In 2023, the global trend toward mobile banking continued, and we will most likely see the appearance of new mobile banking and fintech apps this year, despite 2023 is going to be a year of recalibration for fintech companies. According to our latest article, we see a slowdown in new companies appearing on the market.

Both midmarket and large companies are more concerned than ever about the impact of changes in the industry on their profits. Efficiency of operation and cost have become increasingly vital as revenue growth slows, with larger organisations being more likely to hold back on non-core investments in technologies and internal innovation.

The market for mobile apps is a burgeoning one, and while we’re still waiting to be made aware of 2022 mobile app revenues, by the end of this year, they’re still expected to generate hundreds of billions of dollars.

There’s a growing reliance on mobile digital devices in this modern digital era with consumers turning to them for everyday tasks, such as managing their personal finances. This is the reason behind the willingness of fintech and banking companies to invest evermore into mobile banking and fintech apps.

As well as the widespread use of these apps, their design and technological features continue to evolve, with more apps seeming to appear this year. In this article, we share the latest trends in mobile banking app technologies and design.

1. Industry technology trends for Fintech apps

Let’s start by listing the most advanced technologies for mobile banking and fintech apps.

Artificial Intelligence in banking. Chatbots: the new must-have in customer care.

Alongside demanding 24/7 access to the full range of services, consumers now expect near-instant, seamless, highly-personalized interactions with their banks. By leveraging the power of AI-driven chatbots, digital banks are able to offer this kind of automated yet personalized customer support around the clock.

A new study from Juniper Research has found that the operational cost savings from using chatbots in banking will reach $7.3 billion globally by 2023. This represents time saved for banks in 2023 of 862 million hours, equivalent to nearly half a million working years.

This makes instant customer communication easy, as immediate auto-generated answers can be provided via these channels. The welcome knock-on effect of this is increased customer retention combined with reduced support costs.

When prompted, AI chatbots are able to provide answers to common questions asked by banking customers. For example, a customer can request answers to questions like “What’s the balance of my account” or “What are my last 5 transactions?”.

Chatbots can also act as a human substitute, consulting customers wanting to choose new card plans, open additional payment accounts, report suspicious activity, send different notifications and more.

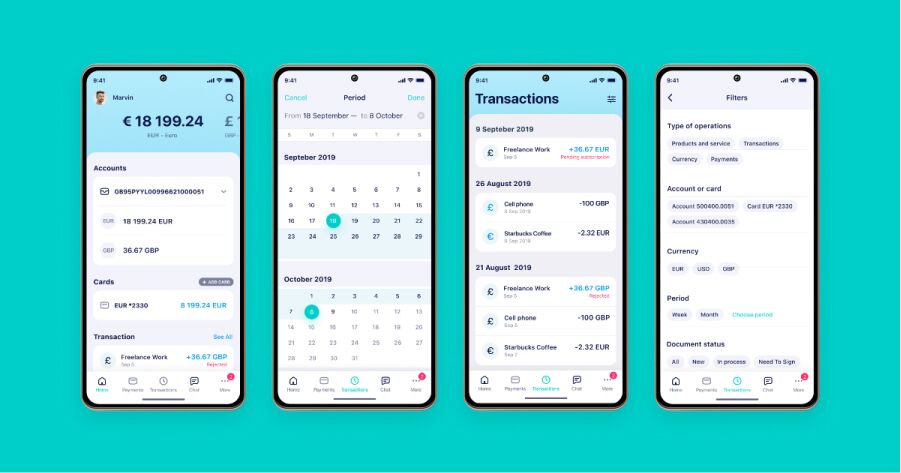

For example, Cleo, a budget app and AI-based financial assistant allows to keep users on top of their financial goals:

Biometric authentication. Sign payments with fingerprints or face-based verification.

In order to facilitate financial regulatory compliance and improve security when dealing with sensitive data, biometric authentication can be used. After recording and storing the customer’s voice, face and fingerprints, biometric security solutions prevent unauthorized access to devices and accounts. Moreover, it can be used by financial companies to prevent phishing, identity theft, skimming and credit card hijacking.

Adding extra security layers for electronic payments, Strong Customer Authentication (SCA) is one of the latest requirements from the PSD2 (Second Payment Services Directive). Introduced across the majority of the EEA on the 1st of Jan 2021 and the UK on September 15th of the same year, this SCA requires e-money, payment companies and banks to carry extra identity checks when making payments.

