Sun, sea, and… fintech?

Financial services probably isn’t the first (or even the second) thing that comes to mind when you think about the Mediterranean island of Malta.

But, with 2000+ licensed firms, including 30 payment institutions, 36 electronic money institutions, and 8 crypto firms (with several others exercising EU passporting rights), Malta is one of the most active fintech hubs in Europe. And also one of the most attractive.

Here’s a look at what makes Malta such a compelling proposition if you’re thinking of setting up a payments or crypto services business in the EU, and a rundown of the licensing process.

- Why Malta?

- Setting up as a financial institution or crypto-asset service provider (CASP) in Malta: what you need to know

- What are the requirements for a payment institution / e-money licence in Malta?

- What documents must you submit with your payment institution / e-money licence application?

- What are the requirements for a crypto asset licence?

- What documents do you need to submit for crypto asset licence?

- Picking the right jurisdiction to do business from is make or break. Choose wisely.

Why Malta?

There are three key features that make Malta stand out as an EU fintech jurisdiction: a pioneering regulatory framework, a knowledgeable and highly experienced English-speaking workforce, and extremely attractive tax rates.

Of course, the weather — 300 days of sunshine a year, on average — doesn’t hurt, either. But that’s a whole other blog post for another day.

Let’s take a closer look at each of the three elements that make Malta such an attractive place to set up and do business as a payments or crypto firm.

Leading the way: Malta’s pioneering regulatory framework

In 2018, Malta became the first country in the world to enact a comprehensive regulatory framework for crypto assets.

The clarity and legal certainty this brought about attracted the likes of Foris DAX, which operates crypto.com, OKX and other leading industry players to the island. The legislation also significantly influenced the EU’s Markets in Crypto-Assets regulation (MiCA), which came into force in June 2023.

With a standardised EU-wide framework now in place, you’d think that, if not identical, the regulatory environment would be highly similar across the bloc. But the reality is that, regulation or no regulation, many member states — and, indeed, many countries around the world — are still grappling with the basics.

Meanwhile, Malta has racked up almost a decade of industry experience, and the knowledge, skills, and track-record to go with them.

When it comes to the payments sector, Malta has also been a pioneer.

The likes of eToro, Moneybase, and embedded finance pioneers Weavr are licensed in Malta. The country was also one of the first in the EU to launch a regulatory framework for standalone electronic money institutions. And, in 2024, it was tied with Germany as the most popular EU jurisdiction for payment and e-money institutions, with 12 licences issued.

The Maltese regulator operates a sandbox which enables early-stage startups to test their products and refine their approach before going through the full licensing process (and the time, effort, and cost this involves).

Malta is also a hub for industries, such as e-commerce and igaming, that create a high demand for payment services. iGaming is a particularly significant industry, with Malta hosting the annual SiGMA Summit — an event that hosts over 1000 exhibitors, expert speakers, and the prestigious Euro-Med Gaming Awards.

Staff that speaks your language

Because of the attractive regulatory environment and thriving fintech community, Malta has developed a highly-skilled workforce.

According to the MFSA — the Malta Financial Services Authority — around 12,200 of Malta’s 500,000-strong population work in the financial services industry. This includes a network of lawyers, accountants, compliance specialists, IT specialists, and other specialised financial services practitioners.

At 312 square kilometres — the size of a small city — the country also has a close-knit business community. This means it’s relatively straightforward to find skilled partners to work with, as everybody knows each other and the ecosystem is highly interconnected.

More significantly, though, while Malta has its own language — Maltese — English is both an official language and the language of business.

This means you can pick up the phone or email anyone feeling confident there won’t be miscommunications — a considerable advantage over other jurisdictions where, while English might be widely understood, it isn’t the main language businesses use to communicate.

The bottom line: What’s the tax situation like?

So far, so promising. But, when all is said and done, how big a cut of your profits will the Maltese tax authorities take?

Malta’s standard corporate tax rate is 35%. But, provided certain conditions are met, your shareholders get 30% of that tax back when you pay out dividends.

This brings down the effective tax rate — that is, the amount your business is actually out of pocket — to 5%. To put that in perspective, Ireland’s corporate tax rate is 12.5% and Luxembourg’s is 24.9%.

This unique tax structure complies with ‘subject to tax’ regulations in double tax treaties. Malta has over 80 double taxation treaties in force. If your firm’s shareholders are resident in one of these countries, Maltese tax law applies, and they won’t be taxed again in the country where they are based.

