We assist in the full licensing process of obtaining an E-money or Payment Institution license in Lithuania

If you are looking to obtain an Authorised Payment Institution or Electronic Money (E-Money) Institution license in Lithuania, Advapay can offer you its legal, technical and business expertise and consulting support.

01

Application preparation, communication with the regulator, business services

Filling out an application form

Communication with regulatory authority during the application phase

Assistance in the development of a business plan

Assistance in the opening of safeguarding accounts

Company formation, staffing services

02

Preparation of legal, financial and IT documents

Legal documents – AML, KYC, IT/Security policies, etc.

Financial documentation – 3-years financial forecast, P&L statement, the flow of funds

Company operational documentation – internal policies, risk operation policies, internal audit, etc.

IT documentation

Doing fintech business in Lithuania

– The Bank of Lithuania provides a regulator function.

– The process to obtain a license takes from 3 months to 6 months.

– Low costs for company maintenance.

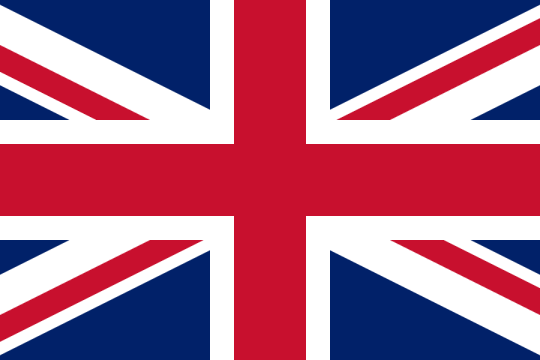

– An attractive jurisdiction for operations in the European region for companies facing difficulties because of Brexit.

– A friendly banking environment to open a segregated account in the Bank of Lithuania for SEPA payment IBANs.

– A future-proof payment infrastructure: direct technical access to SEPA and the possibility to issue own IBANs via Bank of Lithuania API.

– Start-up friendly environment and institutional advice and assistance.

Lithuanian fintech market overview

Lithuania has become the new Fintech hotspot in the EU region, with its fintech-friendly environment, clear legal framework, and stable business and political environment.

According to “The Global Fintech Index 2020” report, Lithuania holds the 4th place in the Global Fintech ranking as a Fintech promoting country.

There are 39 Payment Institutions and 74 E-Money Institutions operating in Lithuania (up to March 2021). The total number of Fintech companies operating in Lithuania at the end of 2019 was 210 companies according to the report “Fintech Landscape in Lithuania 2019-2020”.

In 2020 there are 5 Payment Institution and 15 E-Money Institution licenses were issued.

New regulations and initiatives from the government are expected to arrive in 2021 to make the sector even more flexible and competitive. For example, the Bank of Lithuania is currently building a new framework for addressing risks posed by the provision of digital financial services.

Lithuania offers strong institutional support and assistance to fintech companies during their first year of operations. Meanwhile, the regulatory sandbox environment allows companies to test their financial innovations in a live environment under the guidance and supervision of the Bank of Lithuania.

Types of licenses

1) Authorised Payment Institution license in Lithuania

2) Authorised E-money Institution license in Lithuania

3) Small E-money Institution license in Lithuania

4) Small Payment Institution license in Lithuania

Important information: Lithuania offers 2 main payment institution types – EMI and PI; nonetheless, in most cases, after reviewing the application and all documents, the regulator recommends the EMI license.

Process of authorisation

1) A pre-application meeting is held with representatives of the Bank of Lithuania. The company’s representatives shall be present during the meeting. The initial meeting aims to answer questions that might have arisen in the pre-application stage and find out what financial services the applicant is planning to provide.

2) The applicant submits an application form for an EMI licence to the Supervision Service of the Bank of Lithuania. Over 5 business days, the Supervision Service reviews and notifies whether all the necessary materials are submitted. If there are no formal deficiencies, the entity accepts the application for consideration.

3) The application for a licence of an EMI and documents is assessed. The Board of the Bank of Lithuania analyses the information and documents submitted and takes a decision about the issuance or refusal of a licence.

4) The license is issued, or the entity refuses to grant the license.

Terms

Formally, the licence issuing term for Authorised EMI and PI is 3 months, for Small EMI and PI – 2 months. In cases, when all documents haven’t been submitted or have been submitted with deficiencies, the term is extended for another 3 months for EMI and PI, 2 months – Small EMI and 5-6 months – Small PI.

License fees

– E-money license fee in Lithuania – EUR 1,463

– Small E-money licence fee EUR 1,235

– PI license fee – EUR 898 (for payment institutions providing only account information services, the licence fee is EUR 693)

– Small PI licence fee EUR 682

Requirements

Founders

The founder(s) of an e-money institution must undergo an investor screening procedure with the CCSSO; it is a separate procedure from licensing.

