In the modern financial landscape, core banking systems serve as the backbone of daily operations for financial institutions. This article explores the definition, significance, and vital components of core banking systems. We will delve into the evolution of core banking, providing a historical context for its current state, and present key statistics and a market overview to illustrate its impact on the financial sector. Additionally, we will examine the different types of core banking systems, how they function, and the challenges and opportunities they present for banks and financial institutions.

- What is Core Banking?

- Statistics, Market Overview

- Key Components of Core Banking

- Evolution of core banking

- 1. Early Systems (Pre-1980s)

- 2. Client-Server Architecture (1980s-1990s)

- 3. Internet Banking and Integration (Late 1990s-2000s)

- 4. Modular and Component-Based Systems (2000s-2010s)

- 5. Cloud Computing and Digital Transformation (2010s-Present)

- 6. Artificial Intelligence and Automation (Present-Future)

- 7. Regulatory Compliance and Security

- Key components of Core Banking

- How does core banking work?

- Core banking systems types

- Core banking challenges

- Core Banking Opportunities

What is Core Banking?

Core banking is the central backend system that handles transactions, operations, and client management for financial institutions, including banks, digital banks, e-money institutions, and payment service providers, in real-time. It centralises various banking services and processes, providing a cohesive and integrated customer experience. Essentially, core banking is the backbone that enables banks and fintech companies to deliver seamless, efficient, and dependable services to their customers.

Statistics, Market Overview

The global core banking software market was valued at USD 14.54 billion in 2023. It is projected to grow from USD 17.00 billion in 2024 to USD 62.75 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 17.7% during the forecast period.

The market’s expansion can be attributed to the increased adoption of core banking technology by banks and financial institutions worldwide.

Key Components of Core Banking

Customer Onboarding

The Customer Onboarding module manages the registration and management of new clients and the setup of their accounts. It facilitates collecting and verifying customer information, ensuring compliance with regulatory requirements such as Know Your Customer (KYC) and Anti-Money Laundering (AML). Through automated workflows and seamless integration with external verification services, onboarding reduces manual effort, minimises errors, and accelerates account activation. Additionally, a smooth onboarding experience enhances customer satisfaction and sets the stage for a positive ongoing relationship with the financial institution.

AML/KYC

Anti-Money Laundering (AML) and Know Your Customer (KYC) are critical components of the onboarding process and transaction management, ensuring financial institutions comply with regulatory standards to prevent fraud and money laundering. These processes involve verifying customer identities, monitoring transactions, and assessing risks. Core banking systems can integrate AML/KYC services through APIs provided by compliance service providers such as Sumsub, iSpiral, Veriff, and others. This integration enables digital banks to streamline customer onboarding, enhance due diligence, and maintain up-to-date compliance without requiring extensive in-house resources. By leveraging these third-party services, financial entities can efficiently meet regulatory requirements and safeguard their operations.

Account management

Account management handles the creation, maintenance, and closure of customer accounts. It supports various account types, including current, savings, loans, and investments, ensuring accurate and real-time updates to account balances and transaction histories. This module also enables personalised services by maintaining detailed customer profiles and preferences. With robust security measures and compliance with regulatory standards, account management ensures the integrity and confidentiality of customer data.

Transaction processing

Transaction processing involves managing various transactions, including card and mobile payments, internal transfers, SEPA, SWIFT, CHAPS, BACS, FPS, and other local payment types, as well as withdrawals and utility bill payments. This functionality is enabled by connecting the core banking system to different payment-as-a-service or embedded finance providers, developing its own payment infrastructure, and obtaining the required registrations and memberships (e.g., SEPA, SWIFT). This ensures real-time processing, security, and compliance with regulations.

Currency exchange

Currency exchange allows customers to buy, sell, and convert currencies competitively. The core banking system should be integrated with FX and liquidity providers (e.g., Currency Cloud) to access real-time exchange rates and ensure efficient transaction execution. These integrations enhance the financial institution’s ability to manage currency risk, provide better pricing, and improve overall service quality.