How it works

To benefit from the 5% effective tax rate, the company’s beneficial owners must:

- Not be Maltese residents for tax purposes

- Not be domiciled in Malta. That is, they don’t consider Malta their permanent home

- Be neither resident nor domiciled in Malta

If the beneficial owners fulfil one of these conditions, the company pays 35% on its profits, and dividend recipients receive a refund of 30%, or 6/7.

Say you’re a Maltese-licensed payment institution, owned by a holding company based in the Netherlands, which has a double taxation treaty with Malta.

In 2023, your gross profit is €25 million.

This puts your tax bill at €8.75 million. But, your holding company will receive a €7.5 million refund when you pay out dividends.

Setting up as a financial institution or crypto-asset service provider (CASP) in Malta: what you need to know

While the regulatory environment is extremely favourable, the licensing process is still comprehensive and robust. That said, as long as you’re prepared, the process should be fairly straightforward.

Whether you’re applying for a payment institution, e-money institution, or crypto asset licence, three overarching principles apply.

First, qualifying shareholders — individuals who directly or indirectly hold 10% or more of the firm’s shares or voting rights — have to go through a fit and proper test.

Similarly, corporate shareholders with qualifying holdings have to complete a detailed questionnaire, and their directors, senior managers (the CFO, for instance), and key officers such as the compliance officer and the money laundering reporting officer will also have to go through a fit and proper test.

Second, at least two individuals must effectively direct the financial institution’s or CASP’s business in Malta — the so-called ‘four eyes principle‘. This ensures control isn’t concentrated in the hands of one single person, which keeps risk in check.

Third, you’ll need a physical presence in Malta, with locally-based staff. This ensures you’re a legitimate firm carrying out substantial economic activity.

The licensing process for financial institutions (including payment and e-money institutions) and crypto asset service providers is broadly similar:

- The first step is to submit a statement of intent: a high-level overview of your proposed activities, organisational structure, and business plan. The MFSA will review, give feedback, and may also ask for further information.

- Once the MFSA is happy, the next step is to submit a full application, together with the required documentation. This is when KYC checks, fit and proper tests, and other due diligence procedures take place. The MFSA will also make recommendations and flag any potential issues that must be resolved before the licence is approved.

- If you resolve the issues to the MFSA’s satisfaction, you’ll receive an approval in principle. This comes with a list of conditions you must fulfill before the licence is granted and you can start operations.

The specific requirements, however, vary depending on whether you’re applying for a financial institution licence or a CASP licence.

What are the requirements for a payment institution / e-money licence in Malta?

Unless they provide account information services only, the minimum initial capital requirements to set up as a payment institution range from €20,000 to €125,000, depending on the services you intend to offer. E-money institutions in Malta need at least €350,000 in own funds.

Once licensed, own funds must never fall below the higher of:

- The initial capital requirement

- If you’re a payment institution, between 0.25% and 4% of your annual transaction volume

- If you’re an e-money institution, 2% of your average outstanding e-money liabilities

The goal is to make sure the money you have in reserve is proportionate to your company’s size, complexity, and risk exposure.

If you’re an e-money institution and you also provide payment services that aren’t related to e-money, payment institutions’ own funds requirements apply.

What documents must you submit with your payment institution / e-money licence application?

To prove they’re fit and proper, every controller, officer, and shareholder with qualifying holdings has to provide evidence of their competence, financial standing, and reputation.

As a firm, you’ll also need to submit documentation that proves your organisation is sound, and well-equipped to meet its regulatory obligations.

There are six main categories of documents you’ll need to submit:

1) Mandatory forms and assessments

These include:

- The application form and corporate questionnaire

- A personal questionnaire for every individual that has to go through a fit and proper assessment

- An Involvement Suitability Assessment

- A Digital Operational Resilience Assessment

- A Source of Wealth and Source of Funds Self-Declaration Form

In some cases, you may also need to fill out additional forms. These include a third-party outsourcing assessment, a trusts and fiduciaries additional questionnaire, and an ICT third-party arrangement form.

2) Clear evidence of the source of funds and proof of good financial standing

3) Corporate and legal documents

These include:

- The company’s memorandum and articles of association and incorporation certificate

- A group structure chart and organigram

- Draft service agreements and outsourcing contracts

- Proposed agreements with banks

If your company is already active, you’ll also need to provide the last three years’ audited financial statements and your auditors’ engagement letter, as well as the audit firm’s details.

4) Financials

The documents in this category include:

- Proof of paid up share capital

- A statement of proposed capitalisation

- A detailed breakdown of how you’ll meet own funds requirements

- Financial projections for the first three years, in line with MFSA Guidance Note FIR/032001/01

- Your professional indemnity insurance certificate

5) Programme of operations

The goal here is to describe which services you’ll be offering in detail, how you’ll operate in practice, and a business plan.

