In this post, we are introducing our latest features, integrations, software updates and new apps of our Core Banking software – Macrobank.

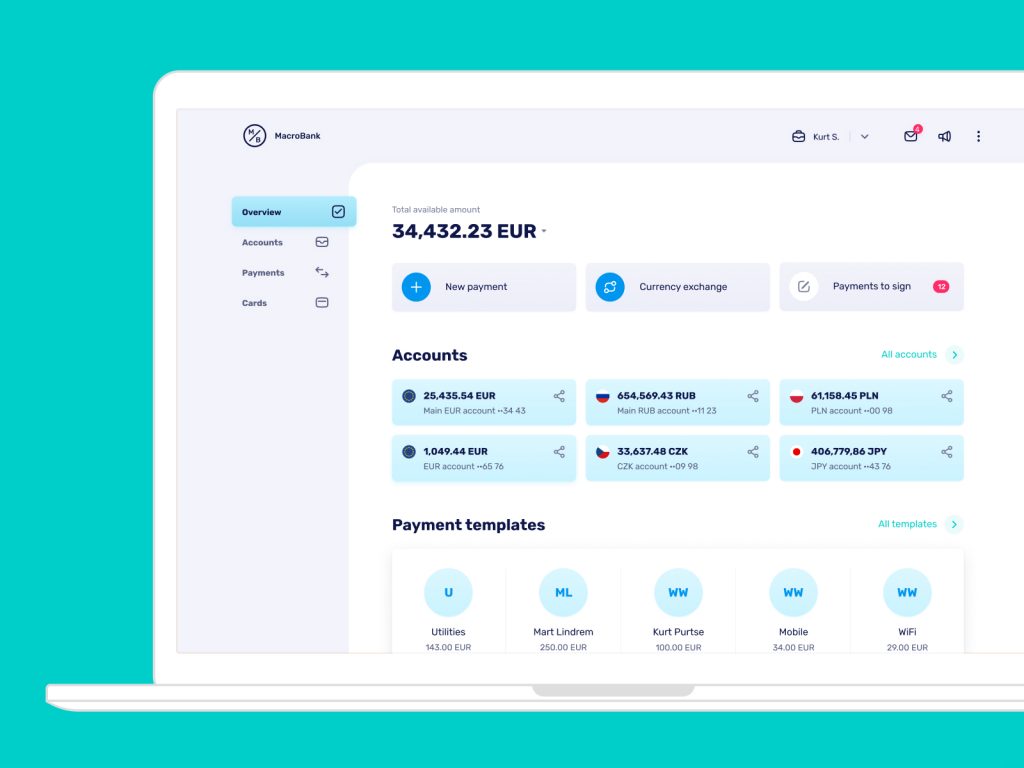

1. White-label web-banking application

A genuinely customer-centric web banking application provides all essential banking functionalities – current accounts, payments, currency exchange, statements, payment templates and others.

• New modern design and user-friendly interface

• Smooth built-in onboarding procedure to provide immediate access to your business/personal account after the registration and continue the verification procedure at the later stage 100% manageable, customizable and branded

• Can be integrated with any Core Banking back-office system

Technology stack

• Angular framework

• Single Page Application technology to improve UX

2. White-label mobile application

Native mobile application for IOS and Android incorporates a wide range of banking functionalities:

• User-friendly modern interface supporting both light/dark themes and different languages

• Account and payment operations: make payments, view payment history, create payment templates, display and download statements, etc.

• Payment card management

• Support for biometric technologies

• Built-in communication tool with your customers, e.g., chat with the operator Push-notifications Dynamic management of the application by the operator with no need for a new app release

Technology stack:

• Swift (iOS), Kotlin (Android) – platform-native languages to ensure the optimized performance of applications

• Instant changes in the app made online from the back office

3. A Back-office of Macrobank Core Banking software

The new version of Macrobank`s Digital Core banking software and back-office offers new integrations and functionalities:

• Integration with automated customer onboarding, KYC and AML platform SumSub and iSpiral

• Integration with iban.com: auto-complete of the recipient’s bank details after when entering IBAN.

• 2-step customer onboarding: preliminary customer registration with verification at the later stage

• Scheduled payments

• Payment cancellation with a multi-user signature

Technology stack:

Database: SQL Server

Flexible setup of the business logic using built-in workflow editor

Integrations: C#, Go.