Card issuing

The card issuing module manages the entire lifecycle of a card, from issuance and activation to expiration and renewal, ensuring seamless and secure card operations. To offer this service, a financial services entity must acquire a Principal membership from a specific card scheme (e.g., Mastercard, Visa), granting the authority to issue cards directly. Alternatively, they can act as an agent for an official card issuer or an IBAN sponsor (e.g., Decta, Wallester). In this arrangement, the core banking system integrates with the card issuer to provide card issuance.

Financial accounting and general ledger

Financial accounting provides accurate, real-time tracking of financial transactions and balances. This module ensures the seamless integration of all banking activities, from customer transactions to internal operations, into the general ledger. It supports regulatory compliance by generating detailed financial statements and reports required by regulatory authorities. Additionally, financial accounting enhances decision-making by offering insights into the financial institution’s financial health and performance through comprehensive data analysis and reporting.

Reporting

Reporting provides comprehensive insights into financial activities and operational performance. This module generates detailed reports on transactions, account balances, and other key metrics, aiding decision-making and strategic planning. It also ensures regulatory compliance by producing accurate and timely financial statements and regulatory filings. Additionally, reporting capabilities help identify trends, detect anomalies, and support audits, enhancing the overall transparency and accountability of the bank’s or fintech company’s operations.

Integration hub

An integration hub in core banking is a centralised platform that connects various service providers, including payment and regulatory compliance services. This hub facilitates seamless integration of third-party services through APIs, allowing financial entities to enhance their product offerings and customer experiences. It enables real-time data exchange, supports agile development of new features, and promotes innovation by leveraging external expertise and technologies. By consolidating connections to multiple providers in one place, the integration hub streamlines operations, reduces complexity and accelerates the time-to-market for new banking services and functionalities.

Evolution of core banking

Significant technological advancements, regulatory changes, and shifts in customer expectations have shaped the evolution of core banking. Here is a timeline highlighting key stages in the development of core banking systems:

1. Early Systems (Pre-1980s)

Before the 1980s, core banking systems primarily operated on large mainframe computers, designed to manage essential functions such as account management, transaction processing, and ledger updates. These early systems relied heavily on batch processing, collecting and processing transactions in bulk during overnight cycles. This approach led to delays in updating account balances and limited real-time capabilities, with customers waiting until the following day for their transactions to be reflected in their accounts. Despite these limitations, mainframe systems established a foundational framework for more advanced banking technologies, providing a reliable, if slow, basis for financial data management and processing.

2. Client-Server Architecture (1980s-1990s)

The 1980s and 1990s introduced client-server architecture to core banking systems. This marked a significant shift from centralised mainframe models to distributed computing. This new architecture enhanced system performance and scalability by delegating tasks between servers and client machines, enabling banks to handle larger volumes of transactions more efficiently. The introduction of Graphical User Interfaces (GUIs) replaced the older command-line interfaces, greatly improving usability for bank staff. This transition streamlined internal operations and enhanced customer service, as bank employees could more easily access and manage account information, process transactions, and assist customers using intuitive graphical interfaces. The client-server model thus laid the groundwork for more responsive and user-friendly banking systems.

3. Internet Banking and Integration (Late 1990s-2000s)

In the late 1990s and 2000s, Internet banking revolutionised the industry by enabling customers to access their accounts, perform transactions, and manage their finances online. This era marked a significant shift towards digital banking, providing unprecedented convenience and flexibility. Concurrently, core banking systems began integrating multiple channels, including branches, ATMs, and online platforms, to deliver a seamless and cohesive customer experience. This integration improved operational efficiency by ensuring consistent, real-time data across all touchpoints, allowing customers to switch between banking methods effortlessly. The unified approach enhanced customer satisfaction and streamlined bank operations, laying the foundation for the modern omnichannel banking experience we know today.

4. Modular and Component-Based Systems (2000s-2010s)

In the 2000s, core banking systems evolved towards modular and component-based architectures, shifting to more flexible and adaptable solutions. Modular architecture allowed banks and financial institutions to customise their systems by adding or removing modules based on specific business needs, such as account management, loan processing, or customer relationship management. This approach facilitated easier upgrades and enhancements and enabled banks to scale their operations more efficiently.

