We help to run fintech businesses and provide fintech consulting

01

Jurisdiction selection and structuring advice

02

Preparation of all business, IT, and compliance documentation

03

Communication with regulators

04

Local team recruitment

05

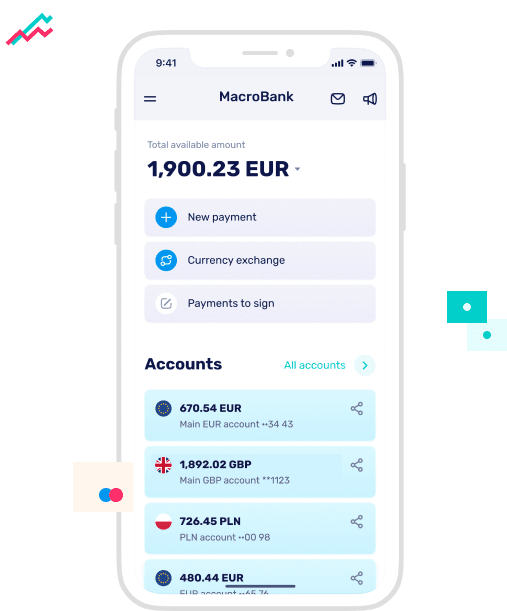

Provide regulatory-compliant core banking software with comprehensive descriptions

06

Payment infrastructure development and BaaS solutions

Advantages of Working With Us

Happy clients worldwide

We have helped dozens of companies from Europe, Africa, Asia, and America launch their fintech.

Practical knowledge

We are fintech practitioners with a proven track record of launching successful payment businesses.

Focus on business

Thorough fintech consulting centered on delivering a working vehicle to meet clients’ goals.

Fintech consulting: start your payment business fast

Canadian MSB registration:

the fastest and easiest way to get your license

The best all-around jurisdiction for new fintechs. It is commonly used by companies with different risk profiles and business models (remittance, e-wallets, crypto).

Pros:

- Affordable, easy, and fast registration

- Covers a wide range of fiat and crypto payment services

- Friendly regulator, open to international businesses

Swiss SRO membership:

easy access to European markets

Well positioned for companies in payments, crypto, and related services thanks to moderate requirements, a clear regulatory framework, and a fast approval process.

Pros:

- Reputable Swiss jurisdiction

- Moderate capital requirements and fast approval process

- Suitable for diverse business models

Jurisdictions for payment, e-money and money remittance businesses

Own Payment Institution, Electronic Money Institution or other Payment Services Provider license is a prestigious and powerful solution for well-established businesses with experienced teams and substantial funding behind them. We offer fintech consulting across various jurisdictions in the EEA/UK, Canada and Bahrain.

Local substance and team: 2-10 officers at the moment of authorisation, depending on the jurisdiction. Some shall be local, and some shall be identified at application submission.

Capital requirements: EUR 125k for PI or EUR 350k for EMI of a minimum share capital in the EEA/UK, additionally funding for the company development (usually over EUR 1 million). For Ancillary Service Provider Specialized License holders in Bahrain, a minimum core capital requirement of BD 250,000 (approximately EUR 615,000 as of October 29, 2024) is mandated.

Timeframe: 6-18 months, depending on the jurisdiction

Jurisdictions

for crypto business

We support crypto businesses. We help you find the right jurisdiction to launch and scale your crypto venture with confidence.

Blog

Looking for Core Banking software for your fintech project?

Learn more