During this on-demand webinar, Advapay, Linares Abogados, and Phantom Compliance will discuss two way how to start payment business fast:

- Launching a Canadian MSB (Money Services Business) and developing payment infrastructure

- The concept of an SPI (Small Payment Institution) in Spain and how it differs from other SPIs in the EEA

One of the main factors influencing time-to-market for fintech companies is obtaining legal rights to provide payment services, which is usually associated with getting a PI or EMI licence in the EU or UK.

Obtaining such a licence in Europe extends the time-to-market for a payment business from one and a half to two years, considering the preparation time before submission and payment infrastructure deployment after authorisation.

Are there other options to start your fintech business faster? Yes! In this webinar, we cover two options for fast-track financial market entry.

Registration

Register and book your space now:

Programme of the on-demand webinar “Two ways to start your payment business fast”

Welcome speech

Presentation 1: Accessing the EEA payment market through Spain’s small Payment Institution, Linares Abogados

- Why Spain’s SPI is a fast way to start operating

- Next steps: API or EMI? Which one to choose

- How to manage crypto-related activities

- The new EBA guidelines and their impact on licensing processes

Speaker: Miguel Linares, founding partner of Linares Abogados

About Linares Abogados:

Linares Abogados is a boutique law firm, specialised in advising financial institutions, fintechs and crypto trading companies.

About Miguel Linares:

Founding partner of Linares Abogados, Miguel has advised financial entities for more than 25 years. Now concentrated in fintechs and crypto companies. Partner driven service guarantees efficiency.

Presentation 2: Canadian MSB – an affordable alternative to the European EMI licence, Advapay

- Advantages and disadvantages compared to the European EMI licence

- The process of obtaining MSB registration

- Development of payment infrastructure

Speaker: Ihor Kreshchenko, Canadian representative, Advapay

About Ihor Kreshchenko:

Ihor specialises in setting up MSB companies and cryptocurrency exchanges from scratch and developing payment and banking infrastructure. His hands-on experience with financial sector players in Canada makes him an expert in compliance field with great understanding of regulatory landscape in the country.

Presentation 3: Money Services Business (MSB) regulations impacting payment and financial services in Canada, Phantom Compliance

- Regulatory requirements: summary of the PCMLTFR and the RPAA

- Physical presence

- Crypto operations under MSB

Speaker: Ryan Mueller, CEO of Phantom Compliance

About Phantom Compliance:

Phantom Compliance offers you unmatched expertise to claim unparalleled rewards. As regulations evolve and transactions stack up, Phantom Compliance keep their sights on compliance so you can keep your eyes on the prize.

About Ryan Mueller:

Payments, compliance and risk expert with 18 years in enterprise level payment processing, risk management, compliance, crypto currency, relationship management and sales.

Closing remarks

Registration

Register and book your space now:

About Advapay:

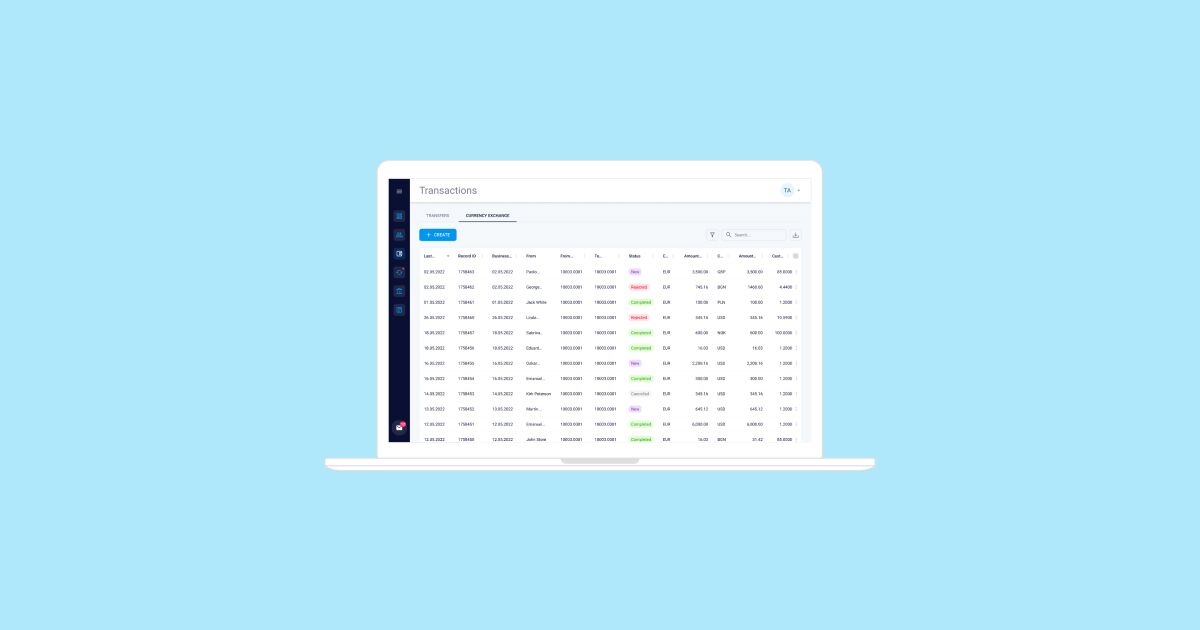

Advapay is a technology company providing the Digital Core Banking platform to empower fintech clients or digital banks to start their businesses and accelerate digital transformation. The platform delivers all essential functionalities, a front-to-back system and a set of tools to customise and bring new integrations. With Advapay, potential and existing customers can connect either to the cloud-based SaaS or on-premise software. Besides the technical infrastructure, the company provides business advisory and fintech licensing services. Interested to learn more, please drop us a message