Want to start a digital bank, a neobank, or an e-wallet – read our article that provides a roadmap of all steps needed to implement your idea to the business.

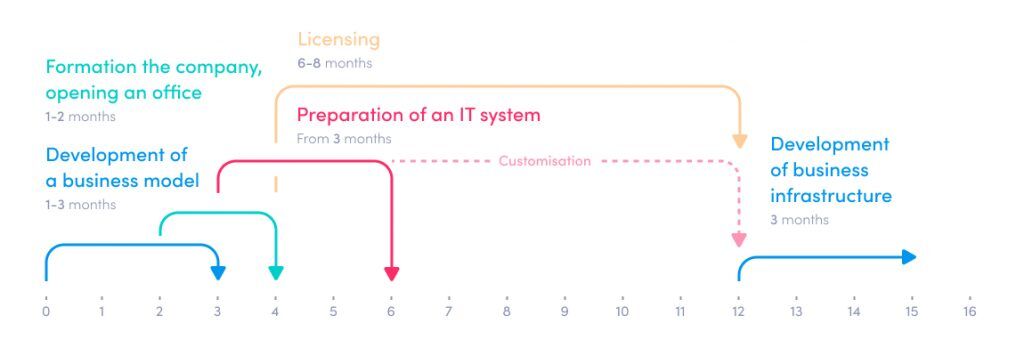

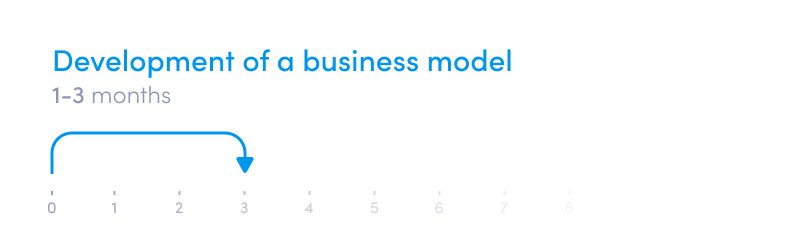

Development of a business model

For any fintech entrepreneur, who wants to start a digital bank, a neobank or fintech company, it is evident that a business plan should come first. It is a living document with specific tasks to be complete to make your new business venture a success both – long-term and short-term. Furthermore, the business plan plays an important role when liaising with investors and regulators.

At the end of the day, if you don’t have a clear vision of the strategic plan and how you will implement it, there is a chance that your business idea will fail. Besides, it all starts with a well-documented business plan when you are looking to raise funds for your business idea. The strategic business plan should be laid out so that it is easy to read and understand for investors, regulators and other essential stakeholders.

The business plan is also the first thing fintech regulators ask as they use it to evaluate your business, risks, and future perspective. The strategy must contain information about in which markets the company plans to operate, its target customers, and its solutions and UVP. In addition, financial forecasts must accompany the plan for three years.

Formation the company, opening an office

Depending on jurisdiction, you may need to register the company as a legal entity and open the office before you apply for a license. Some of regulators do not require to register the company, but only to reserve a company name (e.g., Spain).

From the point of a Fintech regulator, an office is a place, where the company’s general management can meet to take important decisions. The option of coworking office spaces is long gone and all regulators require a real office with local employees. You need to show your regulator that you are ready to start operating. This is why your office is proof that you are serious about your business.

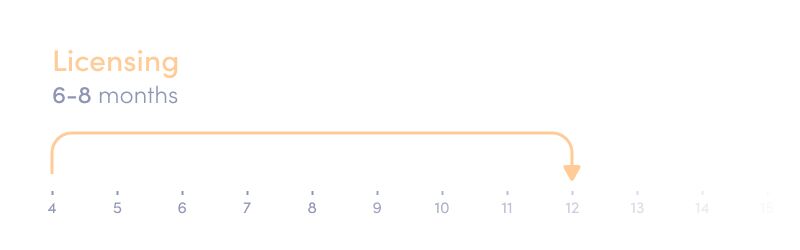

Get licensed and regulated

The next step to start your neobank, digital bank or fintech company is to obtain a license or become an EMD/PSD Agent of a licensed company.

One of the critical factors is to define how your business will be managed from the regulator’s side. Quite a few start-ups prefer to use a license shelter or so-called umbrella of other partner licenses – both e-money and payment. There are many different options available that require new players to operate and compete on their own.

Obtaining an e-money or payment license

E-money or Payment licenses are best suited for launching a digital bank or e-wallet. What are the steps of the license issuing process?

In general, depending on a regulator, the license issuing process maybe 5-12 months long, but the process may last for up to two years in some countries.

STEP 1 – Introduction to the Regulator

Some regulators, e.g., Lithuanian regulator – the Bank of Lithuania, Latvian Regulator – FKTK or Spanish Regulator – the Bank of Spain can invite candidates for a pre-application meeting and presentation to the regulator.

During this stage, the applicant answers the following questions to the regulator:

- What is the planned business model? What service do you plan to provide, and in what manner? Who will be the parties involved, and what functions, rights, responsibilities they will have?