When doing so, banks may request two of the following types of ID verification:

- A known PIN or password

- Verification via card reader, mobile phone or one-time passcode device

- Biometric verification, e.g. a fingerprint check or face recognition

Fingerprint or facial image are one of the most popular types of verification in our everyday life – for civil identity systems, unlocking-blocking mobile phones, and access control. Because of the simplicity and availability of fingerprint and face recognition features in modern phones, they have become more and more popular for a range of purposes that include digital banking applications.

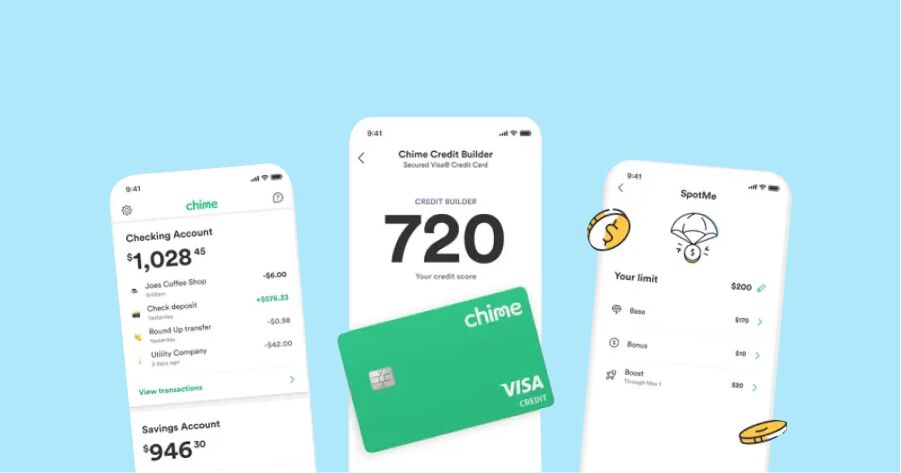

A great example of fingerprint verification being used for payment verification can be seen in the Chime application:

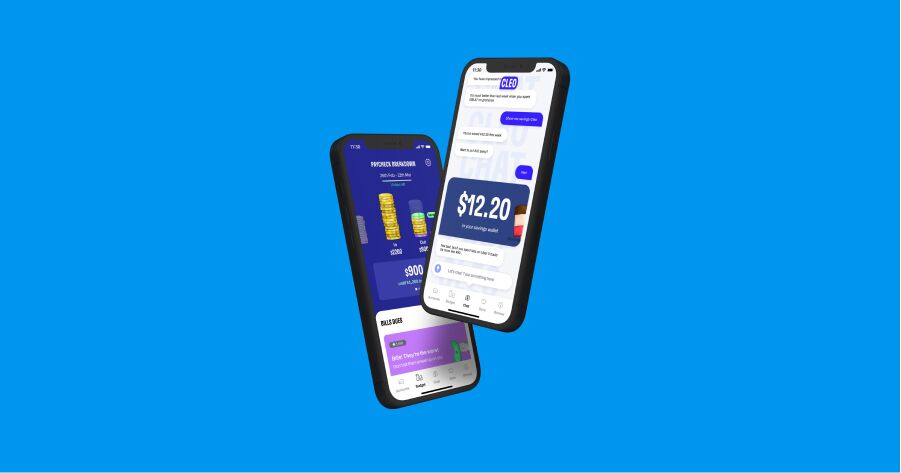

Another example of Face ID verification can be seen in the Revolut application:

Machine learning (ML)

As a subcategory of AI, machine learning (ML) is expected to feature among the main banking technology trends in the coming years. Using this state-of-the-art technology, financial companies and banks are able to identify customer needs through user data analysis.

For example, a software solution can collect data such as reviews, customer inquiries and transactional information. This is then analysed further using ML algorithms in order to create a customer profile that includes factors like satisfaction levels, retention rates and lifetime value.

One of the most useful ML applications in Fintech is credit scoring, as huge simultaneous transaction data sets can be evaluated in real-time. Furthermore, it can also learn from the results, updating models to greatly reduce human input.

The RegTech (Regulatory Technology) represents one of the top financial uses of ML. Due to being able to learn large numbers of regulatory documents, it’s possible for them to identify similarities and correlations that exist between guidelines.

When ML algorithms used for finance are incorporated into cloud platforms, it’s possible to monitor regulatory changes as they happen. Banking companies are also able to automatically identify anomalies by monitoring transactional data, ensuring that all transactions adhere to existing regulations.