The business plan should cover:

- Your organisational structure and governance arrangements

- Audit and internal controls

- Which critical functions, if any, you’ll outsource

6) Compliance, risk, and anti-money laundering / funding of terrorism

These documents include your:

- Compliance monitoring programme

- Internal audit programme

- Risk management manual

- Anti-money laundering and funding of terrorism manual

- Policies on outsourcing, IT security, safeguarding client assets, and business continuity

- Systems auditor report. This must confirm your IT infrastructure is suitably robust.

What are the requirements for a crypto asset licence?

To obtain a crypto asset licence, the own funds requirement depends on whether you’ll be offering class 1, class 2, or class 3 services.

Class 1 services include the reception and transmission of orders, execution of orders, advice, and placing crypto assets. The minimum capital requirement for this type of licence is €50,000.

Class 2, which, alongside class 1 services, includes custody, administration, and exchange (for fiat currency or other crypto assets), has a minimum capital requirement of €125,000.

Class 3 includes class 1 and class 2 services together with the ability to operate a trading platform. This higher breadth of activities is reflected in the higher minimum capital requirement: €150,000.

You’ll need to meet these minimum requirements — or an amount equivalent to 25% of your fixed overheads, if this is higher than the minimum capital requirements — on an ongoing basis.

What documents do you need to submit for crypto asset licence?

Similarly to the process of applying for a payment institution or e-money licence, you’ll need to submit a licence application together with documents that prove your firm is organisationally sound and suitably prepared to meet its regulatory obligations.

Alongside personal questionnaires for all beneficial owners, people with qualifying holdings, senior managers, and administrators, you’ll also have to submit the following documents:

- Corporate questionnaire

- Involvement suitability assessment

- Digital operational resilience assessment

- Incorporation documents, evidence of paid up capital or own funds, financial projections, and own funds forecasts

- Financial statements

- Group structure, organigram and transaction flow diagram

- Programme of operations, setting out the types of crypto-asset services the applicant intends to provide, including how and where those services will be marketed

- Description of Internal Control Mechanisms

- Policies, procedures and internal frameworks, including ones that cover:

- Anti-money laundering and funding of terrorism

- Segregation of clients’ crypto-assets and funds

- Conflicts of interest

- Outsourcing

- Record-keeping

- Accounting

- Business Continuity Planning

- IT and operational resilience, including:

- Technical IT documentation and an extended IT questionnaire

- Technical IT documentation of ICT systems and security arrangements, accompanied by a non-technical description

- Extended IT questionnaire

- Where applicable, third-party outsourcing assessment and arrangement form

- Where applicable, policies covering:

- Placement and execution

- Commercial policy

- Custody and administration

- Advisory services

- Portfolio management

- Transfer services

- Case evidence, an SME self-declaration, and an assessment of the level of protection afforded to third parties

- Reception and transmission of orders

- Market abuse

- Trading platform operating rules

- Case evidence, an SME self-declaration, and an assessment of the level of protection afforded to third parties

Picking the right jurisdiction to do business from is make or break. Choose wisely.

While licensing requirements are broadly similar across the EU — and a licence from any EU member state can be passported across the rest of the bloc — not all jurisdictions are created equal.

Setting up a payments or crypto assets business is a huge investment, and not just in terms of money. You need time, effort, resources, and vision. So it’s critical to choose a jurisdiction that:

- Has a deep understanding of the industry, and a skilled workforce you can draw on to deliver a high standard of service

- Has a crystal clear regulatory framework that will support your long-term plans

With its forward-looking laws, knowledgeable and hard-working staff, ease of doing business, and attractive tax incentives, Malta has a lot to offer to both new and established businesses.

Want to learn more about the licensing process and what the fintech industry in Malta is like?

Book a free, no-obligation chat with our local expert

Advapay at stake:

How can Advapay can assist you in launching your fintech business?