- What will be the client base of the company?

- What is the structure of the company (group), the structure of the founders (to an individual)?

- Where does the capital come from, or what are the origins of the funds?

- Do you have any free resources (financial stability)?

- Depending on the business model and customer base – the AML topic will also be covered.

If the business meets the regulator’s requirements, then you will have to start preparing all documentation. For some countries, e.g., Lithuania, Latvia, you can have unlimited time to prepare documents. In the case of the Spanish regulator, you have only one month to submit all documents after receiving a positive response from the regulator.

Not all regulators have this step in the process, for example, the UK’s regulator, FCA, requires business to start the application with preparing all documents.

STEP 2 – Preparation and submission of all documents

During this step, the applicant fills all required forms and submits all documentation. This process requires consistent communication between the applicant and the consulting company like Advapay. The regulator usually comes with different questions regarding documents and can request additional information and documents.

STEP 3 – Formation of the team

This step begins as soon as you have a clear business model in mind and have chosen the jurisdiction. Depending on the regulator requirements, you may need to have from 2 to 8 people. Finding an experienced staff is quite a challenge and can take up to 2-4 months. And this is critical as you need to provide the information on the qualification and experience of your key personnel together with other documents. Additionally, the key personnel are obliged to go through the additional scanning procedure.

STEP 4 – Opening a business & safeguarding accounts

Opening a business and safeguarding accounts or receiving a letter certificate from the bank confirms opening a safeguarding account. The opening of a safeguarding account can take from 3 months – for this reason, we advise recruiting a consultant who can deal with this process – instead of doing it on your own.

STEP 5 – Pay the initial capital

Depending on the regulator you choose, you will need to pay an initial capital once your application is confirmed or after all documents are submitted. Some regulators may request you to pay the initial capital amount once you register your company before the application procedure.

STEP 6 – Authorisation and passporting (for EU countries)

After following through with all the steps, you will need to submit and get a confirmation from the regulator that it grants a license to provide the requested services. EU-based companies may apply for passporting to operate in specific countries.

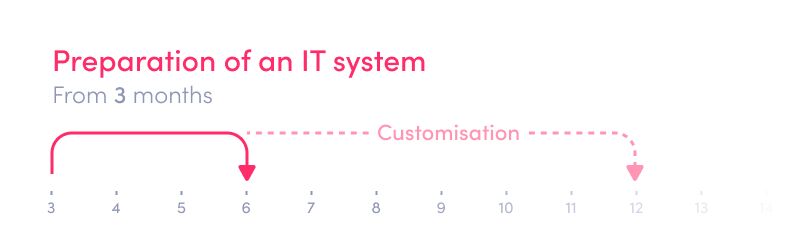

Prepare your IT system for operations

The next important step to start your digital bank is setting up your IT system. For most jurisdictions, once you have applied for a license, you need to have a clear vision of what platform will you use – the one developed on your own or purchased from a vendor. In your answers to the regulator, you will also need to provide information about your solution, providers, security, etc.

Many regulators require to have a ready operating system to the date of the license issuing. However, some regulators give a year for Go live. After that time, they require to perform an audit, and if the audit is completed, then an operational permit is issued.

Develop your business infrastructure

When the license is received, and your IT system is ready to start your business, the next step is developing your payment infrastructure and creating partnerships.

One of the essential tasks is developing relationships with banks – opening business and safeguarding accounts. Some regulators/countries require you to open a safeguarding account before you apply for a license. For some of them, you will need confirmation from a bank. So, you will need to make sure that the bank is ready to open this account as soon as the license is obtained. You will need to get or activate your account (if you have opened the safeguarding account during the licensing stage) or open new (if you do not have the account opened). But in any case, the additional safeguarding account will be pros for your business.

To start issuing IBANs to your customers, you need to obtain a BIC number through SWIFT to connect to SEPA. But there are different ways to issue your IBANs – you can read about this in our previous article.

As soon as you have developed relationships with bank/-s and can issue your IBANs, you can start your business.

To automate some processes, to enable different functionalities and features, you will need to partner with other service providers, e.g., currency exchange providers, card issuers, AML/KYC solution providers, etc. For example, Macrobank Core Banking offers ready-to-use integrations with service providers. So, you will not need to spend some time and money on new integrations – just sign agreements with service providers and start your payment/e-money business.

In this article, we presented 5 main steps how you can start a digital bank, a neobank or fintech company. Any questions in mind – do not hesitatate to contact our team.

About Advapay

Advapay is a technology company providing the Digital Core Banking platform to empower fintech clients or digital banks to start their businesses and accelerate digital transformation. The platform delivers all essential functionalities, a front-to-back system and a set of tools to customise and bring new integrations. With Advapay, potential and existing customers can connect either to the cloud-based SaaS or on-premise software. Besides the technical infrastructure, the company provides business advisory and fintech licensing services. Interested to learn more, please drop us a message