Fintech platforms aren’t stand-alone services, but require partners, which help fintechs to start and operate. The process of establishing such partnerships seems very simple, but without a reliable consultancy and software partner, it will be a huge challenge. We can guide and help you in every step of building your strategic partnerships with the industry.

First, let’s list all partners that fintech companies need to form to start operating. There are 3 types of fintech partners:

1) Legal and business consultants

- Consulting services – guidance on licensing and starting a business

What are the pros and cons of each regulator, which jurisdiction to choose, what are requirements for the license application process and other questions that you can address to fintech consultants.

- Documents preparation for licensing – legal (e.g., application filling and submission, operational policies), business (e.g., business plan) and technical part (e.g., IT infrastructure scheme, different policies)

When considering fintech partners for the document preparation stage, we suggest looking for experienced legal and business consultants, who are experts in the field of financial technologies and they have done this before. But be aware, if you choose lawyer firms, they can only prepare legal documents, not technical and business. Preparation of legal documents and preparation of technical and business documents requires different approaches. In the first case – legal consultants, who work in the fintech industry can help you. In the case of preparation of technical documents – you need partners with a technical background and expertise in fintech solutions. Preparation of business documents – a business plan for the next 3 years – is the area of expertise of fintech business consultants.

But we recommend you to trust companies, which have on-hands experience in delivering an end-to-end solution. We, at Advapay, have expertise in delivering a full package of all required documents -legal, business and technical. Why work with 2-3 partners, when you can work with one? Contact Advapay for a consultation about any issue with license obtaining and business model development.

2) Banks as partners for fintech

One of the main requirements for fintech business operations is opening a safeguarding account. A safeguarding account – is a special account set up with a Bank in which PIs and EMIs hold customers’ money. The main functionality of a safeguarding account is to separate client money from operational funds and to block access to this money by third parties. Without it – you will neither be able to receive a license nor start operations. If opening a current account is not an issue, then opening a safeguarding account could be a problem. There are hundreds of Banks in the EU, but not many of them are ready to cooperate with fintechs. Don`t have a consultancy partner to open a safeguarding account? Contact us and Advapay will assist you with opening safeguarding accounts.

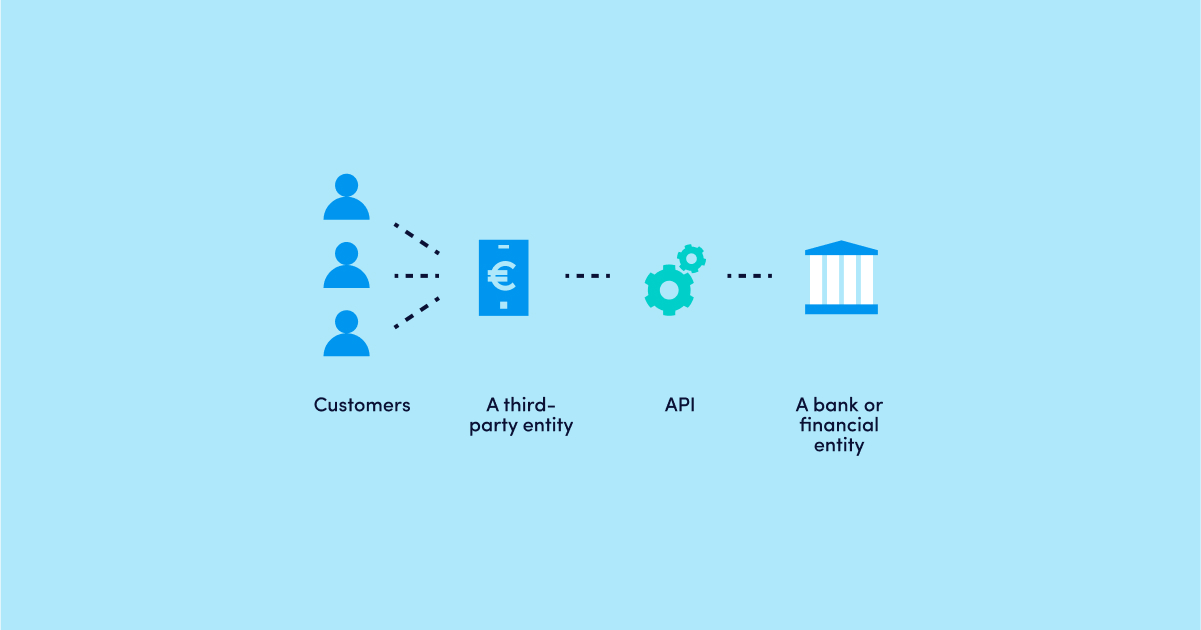

3) Technological partners and payment service providers

To start a fintech business, you need to be connected to different banks, acquirers, FX, payment cards issuers, money transfer systems, payment processing and clearing systems, SWIFT and SEPA, etc. Making many new integrations with payment service providers will cost you a huge amount of money and will take a lot of time. Because it is necessary to agree and sign contracts with all your fintech partners to develop both technical and legal relationships.

If this process sounds too complicated – we are ready to help with both technical and legal solutions. Read about our ready-to-use Core banking solution here. We will support you from start to finish, communicating with your payment and technological partners. For our potential partners: If you have a network of fintech customers and you are looking for the right partner to provide your customers with an end-to-end technical solution or consultancy – contact Advapay! Join our referral partnership program and start earning money today!