We assist in the full licensing process of obtaining a Payment and E-money Institution license in Liechtenstein

If you are looking to obtain a Payment and Electronic Money (E-Money) Institution license in Liechtenstein, Advapay can offer you its legal, technical and business expertise and consulting support.

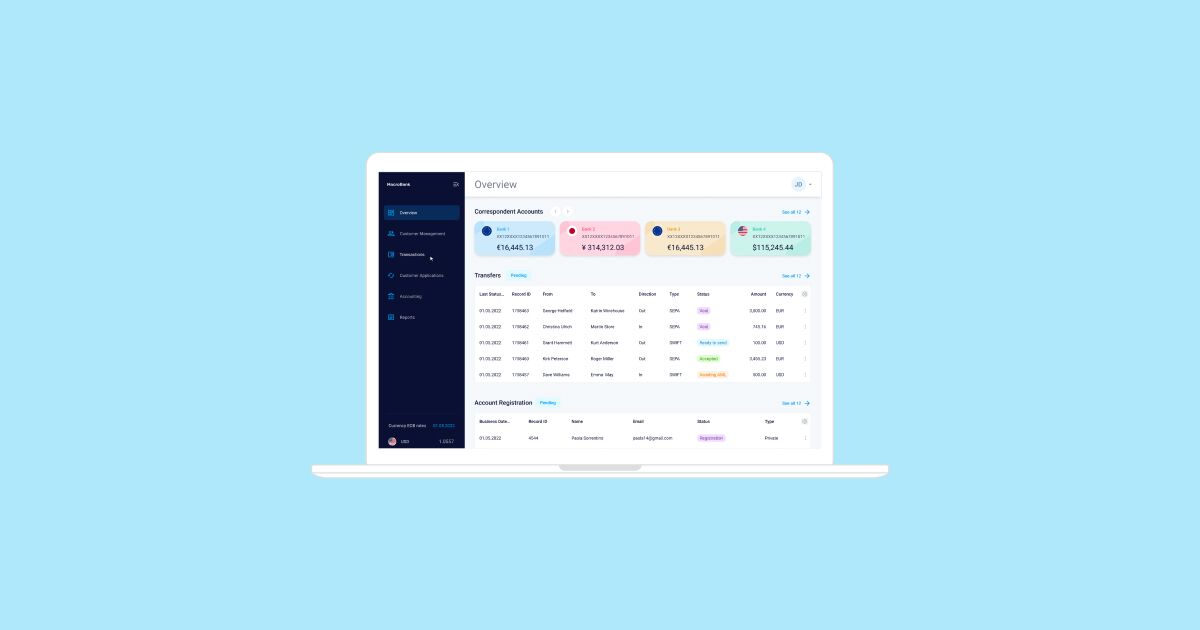

01

Application preparation, communication with the regulator, business services

Filling out an application form

Communication with regulatory authority during the application phase

Assistance in the development of a business plan

Assistance in the opening of safeguarding accounts

Company formation, staffing services

02

Preparation of legal, financial and IT documents

Legal documents – AML, KYC, IT/Security policies, etc.

Financial documentation – 3-years financial forecast, P&L statement, the flow of funds

Company operational documentation – internal policies, risk operation policies, internal audit, etc.

IT documentation

Overview of the Liechtenstein market

Liechtenstein is a member of the European Economic Area (EEA) – it has EU-compliant regulation and full freedom to provide services in all EEA countries. Liechtenstein has close economic relations and the Customs and Currency Treaty with Switzerland, thus allowing Liechtenstein companies to benefit from privileged access to the Swiss economic area.

Liechtenstein is business-friendly and creates the best framework conditions for entrepreneurs. The country’s liberal economic policy is reflected in labour law as well as company law.

The uniform corporate income tax rate for companies in Liechtenstein is 12.5%. Paying this flat tax satisfies all fiscal demands, given that Liechtenstein has no capital or coupon tax.

Regulator

The Regulator of Liechtenstein is Financial Market Authority (FMA)

As an integrated and independent supervisory authority, the FMA supervises the financial market participants in the Liechtenstein financial centre. The FMA ensures the implementation of international standards and participates in the preparation of financial market laws on behalf of the Government. The FMA has set up an internal competence team, the “Regulatory Laboratory”, which deals with regulation and innovation in the field of financial technologies. The FMA advocates sustainable regulation that ensures efficient and effective supervision. To further specify laws and their implementing ordinances, the FMA also issues guidelines and communications.

The most important legal foundations

– Liechtenstein E-Money Act of 17 March 2011 (EMA)

– Liechtenstein E-Money Ordinance of 12 April 2011 (EMO)

– Liechtenstein Payment Services Act of 6 June 2019 (PSA)

– Liechtenstein Payment Services Ordinance of 17 September 2019 (PSO)

Types of licenses

– Electronic Money Institution (EMI) license of Liechtenstein

– Payment Institution license of Liechtenstein

Fees and timeline

Timeline:

Total: 4-6 months:

– Preparation of documents: 4-6 weeks

– FMA approval procedure: up to 3 months

Fees:

– Licensing fee:

The fee for the issuance of a licence for a payment institution is CHF 30,000.00 (Article 30 in conjunction with Annex 1 Section 1 of the Financial Market Authority Act).

– Taxes:

General information on the taxation of banks and investment firms can be obtained from the Liechtenstein Fiscal Authority (www.stv.llv.li).

– Fee for entry in the Commercial Register:

The fees for entry in the Commercial Register and for public certification are governed by the Ordinance on Land and Commercial Register Fees.

Main requirements

Initial Capital:

For Payment Institution of Liechtenstein, the initial capital must amount to at least:

40,000 Swiss francs or the equivalent in euros for payment institutions operating theses payment services:

– services provided by technical service providers, which support the provision of payment services, without them entering at any time into possession of the funds to be transferred.

