Obtaining a Small Payment Institution licence (SPI) in the EEA (including Spain) is a much simpler task than the authorization of a full-fledged Payment Institution (PI) or E-Money Institution (EMI).

This is due to the smaller number of required documents, the absence of initial capital and local team requirements, and the application processing time – an average of 2-4 months, compared to 12-15 months in the case of an authorised EMI or PI.

However, the Small Payment Institution concept is not a popular one in Europe due to passport restrictions (services can only be actively sold at the location of registration) and transaction volume limitations – the average value of the payment operations executed in the preceding 12 months must not exceed €3m per month.

A rough calculation shows that such a volume allows you to receive a gross profit of no more than €30k euros per month (after paying banks for correspondent accounts and transfers). At the same time, the full functioning of SPI involves other expenses, such as hiring multiple employees, purchasing/renting payment software and marketing.

Therefore, SPIs are usually employed either to test some local marketing hypotheses or to service a limited volume of high-risk payments. SPI can be a fairly powerful tool for developing large-scale payment businesses, but the secret is the right choice of jurisdiction and a well-thought-out strategy.

How Spain`s SPI Licences differ from other EEA countries

So how do Spain`s SPI licences differ from those in other EEA countries? Ordinarily, after a small PI reaches the threshold of €3 million in payments per month, you are required to apply for a full PI licence.

The peculiarity in Spain is that when your application is being considered, you’re able to work without payment volume restrictions. Such a strategy allows you to launch a payment business in six months and, indeed, work without restrictions on payment volume limitations.

The only limitation in this scenario is the lack of passporting, meaning a limitation in advertising in other EEA countries, as nobody prohibits you from onboarding clients from outside of Spain who will naturally come to you. An important advantage of this strategy is that your application for a full licence will most likely be considered by the regulator on a priority basis.

Instead of 12-15 months, authorisation will typically take just 6-9 months. Also, after obtaining the SPI registration and a record of past performance (often taken as a likely future performance indicator), you will be able to participate in the Bank of Spain’s regulatory sandbox program. This allows you to freely consult with the regulator on obtaining a large PI licence. Of course, a successful SPI experience will also greatly increase your credibility.

Registration for Spain`s SPI & information required

According to the Bank of Spain, small payment institution licence holders with an average value of payment operations executed in the preceding 12 months not exceeding €3m per month are exempt from the general payment institution authorisation scheme. Although, they must apply for special registration.

To request the Payment Institution Special Registration (Small Payment Institution licence), the company must comply with the following requirements:

a) Have its registered office, effective administration & management body, and payment services located in Spain.

b) Directors of the Payment Institution must be of good repute and possess appropriate knowledge and experience to perform payment services, as established by the Bank of Spain.

c) Establish internal control & reporting procedures and bodies to prevent & deter money laundering and terrorist financing.

d) The Institution will not exercise the freedom of establishment or the freedom to provide services in the rest of the European Union.

e) Set up a company in Spain, registered with Spanish Companies House and request the criminal records certificate of the company.

In addition to the application form, the following documents must be submitted:

a) A programme of activities that specifically includes the type of payment service to be provided, as well as the auxiliary or closely related services. T&Cs to be signed by the Payment Service Users.

b) A business plan (including a forecast budget calculation for the first three years) under which appropriate and proportionate systems, resources and procedures will be employed by the institution to operate soundly.

c) Draft contracts between all parties involved in the provision of the payment services.

d) Procedures for monitoring, handling and following up on security incidents and security-related customer complaints.

e) A description of the procedure established to record, control, track and restrict access to sensitive payment data.

f) A description of the principles and definitions applied for the collection of statistical data on results, operations, and fraud.

g) A security policy document.

h) Internal control & reporting procedures and bodies established to prevent money laundering and terrorist financing. In particular, the mechanisms introduced by the applicant in order to comply with money laundering and terrorism financing regulations.

i) Measures to safeguard user funds.

j) Customer service regulations.

If you are interested in receiving more information about launching your payment business, don’t hesitate to contact our team.

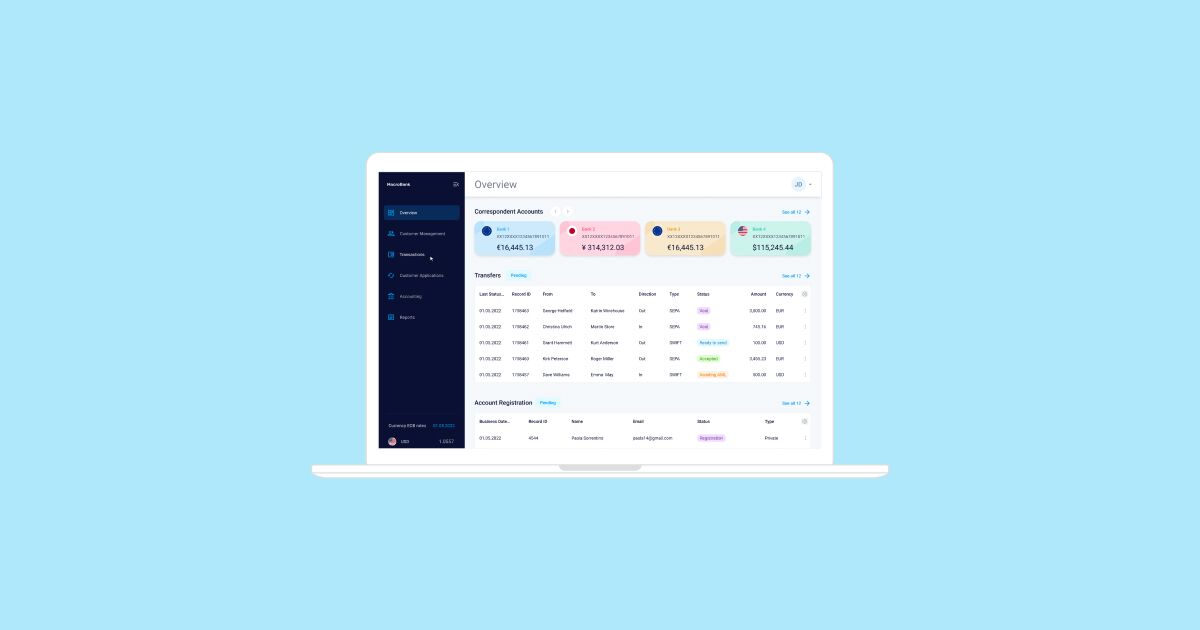

About Advapay

Advapay is a provider of Core Banking platform Macrobank and Banking-as-a-Service solutions for Electronic Money and Payment Institutions, such as digital banks, e-wallets, remittance companies, crypto startups and other fintech companies. Currently, the company serves more than 30 financial services companies across the UK and European Economic Area.

Besides the technical infrastructure, the company provides licensing and fintech consulting services, including assistance in building payment infrastructure.