In an era where technology is reshaping the financial landscape, selecting core banking solutions has never been more critical for banks and financial institutions. As the fintech landscape continues to evolve, institutions face increasing pressure to adopt solutions that meet current demands and are equipped to adapt to future challenges.

Choosing a core banking system is a strategic decision that can determine an organisation’s long-term success. With customer expectations shifting rapidly and regulatory environments becoming more complex, financial institutions need a solution that is scalable, flexible, and capable of seamlessly integrating new technologies. This adaptability ensures that banks and financial institutions can continue to grow, innovate, and provide exceptional service as market conditions change.

- 1. Scalability in Core Banking Solutions: Supporting Growth

- 2. Flexibility in Core Banking Solutions: Adapting to Change

- 3. Customisation of Core Banking Solutions: Tailoring the Solution to Your Needs

- 4. Upgrading from SaaS to Software License: Flexibility in Licensing Models

- 5. Opportunity to Build New Modules or make integrations Internally in Core Banking Solutions

- 6. Compliance and Security for Core Banking Solutions: Ensuring Long-Term Viability

- 7. Vendor Reputation and Support: Long-Term Partnership

- Advapay at stake:

1. Scalability in Core Banking Solutions: Supporting Growth

Scalability is essential for banks and financial institutions as growth brings increased demand on systems due to higher transaction volumes, expanding customer bases, and adding new services and products. A core banking solution that cannot scale efficiently risks service delays, technical bottlenecks, and operational inefficiencies, which could lead to customer dissatisfaction and potential revenue loss.

In a globalised world where banking operates 24/7, customers expect instant access to financial services. A core banking system that fails to keep pace with growing demand can negatively impact a financial institution’s reputation and its ability to compete in a crowded marketplace. Additionally, new product launches, geographic expansions, and regulatory changes often require financial institutions to scale quickly. If the technology cannot support this growth, the institution’s ability to adapt and innovate is hindered.

Scalability extends beyond handling higher transaction volumes; it also includes the system’s capacity to integrate with new technologies, expand infrastructure, and support innovative digital banking services. A scalable solution ensures that a financial institution can meet today’s demands and remain well-positioned for future growth.

When evaluating vendors, consider asking about the system’s maximum transaction load capacity and how easily additional resources, such as servers or storage, can be added without disrupting operations.

Cloud-Based vs. On-Premises Scalability

One of the key decisions financial entities face when selecting a scalable core banking solution is choosing between cloud-based and on-premises systems. Cloud infrastructure enables banks and other financial institutions to scale resources up or down as needed, accommodating changes in customer demand or seasonal fluctuations. This on-demand scalability is cost-effective, as banks only pay for the resources they use, avoiding the need to invest in expensive hardware.

2. Flexibility in Core Banking Solutions: Adapting to Change

Flexibility in core banking solutions is essential for staying competitive and responsive to constant changes in the industry. A flexible system ensures long-term adaptability and success, from supporting new technologies to offering agile deployment options and customisable integrations.

The financial services industry is increasingly influenced by several key factors: evolving regulatory requirements, shifting customer expectations, and technological disruption. Each of these forces requires a flexible core banking system that can adapt without causing significant disruption to operations.

Regulatory changes are ongoing, with new laws introduced globally to enhance financial stability, combat money laundering, and ensure consumer protection. A core banking system that lacks flexibility may struggle to implement these changes efficiently, leading to costly delays and compliance risks. Additionally, consumers expect more personalised, seamless digital experiences from their financial institutions. A rigid system that cannot integrate with new technologies or adjust to changing customer needs could result in missed opportunities and a loss of competitiveness.

A significant aspect of flexibility in core banking systems is their ability to integrate with emerging technologies and other payment or business services. A flexible core banking system should support easy integration through application programming interfaces (APIs). The ability to integrate with new technologies and services not only enhances a bank’s operational capabilities but also opens doors to new revenue streams and innovative customer service models. Financial institutions can partner with fintech companies to offer customers cutting-edge services without the need for extensive internal development.

