As fintech companies continue to grow and disrupt the financial industry, the importance of reliable and efficient core banking software becomes increasingly evident. This article explores the benefits of using core banking software for fintechs and some key features that make it an essential tool for any fintech company.

Let’s begin by defining core banking software. Core banking software is a suite of applications that enable financial institutions to manage their banking operations. This includes opening and closing accounts, managing loans processing transactions, prepaid cards, exchanging currencies and generating reports. Fintech companies have recently adopted modern core banking software to improve operations and compete with traditional banks.

So, what are the main criteria when choosing a core banking solution?

Automation

One of the most important criteria when choosing core banking software is that it must streamline and automate many processes in running a financial institution. For example, instead of manually processing each transaction or creating new IBANs, the software must automate these processes, reducing the risk of errors and freeing up employees to focus on more complex tasks. This improves efficiency and reduces costs, which can be critical for fintech companies operating on tight margins.

Analytics

Another criterion when choosing core banking software is that it must provide real-time data and analytics, which can help fintechs make more informed decisions. For example, the software can track transaction volumes, identify patterns, and generate reports to help fintechs better understand customer behaviour. This data can be used to improve customer service, develop new products and services, and identify potential fraud or money laundering activities.

Integrations

One of the key features of core banking software is its ability to integrate with other applications and systems. This is especially important for fintech companies that often rely on third-party providers for services that include different types of payments, card issuing, KYC verification, and fraud prevention. By integrating these services into the core banking software, fintechs will enhance their proposition and create a more seamless and efficient user experience for their customers while reducing the risk of errors or security breaches.

Scalability

Scalability is also critical, as fintechs will likely experience rapid growth as they gain more customers. The software should be able to handle increased transactional volumes, store and process large amounts of data, and integrate with other systems as needed.

System and data security

Another factor to consider is security. As fintechs deal with sensitive financial information, they must ensure that their core banking software is designed to meet the highest security standards, with features including encryption, multi-factor authentication, and regular security audits.

Data security is critical for fintechs as they manage and protect sensitive financial information. Fintechs must also ensure their systems comply with relevant regulations, such as GDPR or PSD2.

Usability

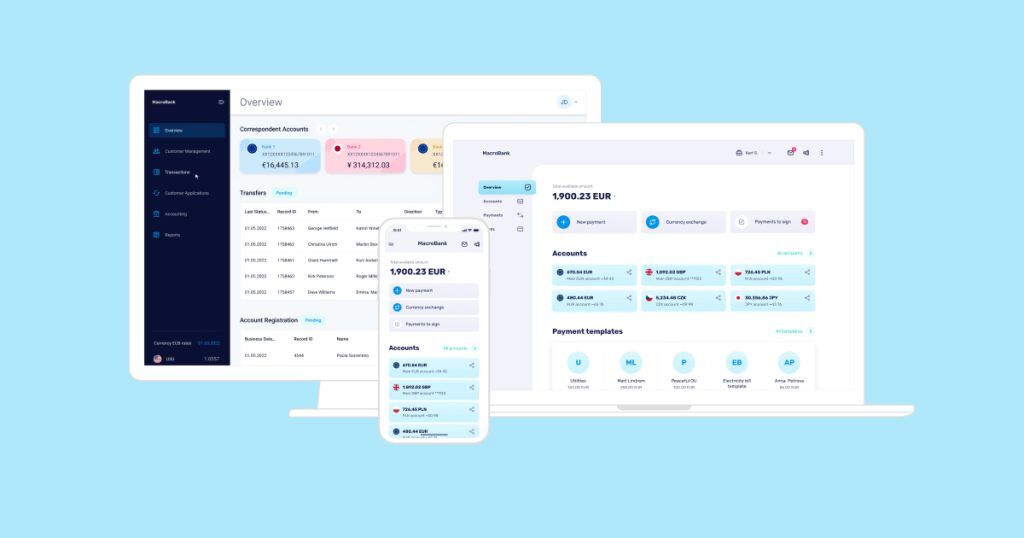

Usability is also essential, as core banking software should be easy to use and navigate for employees and customers. On the one hand, core banking software’s usability is crucial to providing a seamless banking experience to customers. The software’s user interfaces (web and mobile banking apps) should be easy to navigate. But also, the core banking software should be user-friendly for employees. The back-office interface for operators should be easy to configure and customise, allowing employees to perform their duties efficiently.

The usability of the core banking software should also extend to its accessibility. It should be accessible from various devices, such as desktops, laptops, tablets, and mobile phones. The software should also have a responsive design that adapts to different screen sizes and orientations.

