Advapay Canada

Leading service provider for international fintech firms operating as money services businesses (MSB) in Canada

Presence in Canada, clients from over the world

We have a strong presence in Canada and our services cater to a diverse range of clients, spanning from startups and established businesses to unicorn companies across the globe. Our reach extends to various regions, including Europe, Africa, Latin America, and Asia.

More than MSB registration. We provide a fully operational company

Our expertise goes beyond simply registering MSBs; we also provide comprehensive assistance in launching operational payment businesses: opening of correspondent accounts, establishing remittance corridors, and more.

We are Fintech practitioners, not just consultants

We pride ourselves on being fintech practitioners with an extensive network of partners and a profound understanding of the best practices required to ensure a seamless and stress-free launch and operation of payment businesses.

Why Canada

01

Short time-to-market (only three months)

02

Regulator is friendly to companies operating internationally

03

Non-strict local presence requirements

What services Canadian MSBs

can provide:

Open payment accounts

Make payments and money transfers

Exchange currencies

Issue cards

Acquire cards

Exchange, send and receive crypto

Perform crowdfunding activities

Our services for MSB registration in Canada

If you are looking to register a Money services business (MSB) or Foreign Money Services Business (FMSB) in Canada, Advapay can offer you its legal, technical and business expertise and consulting support.

01

MSB registration

Incorporating a company in Canada

Developing a regulatory business description

Completing application forms and finalizing the submission

Responding to clarification requests from the regulator

02

Preparation of custom compliance policies

AML-CTF Policies & Procedures

Risk Assessment

Anti-Bribery & Corruption Policy

Sanctions Policy

Risk Appetite

Other as required

03

Opening accounts in financial institutions

Preparation of custom program of operations, business plan, financial forecast to open accounts in financial institutions

Making intros to banks

Support in filling in the documents

Responding to clarification requests

04

Compliance-as-a-service

Appointing a local compliance officer

Representing the company in communication with the regulator and banking partners

Writing reports and submitting them to regulator

Keeping the compliance program up-to-date

MSB in Canada: main requirements

Legal entity

Corporation is the most common type of legal entity established for the purpose of obtaining MSB license. You may choose to incorporate a company in any Canadian province or federally – it will not affect the process of obtaining the license.

Office

Having an office at the registration stage is not required. The company must have a legal address, which can be, for example, the director’s home address. However, it is recommended to have a commercial address. Virtual offices are not accepted by the regulator.

Personnel

At the registration stage, a Compliance Officer should be appointed – preferable with experience in the financial sector in Canada.

Beneficiaries

You must disclose some information about beneficial owners, such as their name, place of birth, country of residence.

MSB in Canada: documents and information submitted

01

Name of the company that is going to obtain the license

02

Company incorporation information

03

Legal (business) address of the company

04

Contact details of the company representative

05

Description of the services and activities the company plans to provide

06

Information about the company’s bank account (if applicable)

07

Information about your Compliance Officer

08

Staff headcount

09

Information about the owners of your MSB and senior management – for example, their name and date of birth (about the company directors and each person who owns or controls 20% or more)

10

Estimate of the expected total amount of transactions per year for each MSB ser-vice you provide

11

Detailed information about each branch

12

Details about each MSB agent

!! FINTRAC tends to send clarification requests with regards to any piece of the information that the applicant provides in order to confirm that the company is eligible to receive MSB registration. This may also include:

– a business plan with the detailed description of the services that justifies the need of the registration.

– an interview with the compliance officer or contact person appointed for the application.

Application Process

The MSB registration process in Canada is completed online, with a pre-registration phase lasting about 5 business days. The full registration typically takes 3 to 4 months.

1

Incorporating a company in Canada

2

Completing FINTRAC pre-registration form and awaiting further instructions

3

Submitting the MSB registration form and required documents

MSB Legislation and Regulation in Canada

PCMLTFA

FMSBs and MSBs must comply with the full requirements under the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA).

PCMLTFA is Canada’s primary legislation designed to combat money laundering and terrorist financing. It establishes the legal framework for detecting, preventing, and deterring these illegal activities by imposing obligations on financial institutions, businesses, and individuals, including reporting suspicious transactions, keeping records, and implementing compliance programs.