3. Customisation of Core Banking Solutions: Tailoring the Solution to Your Needs

One of the key advantages of customisable core banking solutions is the ability to configure the system to meet specific operational, regulatory, and market requirements. Each financial entity operates uniquely, influenced by its size, target customer base, regulatory environment, and product offerings. A customisable system allows institutions to adjust workflows, compliance settings, and transaction processes to align with their specific needs. For example, a financial institution operating in multiple jurisdictions may need to configure its system to comply with various regulatory standards, such as anti-money laundering (AML) and know-your-customer (KYC) regulations, while maintaining efficient internal processes. Additionally, the system can be customised to support multiple languages.

Customisable settings also enable financial institutions to respond quickly to changing business needs. Whether launching a new product, entering a new market, or adapting to new regulatory guidelines, a core banking system with flexible configuration options empowers banks to implement changes without costly overhauls or delays.

Key Areas for Customization

There are several essential areas within a core banking system that should be easily customisable to ensure flexibility and adaptability.

- Reporting Dashboards: Customisable dashboards allow different teams within the financial entity to track and analyse data relevant to their specific roles. For instance, executives may need high-level performance metrics, while compliance officers may focus on regulatory reports. Tailored dashboards ensure teams have the data they need to make informed decisions quickly.

- Transaction Workflows: Digital banks and other financial entities often have unique internal transaction processes. A customisable system enables these institutions to streamline workflows, ensuring appropriate approvals are in place and transactions are processed efficiently.

- Compliance Tools: Given the constantly evolving regulatory landscape, compliance tools must be adaptable. Customisable compliance settings allow institutions to remain compliant with local and international regulations by modifying processes, alert thresholds, and reporting standards as required.

- Security Protocols: Customisable security settings allow financial entities to tailor their security measures to meet specific regulatory requirements and adapt to evolving threats, providing enhanced protection for both the institution and its customers.

User Interface Customization: Enhancing Customer Experience

In addition to backend configurations, user interface (UI) customisation is becoming increasingly important, especially as customer experience becomes a key differentiator in the banking sector. Modern customers expect personalised and seamless interactions with their financial service providers, whether through a mobile app or web portal.

Core banking systems that allow for easy UI customisation enable financial institutions to offer a personalised experience while maintaining brand consistency. For example, a fintech company might want to customise its mobile banking app to reflect its unique branding, offering a user-friendly interface tailored to its customer demographics. Additionally, financial institutions may need to customise fields, adjust available features, set limits, and manage permissions. These changes should be made through the back-office interface and automatically reflected in the customer-facing application.

4. Upgrading from SaaS to Software License: Flexibility in Licensing Models

In today’s banking environment, institutions have several options when selecting core banking solutions, including flexible licensing models that allow banks to choose between Software-as-a-Service (SaaS), traditional software licenses, or even purchasing source code. While many fintechs start with a SaaS model due to its simplicity and cost-effectiveness, there may come a time when transitioning to a software license model offers greater benefits.

Benefits of SaaS in Core Banking Systems

SaaS models, where the core banking system is hosted and maintained by the vendor, offer several key advantages:

- Lower Upfront Costs: One of the most significant benefits of SaaS is its low upfront cost. Rather than making a substantial capital investment in hardware and software licenses, financial entities can pay a subscription fee that covers the core banking platform, hosting, maintenance, and updates. This appeals to smaller institutions or startups seeking to minimise initial expenditures while accessing robust technology.

- Regular Updates and Maintenance: SaaS models include continuous software updates, ensuring that fintechs always have the latest features and security patches without needing costly, time-consuming in-house IT interventions. This is particularly valuable in an era where digital banking innovations and cybersecurity threats evolve rapidly.

- Reduced IT Overhead: With a SaaS model, the vendor handles much of the technical maintenance—such as server management, data backups, and system troubleshooting—reducing the burden on the financial entity’s IT staff, allowing them to focus on more strategic tasks. It also simplifies compliance with regulatory updates, as the vendor is responsible for ensuring the system meets the necessary standards.

- Scalability: SaaS solutions are inherently scalable, allowing fintech companies to add resources on demand as they grow. This flexibility is essential for entities anticipating rapid expansion or changing market conditions, as they can scale their services without significant additional infrastructure investment.

