As we’ve said goodbye to 2023, it’s time to reflect on the dynamic Advapay landscape. This comprehensive review delves into the pivotal moments, innovative strides, and notable achievements that defined the year for Advapay – from expanding territorial borders to strategic partnerships and new technological advancements.

Expansion to new markets

2023 marks a significant milestone for Advapay’s market expansion as we proudly welcomed new countries into our esteemed customers’ portfolios. Our solutions have positively impacted clients in the UAE, Canada, Nigeria, and South Africa, and we are thrilled to announce our readiness to extend our services to even more clients in these regions. Beyond that, our commitment to global outreach remains steadfast as we gear up to serve new clients in various countries across Africa, the Middle East, and Latin America. The journey of growth and collaboration continues, and we look forward to forging new partnerships and delivering tailored solutions to meet clients’ diverse needs in these dynamic markets.

Opened offices in Toronto (Canada) and Belgrade (Serbia)

Advapay is thrilled to announce the expansion of our operations by opening offices in Toronto, Canada, and Belgrade, Serbia in 2023.

In Toronto, our dedicated team is committed to serving companies worldwide, providing comprehensive assistance in initiating and managing MSB businesses. From company registration to MSB licensing, opening correspondent accounts, and developing payment infrastructure, we offer services to facilitate seamless operations. Additionally, our services extend to delivering cutting-edge core banking software integrated with payment services and other providers.

Meanwhile, in Belgrade, Advapay’s office focuses on meeting European and non-EEA customers’ unique needs. We provide core banking software and secure the licenses for top-notch payment services. These strategic expansions reflect our commitment to global outreach and our dedication to providing tailored solutions to businesses across diverse regions.

Advapay has undertaken a penetration test carried out by cyber security specialist, Bridewell

In November 2023, both Advapay’s frontend and back-office applications and associated APIs was subjected to a security assessment by Bridewell.

Bridewell is an NCSC-certified and CREST-accredited business providing security and risk consulting services.

Bridewell provided penetration testing services in accordance with CREST, TIGER Scheme, and PCI-DSS requirements. The assessment focused on attempting to identify security weaknesses and vulnerabilities and concluded:

‘It is the opinion of Bridewell that the tested application and APIs had a very good security posture. After the recommended remediations were performed, there were no attacks identified by Advapay, which could be used to compromise the confidentiality, integrity or availability of application data.’