Service-oriented architecture (SOA) further revolutionised core banking systems by introducing interoperability and seamless integration with third-party applications and services. Through standardised interfaces and protocols, SOA enabled banks to leverage external functionalities such as payment gateways, credit scoring services, and fraud detection systems. This capability fostered innovation and collaboration across the financial sector, allowing banks to easily integrate with fintech startups and other partners to deliver new services and enhance customer experiences. The adoption of modular and SOA-based systems during the 2000s to 2010s laid the foundation for a more agile and interconnected banking ecosystem, driving continuous innovation and operational efficiency in the industry.

5. Cloud Computing and Digital Transformation (2010s-Present)

Since the 2010s, cloud computing has revolutionised core banking systems, with banks increasingly migrating to cloud-based solutions. Cloud computing offers scalability, flexibility, and cost-efficiency, enabling banks to adjust their computing resources based on demand dynamically. This shift has allowed financial institutions to streamline operations, reduce infrastructure costs, and enhance their agility in deploying new services and updates across their networks. Moreover, cloud-based core banking systems improve data security through advanced encryption and centralised management of security protocols, ensuring robust protection of sensitive customer information.

Simultaneously, the banking industry has undergone a profound digital transformation driven by a shift towards digital-first strategies. Financial entities have prioritised enhancing customer experiences by adopting mobile banking apps, AI-driven analytics, and personalised services. Mobile banking apps have become crucial in providing customers with convenient access to banking services, including account management, payments, and financial planning tools, accessible anytime and anywhere. AI-driven analytics enable financial institutions to analyse vast amounts of customer data to deliver personalised product recommendations and predictive insights, thereby improving customer engagement and satisfaction.

Additionally, regulatory initiatives such as the Payment Services Directive 2 (PSD2) in Europe have catalysed the rise of open banking. These regulations require banks to open their APIs to third-party providers, fostering secure data sharing and collaboration within the fintech ecosystem. Open banking initiatives allow banks to leverage innovative solutions developed by fintechs, enhancing service offerings and driving competitive differentiation. Overall, the convergence of cloud computing, digital transformation, and open banking has reshaped core banking systems, empowering banks to deliver more agile, secure, and personalised banking experiences to their customers.

6. Artificial Intelligence and Automation (Present-Future)

The evolution of core banking systems is increasingly shaped by the integration of Artificial Intelligence (AI) and automation technologies, marking a pivotal shift from the present to the future. AI and machine learning are revolutionising banking operations by automating customer service processes, enhancing fraud detection capabilities, providing personalised product recommendations, and enabling predictive analytics for better decision-making. These technologies analyse vast amounts of real-time data to anticipate customer needs and preferences, thereby improving overall customer satisfaction and operational efficiency.

Furthermore, there is a growing emphasis on real-time processing capabilities within core banking systems. Financial institutions are moving towards instant payments and 24/7 banking services to meet the evolving expectations of customers who demand immediacy and convenience in their financial transactions. Real-time processing enhances the customer experience by reducing transaction times. It supports faster decision-making and responsiveness to market changes. This shift towards real-time capabilities is driven by advancements in technology and infrastructure, allowing banks to provide seamless, on-demand services that align with the digital lifestyles of today’s consumers.

As AI continues to evolve and real-time processing becomes more prevalent, the future of core banking systems promises increased efficiency, innovation, and customer-centricity within the financial services industry.

7. Regulatory Compliance and Security

Regulatory compliance and enhanced security measures have significantly influenced the evolution of core banking systems. Financial institutions have continuously strengthened their cybersecurity frameworks, encryption standards, and data protection protocols to mitigate cyber threats and safeguard sensitive customer information. This commitment to security is essential for maintaining trust and meeting stringent regulatory standards, such as the GDPR (General Data Protection Regulation) in Europe and global Anti-Money Laundering/Know Your Customer (AML/KYC) regulations.

