Banking SaaS or Software as a service is cloud-based software comprising different features and integrations based on a recurring subscription. Fintech companies use cloud-based Digital Core Banking service with its “Pay-as-you-go” pricing model more and more frequently to minimise upfront investments and reduce time-to-market.

Let`s get into functionality and some benefits Banking cloud-based SaaS solution brings to the table.

Functionalities available via Banking SaaS (Software as a service) solutions

Depending on your needs, you can receive a full package of core banking back-office engine, applications and end-user applications:

• Customer onboarding,

• KYC/AML,

• Current accounts,

• Payments & transfers,

• Currencies & rates,

• Tariffs & fees,

• Payment card issuing,

• Financial accounting,

• Mobile banking application,

• Web banking application.

Benefits from Banking Software as a Service (SaaS) solution

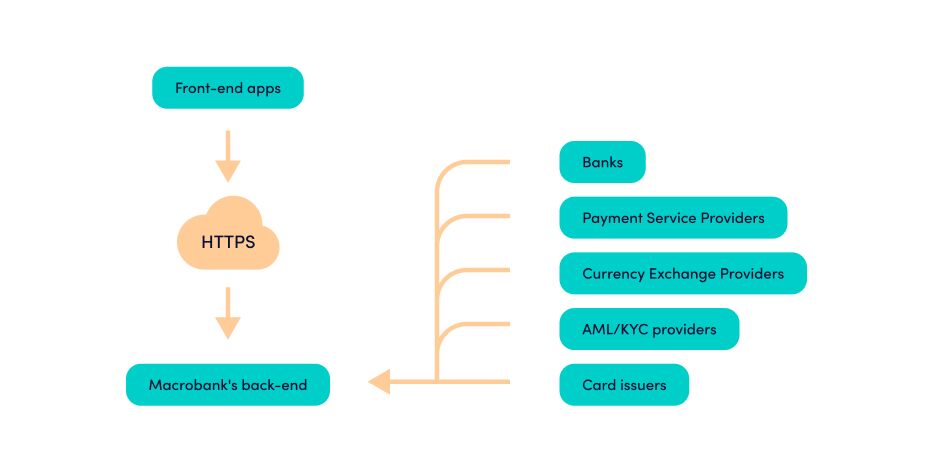

Access to ready integrations and powerful partner ecosystem

With Core banking modules and applications, you receive ready-to-use integrations with banks, payment services providers, KYC/AML providers, currency exchange, card issuers. Each new integration can take quite a lot time, but you receive them free, depending on your package. You can pick required integrations from the list of ready-to-use integrations and start using them.

Fast-to-market strategy

You can launch new products and services faster with pre-integrated services. For example, building your solution, including end-user applications, may take more than twelve months. But with a ready-to-use Banking SaaS, you can receive access to the full-fledged system in three months.

No huge initial investments

Usually, in-house software development, purchasing a software licence or software codes, require enormous investments at the very start. SaaS will help you eliminate or even avoid additional setup costs. With Banking SaaS, you receive a solution on a subscription model and with reduced or even eliminated (for some packages) setup fee.

Simple budget management

You can calculate your budget beforehand. Plan a setup payment if you have got this in your package, use free man/hours for customisation, add additional customisations if needed and budget monthly fee payments. No more unexpected expenses.

Cost-Efficient solution

Banking cloud-based SaaS solution provides a cost-effective pricing model that allows banks and fintechs to avoid substantial capital expenditures (Capex) required for up-front IT investments. It will allow companies to limit high recurring expenses to ensure that infrastructure and software are up to date.

Besides, you don’t need to manage the actual infrastructure and solution. Meaning that, there are no investments in IT resources, including recruitment of internal IT teams and professionals for development, implementation, testing, and support.

Up-to-date integrations

Banking Software as a Service (SaaS) solution ensures that all your integrations and functionalities are continuously kep up to date with all technological and regulatory standards.

Scalability, security and reliability

Inclusive SaaS banking means that you don’t need to take care of the infrastructure and features. The solution will give you scalability, security and at the end of the day – reliability. You will be able to modify and introduce new products quickly and

Technology tailored to your needs

Banking SaaS solutions allow you to tailor new products to your business needs. Applications and business processes logic can be customised and swiftly brought to the market. What is even better? Depending on your package, you will receive free man/hours to make customisations.

In which cases you shouldn’t choose Banking cloud-based SaaS solution for your business

No integrations on-demand available

Keep in mind that Banking cloud-based SaaS solution offers only ready integrations. If you need specific integrations – you need to go for a software license or purchasing codes of our Macrobank.

Lack of support for massive changes

With Banking Software as a Service (SaaS) solution you can make different customisation, e.g. to change business processes logic, brand your apps, add/delete fields, set up modules for your business. However, the solution is pre-designed and won’t provide any massive changes. If you have a project with unique requirements – look at a software license or consider purchasing codes of our Macrobank.

High-priced model for large companies

This model can be less cost-effective when your business starts growing. Banking Software as a Service (SaaS) solution`s pricing usually depends on transaction volumes and how many customers you have. If you are snowballing, we recommend you to transit to a software license or purchase software codes. In case of our Macrobank, your payment for setup for SaaS will be deducted from the price of a software license or software codes.

About Advapay

Advapay is a technology company providing the Digital Core Banking platform to empower fintech clients or digital banks to start their businesses and accelerate digital transformation. The platform delivers all essential functionalities, a front-to-back system and a set of tools to customise and bring new integrations. With Advapay, potential and existing customers can connect either to the cloud-based SaaS or on-premise software. Besides the technical infrastructure, the company provides business advisory and fintech licensing services. Interested to learn more, please drop us a message