Transition to a Software License Model

While SaaS offers many benefits, there are scenarios where a financial institution might choose to transition to a traditional software license model. Some of these scenarios include:

- Data Control and Privacy: As financial entities grow or face stricter regulatory environments; they may prefer to keep sensitive customer data in-house rather than relying on a third-party provider. A software license model gives fintech companies full control over their data, including where it is stored, how it is accessed, and who has access to it. This is particularly important for institutions in highly regulated markets or those that manage a large volume of confidential transactions.

- Regulatory Requirements: In some jurisdictions, regulators may impose specific requirements on how data is handled, stored, and protected. A SaaS model might not always meet these requirements, especially in regions with stringent data sovereignty laws. Transitioning to a licensed software model allows fintechs and banks to comply with local regulations by hosting their core banking system on-premises or within a private cloud environment that meets those standards.

- Cost Management as the Fintech Scales: While SaaS is often the most cost-effective solution for smaller institutions or banks in the early stages of growth, the recurring subscription costs associated with SaaS can become significant as the financial entity scales. At a certain point, transitioning to a software license model may offer better long-term cost management, especially if the bank has the infrastructure and resources to manage the system internally.

Vendor Support for Licensing Flexibility

When evaluating core banking solutions, it’s essential to consider vendors that offer flexibility in licensing models. As a financial institution’s needs evolve, the ability to transition from a SaaS model to a software license—or vice versa—without significant disruption is crucial. Vendors that support seamless transitions between models enable fintech companies to adjust their core banking infrastructure to align with growth, regulatory changes, or cost management strategies.

Fintech companies should seek out core banking software vendors that provide:

- Clear Pathways for Transition: Vendors should offer well-documented processes for moving from a SaaS to a software license model, including support for data migration, configuration, and infrastructure setup.

- Hybrid Licensing Models: Some vendors offer hybrid models, allowing financial sector companies to use a combination of SaaS and licensed software. This approach is particularly useful for institutions that want to keep certain sensitive systems on-premises while leveraging the flexibility of SaaS for other services.

- Long-Term Licensing Options: Vendors that offer flexible licensing terms enable fintechs to better manage their operational and capital expenditures over time, providing both SaaS and perpetual licensing options.

5. Opportunity to Build New Modules or make integrations Internally in Core Banking Solutions

If a financial services company has a strong internal IT team, the capability to develop and integrate new modules internally—alongside implementing other key developments, such as adding new services—allows it to swiftly adapt to changing market demands, regulatory requirements, and customer expectations. With custom-built modules and other in-house enhancements, a financial entity can tailor its services to address specific pain points or capitalise on new business opportunities that might otherwise be missed when relying solely on a third-party vendor for system updates.

For instance, if a financial institution wants to launch a new product—such as a specialised loan offering or a payment acquiring system—it can do so by building a module internally that integrates seamlessly with its existing core banking system. This approach reduces reliance on external providers, allowing the bank to maintain full control over its processes and ensure that the system evolves according to its strategic vision. On the other hand, the company can handle integrations with new service providers in-house, reducing product launch times by eliminating the need to wait for the vendor to fit it into their schedule.

Open Architecture: The Backbone of Internal Development

Choosing a core banking system that supports open architecture is essential for facilitating the development of new modules. Open architecture refers to a system design that allows seamless integration of new functionalities through open APIs (Application Programming Interfaces). APIs enable internal development teams to build or enhance specific features without disrupting the core system. Open architecture also simplifies integration with third-party solutions, such as payment methods, card issuing, AML/KYC services, etc.

Vendor Support for Development

While internal development provides financial entities with a high degree of control, vendor support remains crucial for ensuring that new modules and other enhancements are built, tested, and deployed effectively. A core banking vendor should offer robust tools and documentation to help internal teams understand how to create and implement new modules securely.

Many vendors provide development environments where financial institutions can build and test modules without impacting the live system. These sandbox environments allow new functionalities to be thoroughly vetted for compatibility, security, and performance before going live. Additionally, vendor-provided training and resources are invaluable for internal teams, helping them navigate the complexities of core system integration.