In addition to existing frameworks like PSD2, forthcoming regulations such as PSD3 and amendments to the Payment Services Regulations (PSR) are driving further evolution in core banking systems. These regulations emphasise enhanced security measures and open banking standards, requiring financial institutions to innovate in data protection and API management to facilitate secure and compliant financial transactions across Europe.

Furthermore, core banking systems have evolved to integrate automated reporting and audit capabilities to ensure ongoing compliance with changing regulatory requirements. These systems enable real-time monitoring and reporting of transactions, allowing banks to detect and address compliance risks promptly. The automation of regulatory processes not only enhances operational efficiency but also reduces the likelihood of human error, ensuring accuracy and consistency in regulatory reporting.

Key components of Core Banking

Centralised Database:

All customer data, account information, and transaction records are stored in a centralised database. This database includes details about current accounts, balances, transactions, identity documents, tariff groups, and other critical information. As a core component of the company, the centralised database must be protected internally and externally to meet legal and security requirements.

Core banking engine

The core banking engine is a central system that delivers comprehensive banking and payment services. Built on an open API architecture, it is designed for easy configuration to meet unique needs and integrate seamlessly with various payment services and other providers. This system comprises multiple modules that offer essential functions such as customer onboarding, account management, payments, currency exchange, card issuance, financial accounting, tariffs, and fees. Depending on the provider, these modules can be utilised independently or as part of a unified system.

API and integration hub

An integration hub is a critical middleware component in a fully integrated core banking solution, facilitating the configuration and customisation of a wide array of customer banking services. By adopting an API-first approach, the integration hub ensures seamless interaction between various products. It offers a rapid, secure method for partners to connect to the core banking platform. It typically comes with a range of ready-to-use integrations with payment and service providers, such as banks, different payment types, currency exchange and liquidity providers, card issuers, AML/KYC and fraud verification platforms, and SWIFT. This enables efficient and comprehensive connectivity across systems, services, APIs, apps, partners, and industry sectors. Look at our Partners Marketplace.

White-label web and mobile banking applications

White-label web and mobile banking apps are vital components of a core banking platform, offering financial institutions a customisable and branded interface for their customers. These apps enable financial institutions to provide a seamless, user-friendly experience across web and mobile devices without needing to develop their own software from scratch. They come with a wide range of features, including account management, payments, fund transfers, card services, and customer support. Integration with the core banking engine ensures real-time data synchronisation and consistent functionality. Additionally, these apps can be tailored to reflect each financial institution’s unique branding, design, and specific service requirements, thereby enhancing customer engagement and loyalty. Discover our white-label web banking application in the video below.

Security and compliance systems and services

Security and compliance are integral to core banking systems, protecting sensitive customer data and adhering to regulatory standards. Financial institutions prioritise robust cybersecurity measures, including advanced encryption protocols and continuous monitoring, to safeguard against cyber threats and data breaches. Compliance efforts encompass adherence to GDPR, AML/KYC requirements, and industry-specific standards. Core banking systems incorporate automated compliance tools for real-time monitoring, reporting, and auditing, facilitating efficient regulatory adherence and mitigating compliance risks. Financial entities strengthen trust with customers and regulatory authorities while maintaining operational resilience in the dynamic financial landscape by integrating comprehensive security frameworks and regulatory compliance measures.

How does core banking work?

