The coronavirus, known as Covid-19, has spread to 170 countries worldwide, with more than 205,000 infected (Worldometers, March 18, 2020). The spread of the virus Covid-19 will impact the global economy and some of the world’s largest industries in the next few months, including fintech market.

We need to understand that the effect fintechs can have is both – positive and negative. But what kind? And what fintech companies need to do to adapt these changes? Read the article to find out more.

1. Less cash, more cards; less money spent offline, more – online

Today, habits are changing in response to the outbreak of the coronavirus. First, people avoid using cash when making payments in shops, because banknotes may be spreading the new coronavirus. The World Health Organization warns people about this and advises that people should try to use ‘hygienic’ contactless payments instead.

More and more people will shop online for food and other essentials. E-commerce and other online channels will grow comparing with the period before Caronavirus. Because most will think twice about going to restaurants or running errands at the supermarket with hundreds of other people around, but some countries have put in place restrictions to go to public places. People will stay at home and focus on their health.

Less cross-border spending and credit card transactions mean that sales of Visa and MasterCard will drop by 2%-4%. For example, stocks of Visa have already dropped by 12% since February (Forbes, 2020).

Also, banks and consumer fintech will face pressure. Digital-first banks make a profit from transaction fees paid by merchants for debit card transactions. Due to a decreasing number of shoppers, this market will be down. This is why fintechs are in a better position than traditional banks. Their consultancy services, card acceptance, an application process for a current account and other services usually take place online.

2. Investments at stake

Stock markets have become extremely volatile due to the spreading coronavirus. Consumers have become more worried about investing and fear a recession. The global economy has been already affected. In these conditions, people avoid investing their savings. Digital wealth managers and online trading platforms, including Robinhood and eToro, don’t make money and experience declining trades. Therefore, the Federal Reserve in the USA made the biggest cut in the federal funds rate in more than a decade.

3. Extending functionalities of banking apps

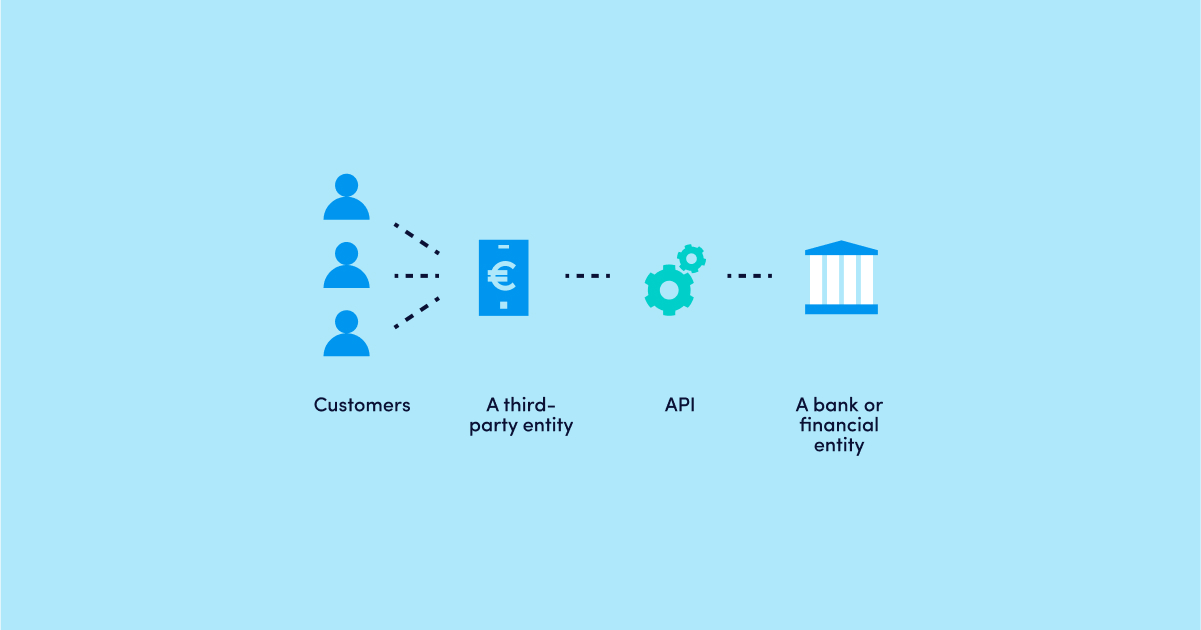

There is no doubt that the economic slowdown and the Covid-19 coronavirus will have a positive impact on the growth of fintech innovations and new features in online and mobile banking. The coronavirus will make fintech companies think of new ways how they can use Open API and Artificial Intelligence. For example, banking apps might be upgraded with new features like insurance, medical and other relevant services in the age of the coronavirus. Is your technical solution ready for such changes?