ML providers for Fintechs enhance the customer experience they offer by employing ML algorithms, as they can analyse a customer’s data to identify their preferences. As such, it’s possible to understand the kind of services and products that are most likely to be of interest.

Financial institutions are also able to protect their mobile banking customers more effectively with ML, safeguarding them against unauthorized access, viruses, malware and fraud. Due to the existence of ML, continuous monitoring can be employed to instantly block attacks from hackers, spot suspicious activity and prioritize risk.

Some of examples of such solutions: Veriff, Sumsub, iSpiral and many more.

Voice-Based Payments

Voice payments have become increasingly popular as more and more customers live truly connected lives. Easier to use and providing a time-saving, voice payments make transacting more straightforward for users while also providing brands with previously unseen access to their customers’ behavioral trends and personal data.

The global voice-based payments market size was valued at USD 5.89 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 10.9% from 2022 to 2030 (Grand View Research).

This mutually beneficial aspect has caused many financial institutions and brands to adopt voice payment technology. Platforms like Venmo, PayPal and Zelle already have customers using voice-activated commands to perform financial and banking functions.

Just link your PayPal account to Alexa and you will be able to chat with Alexa using different commands, like “Show me my balance”, “Pay $10.44 to Barry”, “Request $30 from Shane”.

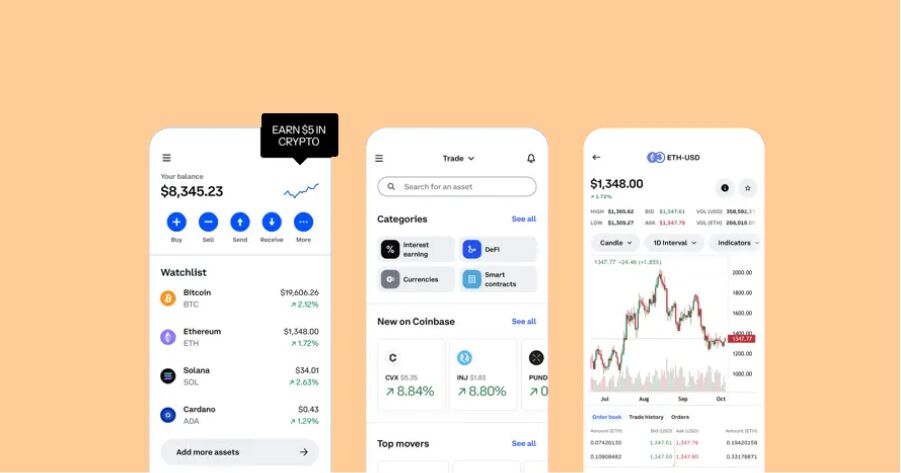

2. The most obvious trends in banking applications UI design

In this paragraph, we take an overview of all current mobile banking and fintech app design trends.

More bright colours

Designs are changing. From light-pastel tones, we’re seeing much more in the way of bright and eye-catching colours.

As competition increases, so are the design options used. Users are becoming ever more choosey, with designers experimenting with colours in an attempt to stand out from the crowd.

Advantages of a UX/UI with bright colours:

- Improved aesthetics for a more attractive app

- Mood is positively influenced

- Reinforces association with your service, product or brand

- Conversion & profitability enhanced, as key calls to action are more easily distinguishable