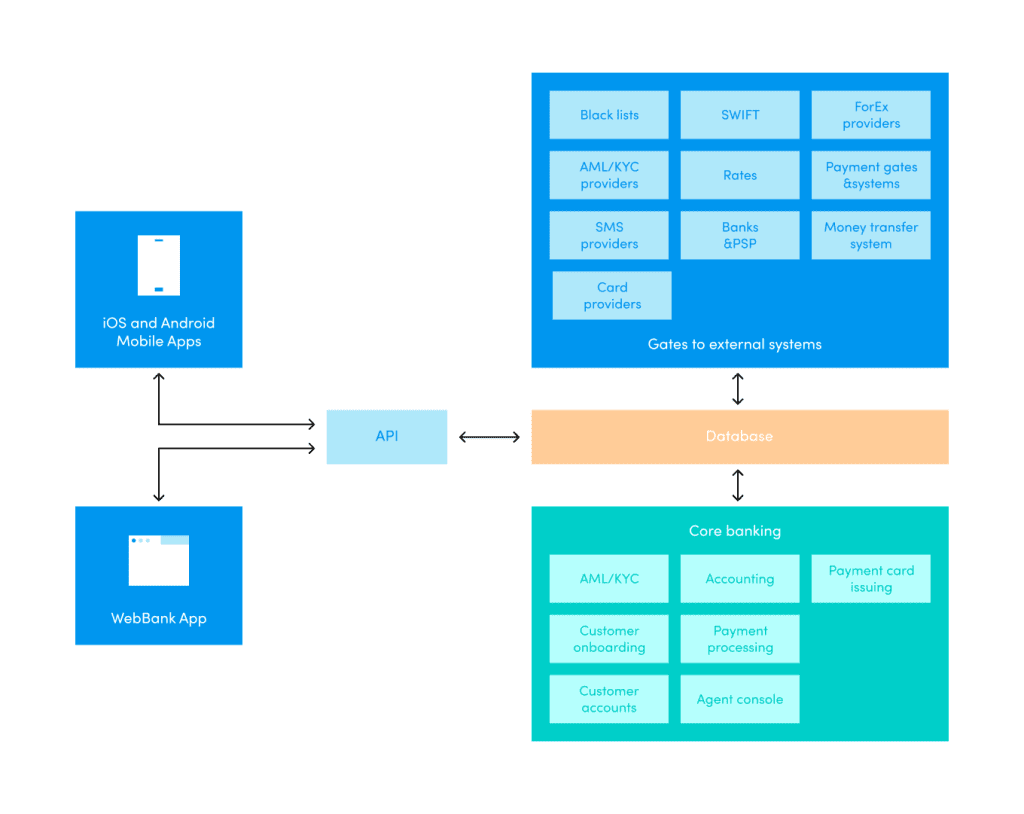

Core banking centralises essential functions and operations through an integrated core banking software system. This allows financial institutions to manage customers and accounts, process transactions, and deliver services efficiently.

Core banking systems use a centralised database and modular architecture to manage and process banking transactions and services. Technically, they are built on an API framework that allows for seamless integration with various external services and applications. The system’s central database ensures that all customer data, account information, and transaction records are stored and managed in real-time, providing up-to-date information across all banking channels. Each functional module, such as payments, cards, or customer onboarding, interacts with the core database through standardised APIs, ensuring consistent data flow and operations.

Using an integration hub further facilitates communication between the core system and external service providers, enabling features like different types of payments, currency exchange, fraud detection, and regulatory compliance. This architecture supports scalability and flexibility and enhances security and performance, ensuring reliable and efficient banking operations.

Core banking systems types

Core banking systems can be categorised based on various criteria, such as architecture, deployment method, and technology. Here are the primary types:

1. Core banking systems types based on Technology and Architecture

Legacy Core Banking Systems

Legacy core banking systems, typically built on mainframe computers and traditional databases, form the backbone of many longstanding financial institutions. These older systems are often characterised by their rigidity, offering limited flexibility and scalability to adapt to the rapidly changing banking environment. Maintaining these systems incurs high costs due to their complexity and the dwindling availability of skilled professionals familiar with such technology. Moreover, integrating legacy systems with modern technologies poses significant challenges, hindering efforts to innovate and deploy new services. Their limited support for digital banking solutions further constrains banks’ ability to meet contemporary customer expectations for seamless, real-time, and mobile-first banking experiences. As a result, many institutions are compelled to modernise their core banking infrastructure to remain competitive and agile in the digital age. These systems can be built internally or purchased from a core banking software vendor.