100,000 Swiss francs or the equivalent in euros for payment institutions theses operating payment services:

– services based on specific payment instruments that can be used only in a limited way, provided that they meet one of the following conditions:

a) instruments allowing the holder to acquire goods or services only in the premises of the issuer or within a limited network of service providers under direct commercial agreement with a professional issuer;

b) instruments which can be used only to acquire a very limited range of goods or services;

c) instruments valid only in Liechtenstein or an EEA Member State provided at the request of an undertaking or a public sector entity and regulated by a national or regional public authority for specific social or tax purposes to acquire specific goods or services from suppliers having a commercial agreement with the issuer;

250,000 Swiss francs or the equivalent in euros for payment institutions operating these payment services:

a) cash withdrawal services offered by means of ATM by providers, acting on behalf of one or more card issuers;

b) cash-to-cash currency exchange operations where the funds are not held on a payment account;

c) professional physical transport of banknotes and coins, including their collection, processing and delivery;

d) payment transactions consisting of the non-professional cash collection and delivery within the framework of a non-profit or charitable activity;

e) services where cash is provided by the payee to the payer as part of a payment transaction following an explicit request by the payment service user just before the execution of the payment transaction through a payment for the purchase of goods or services.

For E-money Institution of Liechtenstein, the initial capital must amount to at least:

The initial capital of an e-money institution must be at least EUR 350,000.00, or the equivalent in Swiss

francs.

Safeguarding assets:

Payment and E-money Institutions in Liechtenstein must adequately safeguard the funds received from clients either directly or indirectly and inform the FMA in advance about any material changes with respect to the safeguarding of funds.

Registered office and head office:

The registered office and the head office of the e-money institution must be situated in Liechtenstein.

Management & Personnel in Liechtenstein:

– Minimum 2 directors – they should have an experience in financial industry (fit and proper) and EU passport

– Internal Auditor

– Compliance

– Risk Management

– Internal software and control system

Documents

The following information and documents, in particular, must be enclosed with the application for an E-money licence in Liechtenstein:

1) Identification details;

2) The business model demonstrating, in particular, the nature of the intended e-money services;

3) A business plan, including a marketing plan, with a budget plan for the first three financial years and information about own funds, including the amount, and information on the capital requirements and their calculation;

4) A description of the applicant’s organisational structure, including, where applicable, a description of the planned use of agents and branches, as well as an account of any outsourcing agreements and a description of the manner of its participation in a national or international payment system;

5) Evidence of initial capital;

6) A description of the measures for safeguarding the funds of e-money users and/or payment services

users;

7) A description of the corporate governance and internal control mechanisms of the applicant, including the administration, risk management and accounting practices;

8) A description of the procedures for monitoring, handling and following up on security incidents and security-related client complaints;

9) The procedures for recording, monitoring, tracking and restricting access to sensitive payment data;

10) Business continuity arrangements;

11) The principles and definitions applicable to the recording of statistical data on performance, transactions and cases of fraud

12) Security strategy document;

13) A description of the internal control mechanisms for ensuring compliance with requirements relating to the prevention of money laundering and terrorist financing, in particular the requirements set out under due diligence legislation, including Regulation (EU) No. 2015/847;

14) Identity and assessment of suitability of persons with a qualifying holding in the applicant;

15) Identity and suitability assessment of the directors and persons responsible for the management of the e-money institution;

16) Identity of statutory auditors and audit firms;

Other supporting documents:

17) A declaration from an FMA-recognised firm of auditors that it accepts the mandate of external auditor;

18) A declaration from a firm of auditors that it is in agreement with the draft articles of association and draft rules of procedure;

19) Detailed statement of the firm of auditors with respect to the intended organisational structure (including IT), the safeguarding of client funds, risk management, corporate governance and the internal control system;

20) Job descriptions/requirements profiles.

The following information and documents must be enclosed with the application for a Payment Institution licence in Liechtenstein:

1) The business model, setting out in particular the type of payment services envisaged;

2) The business plan including a forecast budget calculation for the first three financial years;

3) Evidence that the payment institution holds the necessary initial capital;

4) A description of the measures taken for safeguarding clients’ assets;

5) A description of the applicant’s governance arrangements and internal control mechanisms, including administrative, risk management, and accounting procedures;

6) A description of the internal control mechanisms in order to comply with due diligence legislation, etc.

7) A description of the applicant’s structural organisation (where applicable, a description of the intended use of agents and branches and a description of outsourcing arrangements);

8) The identity of persons holding in the applicant, directly or indirectly, qualifying holdings within the meaning of Article 3a(1)(8) of the Banking Act, and the size of their holdings;

9) The identity of directors and persons responsible for the management of the payment institution and, where relevant, persons responsible for the management of the payment transactions of the payment institution, as well as evidence that they are of good repute and possess appropriate knowledge and experience to perform payment services;

10) The names of the statutory auditors and external auditor;

11) The applicant’s legal form and articles of association;

12) The registered office and the address of the central administration of the applicant.

Other application materials:

13) Declaration by an auditor recognised by the FMA that it accepts the mandate as an external auditor;

14) Declaration by the external auditor that it approves the draft articles of association and business regulation;

15) Description of the IT solution;

16) Detailed statement by the external auditor on the envisaged organisation (including IT), the safeguarding of payment service users’ assets, risk management, governance, and the internal control system (Article 3(2) PSO);

17) Job descriptions/requirement profiles;

18) Marketing concept.

Note: The FMA may also request additional documents.

Jurisdictions

we cover

We have a strong focus on fintech businesses like digital banks, e-wallets, fiat-crypto wallets & e-commerce banking with the main product Digital banking.

We do not work with businesses that ONLY provide remittance services without opening payment accounts.