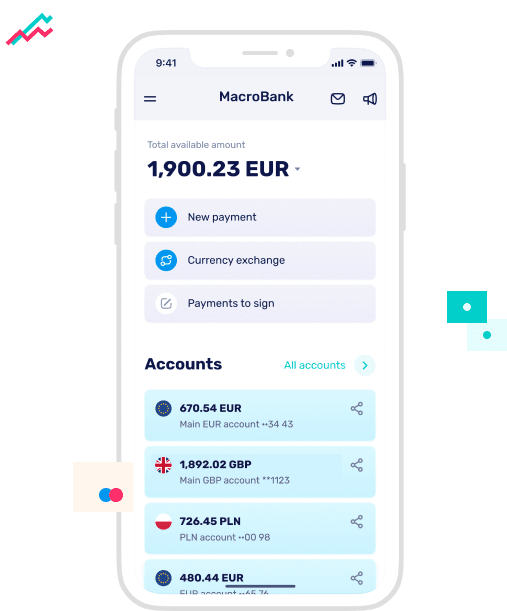

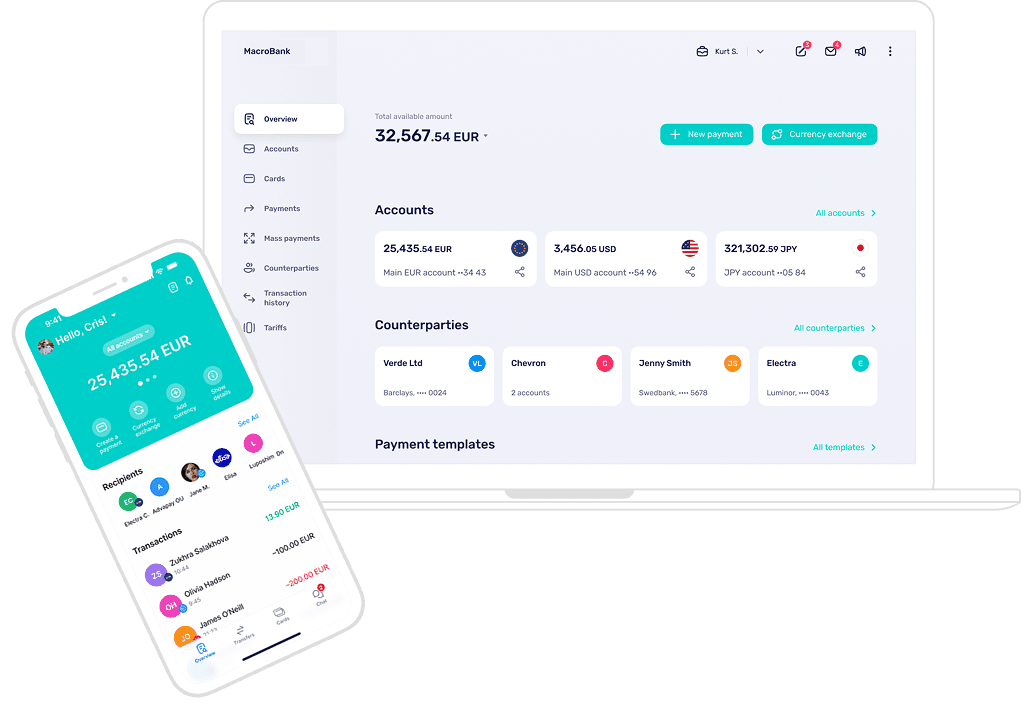

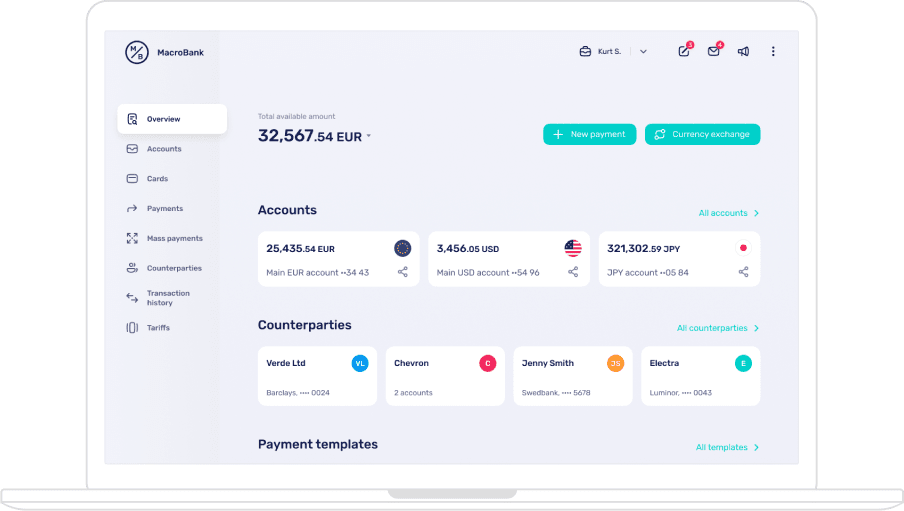

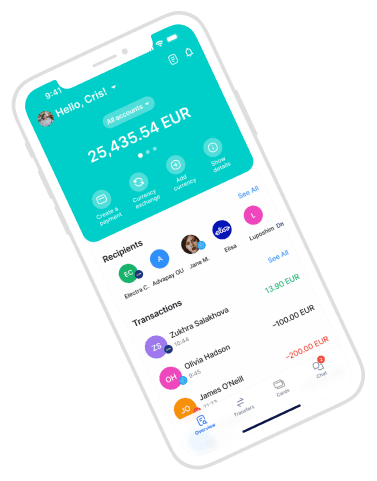

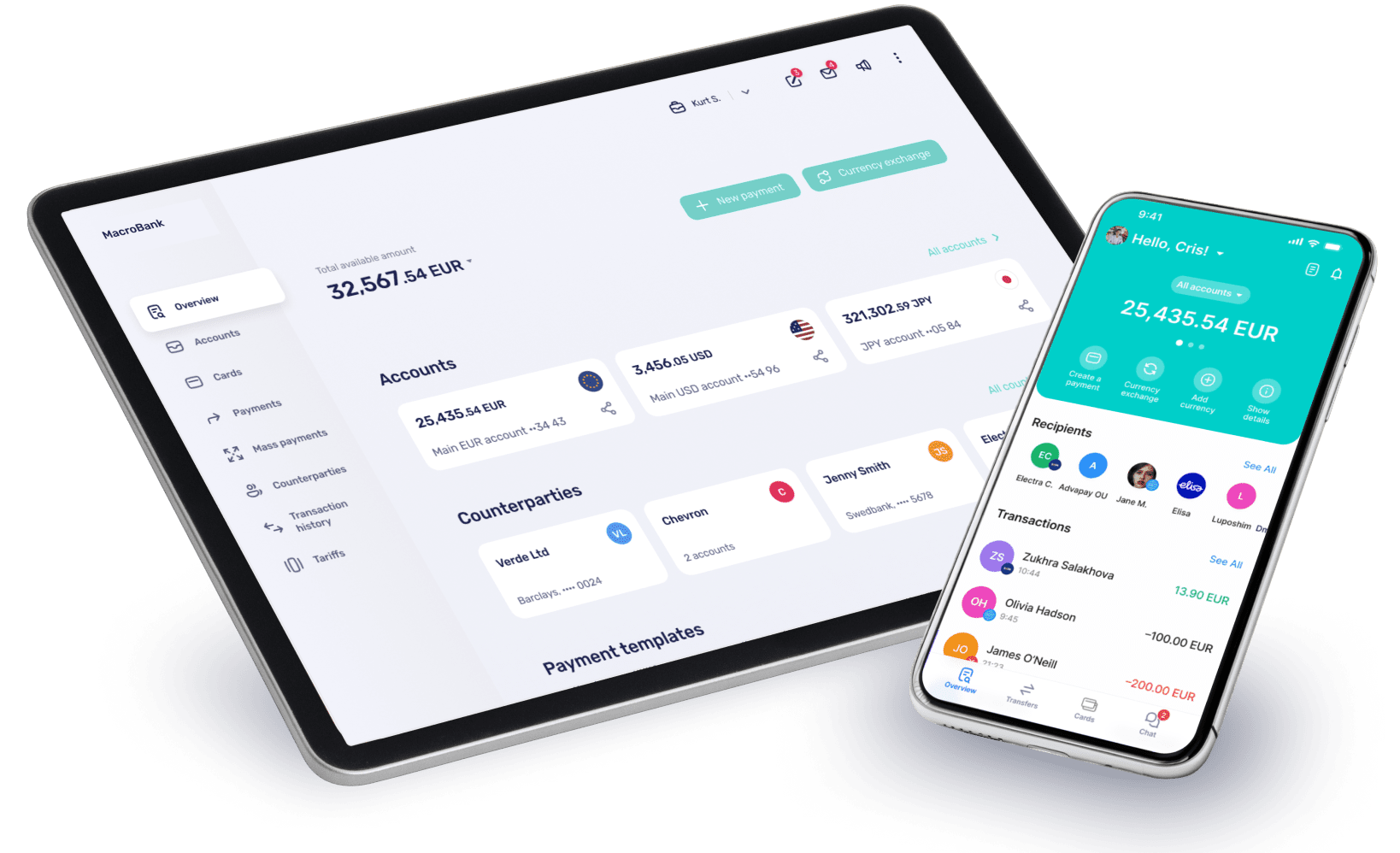

Macrobank Digital Core Banking Software incorporates all banking and payment functions in one single platform. Approved by many regulators, flexible and customizable, API-based, cloud-hosted or on-premise-installed, available in SaaS or perpetual license model, opportunity to purchase source codes.

