We assist in the full licensing process of obtaining a Payment Institution license in Poland

If you are looking to obtain an Authorised Payment Institution license in Poland, Advapay can offer you its legal, technical and business expertise and consulting support.

01

Application preparation, communication with the regulator, business services

Filling out an application form

Communication with regulatory authority during the application phase

Assistance in the development of a business plan

Assistance in the opening of safeguarding accounts

Hiring local team and launch of the Polish office

02

Preparation of legal, financial and IT documents

Legal documents – AML, KYC, IT/Security policies, etc.

Financial documentation – 3-years financial forecast, P&L statement, the flow of funds

Company operational documentation – internal policies, risk operation policies, internal audit, etc.

IT documentation

Overview of the Polish fintech market

Poland is one of the most promising jurisdictions for new fintech companies.

The country provides fintechs with a large share of skilled workers. Besides, the labour market is known for its low wages and specialists with relevant experience.

From the country’s sustainable development to payment service habits of the population and the growing numbers of migrants in Poland and locals emigrating to other countries, who continuously require currency exchange – there are several factors that make Poland a great go-to-market for both B2B and B2C service providers.

The regulator holds a balanced position – it carefully evaluates new companies, but at the same time doesn’t bring any problems for businesses that seem reliable and comply with recommendations.

As of June 2019, 49 companies had an Authorised (National) Payment Institution license, 59 companies were functioning as Small Payment Institutions, and 1300 companies had been accredited as Payment Service offices by the authority. In 2019 and 2020 Poland issued 5 E-Money and Payment Institution licenses.

Also, Revolut selected Poland as a place for its second-largest office globally after its headquarters in London.

Regulator and legislation

Payment institutions in Poland are allowed to conduct their commercial activities only with a license granted by the local regulator – the Polish Financial Supervision Commission (in Polish – Komisja Nadzoru Finansowego, KNF).

Doing business in Poland

1) Openness for services targeting customers from Eastern Europe.

2) Inexpensive, high-quality human resources.

3) Ease of opening a business account in Polish banks.

4) Simple process of obtaining a residence permit for managers and employees.

5) Access to national currency Złoty which creates a large FX market.

6) Business opportunities for remittance companies because of a large number of immigrants and emigrants.

Main requirements

Personnel

The required number of local staff and management is not strictly defined and instead described as sufficient to provide quality services and implement the proposed business plan. Besides, it is recommended to have a local team of least two board members and soft commitment from four employees (legal contracts aren’t required at the application stage).

Management

The management must cover the following functions:

AML;

Compliance;

Risk management;

Finance and accounting;

Technical part including cybersecurity;

Commercial part (sales & marketing & business development).

Initial Capital requirements

The company must prove that it has an initial capital of no less than EUR 125 000.

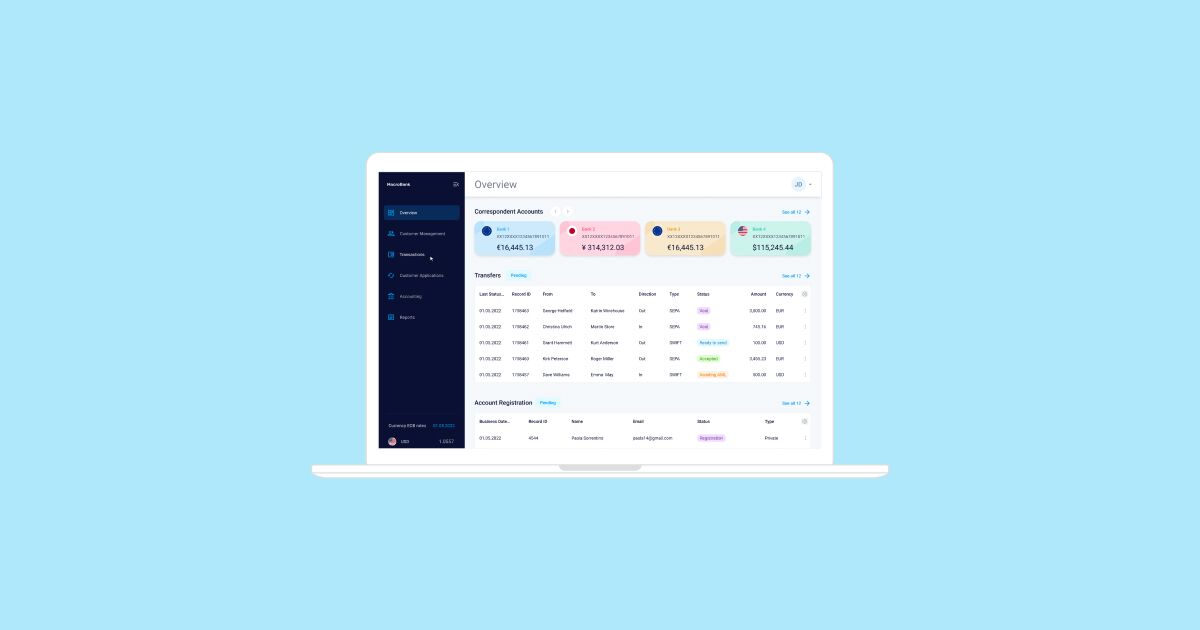

Infrastructure

After obtaining a license, the company has 6 months to launch the infrastructure and start operations

Documents

1) Company identification data (company details, articles of association).

2) List of payment services to be provided.

3) Financial statements.

4) Business plan for at least three years (including marketing and operation plans).

5) Financial plan for at least three years.

6) Proof of funds.

7) Description of the risk management and internal control system.

8) Structure scheme of the company and the group, if the applicant belongs to such a group.

9) Identification data of the managers and persons with qualifying holdings in the company.

10) Proof whether the applicant and persons are qualifying for prudent and stable management of the payment institution.

11) Identity of Statutory Auditors and Audit Firms.

12) Proof of possession of civil liability insurance or bank guarantee.

13) Proof that technical standards for strong customer authentication and common and secure open standards of communication are met.

14) Confirmation of payment of the authorisation fee.

15) List of applicant’s agents if the applicant plans to provide payment services through agents.

16) List of applicant’s branches if the applicant intends to provide payment services in branches.

Jurisdictions

we cover

We have a strong focus on fintech businesses like digital banks, e-wallets, fiat-crypto wallets & e-commerce banking with the main product Digital banking.

We do not work with businesses that ONLY provide remittance services without opening payment accounts.