• Assistance in EMI/PI licencing in the EEA/UK

• Registration of MSB company in Canada

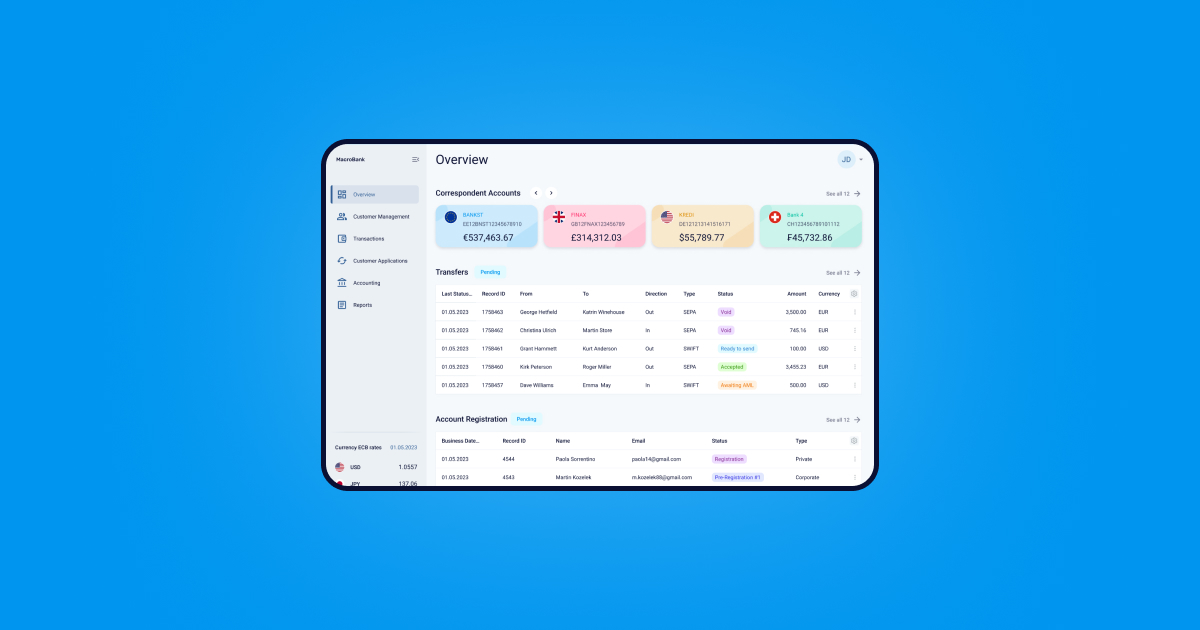

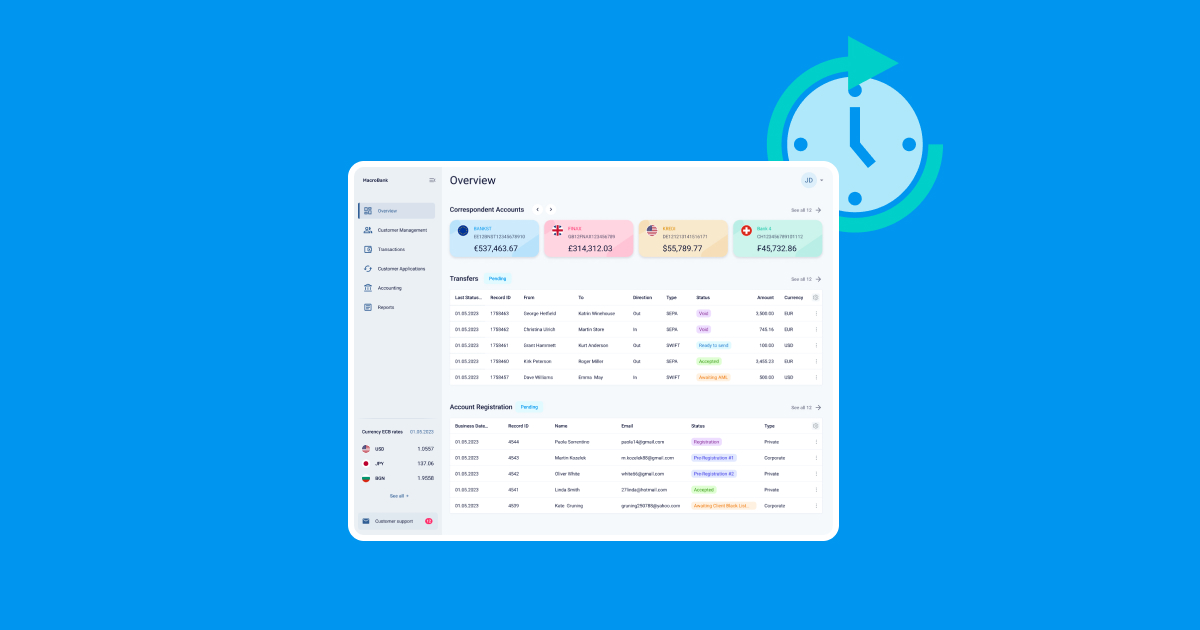

• Delivery of a comprehensive Core banking system encompassing back-office and white-label applications for end-users

• Assistance in payment infrastructure development

• BaaS-solutions in collaboration with our partners – EEA/UK licenced EMIs and PIs