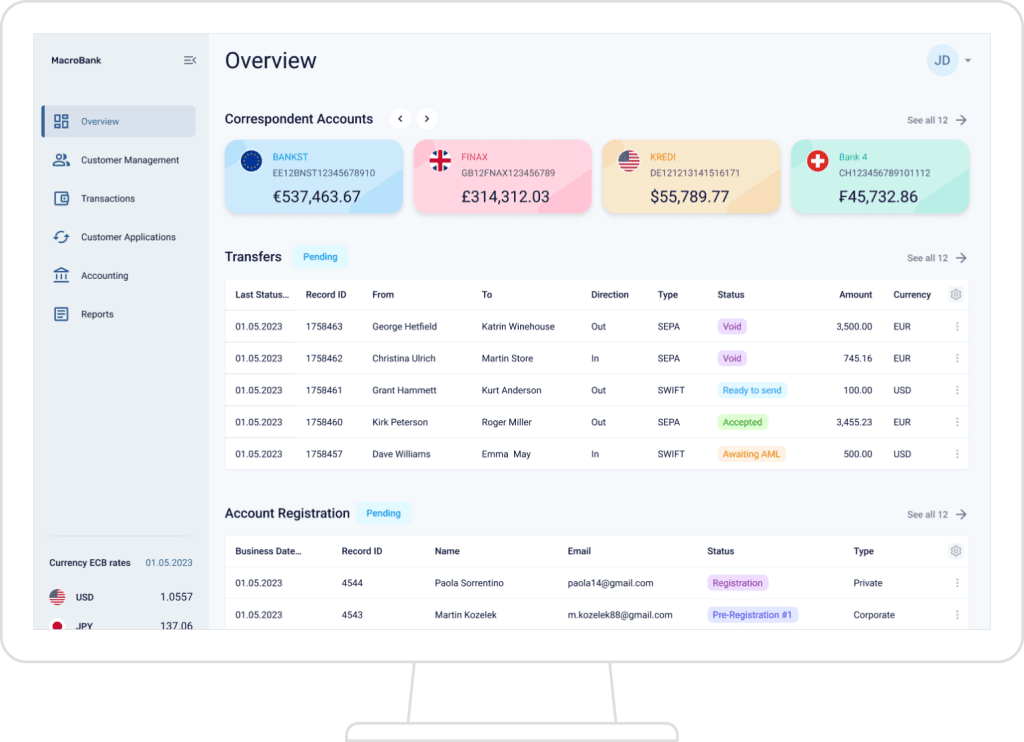

New Macrobank Core Banking Back-Office Application for operators

Boasting a sleek user interface and robust management tools, our new Core banking back-office application is designed to elevate the everyday operations of digital banks or fintech companies’ employees.

Key highlights of the Macrobank Core banking back-office application:

- Streamlined Operations Management: Effortlessly handle applications, customers, and transactions with just a few clicks to enhance workflow efficiency.

- User-Centric Tools: Immerse yourself in a suite of tools crafted to elevate user interactions and satisfaction.

- Swift Customer Requests Handling: Respond to customer queries and requests with unprecedented speed and precision.

- A User-Friendly Interface: Recognising the importance of a user-friendly interface, our back-office application ensures that daily tasks are not just completed but enjoyed by your dedicated team.

- New modern design: adapted to the digital bank or fintech company’s brand colours.

Macrobank’s core banking back-office application offers a comprehensive suite of functionalities crucial for efficient operations.

🔄 Seamless Process Management: Operators can effortlessly handle customers’ applications, streamline registration and onboarding processes, and efficiently process customer orders and applications.

📊 Robust Accounting Integration: The application integrates a powerful general ledger system to manage client accounting systems effectively.

🛠️ Customisation Tools: Operators enjoy flexibility in creating customer groups based on various parameters, setting individualised tariffs, rates, and transaction limits for personalised service.

🔐 Enhanced Control: The system provides extensive control over access rights, enabling the configuration of standard or unique user profiles.

🌐 KYC/AML Compliance: Operators control processes and payments, monitoring incoming, outgoing, and internal transactions while implementing and adjusting KYC and AML rules.

📈 Comprehensive Reporting: The application empowers operators to design and generate technical, business, and accounting reports, ensuring compliance with IFRS or local requirements and offering a comprehensive overview of financial activities.

New Core Banking back-office application features:

Discover all Macrobank Core Banking back-office application features:

1) Customer Management

2) Customer Account Management

3) Remote Users Management

4) Transactions

5) Customer Applications

6) Accounting

7) Overview

8) Reports

9) Customer Support

10) User Profile info

11) 2FA Authentication

12) Push-up notifications about new messages and requests

Are you curious about how Macrobank’s back-office application can transform your operations? Connect with Advapay, watch a demo, and embark on this innovation journey together! Contact our team!

Discover an enriched version of our Web-banking platform, now equipped with the following features:

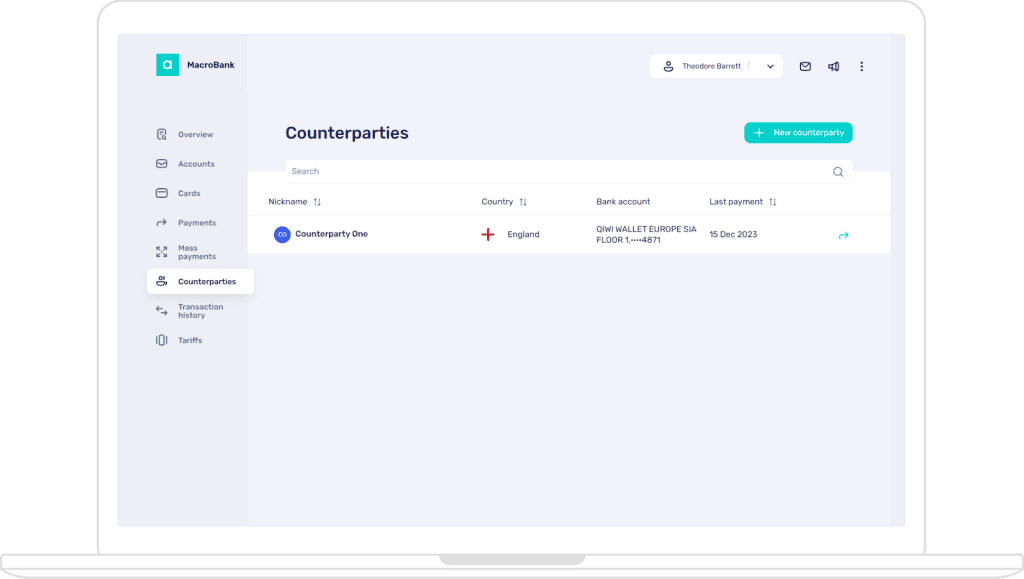

Counterparties section

This section lists all previously saved counterparties – family members, business partners or friends. From this section, users can create a new counterparty, a potential beneficiary, to input necessary details and save the information. Besides, a user can add multiple accounts to a counterparty. Saved prepopulated counterparties enhance the user experience by streamlining the payment process. Also, the user can generate a new counterparty directly from the Payments section.

Document attachment to SEPA and Swift payments

Another released feature is a document attachment for SEPA and Swift payments! Users can easily attach files like invoices and contracts while creating and editing payments, providing a clear justification for each transaction.

New and updated integrations

Integration with Salv

Salv, the world’s first real-time collaborative financial crime-fighting platform, was integrated with Macrobank for AML screening and AML monitoring activities. It enables Advapay’s Macrobank Core banking solution to accomplish the following tasks:

- Verify all clients and transactions.

- Send all requests for Client Screening and Transactions Screening and Monitoring.

- Handle notifications from the Salv platform and integrate them into adjusted payments business flows. For example, a notification about the payment received from the Salv platform can change the payment status in the Macrobank platform to “Cancelled” or “Requires investigation.”

Integrations with Sumsub

Also, in 2023 Advapay has integrated the Macrobank Core banking platform with Sumsub, an Identity verification platform, to verify onboarding and transaction processes.

Sumsub Onboarding for individuals and businesses

- Onboarding for individuals via Sumsub integration includes identity and address verification and biometric verification. All data collected from Sumsub is automatically transferred to the Macrobank Core banking system.

- Onboarding for businesses via Sumsub includes AML screening and a wide range of automated KYC checks integrated into Macrobank business flows.

Sumsub KYT or Know Your Transaction

Advapay has integrated Sumsub’s KYT service, which continuously monitors real-time transactions. Incoming and outgoing transactions are checked against regulatory requirements and compliance standards. If the system identifies a suspicious transaction, it generates alerts in Macrobank for further review.

Integration with XE service

Advapay has integrated the Macrobank Core banking platform with Xe.com, a Canada-based online foreign exchange tools and services platform. Their currency exchange rate service provides real-time, accurate, and reliable currency exchange data for hundreds of worldwide currencies.

Updates for existing integrations

Also, in 2023 updates were made for existing integrations with various service providers and banks, such as Regtek, CurrencyCloud, and Bank of Lithuania.

Whether you’re venturing into the realm of payments, e-money, or MSB companies, exploring cutting-edge Core banking software, or delving into BaaS offerings, we’re here for you. Let’s shape the future together! Feel free to reach out and discuss your project in detail. Here’s to a transformative year ahead!