Modern core banking systems

Modern core banking systems are designed using cutting-edge architectures. These contemporary systems are characterised by their flexibility, scalability, and ease of integration with other systems and providers. They offer significant benefits, including an improved user experience through intuitive interfaces and personalised services. Additionally, modern systems provide robust support for digital and mobile banking, enabling financial institutions to meet the growing demand for seamless, on-the-go financial services. By adopting modern core banking systems, financial institutions can better adapt to market changes, innovate rapidly, and deliver superior customer service.

2. Core Banking systems Based on Deployment Method

On-Premise Core Banking Systems

On-premise core banking systems are installed and operated on the bank’s or financial institution’s own servers and infrastructure. These systems offer greater control over data and security, as the financial institution retains full ownership and oversight of its IT environment. However, they come with significant challenges, including high upfront hardware and software costs and ongoing maintenance expenses. Additionally, on-premise systems require substantial in-house IT expertise to manage and troubleshoot, which can strain internal resources. Despite these challenges, some financial institutions prefer on-premise solutions for the enhanced security and control they provide over sensitive financial data.

Cloud-based core banking systems

Cloud-based core banking systems are hosted on the cloud and accessed via the Internet. These systems are characterised by their cost-effectiveness, scalability, and minimal need for in-house IT infrastructure. They offer numerous benefits, including rapid deployment, allowing banks to quickly implement new features and services. Automatic updates ensure the system remains current with the latest technology and security enhancements, reducing the burden on internal IT staff. Additionally, cloud-based systems provide high availability, ensuring continuous access and reliability for the bank and its customers. This modern approach enables financial institutions to remain agile and responsive in a competitive market.

3. Core banking system based on Development

In-house developed core banking systems

Internally developed core banking systems are custom-built by a bank’s in-house IT team to meet the specific needs and requirements of the institution. These systems offer the advantage of being highly tailored to the bank’s unique processes and workflows, providing a bespoke solution that aligns perfectly with the bank’s strategic goals. However, developing a core banking system internally requires significant resources, including a highly skilled team of developers, substantial financial investment, and considerable time for development and testing. Maintenance and updates also fall solely on the internal team, which can be resource-intensive and may divert focus from other critical IT projects. Despite these challenges, internally developed systems can offer unparalleled flexibility and control, allowing banks to innovate and adapt quickly to market changes.

Ready-made core banking systems

Conversely, core banking systems purchased or rented from core banking software vendors are ready-made solutions designed to meet the needs of a wide range of financial institutions. These systems (e.g., Macrobank by Advapay) are typically built using best practices and standardised processes, ensuring robust functionality and reliability. Purchasing a core banking system from a vendor can significantly reduce implementation time and costs compared to building one internally. Vendors often provide comprehensive support and regular updates, ensuring the system remains up-to-date with the latest technological advancements and regulatory requirements. Vendor-provided systems offer a viable and efficient alternative for banks looking to modernise their core operations without the burden of developing and maintaining a system in-house. For a more detailed comparison, you can read our latest article on the pros and cons of ready-made versus in-house developed core banking systems.

Core banking challenges

As technology advances and the regulatory landscape evolves, banks and financial institutions face significant challenges in maintaining robust and efficient core banking systems. Below are the primary obstacles financial institutions encounter in building and managing their core banking infrastructure, along with the critical areas that need addressing to ensure operational excellence and customer satisfaction:

Building a Reliable IT Infrastructure

A reliable IT infrastructure forms the foundation of any successful core banking system. Financial institutions must ensure their systems can handle high transaction volumes, provide seamless service, and prevent downtimes. Achieving this requires a combination of cutting-edge hardware (for on-premise systems), efficient software solutions, and a robust network architecture. Redundancy, failover mechanisms, and regular system updates are essential to maintaining high availability and reliability. Moreover, leveraging cloud technologies can enhance scalability and flexibility, enabling banks and fintechs to adjust resources according to demand.

