

04

Compile comprehensive reports needed for financial services regulatory purposes.

Adherence to Regulatory Requirements

01

Enjoy a digital core banking software solution approved by a large number of UK/EEA regulators, meaning you don’t have to spend huge amounts of time and resources developing in-house core banking solution that adhere to regulatory requirements.

02

A manual verification onboarding module is offered by our solution, as well as integrated KYC/AML tools and integrations that automate the process. Our digital core banking software solution is compatible with many KYC/AML and transaction monitoring tools.

03

Our software solution is SCA (Strong Customer Authentication) and PSD2-compliant. Advapay provides a secure digital banking/fintech application – OTP/MAC Generator – that complies with SCA requirements, ensuring that payment signing and authentication are carried out with unparalleled levels of security while allowing you to retain ownership of the customer journey.

04

In the event of regulations changing, our solution is easy to adapt and customise.

BaaS-solution Ready

Connect to a variety of different BaaS providers to diversify what you offer.

01

Enjoy the variety of banking services offered via our BaaS Service Provider marketplace or connect to something new.

02

Tailor your solution to include only the services you require, as we allow you to connect to as many BaaS providers as your business requires.

03

Deal with legal provider agreements, and we’ll take care of all your integrations and technical requirements.

The full range of functionality

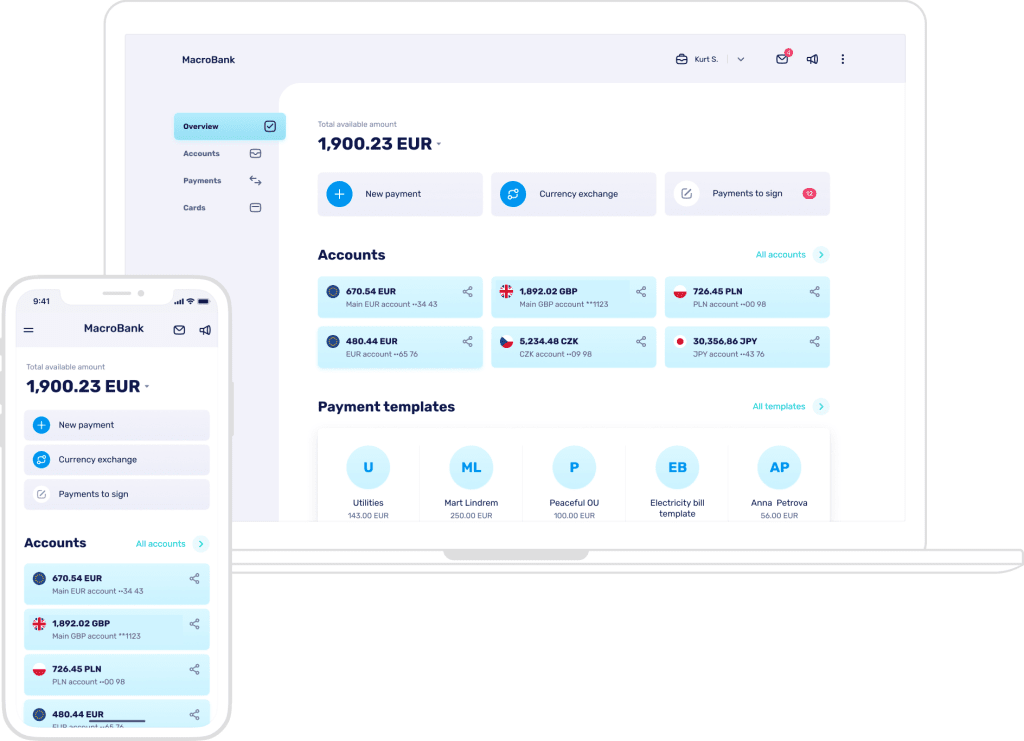

White-label web banking & mobile apps

The white-label web and mobile banking solutions we offer are ideal for financial organisations looking for banking apps that are easily customised and cost-effective. Catering to all customer needs, they allow for balancing checking, statement viewing, payments, and more. Furthermore, our white-label applications can be customised and branded to meet all your business requirements.

Permissions, Rules & Roles

Our software allows you to set up roles and permission for employees of your digital bank, as well as manage customers and the activities/transactions they make. It’s also possible to assign different permissions & rules to allow customers to manage their roles in mobile and web banking.

Supporting Customers

Via the tool, your customer support department is able to streamline the experience customers get during interactions. Thanks to top features like a list of requests and your message inbox, customer satisfaction levels are increased. The tool allows you to support customer service teams during their day-to-day duties using filters, status updates and other important messaging.

FAQs

Q: Which deployment options do you provide?

A: We provide 2 options. You can opt for a SaaS solution located on our servers or on-premise in the event you choose to buy core banking software source codes or a software licence.

Q: Which integration does your solution have built-in?

A: We offer a range of ready integrations for AML/KYC providers, payment service providers, banks and card issuers. See below for an extensive list.

Q: Can you add new integrations, not on the existing list?

A: Absolutely! If you opt for a provider that’s not featured on our integrations list, and you have a fully legal relationship set up, we can offer complete integration support. If you have an in-house IT team and you’d rather carry out integrations internally, it’s possible to switch to purchasing source codes or a software licence.

Q: Is it possible to see a product demonstration?

A: Yes! Just enter your details into the form below and we’ll get back to you ASAP.

Q: How much does your solution cost?

A: The amount you’ll pay will depend on which integrations you opt for. Once we’ve gained a full understanding of what your project entails, we’ll provide you with an accurate quote for the solution, including any extra developments required.

Q: How is your solution pricing set up?

A: We offer a SaaS solution with a monthly subscription that doesn’t involve you paying a setup fee. If you opt for a software licence, it’s possible to pay a setup fee and then provide support internally, meaning no more costs from us. It’s also possible to buy fixed-cost source codes and again support development internally.

Q: Are other deployment options on offer (such as on-premise)?

A: Absolutely. You can decide to go for a software licence model or buy source codes for deployment on your IT network.

Q: Is it easy to connect to BaaS providers?

A: Sure, and there are a couple of ways to do it. Either onboard with our BaaS-partners, and we will carry out the integration once you’re confirmed or locate a BaaS provider by yourself, and we’ll take care of all the technical aspects.