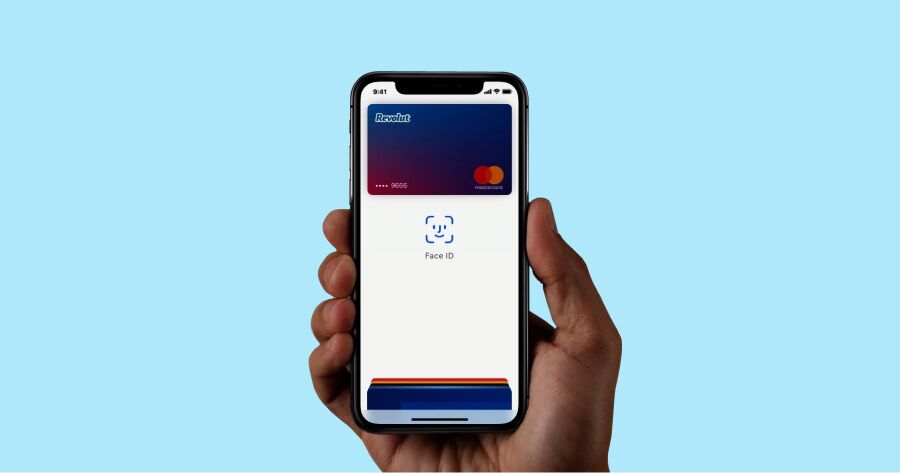

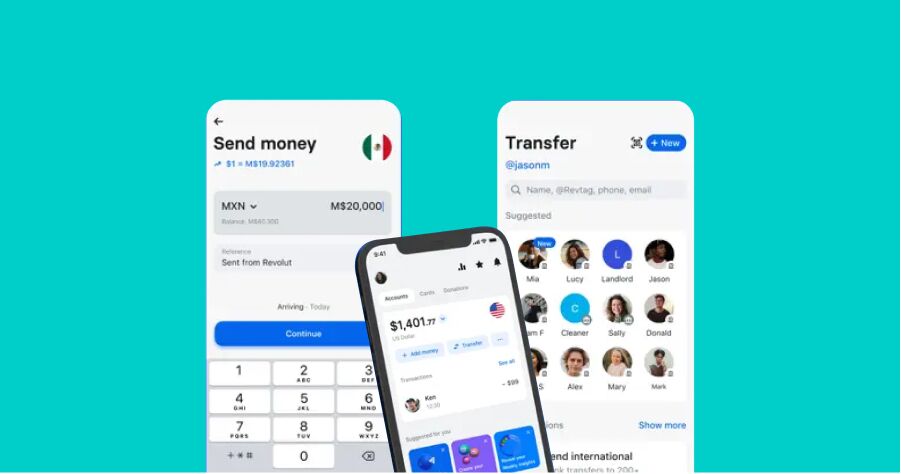

Look at these 2 designs from Coinbase and Revolut. Bright colours on the white background look great!

More emotional UX – more pictures, less text

Customers will typically have a formal, grey and often boring perception of banking. As such, it’s not surprising that financial products are talked about with this kind of underlying vibe. However, in the fast-paced colourful and emotive world we live in, with the likes of TikTok and Instagram to be compared to, the contrast is even more noticeable.

Users make quick, intuitive decisions based on their emotions. Cognition is employed to understand the world around us and emotions drive decision-making.

How the content is delivered on financial apps matters. Instead of boring tables and text, eye-catching pictures, diagrams and illustrations can be used to create a beautiful app that engages the customer and leads to action being taken.

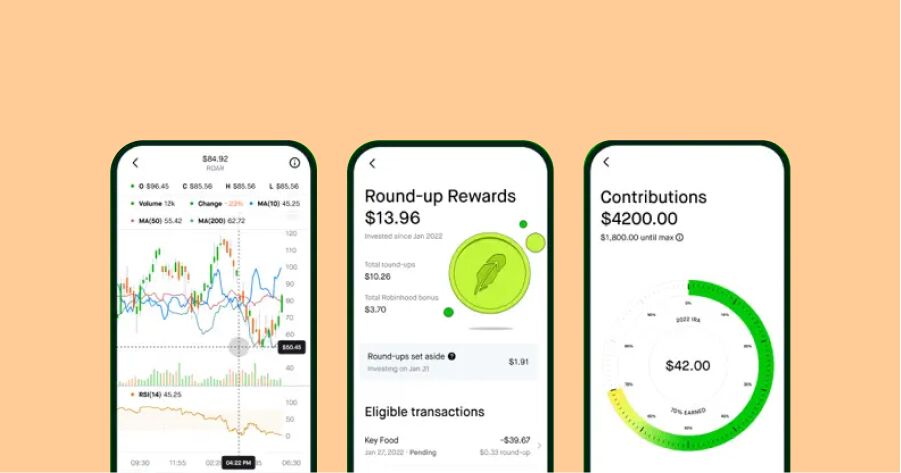

Just look at the Stock Trading & Investing App from Robinhood below! Look at how the most important information is being highlighted in these eye-catching layouts.

Authentic images

A trend that transferred from web design to UX is the use of authentic images, meaning no more standard icons and illustrations. Fintech companies can now use any style they want to, and it’s no longer considered abnormal. Look at this cartoon design from banking services company Chime:

3. White-label mobile banking applications

If you are looking for a ready mobile banking or web application for your digital bank or fintech company, look at our white-label solutions: white-label mobile or web banking applications. Built on the most advanced architecture, these genuinely customer-centric web banking and mobile banking applications provide all the functionalities your customers need – check the balance, view statements, make payments, and many more. Applications are designed to be branded to reflect your brand’s identity. Want to know more, please contact our team.