Digital Core Banking functionality –

everything you need

Connected

to different third-party providers

Ready-to-deploy integrations with banks, card issuers, payment service providers, KYC/AML, FX, and others

Advapay`s Open API meets the PSD2 requirements and offers an access for AISPs and PISPs

Advapay`s Digital Core Banking provides customised connections to new service providers on demand

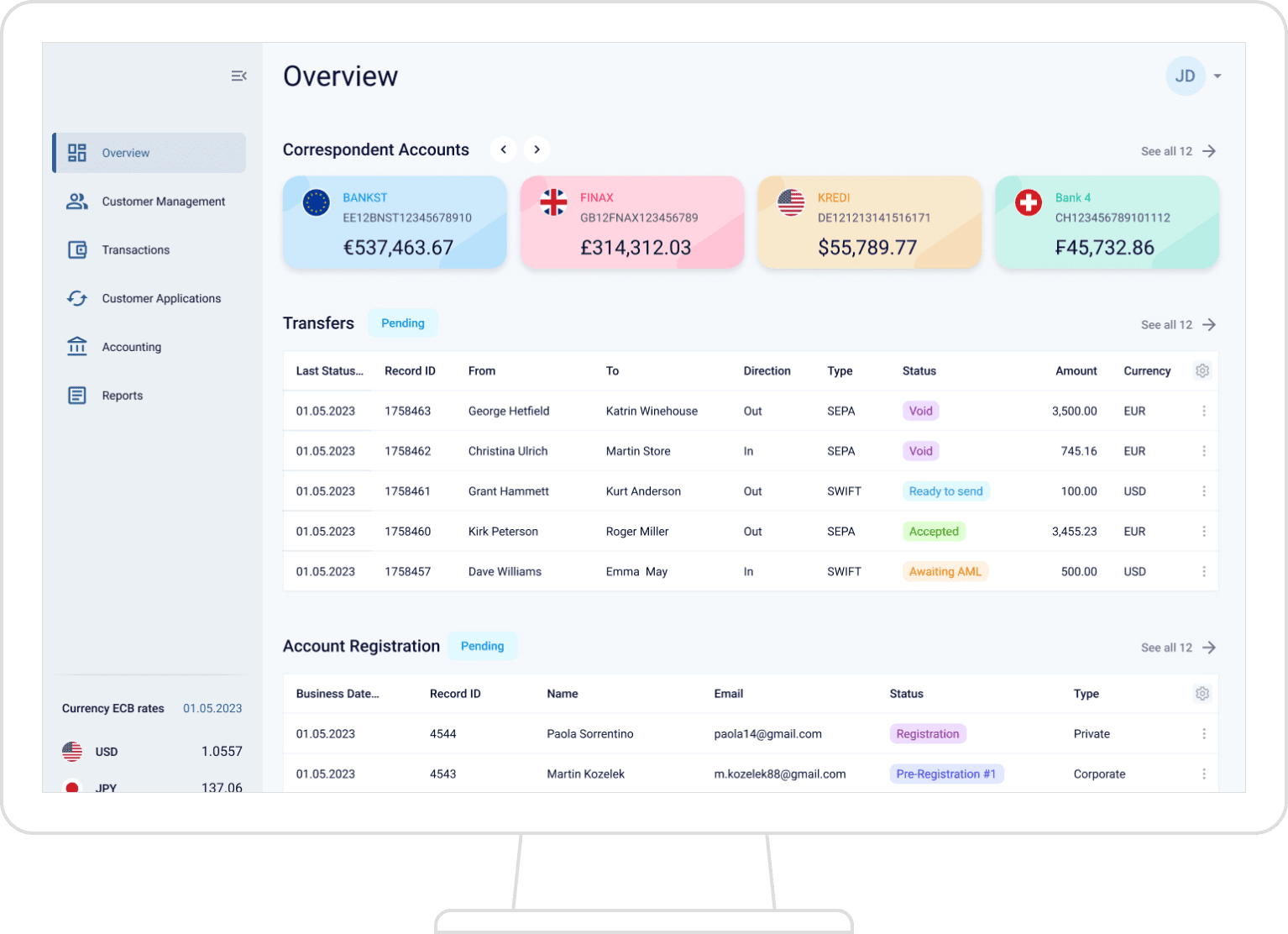

Multi-functional back office for PSP management

01

Interfaces for admins and operators

02

Built-in tools for business flow customisation

03

Customisable Reports

Comply with security standards

Seamless two-factor authentication

to comply with SCA under PSD2 directive

Role-based and different level access rights for multi-users

Encrypted connection between all components of the solution

Run your Digital Bank with Advapay.

Let’s speak