4. Increasing demand for insurance

Many international and local events and conferences are cancelled at the last minute as the coronavirus escalates. Under these circumstances, different insurance products, starting from health and life insurance to business and event cancellation, have become a must-have. However, most insurance packages don’t cover pandemic and epidemic outbreaks, meaning that there will be no rise in claims related to cancellations and damage resulting from the coronavirus.

5. Covid-19 impact on Chinese fintech market

Funding of Chinese fintech has annually decreased from $1.8 billion to $298 million in 2019 (Business Insider, 2020). The coronavirus will make the market even more uncertain and the influx of external funding will remain low. As a result, 2020 will bring even bigger turbulence in investment opportunities and fintechs will need to shift to a more sustainable business model. All this won’t be limited to Chinese fintech, the coronavirus will be a shockwave for fintechs around the world.

As the coronavirus continues to spread, fintech giants, including Tencent, Baidu, and Ant Financial strengthen the local economy by supporting those in need like merchants, hospitals, and scientists. Let’s take the example of MYbank, a brand under the Ant Financial. The company helps companies in Hube province in Central China, offering zero-interest for the first three months and a 20% discount for the remaining nine months of the one-year loan (Informa PLC, 2020). Also, the mobile payment platform WeChat offers financial aid of $143.5 per day for smaller merchants for 30 days (Fintechnews, 2020).

According to the government of China, the country will be back on track by June. Around 65% of people have returned to the city and their routine (Forbes, 2020).

6. Loss of venture capital funding

There are negative effects of the coronavirus on venture capital (VC) funding for both – new and existing fintech companies. Investor habits have changed and most of them are on the lookout for safe investments. Therefore, currently, venture capital financing in fintech is relatively flat. There are negative effects of the coronavirus on venture capital (VC) funding for both – new and existing fintech companies. Investor habits have changed and most of them are on the lookout for safe investments. Therefore, currently, venture capital financing in fintech is relatively flat. VCs will become more selective. “VCs can and will slow down, but the best companies will still get funded”, says Paul Murphy, a partner at Northzone.

7. Increasing government and regulator support

To jumpstart the local and global economies together with the fintech industry, governments and regulators will have to increase the measures to fight the economic crises and provide much-needed support for businesses. These include the World Health Organization that is encouraging contactless payments and South Korea that will temporarily offer more flexible regulations for fintechs (Financial Brand, 2020). Besides that, the Bank of England has come up with an action plan and urged the government to soon provide financial support to local companies suffering from the outbreak of the coronavirus (FinTech Magazines, 2020). European governments have come with measures for companies, suffered from Coronavirus crisis – for example, companies can request to suspend mortgages or defer tax payments. In some countries, social charges and tax payments due in March will be pushed back automatically.

Final thoughts:

From these facts, one may think that most consequences have a negative impact on the world. But the economic slowdown has a couple of advantages, including the opportunity to start a business and develop new products and services for the next 4 months – the forecasts how long the fintech market recession will last.

The virus also taps into the necessity to evaluate the potential impact and come up with a strategic recovery plan. The situation is changing fast – adapt your business to new business model and continue to invest in technologies. Your capabilities to adapt the changes in the fintech world depend on your technical solution capabilities. In other words, how flexible is your solution.

Advapay is a technology company providing the Digital Core Banking platform to empower fintech clients or digital banks to start their businesses and accelerate digital transformation. The platform delivers all essential functionalities, a front-to-back system and a set of tools to customise and bring new integrations. With Advapay, potential and existing customers can connect either to the cloud-based SaaS or on-premise software. Besides the technical infrastructure, the company provides business advisory and fintech licensing services. Interested to learn more, please drop us a message.