Collaboration with Fintech Startups

Building new modules does not mean financial entities will work in isolation. They should collaborate with other fintech companies to connect core banking systems with third-party service providers. By partnering with fintech startups, financial entities can co-create solutions that enhance their offerings, streamline operations, and deliver a more seamless customer experience. Additionally, these partnerships help financial institutions stay competitive by expanding their service portfolios and improving scalability without overburdening internal resources.

6. Compliance and Security for Core Banking Solutions: Ensuring Long-Term Viability

The regulatory environment for financial institutions is becoming increasingly stringent, with new laws and regulations designed to protect consumer rights, ensure financial stability, and combat financial crime. Compliance with these regulations is not only a legal requirement but also crucial for maintaining the reputation and operational continuity of a financial institution.

A core banking system must be adaptable to meet the demands of evolving regulations, such as the General Data Protection Regulation (GDPR), Anti-Money Laundering (AML) laws, the Second Payment Services Directive (PSD2), and other local regulations. For example, GDPR requires financial entities to implement strict data protection measures, ensuring customer data is securely stored and processed. Similarly, AML laws necessitate rigorous transaction monitoring to detect and prevent money laundering and other illicit activities. PSD2 mandates strong security measures and compliance with open banking standards.

Financial institutions that fail to comply with these regulations risk heavy fines, legal penalties, and reputational damage. Therefore, selecting a core banking system that can easily integrate with regulatory tools, automate compliance processes, and generate audit-ready reports is essential. The system should also be flexible enough to adapt to future regulatory changes, allowing the bank to remain compliant as new laws are introduced.

Security Considerations: Protecting Against Emerging Threats

With the rise of digital banking and online transactions, cybersecurity threats are at an all-time high. Financial entities are prime targets for cybercriminals due to the sensitive data they handle and the large volume of transactions they process daily. A core banking system must incorporate advanced security features to protect against these threats and safeguard customer information.

One of the most critical security features is encryption, which ensures that data is protected both in transit and at rest, making it difficult for unauthorised parties to access or alter sensitive information. Additionally, multi-factor authentication (MFA) adds an extra layer of security by requiring users to provide multiple forms of verification before accessing the system. This is especially important for preventing unauthorised access in the case of compromised passwords or other credentials.

Automated fraud detection is another essential feature. It uses machine learning algorithms to monitor transactions in real-time and identify suspicious patterns that could indicate fraudulent activity. By flagging unusual behaviour, financial entities can prevent fraud before it occurs, protecting both the institution and its customers.

Maintaining system security also involves regular penetration testing and vulnerability assessments. Financial entities should work closely with their core banking solution vendors to ensure these assessments are conducted regularly. This will help identify and address potential security weaknesses before they can be exploited.

Regular Updates: Staying Ahead of Threats and Regulations

As technology and regulations continually evolve, core banking systems must remain up-to-date to ensure security and compliance. Regular software updates are essential for patching vulnerabilities, improving system performance, and aligning with regulatory standards.

Vendors play a critical role in this process, as they are responsible for providing timely updates to address security flaws and integrate features required for compliance with the latest laws. Without these updates, financial entities risk lagging in security protocols and regulatory requirements, potentially leaving them vulnerable to cyberattacks or non-compliance penalties. Additionally, the update process should be seamless and minimally disruptive, allowing banks and fintech companies to maintain daily operations while ensuring the system stays secure and compliant.

7. Vendor Reputation and Support: Long-Term Partnership

Selecting the right core banking system is a critical decision for any financial institution, but the software itself is only part of the equation. Equally important is choosing a vendor with a strong reputation, stability, and a long-term commitment to supporting the institution’s evolving needs. A core banking system is not a one-time investment but an ongoing partnership where consistent support, training, and adaptability is essential.

Vendor stability is especially important for long-term success. A vendor with a proven track record of innovation and reliability is likelier to invest in research and development, ensuring that the core banking system remains competitive in a rapidly changing industry. Additionally, a reputable vendor typically has a loyal client base, reflecting strong customer satisfaction and trust.

When assessing a vendor’s reputation, consider its history in the industry: How long has it been in business? Is it known for delivering cutting-edge solutions? Has it effectively adapted to new trends, such as cloud-based banking or digital transformation? A well-regarded vendor known for innovation is more likely to help a financial institution stay competitive.