Compliance with Regulatory Requirements

Regulatory compliance is a non-negotiable aspect of banking and financial operations. Institutions must adhere to various local and international regulations, which are frequently updated. Developing solutions that comply with these regulations and facilitate easy adaptation to new requirements is critical. This includes implementing systems that can generate accurate, timely reports for regulatory bodies. Automated compliance management tools can help financial institutions stay ahead of regulatory changes, reducing the risk of non-compliance and the associated penalties.

Flexibility and Scalability

In a rapidly evolving financial landscape, financial institutions require core banking systems that offer flexibility and scalability. This includes the ability to integrate with new providers and third-party services seamlessly. An open architecture that supports APIs (Application Programming Interfaces) is crucial for achieving this integration. Moreover, scalable systems must handle increased workloads during peak times, ensuring customer service remains unaffected by high transaction volumes.

Reliable Financial Accounting

Accurate financial accounting is fundamental to the integrity of financial operations. Financial entities must manage all operations efficiently and generate precise financial reports. This necessitates integrating a financial module within the core banking system or purchasing a ready-made system with built-in, reliable financial accounting features, such as Macrobank. Key functionalities should include a general ledger, accounts payable and receivable, and NOSTRO/VOSTRO accounts. Automated reconciliation processes and real-time financial reporting capabilities are crucial for ensuring financial accuracy and transparency.

Process Automation and Real-Time Transactions

Automation is essential for enhancing operational efficiency and minimising manual errors. Banks and financial institutions must automate routine processes, from transaction processing to customer service workflows. Real-time transaction capabilities are critical in today’s fast-paced financial environment, enabling customers to transfer funds, make payments, and check balances instantly. Advanced technologies such as robotic process automation (RPA) and artificial intelligence (AI) further streamline operations and improve service delivery.

System Security

As cyber threats become increasingly sophisticated, ensuring the security of core banking systems is crucial. Financial institutions must implement comprehensive security measures, including encryption, multi-factor authentication, and intrusion detection systems. Regular security audits, vulnerability assessments, and employee training are vital for maintaining a robust security posture. Data protection and privacy measures must also adhere to stringent regulatory standards to safeguard customer information.

Business Continuity Support

Uninterrupted service is essential for maintaining customer trust and ensuring regulatory compliance. Effective business continuity planning involves developing strategies to sustain operations during and after a disaster. This includes creating disaster recovery plans, implementing backup systems, and regularly testing these plans to verify their effectiveness. Cloud-based solutions and geographically distributed data centres enhance resilience and ensure continuous service availability.