Microservice architecture allows Advapay’s clients to replace or readjust individual components without making an effect on the entire system.

Azure cloud hosting:

• Access to high-quality geo-distributed hosting

• Secured data storage based on Microsoft Security Development Lifecycle

• Less human resources required, e.g., IT specialists and database administrators

• Cost-effectiveness with a pay-as-you-go model

4. RESTful API

• Flexible microservice architecture facilitates setup and readjustment of separate components

• Synchronicity to support bid data load and processing

• Unified standard for the service interaction and increased control over resources distributed for service delivery

• Faster system response

• Transparency and reliability ensured through parallel processing and high security of a single point of interaction

• Built on .NET Сore (using C#)

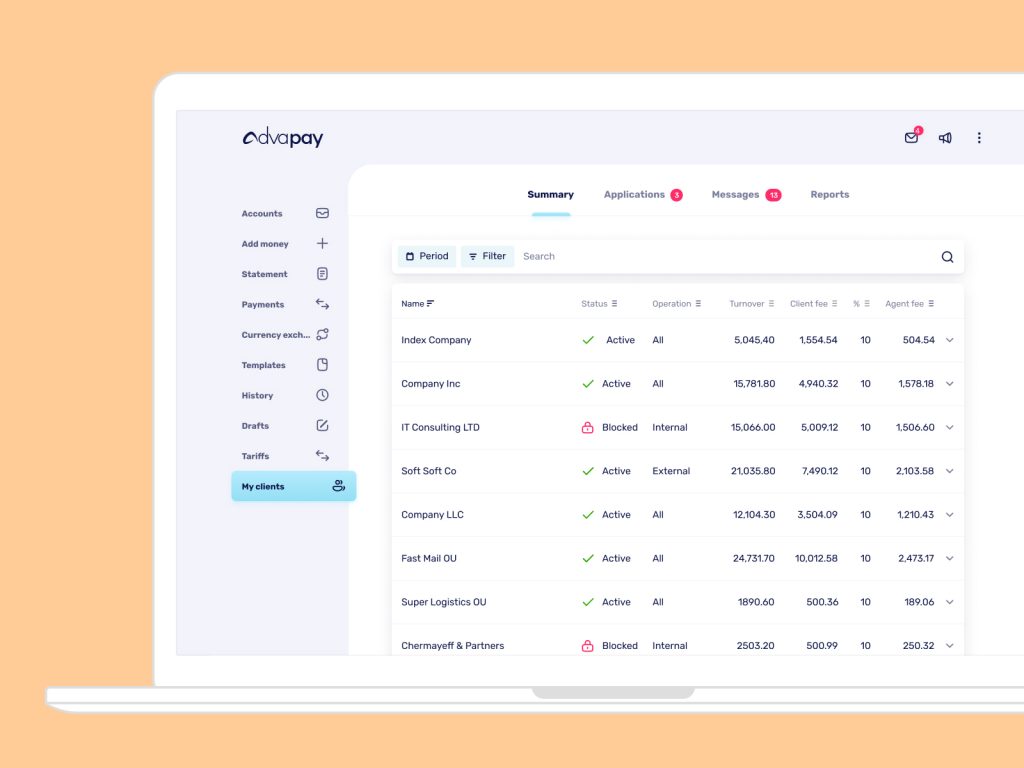

5. Agent Console

The Agent Console allows Advapay’s clients to create an agent network and onboard their customers in Macrobank’s Core Banking back office:

• Onboarding and management of customer applications

• Pre-registration of customers with minimum information

• Functionality to tag the specific customer to the agent

• Customer onboarding by agents using external KYC/AML services

• 2-step registration procedure to allow the customer to continue the onboarding process after pre-registration

• Processing of customer applications for further approval by the Operator of the PSP

• View available to check the total of customer payments, invoices, types of payments, and specific transactions and the total of the Agent’s commissions by clients, accounts, types of payments, and specific transactions

• Direct communication with customers in the Agent Console

• Generation and management of reports

Advapay is a technology company providing the Digital Core Banking software to empower fintech clients or digital banks to start their businesses and accelerate digital transformation. The platform delivers all essential functionalities, a front-to-back system and a set of tools to customise and bring new integrations. With Advapay, potential and existing customers can connect either to the cloud-based SaaS or on-premise software. Besides the technical infrastructure, the company provides business advisory and fintech licensing services. Interested to learn more, please drop us a message.