In this article we have listed 4 ways of how Payment Service Providers (PSP) can issue IBANs to their customers.

An international bank account number (IBAN) is a standard international numbering system for bank accounts worldwide. The IBAN comprises a code that identifies the account’s country, the account holder’s bank and the account number itself. The IBAN is created according to international standards. Following these standards, the creation of IBANs is coordinated and regulated at the national level.

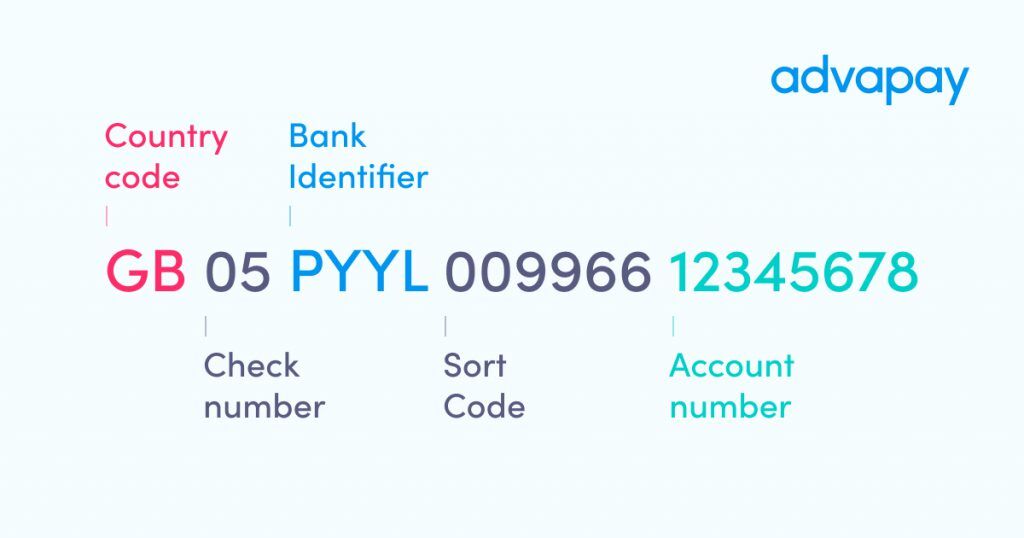

The IBAN allows everyone worldwide to quickly identify the country where the bank and the money transfer recipient’s account number are located. The IBAN also acts as a method of checking whether the transaction details are correct. The number usually starts with a two-digit country code, then two numerals, followed by up to thirty-five alphanumeric characters.

If you plan to operate as a Payment Service Provider, digital bank or e-wallet and open current/payment accounts, you will need to assign IBANs for your customers. There are various ways how you can receive these IBANs.

1-Become a SEPA participant and issue dedicated IBANs for your customers

To join the SEPA scheme, Payment Service Providers and E-Money institutions need to comply with the European Payments Council (EPC) requirements:

- Have the legal status and demonstrate that it is not insolvent.

- Be licensed and regulated by a relevant regulatory body within the SEPA.

- Show that the company maintains sufficient liquidity and regulatory capital following the relevant laws and regulatory rules to which they are related.

- Demonstrate that you are active in providing payment accounts, holding funds for customers or making them available when they come in.

- Comply with the applicable laws concerning anti-money laundering, terrorist financing and sanctions.

- Obtain a Bank Identification Code (BIC) from the SWIFT financial messaging network.

- Be technically and operationally ready to participate in the scheme, receive and process SEPA payments and have a Core Banking system, such as Macrobank.

- Have direct access to the European clearing and settlement system through the existing system’s participant. As Payment Service Providers and E-money institutions cannot directly join any clearing and settlement systems, you will need to partner with banks or payment systems that have access to the European clearing and settlement system.

After joining the SEPA scheme, the company receives rights to issue IBANs. The generation of IBANs takes place in the Core Banking system – in the current accounts & IBANs generation module.

In order to provide payments to or from these IBANs, the company must be connected to the SEPA system through a bank or a payment system that provides the gateway to the Single Euro Payments Area, for example, CENTROlink (a payment system operated by the Bank of Lithuania).

From the customer’s view, the customer receives a dedicated IBAN with your company details because this option allows you to create IBANs in your company’s name.

2- IBAN Sponsorship

There are dozens of regulated e-money companies that offer the opportunity to generate IBANs and manage eWallet accounts without the need for an individual e-money or payment license. Such companies allow to issue and manage IBANs automatically through their API. These IBANs are created in the partner’s name, not your company – the customer receives a dedicated IBAN with partner (e.g., bank, payment system) details.

3-Receive virtual IBANs from your bank partners

Commercial banks and payment systems that are direct SEPA scheme participants, can issue virtual IBANs to E-money or Payment Institutions. Virtual IBAN accounts offer an alternative to standard IBANs and provide simple ways to make cross border payments. A virtual IBAN is an IBAN (International Bank Account Number) reference issued by a bank. It allows E-money and Payment Institutions to reroute incoming payments to the physical bank account. Virtual IBAN accounts can be used to send and receive payments worldwide.

From the customer’s view, the customer receives a dedicated IBAN with partner (e.g., bank, payment system) details.

4-Become EMD/PSD Agent and issue IBANs through your partners

You can acquire your E-Money License as an EMD (Electronic Money Directive) or PSD (Payment Services Directive) Agent and start partnering with businesses in the UK and EU. The PSD or EMD agent is a company that can act on behalf of another company that is authorised or registered by the regulator (e.g. FCA) as a payment or e-money institution.

In this case, you will be able to issue your partner’s IBANs with their company details. To acquire customers, you will need to have a front interface and an agent module to view and manage your customers. Customer onboarding and payment processing will be a part of your partner.

Advapay is a technology company providing the Digital Core Banking platform to empower fintech clients or digital banks to start their businesses and accelerate digital transformation. The platform delivers all essential functionalities, a front-to-back ystem and a set of tools to customise and bring new integrations. With Advapay, potential and existing customers can connect either to the cloud-based SaaS or on-premise software. Besides the technical infrastructure, the company provides business advisory and fintech licensing services. Interested to learn more, please drop us a message.