Customer Support and Training: Ensuring a Smooth Transition

Implementing a new core banking system is a complex process that requires extensive coordination and technical expertise. Therefore, the level of customer support and training the vendor provides is a crucial consideration. A vendor that offers robust support during implementation and beyond can significantly ease the transition and minimise disruptions to daily operations.

Customer support goes beyond merely troubleshooting issues. A reliable vendor will collaborate closely with the financial institution’s team to ensure that the system is customised to meet specific needs and will provide ongoing assistance as those needs evolve. This includes access to a dedicated support team, regular software updates, and comprehensive training resources for both IT staff and end users.

Training is essential to ensure the financial institution’s employees can use the system effectively. The best vendors offer various training options, such as on-site workshops, online courses, and detailed documentation. This variety ensures that staff can quickly become proficient with the new system, reducing the learning curve and enhancing operational efficiency.

Conclusion

In today’s dynamic financial environment, choosing the right core banking solution is essential for long-term success and resilience. Investing in a system that addresses both current needs and future challenges is critical. As the financial landscape continues to evolve, choosing a solution with robust capabilities will position financial institutions not only to survive but thrive. A forward-thinking approach to core banking will empower these entities to adapt, innovate, and remain competitive in an increasingly complex market, ensuring they can meet their customers’ needs both now and in the future.

Advapay at stake:

How can Advapay can assist you in launching your fintech business?

• Assistance in EMI/PI licencing in the EEA/UK

• Registration of MSB company in Canada

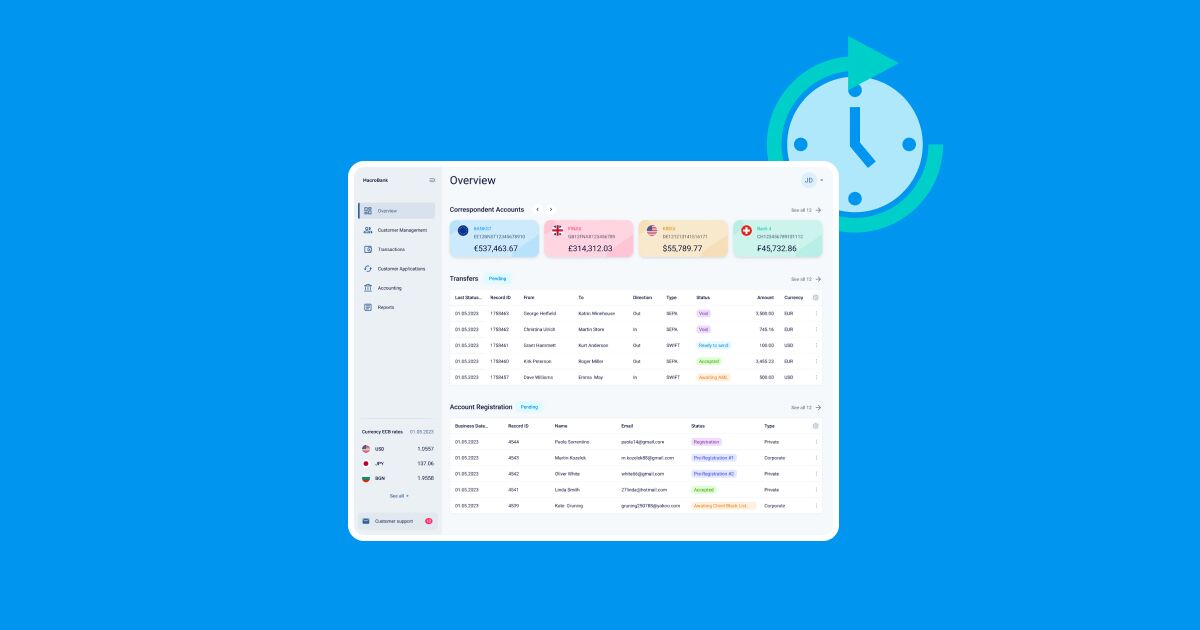

• Delivery of a comprehensive Core banking system encompassing back-office and white-label applications for end-users

• Assistance in payment infrastructure development

• BaaS-solutions and Embedded Payments solutions in collaboration with our partners – EEA/UK licenced EMIs and PIs