FINTRAC

To conduct Money services business, the company must be registered with the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC).

FINTRAC is Canada’s financial intelligence unit (FIU). The Centre assists in the detection, prevention and deterrence of money laundering and the financing of terrorist activities. FINTRAC was established by, and operates within the ambit of PCMLTFA and its Regulations. The Centre is one of several domestic partners in Canada’s anti-money laundering and anti-terrorist financing (AML/ATF) regime, which is led by the Department of Finance.

RPAA

Canada’s financial landscape is set to undergo a major shift with the introduction of the Retail Payment Activities Act (RPAA), aimed at strengthening the security and dependability of the country’s payment ecosystem. It’s important to note that this new requirement does not replace the existing MSB registration. For most MSBs, the RPAA registration will be an additional obligation.

Bank of Canada

Under the new RPAA framework, all payment service providers (PSPs) — both domestic and foreign — will need to register with the Bank of Canada as a first step toward regulatory compliance. While FINTRAC remains responsible for overseeing anti-money laundering (AML) and counter-terrorist financing (CTF) measures through MSB registration, the Bank of Canada’s role under the RPAA will focus on ensuring that PSPs implement robust systems for operational risk management and incident response.

Register for our on-demand webinar “RPAA Regulations in Canada – Requirements and Registration”

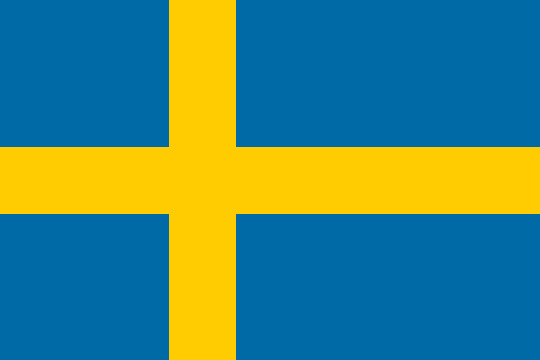

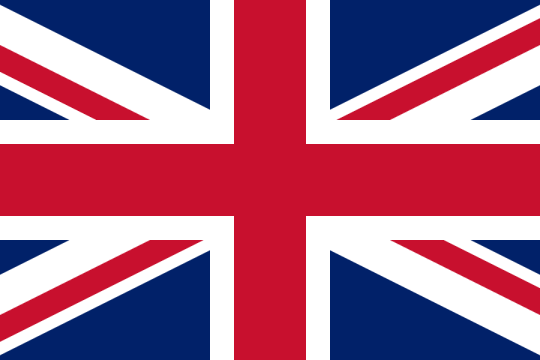

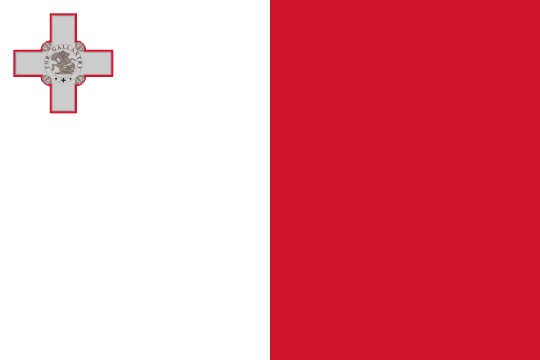

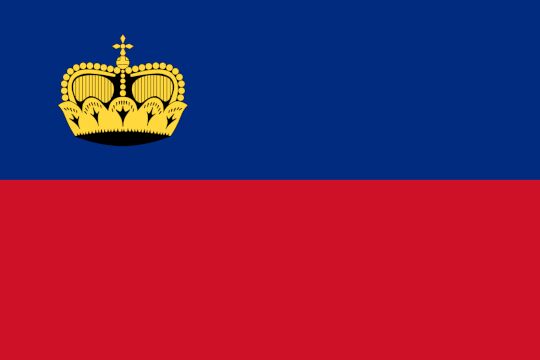

Jurisdictions

we cover

We have a strong focus on fintech businesses like digital banks, e-wallets, fiat-crypto wallets, e-commerce banking and remittance.

Jurisdictions

for crypto business

We support crypto businesses. We help you find the right jurisdiction to launch and scale your crypto venture with confidence.