Personnel

The management structure is specified. The company must have the Board, consisting of a minimum of 3 members and the CEO.

Other key personnel for licencing must be identified. When applying for a licence, the company must provide information on key personnel, e.g., anti-money laundering officer, information security officer. It is vital to prove that the relevant employees have the necessary qualifications and experience.

Initial capital requirement

The initial capital requirement for EMIs is EUR 350 000. Nonetheless, the Bank of Lithuania requires a capital buffer. The size of the buffer depends on the business plan calculations. Small EMIs aren’t subject to the minimum initial capital requirement.

The initial capital requirements for PI are as follows:

– no less than EUR 20,000 where the payment institution intends to provide money transfer services only;

– no less than EUR 50,000 where the payment institution intends to execute only payment initiation services;

– no less than EUR 125,000 where the payment institution intends to provide all other services.

Partnership agreements

Prior to submitting all documents for a license, you need to have a clear vision of your technical solution (e.g. accountants) and drafted outsourcing agreements, as well as agreements with parties involved in the process of provisioning payment services.

Submitting documents for EMI or PI

1) Documents confirming the legal status of the applicant.

2) Document confirming the right of representation of a representative.

3) Document confirming the payment of stamp duty for licence issue.

4) Programme of operations.

5) Business plan.

6) Documentary evidence that the minimum size of the equity capital does not fall below the amount specified in Article 22(2) for EMI or Article 14(2) for PI of the Republic of Lithuania Law on Electronic Money and Electronic Money Institutions.

7) Description of measures taken (to be taken) to safeguard consumer funds.

8) Description of governance arrangements and internal control mechanisms, including administrative, risk management and accounting systems.

9) Description of structural organisation.

10) Notification of the proposed acquisition.

11) Questionnaires of members of the management body and key function holders.

12) Professional indemnity insurance contract and documents confirming other equivalent liability guarantees and details and substantiation of calculation of the sum insured or of other comparable liability guarantee.

13) Questionnaire on the operational risk of the applicant’s activities.

Submitting documents for Small EMI and Small PI

1) Documents confirming the legal status of the applicant.

2) Document confirming the right of representation of a representative.

3) Document confirming the payment of stamp duty for licence issue.

4) Business plan.

5) Documents proving that the average outstanding electronic money of the electronic money institution will not exceed EUR 900k and the average of the preceding 12 months’ total amount of payment transactions executed by the payment institution will not exceed EUR 3m per month.

6) Description of measures taken to be taken to safeguard consumer funds.

7) Description of structural organisation.

8) Questionnaires of members of the management body and key function holders.

9) Questionnaire on the operational risk of the applicant’s activities.

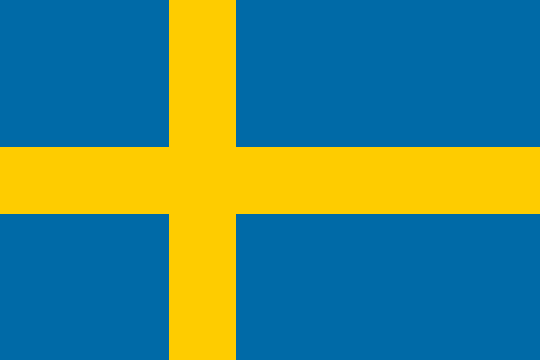

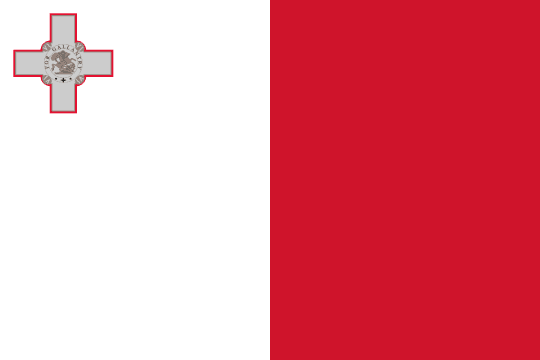

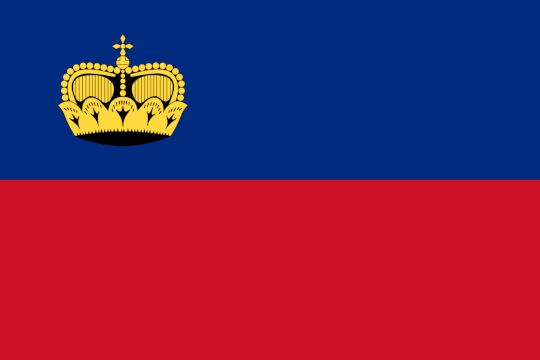

Jurisdictions

we cover

We have a strong focus on fintech businesses like digital banks, e-wallets, fiat-crypto wallets & e-commerce banking with the main product Digital banking.

We do not work with businesses that ONLY provide remittance services without opening payment accounts.