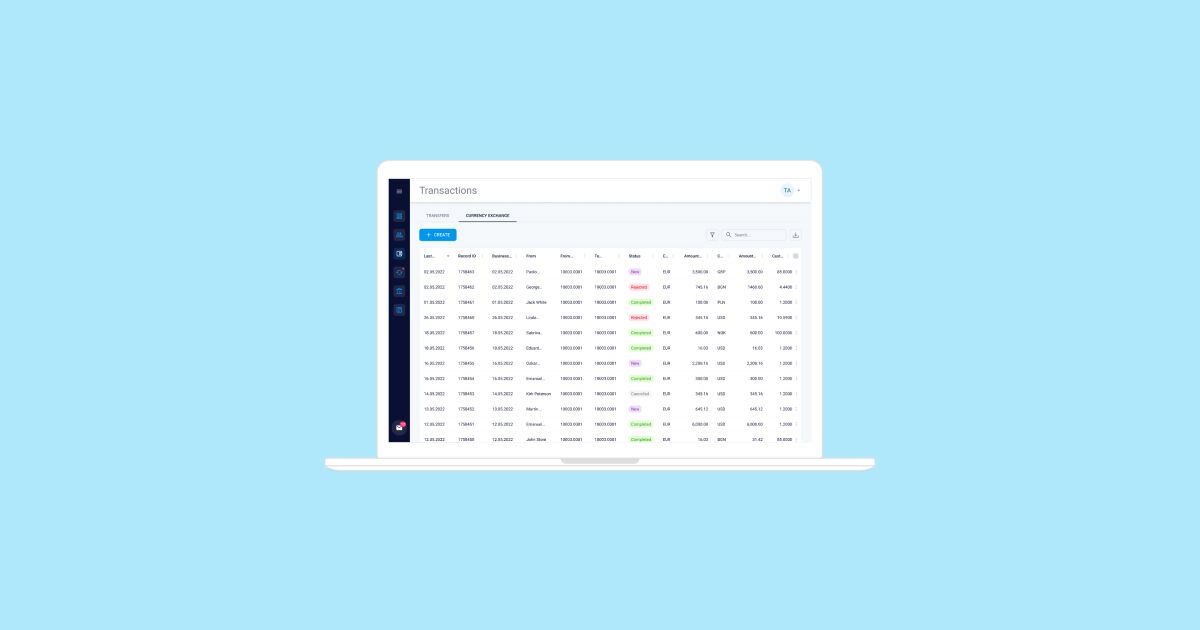

User-Intuitive Operator Interfaces

The usability of a core banking system’s operator interfaces significantly impacts the efficiency of banking operations. Intuitive and user-friendly interfaces reduce employees’ learning curves, boost productivity, and minimise errors. Investing in modern UI/UX design principles ensures the system is easy to navigate and manage, leading to smoother daily operations and higher employee satisfaction. For an example of a well-designed core banking operator interface, see Advapay’s Core Banking Operator Interface.

Core banking system replacement or migration

Replacing or migrating a core banking system is a complex and challenging undertaking fraught with potential risks. This process involves transitioning from an existing system—often a legacy or basic platform—to a more advanced, efficient solution. Successful migration requires meticulous planning and execution to prevent data loss, minimise system downtime, and avoid operational disruptions. The process encompasses comprehensive data migration, system integration, extensive testing, and thorough user training. Given the high risk of business interruption, implementing robust risk management and business continuity strategies is crucial.

Core Banking Opportunities

Core banking systems are at the heart of financial institutions. They are evolving to meet the demands of a rapidly changing financial sector. Driven by technological advancements and shifting customer expectations, these changes present numerous opportunities for banks and financial institutions to innovate and expand. By embracing these advancements, institutions can enhance their service offerings, improve operational efficiency, and stay competitive in an increasingly dynamic market.

Adding New Services and Products

Introducing new services and products is a significant opportunity in core banking. Today’s customers expect a comprehensive suite of financial services, ranging from basic banking operations to advanced investment and wealth management solutions. Expanding service offerings enhances customer satisfaction and helps banks remain competitive in a crowded marketplace. By continuously innovating and diversifying their product portfolios, banks can attract new customers and retain existing ones, ensuring sustained growth and relevance.

Covering New Regions and Adapting to New Territories

Expanding into new geographic regions offers substantial growth opportunities. Modern core banking systems can be adapted to meet different territories’ regulatory and operational requirements, enabling financial institutions to enter new markets effectively. Key strategies for regional expansion include customising banking services to align with local regulations, languages, and cultural preferences, compliance with local financial regulations and reporting requirements, and partnerships with local institutions.

Implementing AI to Make the System “Smart”

Artificial Intelligence (AI) revolutionises core banking by making systems more intelligent and responsive. AI-driven core banking systems can process vast amounts of data quickly and accurately, thereby improving operational efficiency and decision-making. This enhancement improves the customer experience and helps banks reduce costs and mitigate risks.

Collaborating with Partners to Deliver Diverse Offerings

Collaborations with various partners enable financial entities to expand their service portfolios, enter new markets, enhance customer loyalty, and generate additional revenue streams. By working with fintech companies or non-financial organisations, financial institutions and banks can offer a broader range of services, including insurance, health services, travel and lifestyle offerings, and e-commerce products.

Advapay at stake:

How can Advapay can assist you in launching your fintech business?

• Assistance in EMI/PI licencing in the EEA/UK

• Registration of MSB company in Canada

• Delivery of a comprehensive Core banking system encompassing back-office and white-label applications for end-users

• Assistance in payment infrastructure development

• BaaS-solutions in collaboration with our partners – EEA/UK licenced EMIs and PIs