Customisation

Fintechs may have specific requirements for their core banking software, such as customising user interfaces or integrating with specific third-party providers. Customisation can be expensive and time-consuming, requiring significant coordination with the software provider to meet all requirements. Fintechs must carefully consider their customisation requirements and work closely with their software provider to ensure they are feasible and cost-effective.

Regulatory Compliance

Fintechs must comply with various regulations, including data privacy laws, anti-money laundering regulations, and consumer protection laws. Core banking software must be designed to meet these requirements, which can be complex and time-consuming. Failure to comply with these regulations can result in significant fines and reputational damage, so fintechs must work closely with their software providers to ensure their systems comply.

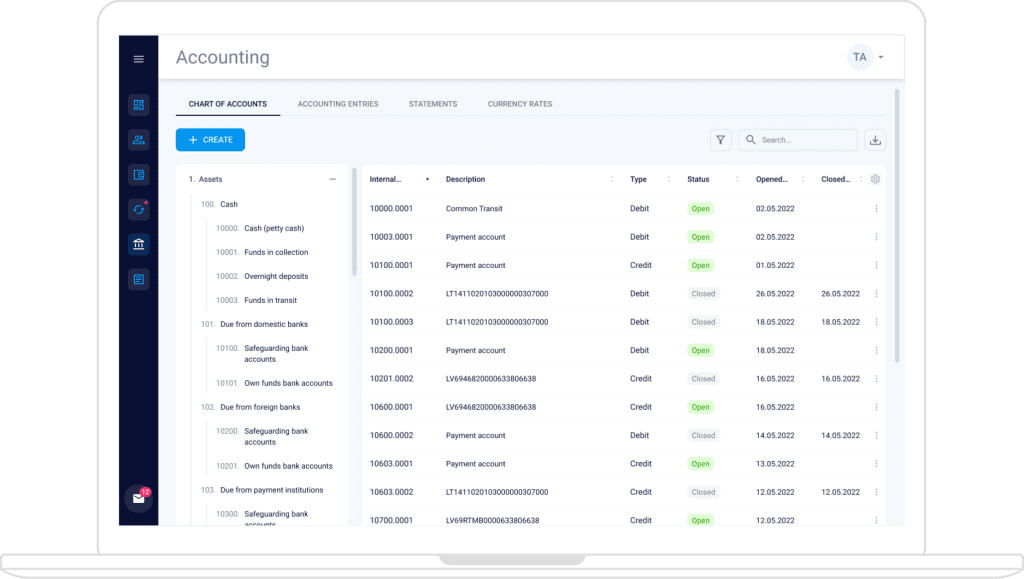

Built-in accounting and General Ledger

A general ledger and accounting system are crucial to any core banking software. It allows fintechs to accurately record, track, and manage financial transactions, providing a comprehensive view of a digital bank’s financial health.

A general ledger is a record of all financial transactions for a digital bank of a fintech company, including accounts, deposits, withdrawals, and transfers. It is the central accounting record that summarises the financial activity of a bank over a given period. The general ledger generates financial statements such as balance sheets, income statements, and cash flow statements.

The General Ledger and Chart of Accounts must correspond to International Financial Reporting Standards (IFRS). It also manages your fintech company’s nostro and vostro accounts, as well as providing support for the reconciliation of these accounts.

Costs

The core banking solution you choose must fit within your budget. There are several factors to consider when calculating your ultimate core banking software costs. These include:

- Purchase of software

- Cost of setup

- Monthly & maintenance fees

- Integration costs

- System hosting & software updates

Final considerations

By considering all of these factors, you can arrive at an accurate estimate of the total cost of the core banking solution. It is essential to remember that the cheapest option may not always be the best in the long run. Choosing a core banking solution that meets your current needs while allowing for future growth and scalability can save you money in the long term. Additionally, ensure your solution is reliable, secure, and easily integrated with other payment service providers to avoid unexpected expenses or complications.

In conclusion, core banking software is essential for fintechs wanting to compete with traditional banks and provide innovative financial services to their customers. By automating and streamlining operations, providing real-time data and analytics, and integrating with other systems and applications, fintechs provide a more efficient, secure, and user-friendly banking experience. By investing in modern technology, digital banks and fintech companies can break free from rigid legacy systems and deliver customers the best banking experience possible.

About Advapay

Advapay is a technology company providing the Digital Core Banking platform to empower fintech clients or digital banks to start their businesses and accelerate digital transformation. The platform delivers all essential functionalities, a front-to-back system and a set of tools to customise and bring new integrations. With Advapay, potential and existing customers can connect either to the cloud-based SaaS or on-premise software. Besides the technical infrastructure, the company provides business advisory and fintech licensing services. Interested to learn more, please drop us a message